Investing in Mutual Funds vs Direct Stocks – Which is better option?

Should you invest directly in stocks of companies or rather buy mutual funds? Which option is more “suitable” for you?

A lot of investors feel that they should invest directly in shares, because that’s what mutual fund do at the end of the day, however stock investing is a very different game altogether and the dynamics are very different there. Let’s see them one by one.

#1 – Knowledge Required

Most of the people think that investing in stocks is as simple as buying some stocks using hot tips and then waiting for the stock to become multibagger in next few months / years.

Experienced investors know that nothing is far from truth. They know that it requires great amount of knowledge and expertise to study the company’s balance sheets and choose the right stocks for future. There are investors who have spent their life time in studying how to do stock investing and still they make big mistakes.

So coming to the point, stock investing is not a child’s play. It takes years of hard work and a lot of knowledge to pick the correct stocks, where as you do not need much knowledge when it comes to mutual funds investing.

Infact, mutual funds as a product is created for those investors who can’t spend much time themselves to study stock investing. You can just pick a “reasonably good” mutual fund on your own using some basic rules or hire a financial advisor who can do that for you.

#2 – No control on stocks chosen

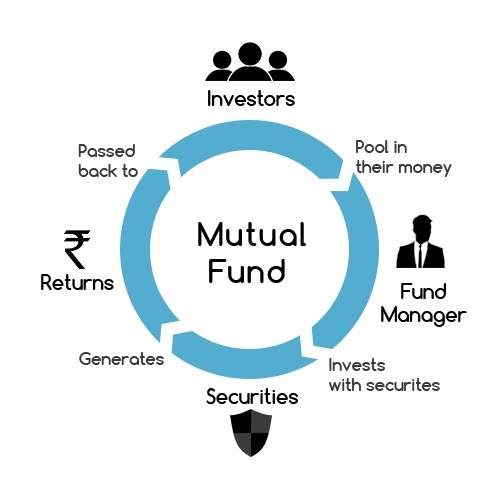

When you invest in mutual funds, you can not control which stocks go in and go out from time to time. That is the job of the fund manager. You only invest in the mutual fund and give your money to the professional management. So you have ZERO control on the stocks which are chosen by the fund manager.

However when you do direct stock investing, you are the fund manager and you have full control over it. So based on your study, gut feeling, logic, hearsay, hot tips, you can buy and sell the stocks, but that’s not the case with mutual funds.

The person who is taking the decision of buying and selling of stocks is a professional who knows the game.

#3 – Professional Manager

There is a different between a pilot controlling the airplane and the doctor doing the same. There is a great chance that the airplane will crash if it’s handled by a doctor (unless he an additional qualification of flying planes).

The same happens when it comes to equities. A mutual fund is managed by a very high quality and professional fund manager who has years of knowledge of various things like economy, credit cycle, interest rates cycle, economy, fundamental analysis, taxation, businesses and has years of experience of equity markets across various countries. They have completed professional studies related to wealth management.

When they manage and take decisions on which stock to buy or sell, they have very deep understanding the sectors and that business. They visit the companies, their factories and meet their top management. They have hidden knowledge sometimes on what is going on within the companies and can predict the future of companies in a better way compared to a normal person.

However, most of the equity investors feel they can successfully invest in direct stocks with great expertise for long term and generate great returns just like a professional manager.

An IT engineer sitting in a cubical at TCS or Infosys can surely buy some stocks based on hot tips, but can’t match the expertise of a professional fund manager who earns crores of salaries in fund houses (and if they can match, it then why not leave your job and shift to Mumbai)

#4 – Volatility & Return

This is very important point, hence read very carefully.

When you buy a mutual fund, you are investing a very large portfolio of different stocks which can range from 30-100 companies.

So your profits and losses are dependent on a large number of stocks, hence the risk is distributed among those stocks and in the same way the returns you get is the average of all. In short there is lower risk and lower return potential compared to a small 4-10 stock portfolio.

