Why some agents pay your first year premium ?

While replying to some of the comments 2 days back, something caught my attention. One of the reader wanted my opinion on what he should do with his Jeevan Saral Policy for which the first premium was paid by the agent and future premiums were to be paid by him. As this happened recently in Jan 2012 […]

Financial Planning

Dear Sir, I wish to describe here my present investment details as follws : [A] Insurance : Sl.No. Policy Name Start Date Annual Premium (Rs) 1 Birla Sunlife – Freedom 58 – Super 20 28/03/2010 15,000 2 ICICI Prudential – Assure Wealth Plus 15/02/2010 25,000 3 ICICI Prudential – Life Time Super Pension 08/02/2008 12,000 […]

What is the difference between Surrender & Paid up??

I want to know the difference between surrender & Paid of lic policy?? Also what is the procedure for the both. I have a jeevan saral policy 1000/mth completing 4 years. What will be better surrender or paid up?

Surrender of Policy

Hi, From last 3 years I showed my premium of LIC Jeevan Saral policy for income tax deduction. In current FY year (2011-12) also I want show policy premium for IT deduction. My question is that if Surrender this Policy in Apr-2012 then premium paid by me in current FY is valid for tax deduction […]

WHAT TO DO?

What is max return one can expect from jivan saral policy. i have paid 2 years premium of jeevan saral 1000/mth (term 10 years). should i continue it? if i discontinue it now and pay rs 1000/mth sip in HDFC PRUDENCE or any balanced mf how much return should i expect after 8 years? Kindly […]

Enquiry about child career plan

Hi, I am 40 years of age and have a kid of 1 year and service in private firm. I need suggestion about following two points: 1) Financial plan for my child\’s career. 2) Retirement planning for myself. I want to keep two different portfolio for this and trying to achieve a target of Rs. […]

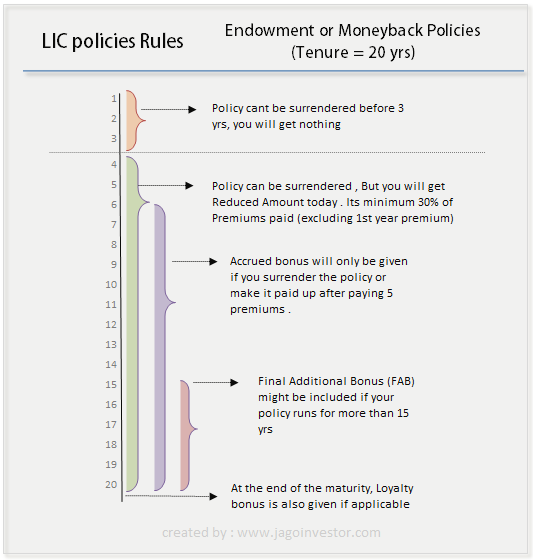

How LIC policies works ? Bonus, Premiums, Maturity, Loan !

There are so many LIC policies with different names ? For example – LIC Jeevan Saral , Jeevan Anand , Jeevan Tarang and many more LIC policies. So almost every person in India holds some LIC policies, but majority of them do not know how these LIC policies works ? How LIC Policies Work ? Most […]

Investment & Insurance Plan- Your advice

Hi Sir, I happened to stumble upon this site and had read many blogs of Manish till late night 4.A.M. This site should be \”bookmarked\” by one and all as i see the discussions on this forum really enlightening and honest. I need some advice on the insurance & investment front.Here are the details: 1) […]

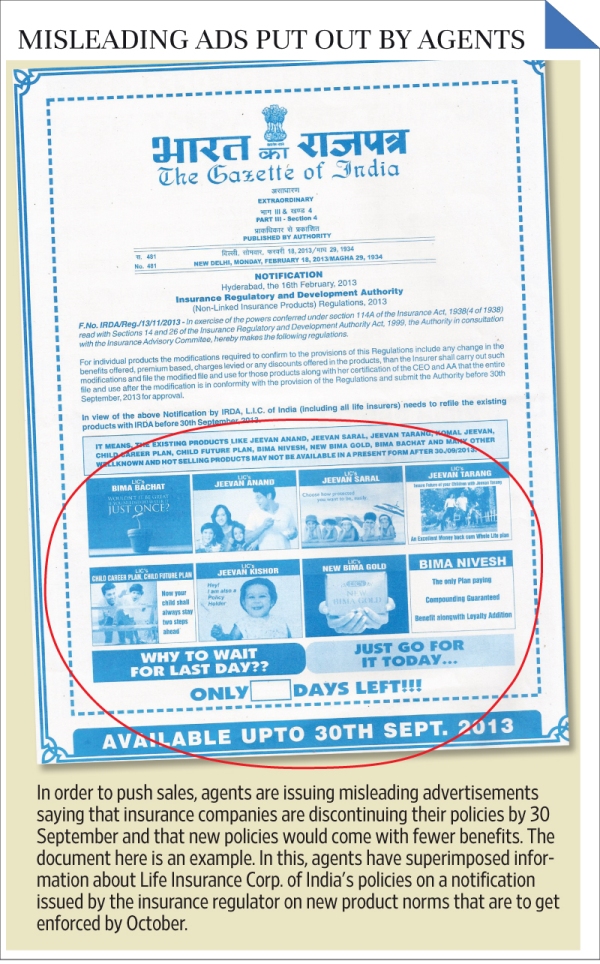

5 major changes in life insurance policies from Jan 1, 2014 – How it affects you ?

Some major changes are going to happen in life insurance industry from Jan 1, 2014, especially in traditional policies like Endowment Plans, money-back plans and even ULIP’s. You will surely have a LIC policy or any other private sector traditional plans or might buy them in coming times. Here are 5 major changes which you […]

Help needed in re-organizing investments

Hi, This is Srinivas. I am 41 yers old, married and have 6 year old kid. I am covered individually for 1 lac by employer and do not have health insurance or term insurance. Please find below my investments and help me re-organizing my investments. Let me know in case I need to furnish any […]