For the last 2-3 yrs, more and more investors want to diversify beyond Indian equities and want to invest in other countries stocks.

We all have seen news of how some international stocks like Amazon, Facebook, and Tesla etc are doing wonderful and today we will see how Indian investors can also invest in these international stocks in 3 ways

#1 – Directly through a Broker website

One of the ways to invest in global equities is through a brokerage house by opening a Demat/trading account.

This can either be an Indian brokerage house like ICICIDirect, Motilal Oswal which has tie-up with a foreign brokerage house again. Or it can also be some new-age startups like Vested, IndMoney which has a direct tie-up with the global brokerage houses.

Once your account is opened, you can transfer the money to that account and do the buy and sell transactions. However note that these are quite expensive in nature, simply because there are transfer fees (while sending and while taking back the money in your account) which can make them quite expensive especially if your ticket size is quite small.

Here is a simple illustration given in this tweet on only Rs 6,166 get invested when you put Rs 10,000 because a lot of money gets eaten up in the charges etc.

Tempted to invest in US Stocks directly?

Hold your horses✋

If you can’t invest at least ₹1 Lakh at a time, you’re doomed to make significant losses the moment you transfer???? into your US broker a/c.

Huge remittance charges (per transaction) is the devil no one talks about ???? pic.twitter.com/OJX39TvXTK

— Babu (@pooniawalla) March 23, 2021

This simply means that this route is only for someone whose transactions is of large size, and someone who wants the fun of selecting the stocks themselves and reviews them on their own. I feel this is a cumbersome method of investing out of India, simply due to the paperwork and hassles involved.

#2 – Investing through a mutual fund

Another way to invest in international stocks is through a mutual fund. The best part of this is that for a retail investor, there is no change in process and no extra paperwork. You can simply buy the units of mutual funds or do the SIP in the same manner.

Another great advantage is that you get tons of variety and options you get through a mutual fund. If you want to invest directly in stocks through a broker, mostly you will see the option for investing in US-based companies only.

However, with mutual funds, you can get options based on countries, emerging markets, sectors or geographies.. Here are some examples

By Countries / Region

These are mutual funds that focus mostly on a specific country or a region.

- Edelweiss Greater China Equity Off-shore Fund

- DSP US Flexible Equity

- Edelweiss US Value Equity Offshore Fund

- Edelweiss Europe Dynamic Equity Offshore Fund

- Edelweiss Asean Equity Off Shore Fund

- HSBC Brazil Fund Gr Dir

Global or Emerging Markets Funds (which invested in various countries)

These are funds that mainly are not linked to any country, but are ready to invest in various countries stocks depending on growth sectors and opportunities spotted.

- Kotak Global Emerging Mkt

- ABSL Global Emerging Opp

- PGIM India Global Equity Opp

- Sundaram Global Brand Fund

- Edelweiss Emerging Mkts Opp Equity Offshore Fund

- Mirae Asset NYSE FANG + ETF FOF

- Kotak NASDAQ 100 FOF

- Motilal Oswal S&P 500 Index Fund

Funds based on a theme/sector

Finally, there are funds that are focused on a specific sector or theme and feel that it’s too promising. It can be technology, Real estate or consumption etc.