When you are a direct stock investor, how many stocks will you buy will decide how volatile is the returns from your portfolio. Most of the direct equity investors bet on very few stocks, they buy 5-10 stocks only (some times only 2-3). So each stock size is quite large in the portfolio and any change (up or down) impacts the overall portfolio return.

Most of the investors are not equipped to handle very high return or very high loss. If there is very huge return, investors sell their stocks and want to lock in the profits and in the same way if there is a steep loss, they want to sell it off and get out of the “risky” game.

In both the cases, investors feel the urge to get out and wait on the sideline, rather than stay in the game – because it’s emotionally very over whelming to handle it.

This is exactly the reason why you will find investors who have a mutual fund for last 10 yrs, but very rarely you will find an investor holding the same stock for 10 yrs.

#5 – Automatic Investments (SIP)

When you invest in mutual funds, there is a standard facility of automatic investing called SIP . This is a great way to automate your investing and create a habit of regular investing. This suits an investor who wants to systematically invest a fixed amount each month on a given date.

However when you buy stocks, you have to manually invest in each stock every month if you want to regularly invest in them. This becomes practically challenging and inefficient because human mind is lazy as per design. No matter how many reminders you set and how “committed” you are, after few months of “success” , it all falls apart for 99% of the investors.

Some portals like HDFC securities have now started the SIP in equities also, so what I am saying does not apply to each and every platform.

#6 – 80C Benefits

Direct stock investing has no 80C tax benefits, however if you invest in ELSS (tax saving mutual funds), you can avail the taxation benefits.

This is one small reason why you can prefer mutual funds over direct stocks

#7 – Active vs. Passive Involvement

Mutual funds are made for those investors who have no knowledge and no time on their side. Once you invest in mutual funds, your involvement is very limited in reviewing the funds over time. The important decisions of which stock to buy, when to buy, how much to buy is taken care by the fund manager and his specialized team of 5-20 research analysts.

However, if you decide to directly invest in shares, all this has to be done by you. Even though it’s not exhausting like day trading, but still you have to study companies, keep a track of what’s happening with each companies in your portfolio, control your emotions (true for mutual funds also) and what not.

In short, you have to be quite active in direct stock investing. It gets tough to focus on stock investing because of so many things in life.

#8 – Fees and Cost

When you buy stocks directly, you only have to incur the demat account charges along with STT and transaction charges if any.

However when you invest in mutual funds, you have to pay something called as Expense Ratio. This is the fees which is charged on daily basis out of the funds, however you never see it yourself and all the NAV’s which are published are post-expense ratio.

These charges are in range of 2-2.5% for equity mutual funds (less charges for debt funds). So this is one point where direct stocks are better than mutual funds, but only if you are able to generate the same returns like mutual funds yourself. There is no harm to pay the fees if the fund manager is able to generate value for you in your wealth creation process.

Investing in stocks directly, just because you will save expense ratio is like not spending money on salt while preparing a dish, because you will save some money. You need to focus on the final taste.

However if you can do successful stock investing on your own, it does not make any sense to invest via mutual funds.

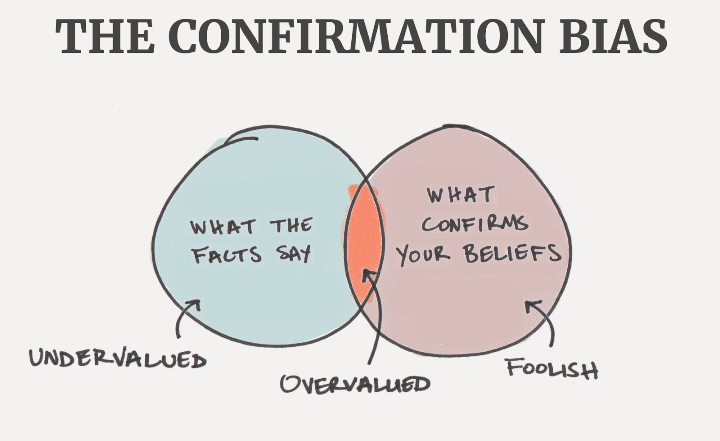

#9 – Emotional Bias

This one is Epic.

