Congratulations, Now you can now go and deposit the extra Rs 50,000 in your PPF account as the limit for your PPF investments was raised from Rs 1 lac per year to Rs 1.5 lacs in this budget.

A lot of investors had invested Rs 1 lac in their PPF account this year start and when the budget raised the limit by extra Rs 50,000 . They had this big question – “Can I invest Rs 50,000 more in my PPF account this year and get the income tax benefit?”

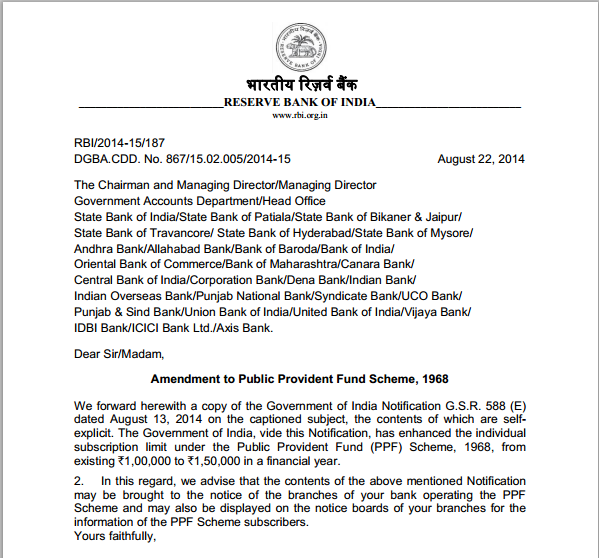

The thing is even if the budget has mentioned that PPF limit was raised, it does not get increased instantly. I mean the banks officials and post office staff does not allow the max limit the same moment. A separate notification is required by the RBI after making the required amendments in the Public Provident Fund scheme and that’s exactly what happened on 22nd Aug .

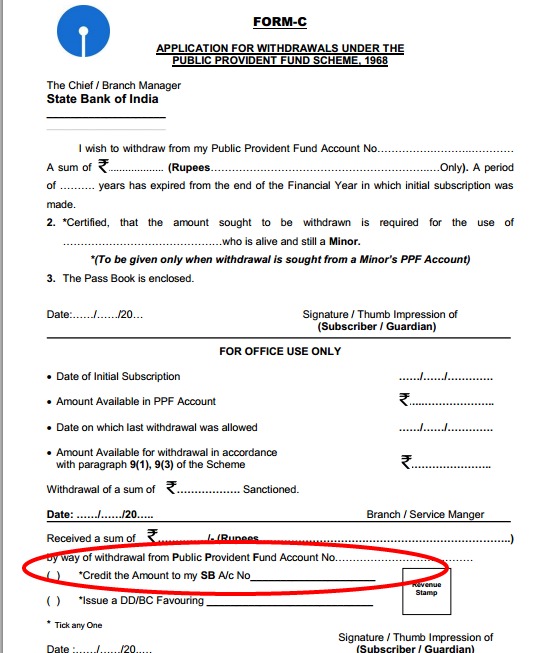

PUBLIC PROVIDENT FUND (AMENDMENT) SCHEME, 2014 – AMENDMENT IN PARAGRAPH 3 AND FORM-A

NOTIFICATION NO. GSR 588(E) [F.NO.1/2/2014-NS.II], DATED 13-8-2014

In exercise of the powers conferred by sub-section (4) of Section 3 of the Public Provident Fund Act, 1968 (23 of 1968), the Central Government hereby makes the following further amendments to the Public Provident Fund Scheme, 1968, namely :—

1. (1) This Scheme may be called the Public Provident Fund (Amendment) Scheme, 2014.

(2) It shall come into force from the date of its publication in the Official Gazette.2. In the Public Provident Fund Scheme, 1968,—

(i) in paragraph 3, in sub-paragraph (1), for the letters and figures “Rs.1,00,000”, the letters and figures “Rs.1,50,000” shall be substituted;

(ii) In Form-A, in paragraph (iv), for the letters and figures “Rs.1,00,000”, the letters and figures “Rs.1,50,000” shall be substituted.

Below you can see the copy of the notification which came 1 day back and the same has been sent to all the banks and post office departments and RBI has asked them to now incorporate it and also inform to all the PPF subscribers.

How much extra income tax you will save by investing Rs 50,000 more in PPF ?

If you are into the highest bracket of 30% , in that case you will save 30% tax on the extra Rs.50,000 invested in PPF. So that comes to Rs.15,000.

Earlier you used to pay income tax on Rs.50,000 (because you had maxed out your investments in income tax saving products) , but now you will save 50,000 and also pay Rs.15,000 less in your income tax (because your taxable income will come down by 50,000)

So now you can visit your SBI Bank or Post office or any other bank where you have your PPF account and invest the extra Rs.50,000 🙂