Do you think corporate fixed deposits are as safe as bank Fixed Deposits? Has come agent convinced you that you will get 2-3% higher returns from corporate fixed deposits without any risk?

If that’s the case, you need to be educated a little more about corporate fixed deposits. I will talk about 5 major things every investor should know before they put their hard-earned money in corporate fixed deposits.

What are Corporate Fixed Deposits?

Corporate Fixed Deposits are deposits that are issued by private and public companies, which work very much like bank fixed deposits. There is an interest rate offered and there is a maturity duration for the company deposit. You can either opt for a cumulative option (where your interest is added in deposits) or you can opt for a non-cumulative option, where you are paid the interest after every fixed duration.

A lot of agents get a good commission for selling these corporate fixed deposits to their clients. Nothing bad in that as such, but you need to be clear about some important and critical points related to company fixed deposits.

Let’s start…

Higher the return, higher the chances of Default

In almost all cases, the corporate fixed deposits offer quite higher returns compared to a bank deposit. If bank deposits rates are 7 %, you will see that company deposits floating in markets are providing your returns in the range of 8-14%.

Always ask the basic question – “Why is a company providing higher returns?”

The logic is very simple, a company needs money for expansion or for some project and to fund that project, they can either take a loan from a bank or raise money from other measures and for that they will have to pay very high interest.

So they float corporate fixed deposits where normal investors like you and me can invest in their deposits and earn higher returns.

But, because you get higher returns, there is also high risk involved in corporate deposits. You never know how the company will do in the next few months or years. You never know how the project of a company turns out and if it’s going to make a profit or loss.

In short, after a few years, when its time for maturity – what will happen if the company’s financial health is not good? Will they repay the money on time? Will they repay the money at all?

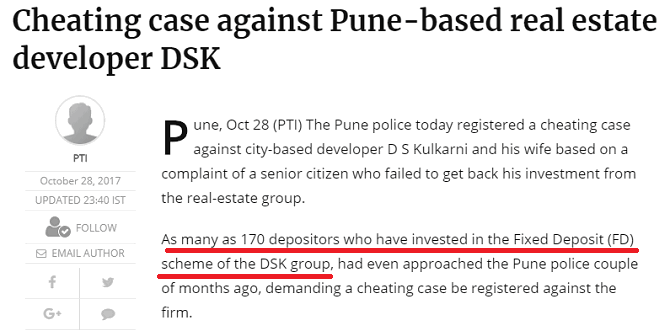

In one of the recent examples, a lot of investors had put their money in DSK group fixed deposits

A lot of senior citizens are lured into parking their hard-earned money into many shady fixed deposits offered by small or medium-sized company fixed deposits by showing them high returns.

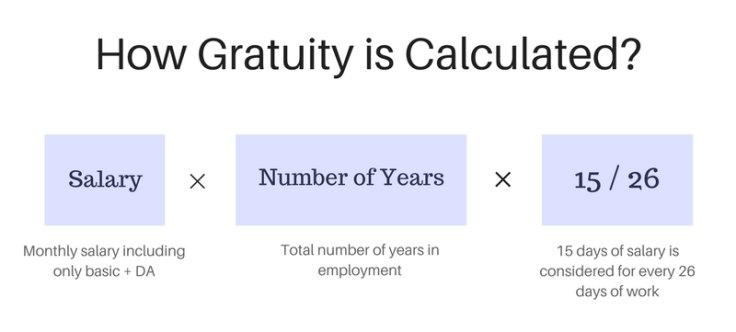

Below is a heart breaking case study of a 78 yr old person who had put all his gratuity and PF money into DSK Kulkarni FD (a very big real estate group in Maharashtra). When his FD maturity came, he was told that he should renew it for another 6 months as its tough to repay right now. The video below is in Marathi, but you will understand some words and will be able to make out what is being said!

So please understand that when you are investing in corporate fixed deposits, there are good chances that if it’s offering very high returns, there is a lot of risks involved in that. You cant get higher return just like that.