Your creation is always special for you and hence when you buy a stock based on whatever research and study you do, it gets very tough later to accept that you were wrong (incase you were) . You will become very biased about your buying decision and will not sell at the right time.

It gets very tough to accept that you were idiot in past for believing in a stock purchase decision and will not sell when the right time comes.

This is exactly why bad equity investors become long term investors. They stay with bad investments for many years and eventually loose. It’s your money and it’s your decision.

However when you invest in mutual funds, all the decisions are taken by a professional who is earning a salary for performance. They take decisions based on logic and keep the emotions out of their system. If their process says “SELL” , they sell it . If it says “BUY” , they buy it ! .

Conclusion

Finally, there are some benefits of going directly with stocks and in the same way with mutual funds. However , direct stock investing is a specialized game to play and it’s not everyone’s cup of tea. For those investors, who want to play little safe with their wealth creation, should choose equity mutual funds rather than trying to burn their fingers in direct equities.

Disclaimer – I would like to disclose that we as a company deal in mutual funds (click here if you want to invest in mutual funds), however we have tried to make sure that we are not biased when we are talking about direct stocks vs mutual funds. In some cases, direct stocks can really outperform mutual funds, but for general masses, mutual funds are better structured products when it comes to long term wealth creation.

September 14, 2018

September 14, 2018

A very good article,nicely balanced. Thanks Jagoinvestor team!

Welcome !

Nice

Great article! I regularly read your blog and get a huge value out of it. It gives me lot of idea for writing my own post on financiallypro.com.

I am CA Student and know very well about how to invest directly in equity. Still i prefer mutual fund as i know what kind of research is required for Investing in equity and I don’t get time to research.

Waiting for your next post!

Thanks for sharing that.

Thanks, Priyanka, for sharing the article.

Welcome !

Dear sir,

today first time I smell ‘bias ness’ in your post. Let me tell you that till date what ever posts published from you were found neutral but today it wasn’t. Anyways one can always says that mutual funds are better for common people. But I’m having one question in mind that if the fund managers are so called expert of the market, then why all funds are not performing best? Some funds do better and some are poor. Are poor funds not run by a good paid fund managers?

One more question I would like to ask that if they are doing job of managing fund for people, then why they are not investing for them only. In that case they would earn better than this job.

Hi Nimesh

I would be happy to know which point made you feel that? I have put all the points very clearly and with facts. Let me know which line or which statement made you feel that I am pushing mutual funds compared to stocks?

Also do you have full understanding of how mutual funds work?

You asked “Why all funds are not performing best when its run by experts?” . The simple answer to that is, why do all people not run the race in olympics, when they are all well trained and experts? Its obvious that some will be 1st and some will be last.

In mutual funds also, there are various factors like management style, fund manager expertise, luck and many others things which makes some funds better than others. Yes, not all funds will perform better .

Also, why fund managers do not invest their own money in the funds? The counter question for that is who said that they should? Why should they?

If a person is selling Gujrati food and saying that its great food, then will you say that if its so great, then you dont you eat it yourself? May be they like South Indian food.

By the way many fund managers do have exposure of their own money in some funds and some times its also restricted by SEBI to make sure there is no undue advantage taken by fund managers and companies.

Its quite a different world and its important to have deep understanding become making some statement. I request you to point of which part of my article made you feel that I have made wrong representation ? We can talk/debate on that .

Manish

Very nice article Manish and Nandish. Definitely useful for us investors.

Could you please share some criteria that help to figure out the best mutual funds out of tons to choose from?

Will write an article on this soon, but its not a few points checklist . I mean you can still choose some good funds out of a small checklist, but to do the best work, you need more better tools and resources.

Manish

The article does not address the issue that a vast majority of Mutual Funds have given mediocre returns considering the fess that the fund houses charge.

Yes, there will be many funds like that .. Which time frame are you talking about? And did those funds beat the benchmark?

