What is the equity and debt exposure of your portfolio? How many different companies have you invested in through mutual funds? And do you know of any tool with great UI and simple features that can help you analyse your mutual funds and stocks in detail? If you wondered that there is no such website which can do such analysis and that too for FREE, I am happy to introduce you to moneysights.com. It does it all that for you and much more…

From a few months, I am in touch with moneysight’s team. At that time they were still building their product and were trying to solve some key issues which investors face today and I knew from beginning that users will like their product when it goes live. Just a month or so back when their product was in beta mode, all the Jagoinvestor readers on email (see sidebar for subscription link) received the beta invitation from moneysights and they got a chance to use their tool exclusively and in advance than others.

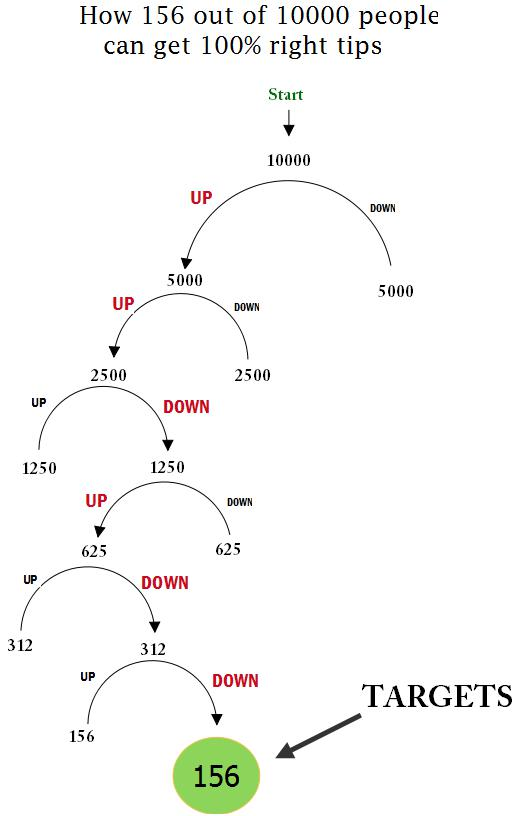

The reason why I want to know about moneysights is because they aim to solve 3 key problems that is faced by common investors in India. These problems have played a crucial role in ensuring that Mutual Funds & Direct Equity investments remain under-penetrated as fas as mass market retail investors are concerned. I have described these problems below from Mutual Funds point of view –

Problem 1 : Choice & Suitability

There are 4,000+ of Mutual Fund schemes in the India today. If one includes the variations & scheme options like Growth, Dividend, etc. These schemes are broadly classified in 10+ types like Equity, Debt, Balanced, MIPs, ELSS etc. Most of the average retail investors don’t understand or demand so much of choice and option. A large number of schemes not only adds confusion to the decision-making process but also often results in postponing our investment decisions (i.e. taking actions).

If the quantity of schemes in the market is the first problem, then knowing the suitability of the scheme to an individual is another problem to be cleared? Not every scheme is suitable to every type of investor. An ICICI Prudential Discovery or IDFC Premier Equity may have given great returns & hence they command a 5-STAR return rating but how many of us know that both of them primarily invest in stocks which most often may not be Large-cap stable businesses. And hence they may not be suitable for someone who is risk-averse or someone who is just beginning to invest. Wouldn’t investing purely on return ratings may bring-in a surprise to the investor when the markets go into a downward trend?

Problem 2 : Construction of Mutual funds portfolio

Reading my previous posts on how to create a Mutual Fund Portfolio or How many funds are ideal to have in a Portfolio, you would have realized that diversification in the Portfolio is very important. But then, why how does one construct a diversified portfolio of 4-5 different Mutual Fund schemes. There is so much information needed to construct a diversified portfolio that it’s definitely a cumbersome task to construct one manually.

For example having a HDFC Top 200 & a Birla Sun Life Frontline Equity isn’t diversification but duplication. They are 2 similar funds & having both of them doesn’t make sense in a diversified portfolio. Look at this jagoinvestor forum question of mutual funds portfolio review and moneysights helping him.

