Is your under-construction flatin Noida Extention in danger? No! But there are thousands of buyers who have invested their hard earned money in flats that are being constructed at Noida Extension. In this article I will talk on the issue of Noida Extension and what learnings can we take from this whole issue. For people who are not aware on the recent Supreme Court decision to stop construction in a part of Noida Extension and give it back to farmers from whom it was taken by the Noida Authority in the name of “Land Acquisition”. Now thousands of buyers who booked their flats are in danger of not getting their homes which they had booked.

Background

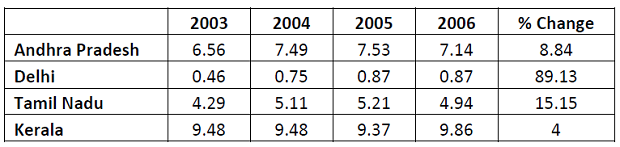

So the whole issue goes back to 2005-06 when Noida Authority snatched land from farmers saying that the land will be used for “Development” purposes, Industries will be put in, there will be factories which will further help villagers and their future generations get employment and their life will be “great”. They were given pennies for that land. Then later this land was given to Builders for construction purpose and thousands and lacs of investors bought their dream homes in these projects.

The land was under dispute and after a lot of construction has already happened and people have put their hard earned money in lumpsum or through EMI’s. Now Supreme Court says that the land acquisition was illegal and was not done in the right way, so the land now should be given back to farmers. This is only for one part of Noida Extension issue which still affects thousands of buyers and later again there was a judgement passed in favour of farmers for another village.

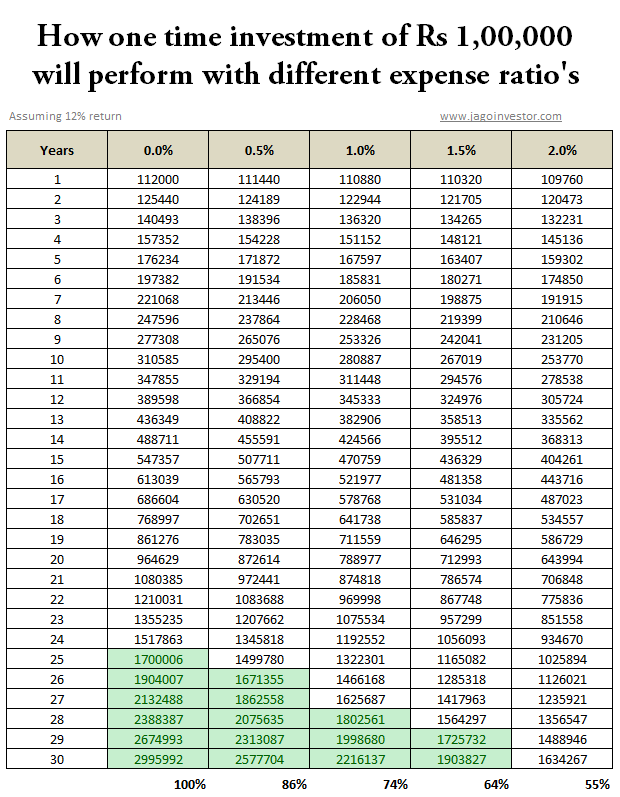

Now this has given farmers the confidence that even they have a big say in this issue and someone is there to listen to them. All villagers now want a revised compensation at high rates (which I feel is totally right and it should always have been that way) or they want their land back. The builders have already spent crores of rupees in construction buyers have already paid the money for flats or have taken a home loan and paying the EMI. Now if all the land is given back to farmers what will happen to builders and thousands of buyers who bought the homes? Who will bear the loss of the mental agony and financial setback which will come as part of this package?

Recently, the judgement has been postponed till mid Aug 2011, when Allahabad High court will decide on the final judgement for the dozens of villagers land. If it says that the land has to be given back, the situation will get uglier. This whole issue is now engulfing whole of Noida and Greater Noida.

Who is to be blamed ?

Now assuming you have understood the situation, who do you think is the real culprit here? Is it the builders lobby who are known (or I would say secretly known) to manipulate the land acquisition part and then do construction there? Or is it only Noida Authority (read Mayawati Sarkar) and their policies for land acquisition? Or if you allow me to say, is it buyers who didn’t spend too much time to foresee the future of their houses if legal dispute gets uglier later? Who among all took things for granted?

I personally feel that there are two main parties who are really suffering here and those are Farmers and the home buyers. Farmers plight is from long time who are fighting for their rights from years and not even living a life of dignity even after feeding me and you and the whole country. Buyers are those who had spend their life earnings in their dream homes and now are seeing chances of delay, in their dream to own a house. More than financial loss, I see it as a big emotional breakdown. No one is there to hear and address their issues. They are skipping their work and business to give Dharna’s and by showing their outrage in masses.

What do you think is the solution in this case? Do you think incident like these are going to change the way people look at real estate buying? Can this Noida Extension issue teach people to pay more attention in what they are buying?

What do you think about this? Open your heart on comments section and let’s discuss it?