Unrealistic returns

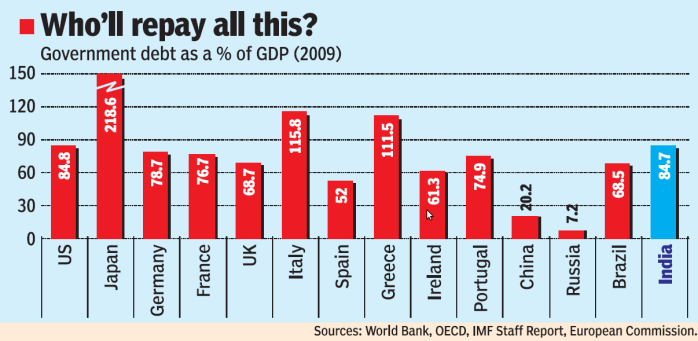

Risk free returns, in our country are amongst the highest in the world. In countries like US, the interest rates are 1-2%. Equity markets in our country continue to provide 12-15% annual returns (Find Why) . But how much do investors expect from equity these days? A lot! No one is ready to settle below 20-25%? 12% is abusive to them, & makes them feel like they are cheated. A reader told me that he earned 100% this year from equity (2009) and he will be happy with even 25% next time! LOL! This happens when you look at short-term returns. Investors who started in 2004 started thinking that they are all “Warren Buffet” and can leave their jobs in some years! Whereas all investors who started in 2007 end or 2008 start compare equity with their mother-in-laws, they just can’t stand it.

Think long-term, and timing will just not matter much. For retirement and child education, which is 15-20+ years away, just start a SIP in an Index fund and then go into a COMA, come back once in a while and just review it every 6 months to a year. That’s all.

Feeling special when it comes to Life or Health Insurance

I’m not sure why, but some people feel that they are god gifted. They feel good health is a good excuse to skip Health Insurance and just because they don’t drive carelessly, it makes them “Accident proof”. They don’t realise that most people die in accidents not because they don’t drive well; it’s because the other person does not. Probability of dying is almost the same for everyone, but everyone feels that they have better chances, of not being part of an accident or an attack.

Be realistic; especially in bigger cities the chances of accident is higher than smaller cities. Most and more casualties happen in bigger cities. Take adequate Life and Health cover.

Excessive Leverage and careless spending

In recent times, we spend like there’s no tomorrow. Easy available credit for home loan & the tax breaks available on them, EMIs available as an option for buying almost anything these days; all these easy means for laying hands on money has suddenly changed the way we see “Acquiring Assets” and “Spending”. Unlike our parents and grandparents, we are spending money, which we haven’t even earned. We buy houses, cars, vacations etc., and then pay the cost for the rest of our working lives. In some cases, it might make sense, but a large section of society just lives beyond their means (See this eye-opener from Subrmoney) .

Research shows, that we feel less guilty when we pay with our credit cards rather than cash. When we use cards, we don’t see money going out; there’s just a consolidated bill at the end. Nothing can be done (or undone) then, you just pay it. Imagine you are paying cash every time you are buying something you really do not need. We buy unwanted clothes, & unnecessary gadgets we can do without. How many of us claim, sometimes that we just can’t survive without a certain device, or feel that we can’t enjoy our life without certain doodads? Didn’t our parents and the old generation live without them or with limited quantities ?

Why have we all suddenly shifted to plasma TV rather than the old TV we have used in our childhood? Of course, technological changes should happen and we should always move forward, but buying a Plasma TV just because it looks cool in your drawing-room, does not make sense at all; that too, if you haven’t yet planned for your retirement or taken care of all the important goals in life. If it’s really your need , then go ahead , I would encourage , but most of the time people buy it out of comparison with friends and relatives. Once your other priorities have been achieved , you can go for it, But not at the cost of something more important .

I’ve heard horror stories of people who have bought homes and are crying today. Their home prices are moving up, but the quality of life has drastically decreased. They suffer horrible amounts of stress because now, even small things in life which gave them happiness, look unaffordable… all because that 2 BHK Flat’s EMI has to go through next month (A close look at Real Estate Returns in India).

No quality trips & vacations, heavy stress because of insecurities of jobs. Imagine a double income family with income of more than Rs 1 lac, who belongs to top 1 percentile of the highest earners in the country, but not leading a happy life because of excessive debt they have taken on all the loans and not enjoying little things in life because of these issues . Whats the point of earning so well then ? Don’t try to be over ambitious at the cost of your current lifestyle and happiness! If you can’t manage your life successfully and happily, then the car, and the house, and all that financial planning is just a waste. (Read What is the goal of Financial Planning)

Short vision

Close your eyes and try to imagine your retirement, child education & marriage related expenses, and health care costs after 30 years. Can you predict your grocery bills after retirement? Living in present is great, but planning your future is critical now. Let us do a small exercise to show you what your dietary (food & eating) expenses at home after retirement will be.

Consider a 30 years old couple today… How much do they need to eat a decent breakfast, lunch and dinner at home? Even if you consider a meal at Rs 25, that’s Rs 150 for 3 meals/2 person a day, thats Rs 4,500 per month. I guess that’s what the grocery bill of most married couples in their 30’s would look like (I am unmarried, as yet). Now, Rs 4,500 per month today, means 25,000 per month after 30 yrs, which is 3 lacs per year just for groceries. Forget inflation for now, if you live for 30 yrs after retirement (worst case), that’s 30 years X 3 lacs = 90 lacs just for your breakfast, lunch and dinner and this, doesn’t even consider inflation. Some people think they would need 1 crore for their retirement , LOL !! . You will require at least 10-15 crores, start working on it NOW !! . Pray to God, you don’t live longer than that, else it would be really painful!

Not ready to pay for Advice

This is in our culture & our genes, it seems. The very idea of paying for advice is anathema to us. We rely on “free” advice most of the time. If we can get the top 10 mutual funds from valueresearchonline.com, then why pay someone for advice? When we know term insurance is best, and we have a good formula to calculate life insurance requirement, then why do we need a financial planner to tell us how much Insurance we need? If we have so many personal finance websites and magazines then why do we need financial planner, we can do it all by ourselves? We are a DYI (do it yourself) country! . I get many questions over email and comments, Imagine me asking for money for giving personalised advice, How many people will consider paying or will even accept that its fine ?

We must understand, however, that there are situations where you just can’t match professionals in some areas. The other thing is some advice can be general. For example “top 10 mutual funds” might not work for you, & might not be suitable for your situation. A different set of mutual funds might work in your case and to analyse your situation, an investment consultant can be helpful. You have to take a call on whether its worth doing it all yourself or pay the fees & have a pro handle it.

Take large real estate transactions for example; I am amazed to see many people mailing me questions on complicated real estate deals, they are doing themselves, which actually might need a CA attention or professional advice to deal with. But why pay the CA that extra 10k or 15k he will ask for? They then, make mistakes and in long run lose a big amount of money just because of ignorance and not having optimized the whole deal.

Read Part 1 of Common Mistakes in Personal Finance

Comments Please , What are your views on these mistakes , which was the real eye-opener for you ? Do you want more of these kind of articles ?

Source : DNA

Source : DNA