- Edelweiss US Technology Equity FOF

- Axis Global Innovation FOF

- Invesco India Invesco Global Consumer Trends FOF

- DSP World Gold Fund

- Kotak Intl REIT FOF

- DSP World Energy

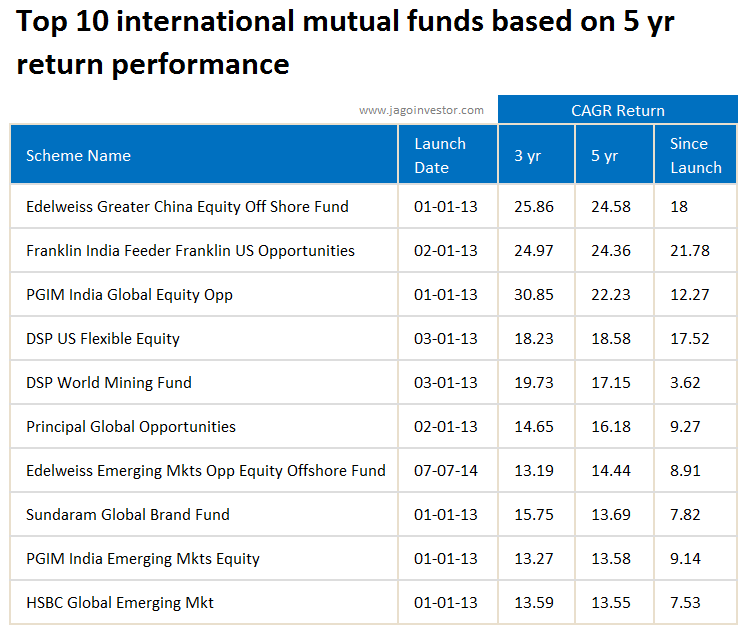

I would to also show you the top 10 international mutual funds based on 5 yrs returns.

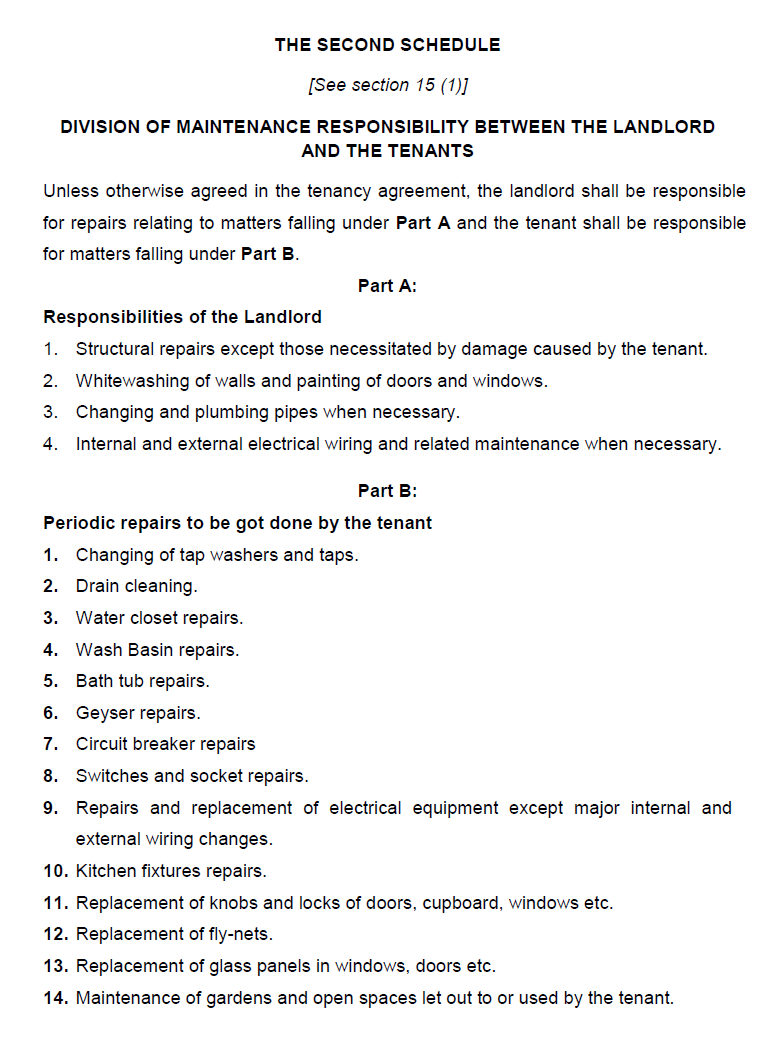

Know this, before you invest in international mutual funds

Note that it’s also quite fancy to think that you are investing in an international portfolio, so many people go overboard and put a very high amount in these funds. Look at these funds mainly as a way to diversify your portfolio and reduce the dependence on Indian equities only. There is no compulsion that you have to invest out of India.

Also, on the taxation front, one big disadvantage of these international mutual funds is that they are taxed like a debt fund. Yes- so any profits you earn before 3 yrs, they will be treated as a short term capital gain and taxed at your income slab rates.

Final point is that these are all mostly funds of funds at the end of the day, which means that they are just a mutual fund that is buying the mutual fund units of another foreign mutual fund (that’s totally ok). So their expense ratio may be a little on the higher side!. But if they are saying you from all hassles, paperwork and guesswork, I think it’s worth paying the fees and participate in the fund.

Do let me know if you have any questions on investing in global equities?