Manish

There is one middle way in between that many doesn’t know, check the portfolio of whichever Mutual funds you like and in that check their major stock holding. You may select those stocks as they have definitely selected after thorough study. 🙂 Even if you do not trust them then check the shares under Nifty50 and buy whichever shares of businesses you understand i.e. Bank,IT,FMCG,Pharma,Metal,Auto. I hope this will be helpful because you can sell your shares anytime if you need your money and there is no any exit load like mutual funds.

Disclaimer: This is for the people who at least understand very basics of the stock market and take risks.

Yea , one can do that, but this is quite risky for retail investors who do not understand much of equity !

You Earn salary or income. You invest directly in share. Profit or loss is yours. Slowly you will learn the trick . But do not invest all in one asset class. You invest in mutual fund . You pay for commission , bonus and perks for fund manager and employees. Why entrust your hard earned money to some one. Over and above, that pay him for it ? 10 %- 12 % returns per year you can always make in share trading plus thrill of it. But it should only be about 20 % of your invest-able fund. This is 28 years experience. Take t or leave it.

Hi George

I agree that you can make 10-12% return each year compounded if you do it in right way and have patience. But the logic of why to invest in mutual funds because fund managers, and company and distributors earn from it , is a unhealthy way of looking at it.

Mutual funds is a business at the end of the day and there are entities who are involved in this who play an important role . Just because someone is earning out of your money does not make things bad for you.

You need to focus on how its adding and benefiting in your life, rather than how others are benefitting from it.

Yes, if you are loosing out of it and its a bad thing for you, then no one should earn from it.

If every body thought like this, I think we will be back to stone age because everything in this world is helping someone else earn money. Thats how trade and businesses work

I hope I was able to understand what you tried to say. If not, let me know

Manish

Sorry, I did not wish to hurt any body’s feelings. I forgot to mentioned that I burned my fingers in quite a few MFs. I do’nt wish to name them. I am sure , the fund managers must be getting their salary, perks in spite of fund loosing. I wish all the MF investors the best of luck.

Hi George

May be your bought some mutual funds without having proper understanding of how it will benefit you in long run. Mutual funds are volatile in short term (<5 yrs) and your value will go up and down.

Mutual funds are long term wealth creations tools and judging its performance on short term is not a correct thing.

May be the person who sold it to you did not educate you enough on how to benefit on it.

I take responsibility of educating you on this incase you want to . Let me know if you have any queries which can change your relationship with mutual funds. I would be happy to answer them and bring back your confidence in mutual funds

Manish

Thanks for information,very useful

Welcome !

Nice informative article. Mutual funds also give you an option of ‘switch’ across funds within a fund house whereas direct stocks do not have any such option.

Yes, good point ! ..

One type error ‘ NOT ‘ in second point first sentence is missing.

Thank you for writing. You are my first blogger. Benefited me most

Fixed ! .. thanks for pointing it out !

Great Article. Thank You For Sharing Priyanka,

Welcome !

Well said. Nice & Simple article..

Welcome !

A million mutual funds out there. Anybody’s guess.

MFs are there to make money out of investors, rarely for them.

Equal profit or loss for reasonably intelligent investor, from MFs or stocks.

This article sponsored by MFs

“MFs are there to make money out of investors, rarely for them”?

Sir, please share some data on this. Are you saying mutual funds have not done wealth creation for investors over long term?

I would love to know which is a 15-20 old mutual fund and have destroyed wealth ?

“This article sponsored by MFs” .. Yes, we do business in mutual funds and we earn out of it, and it was clearly written in disclaimer, however how did you figure out that its a sponsored article? We get many offers for writing for money, and one of the conditions is to mention the brand , write great things about it and also offer a link back. I think there is nothing of that sort in this article !

Critical comments are welcome on this blog, it helps in discussion, but please give some basis of what you commented!

Manish

Hi Manish

I have been following you for long time and i agree that your articles used to be really informative and it has helped me and for sure many more like me to be financially conscious.

But here is a catch , all this effort you put to make the “brand ” as you say was for this day when you can yourself become a broker selling the MF and earn a commission out of the profit of the investor . I don’t criticize your business model , you are fully free to do what you like and its your right . They say na , nothing comes free in this world . But stop trying to show that you are still impartial . Have courage and come out and openly say that you are a broker now and your aim is to make money by taking commission out of each MF sold through you .