Problem 3 : Tracking of Mutual funds portfolio

After someone invests in a set of Mutual Funds, is there a way to track, monitor & manage the Portfolio in a seamless manner? Most websites do offer tracking services. But then, again people like Venshu had asked about how to get annualized returns so as to compare portfolio performance, sector allocation, etc. so that one can get actionable insights to manage the Portfolio on an ongoing basis that minimizes portfolio risks & optimizes returns. I have used their tracking tool myself and it looks simple and good to me.

Some more good features

Some of you who would have registered on moneysights.com may be able to relate to what i’m talking here. However, if you have not tried it yet, let me summarize quickly on what stood out for me –

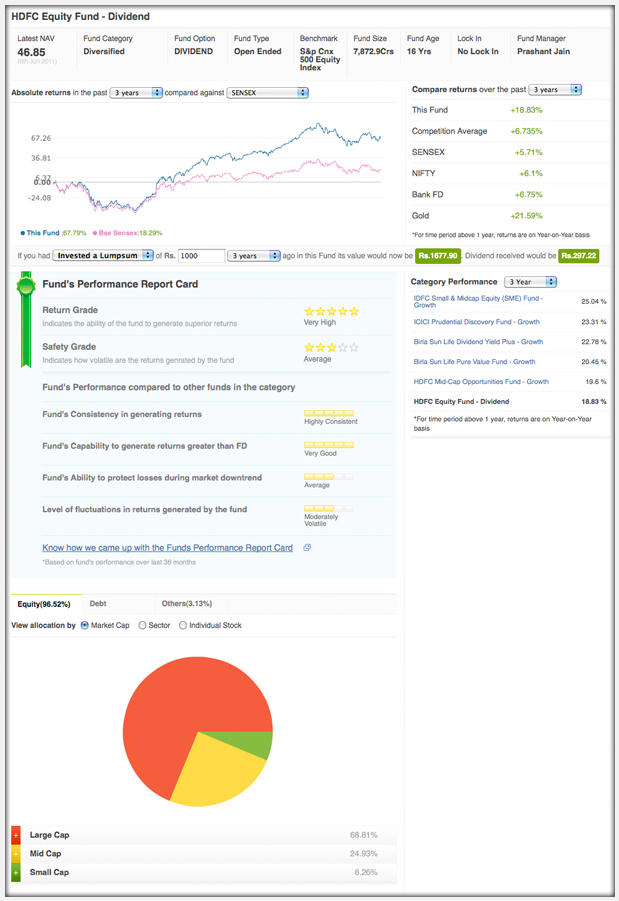

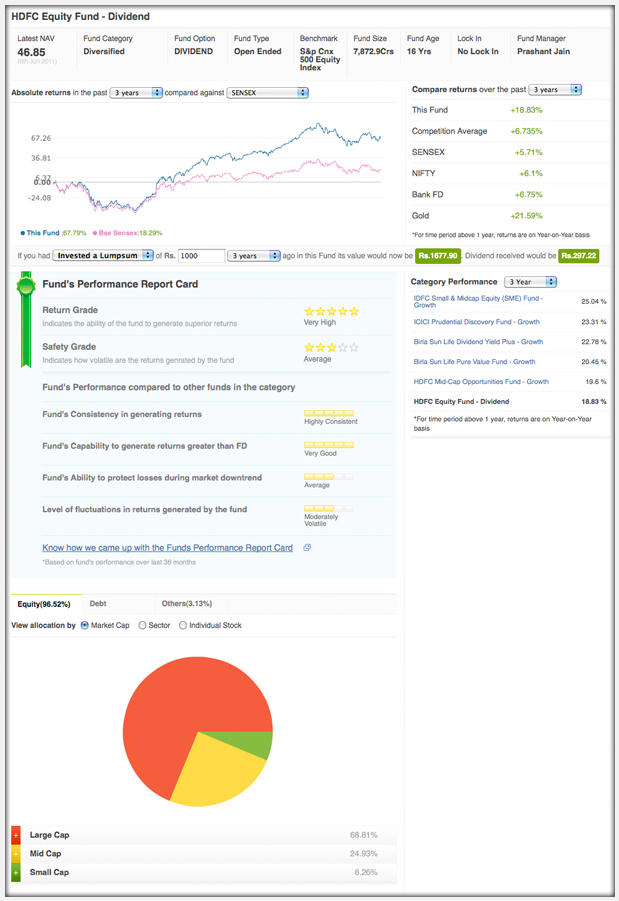

1. Fund’s Performance Report Card

Moneysights allows you to get more information about a specific mutual fund scheme in a quick & simple way. Just go to the Find Mutual Funds section where you can search or browse for specific Mutual Fund schemes. Opening the detail page of a Mutual Fund scheme like HDFC Equity Fund would allow you to see –

- A unique way of portraying Fund’s Performance through Fund’s Performance Report Card – also notice the no-use of financial jargon

- Performance Comparison with fund’s benchmark, SENSEX or NIFTY – notice the lack of importance to NAV & prominence to performance chart w.r.t. various benchmarks