Many big companies also offer corporate fixed deposits, but then the interest offered is quite lower and looks reasonable. However the risk is still there unlike a bank FD.

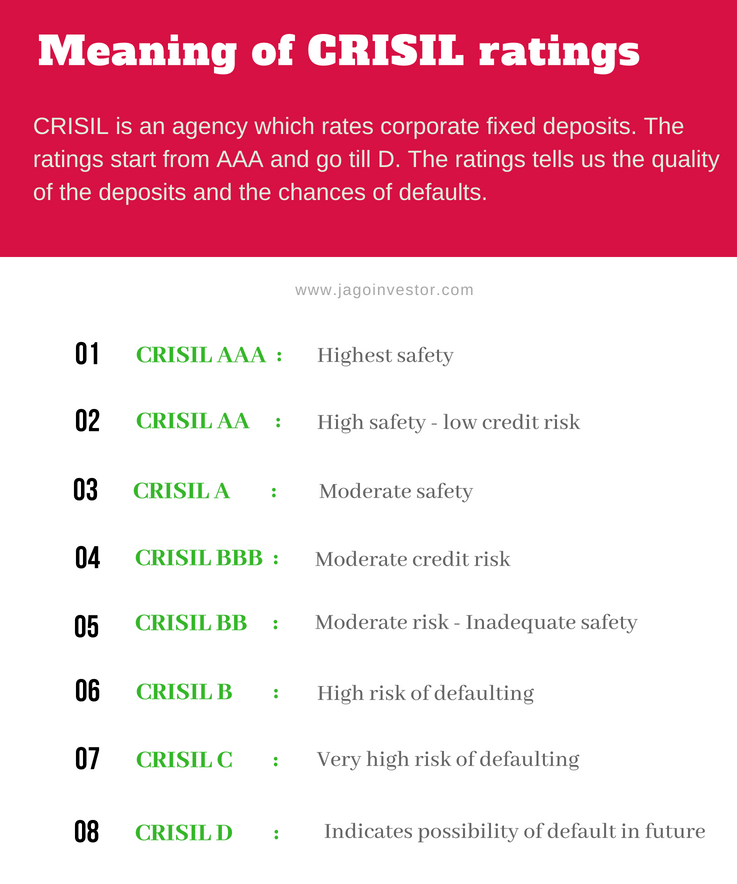

Every company fixed deposits are rated by agencies like ICRA, Crisil, CARE etc and they give a rating to the FD. These ratings are a measure of the company’s ability to pay the interest as well as principal to its investors. A high rating means no or very low probability of default.

Corporate FD’s are not regulated by banking rules

Note that unlike bank fixed deposits, corporate fixed deposits are not regulated directly by RBI regulations. All the deposits under corporate deposits are governed by provisions of 73 to 76A of the Companies Act 2013 (erstwhile section 58-A of The Companies Act 1956).

If the company is not paying you on time, you cant do much in that other than following up with the company. However, Fixed Deposits of Corporates are secured borrowing, so in case of winding up of business, secured borrowings are given preference over equity shareholders in terms of repayment.

Some important points related to Corporate Fixed Deposits

- TDS is deducted @10% if the yearly interest is more than Rs 5,000

- Premature closure of company FD is not possible for 3-6 months

- Pre-closure of company FD is not a straight forward process, it’s cumbersome and involves too many documents

Still, want to invest in Corporate Fixed Deposit?

If you still want to go ahead and invest in a company fixed deposits, please take care of the following points.

- Make sure that the company is paying regular dividends to its share holders

- The balance sheet of companies is showing profits at least for 3 yrs in a row

- Make sure its an at least a 5 yr of company

- Make sure they are offering realistic returns (2-3% more than a bank FD). Do not fall for those companies which are offering very very high returns

- Make sure these companies are listed on the stock exchange

- Make sure that they have got a high rating from CRISIL like (AAA or AA or A at least)

Let us know if you liked the article?