But to add , surely the moment you become a broker house for the MFs , the impartiality and credibility to give honest opinion goes for a toss and hence the theme “Jaago Investor” loses its significance .

Your article should have prominently mention that if some one wants to invest in the MF , the Direct MF is much better option . It is proven to give a benefit of 15-20 Lakhs better return for the same MF growth option ( for 20 yrs SIP of 10k with 12 % CAGR return) that you offer .

If the same article would have been published 3 years back in Jaago investor wan impartial Manish would have advised to go for a “Direct Plan ” for a MF so as to minimize the Expanse Ratio.

Hi Sumit

Thanks for sharing your honest views. I am not sure for how long you have been reading our blog. We have mutual funds as one of our core revenue models and it has also grown well in last few years and we have come to a point where we need to continue with the same business model for near future. So when you say that I am biased towards it , I would not deny it .

We are all biased in whatever we do and engaged it, we give people all the reasoning and points which shows us correct and others wrong and I am well aware of my biasness.

I am not sure how long you have been reading our website, but you saying that we did create this website and everything we do on this blog is so that we can sell products and earn commission is a little over judgement. I dont deny that we do lot of content creation and we are creating our brand so that our mutual fund business and other things we plan to come up with can grow, at the end we are into business only.

However saying that “Direct funds will make 25 lacs more compared to regular over 25-30 yrs” is surely selling dreams for a common Indian investor who is seen by everyone like a advanced pro investor who has maturity to stay invested for 30 yrs and also do his reviews and changes in portfolio from time to time on his own.

I have no doubt (no one should have it) that if you choose portfolio A and stay with it for 30 yrs in Direct option, it will surely beat Regular because of low expense ratio. Its pure mathematics, but when you do wealth creation there are many other elements which seem very simple and many think that there not “much” in that and we all can do it ourself.

No one talks about Advisor Alpha (the additional returns which comes due to good hand holding , timely reviews, by controlling investor behaviour), If mutual fund investing was all about investing one time or starting a SIP and leaving it for many many years with once in a while changing it, then surely direct was better all times. But sadly at this point, most of our investors are not at that level , where they can do all this by themselves (this point is debatable).

There are 95% advisors in mutual funds whose whole focus is only to sell funds which are giving them high commissions and nothing else. They are not here for any long term business/profession and they treat their investors as wallets selling them shitty products which does not suit their requirement , nor their risk appetite.

However there is a call of advisors who sell regular plans and they are here to build a client base who create massive wealth by focusing on everything whatever is needed for it. Sadly, the whole advisor community is seen as bad and trying to only snatch the commissions.

Anyways, I just wanted to give my view point. We also have fees only clients who are doing planning and advice with us and doing Direct plan somewhere else.

At the same time, we are also seeing many clients who are doing Direct and came to us that they want to get into Regular now as they are not able to manage things well themselves and need someone to fully handle their portfolio. When we asked them that they can pay a higher fees (which is a right compentation for our work), some paid that, but majority said that they know that we will be paid by companies.

At the same time, we had had many investors recently who signed up with us and when we said that they can choose direct (by paying us fees) or Regular , they said something like – “I will do Regular as of now, because your fees is high for me (not more than Rs 10,000)” and % wise the commission you will get will be much lower” . Nothing wrong in that, but I am just trying to show where is the focus of most of the new investors .

Its not a “X is always better than Y” when it comes to Regular and Direct as projected by many investors. Also at the same time, the advisor community is also too much against Direct and does not give the recognition and importance it deserves, which is also not right.

Anyways , I dont want to defend myself, just want to debate the topic openly in a fair way.

Also, thanks for the maturity you showed when you said – “I don’t criticize your business model , you are fully free to do what you like and its your right . They say na , nothing comes free in this world” . Many investors right now have to cross atleast this benchmark 🙂

Have a great day and let me know what you feel about what I wrote.

Manish