People are confused , really confused …

There are 3 Mutual Funds Options (Growth , dividend , dividend Re-investment) and we will discuss those today. There are lot of misconceptions and myths which add to confusion in the world of mutual funds and agents use it against investors and make them fool …

Different Options in Mutual funds

1. Growth Option

Under this option you get the units at the time of buying and you have same number of units till the end. The NAV keeps changing according to performance.

2. Dividend Option

This is the most misunderstood option in mutual fund.

Dividend option in mutual funds means that you will be repaid some amount of your investments every year and it will be called as “dividends”, this helps those people who want some regular returns every year from their investments in mutual funds.

People think that dividend is something extra which they receive other then their investments which is not true 🙂

Dividend is declared per unit basis, if you have 100 units and MF declares dividend Rs.4 per unit, you receive Rs.400, and you think that your earlier investments have the same worth, where as it decreases by the amount you receive as dividend, because its paid out of your investments only.

The NAV of the unit goes down after paying dividend proportionately.

Example : Let assume you have Rs 1 lac of units in a mutual fund with NAV of Rs 100, you will have 1000 units. dividend declared : Rs 20 per unit

How it works :

You will get Rs 20,000 and then your remaining worth will be Rs 80,000 and as you have 1000 units, the NAV will go down to 80. So your actual worth is same as Rs 1 lac. The only advantage to you is that you are getting liquidity with your investments and getting regular cash every year, unlike growth option.

Agents generally lure investors to invest in NFO’s claiming that if company declared dividends, they will get more dividend compared to existing funds as they will have more units, Which is nothing but a idiotic myth 🙂

3. Dividend reinvestment

In this option ,the step is as follows

- Re-adjust the NAV assuming that dividend is paid.

- After that buy more units of same MF with that dividend money and allot it. So ultimately the number of units increases and the NAV goes down. In this case dividend money is not given to the investor but re-invested in the same scheme.

Example : Let assume you have Rs 1 lac of units in a mutual fund with NAV of Rs.100, you will have 1000 units. dividend declared : Rs.20 per unit

How it works :

Your dividend will be Rs.20,000 , and NAV will come down to Rs.80 like it happened above. Now this 20,000 will be re-invested in same mutual fund and you will get extra 250 units (20000/80).

Your Total units = 1250

NAV = Rs.80

Worth = 1250 * 80 = 1,00,000

Which one is better Dividend or Growth?

It depends. There is no thumb rule to decide which one is better then the other, it depends on the situation and your needs.

Watch the video to learn more about growth and dividend option:

When is Growth Option better?

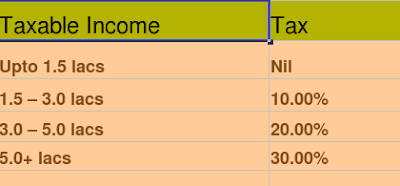

If you are a person who earns well and does not need regular money back from your investment and if you are looking at long term investments then growth option is best for you because your investments gets compounded, which does not happen on the dividend part in dividend option as it goes back to investor and its never part of future growth.

When is Dividend Option better?

If you are a person who need regular money every year from investments for some purpose, It may happen that you have more responsibilities and more dependents and if any small money which you get extra every year is helpful to you , in that case you can go for dividend option.

Conclusion : Different options in mutual funds are for different types of investors, before investing just see what do you want from your investments and take appropriate option.

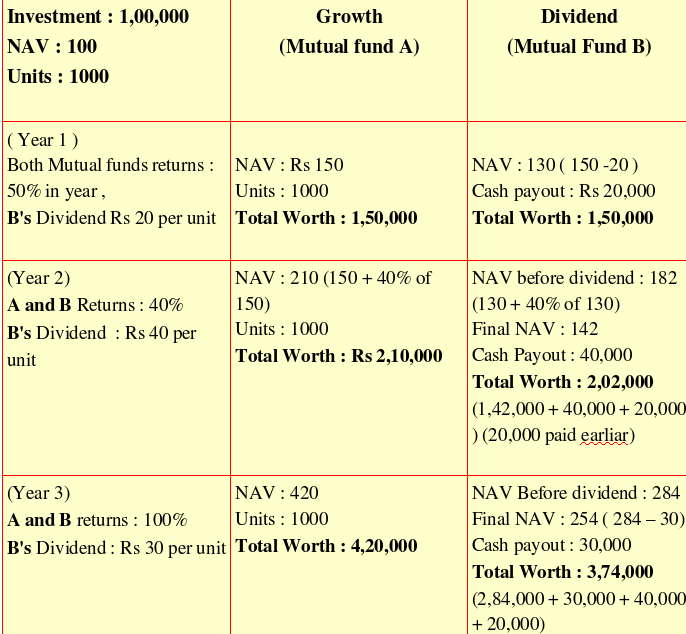

Returns in long term from Dividend and Growth :

Below is an example which shows the returns from similar funds with growth and dividend options and there performance over 3 years.

I would be happy to read your comments or disagreement on any topic. Please leave a comment.