A lot of people avoid investing in shares because of the lack of knowledge about stock market investments. In this article, I’m going to tell you about the important terms and terminologies related to investment, finances, insurance, and tax.

First of all let’s know the meaning of each term.

Share or Stock: A Share is a representation of the amount of a company that you own. So if you own 100 shares of a company that has 100000 shares you are an owner for 1/1000th part.

Entry Load: Commission paid while purchasing units of a mutual fund from a broker, No Entry Load to be paid if directly purchased from Mutual Fund Office or its Website online.

Exit Load: Commission paid while selling off the mutual funds before a specified time limit. generally it is. 5% or 1% if exit before 6 months or 1 year.

NAV: The current price of each Unit of Mutual Fund, it goes up or down depending on the growth or decline in value of mutual fund investment.

NFO: New Fund Offer, When a new Mutual Fund is Launched, its call NFO of that Mutual Fund.

Different types of funds

Open Ended Mutual Funds: Mutual funds without restriction on Entry or Exit, Anyone can buy or sell the units anytime.

Close Ended Mutual Funds: Mutual Funds having restriction time on entry and exit , there is some particular time duration to buy the units and then its locked for some pre-decided period. For Eg. ABC mutual fund, a 3 years Close Ended Fund.

Growth option in Mutual Funds: Upon choosing this option, a unit holder does not receives any dividend from Mutual funds but the money it is added to investments which helps in increasing the NAV of mutual fund. Its good for people who do not want to receive cash regularly as dividend.

Dividend Option in Mutual Funds: By choosing this option a investor receives the dividend from the mutual funds whenever it is declared. Its good for investors who need regular cash.

Equity Fund: These are the funds which put most of there money in Equity and less in Debt. Equity refers to instruments with high risk and high returns like Shares, and Debt refers to instruments with no risk or low risk and less returns like bonds, Fixed deposits etc. These are high risky and with high returns.

Debt Fund: The funds which put more money in Debt and less in Equity. these are Less risky and with less returns.

Balanced Fund: The Funds which have money in both the categories in a ratio such that it makes it medium risk and medium return Fund. The ratio need not be 50:50 … even a ratio of 70:30 in booming markets can be considered as balanced. and 20:80 in bad situation will be considered as balanced.

Fund House: A Fund House is a company which manages money invested in different kind of mutual funds. Like all the HDFC Mutual funds belong to

Sectoral Funds: These funds put money in a specific sector or a group of inter-related sectors. They have high risk, high return nature.

Fund Managers: These are the experts who manage he Mutual Fund, they take the decisions like, which sectors to put money in, and which company they will pick up, the strategy, the road map, etc …

Watch this video to learn about different terms of the stock market:

Mutual Fund Benchmark: Every mutual fund has a benchmark against which they measure their performance, they perform better than there benchmark it’s considered that they have done good, else bad. For Eg. A lot of mutual funds have Sensex as the benchmark, some sectoral fund investing in Pharmaceutical may have BSE Heath care as its benchmark.

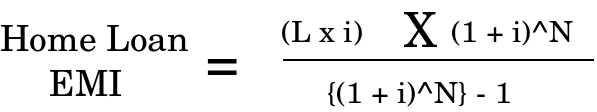

SIP (Systematic Investment Plan): This an investment method through which you can invest in mutual funds every month. Instead of paying 60,000 together, one can take a SIP of 5,000 for a year.

Stock Market: It’s a market that facilitates the buying and selling the shares of companies by connecting buyers and sellers. It can be considered as a mediator between buyer and seller. So anyone who wants to buy or sell shares can do it from the stock market.

Sensex and Nifty: These are indexes of BSE (Bombay Stock Exchange) and NSE(National Stock Exchange). Sensex and Nifty, are indicators of how prices of major stocks are moving at any point in time. Sensex comprises of 30 Shares and Nifty comprises of 50 shares.

They are calculated by a method called “Free Flow Market Capitalization” . When Sensex moves up it indicates that on an average more shares have increased there value and some have declined and vice-versa. It moves up or down depending on the combined valuations of the shares they comprise of.

Market Capitalization: This means how much worth all company shares collectively are. Simply putting:

Market Capitalization = Total number of shares available X Current Price .

Its the total money required to buy all the shares of the company available to the public.

IPO (Initial Public Offer): When a company offers shares to the general public for the first time, its call IPO. The purpose of this is generally to raise funds to finance their future projects and expanding there business.

Correction: It is a sharp increase or decrease in the stock market which was overdue for long. When market goes more up or down than expected because of rumors or for some short term reason, then to average out that correction happens …

Term Insurance: In this, you are insured for a big amount for a very less annual premium, but don’t receive anything when your maturity expires. Its a very cheap form of insurance and considered the best insurance anyone can get.

Endowment and Money Back Plans: In this you get insurance and you get a big lump sum after the tenure expires along with periodic payments in between. The premium is high per Annam.

ULIP’s: These are insurance+investment product, from the premium you pay, some amount is used as your premium towards insurance and rest is invested as per your choice. this product needs a lot of questions to be answered before taking it.

Short Term and Long term Capital Gain and Loss :

In the case of Shares and Mutual Funds, Any profit or loss made within 1 year. Tax treatment will be:

– Short term profits : 15% flat. (2008-2009)

– Long term Profits : Nil

In the case of Land, House, Jewellery, Any profit or loss made within 3 years. Tax treatment will be:

– Short term profits : 20% Flat

– Long term Profits : 30% Flat

Portfolio: Total investments combined are called Portfolio. So if Person ABC has invested Rs x in shares, Rs.y in Insurance, Rs z in PPF and Rs k in Real Estate, it will be combined to his Portfolio.

Trading Account: An account through which a person deals in instruments on the stock market.

Demat Account: An account where shares are stored in electronic format. It’s just an account which stores shares.

Commodities: Commodities are things like sugar, steel, etc … A person can trade in these things also just like shares and mutual funds. Multi Commodity Exchange of India Limited (MCX) is the commodity exchange in India just like BSE and NSE for shares.

I would be happy to read your comments or disagreement on any topic. Please leave a comment.