- Return Comparison with SENSEX, NIFTY, Category Average, etc. in tabular format during different time periods

- How much your money would have grown had you chosen to invest in this scheme – notice the actual amount of dividend you would have earned

- Mutual Fund Category Performance comparison within different time-frames

- Portfolio composition of the scheme in terms of asset class, market capitalization, sector exposure & underlying stocks

So, all the information you require for knowing how good or bad a Mutual Fund scheme is available within a single-page interface.

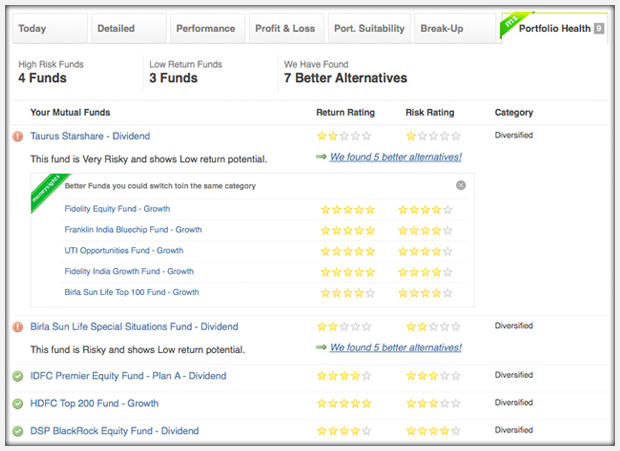

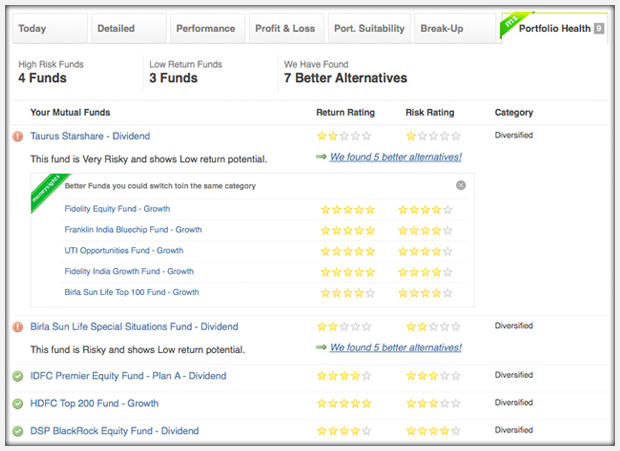

2. Portfolio Health

Now this is another valuable feature. Many a times, readers have posted questions on forum about specific funds that they have invested in. Questions like shall I stay invested in (say) a Reliance Vision Fund or Sundaram SMILE Fund which probably used to be good performers at some point in time but are not the best ones today. Does it make sense to redeem & divert the investment in some other fund in similar category? Portfolio Health answers this.

The way I understand moneysights is doing is they find a scheme which belongs to same category as you have & check if there is a scheme which has performed better – i.e. taken lesser risk but has offered more returns. If they are able to find a better option, they show these options. Let me know what you feel about this in comments section.

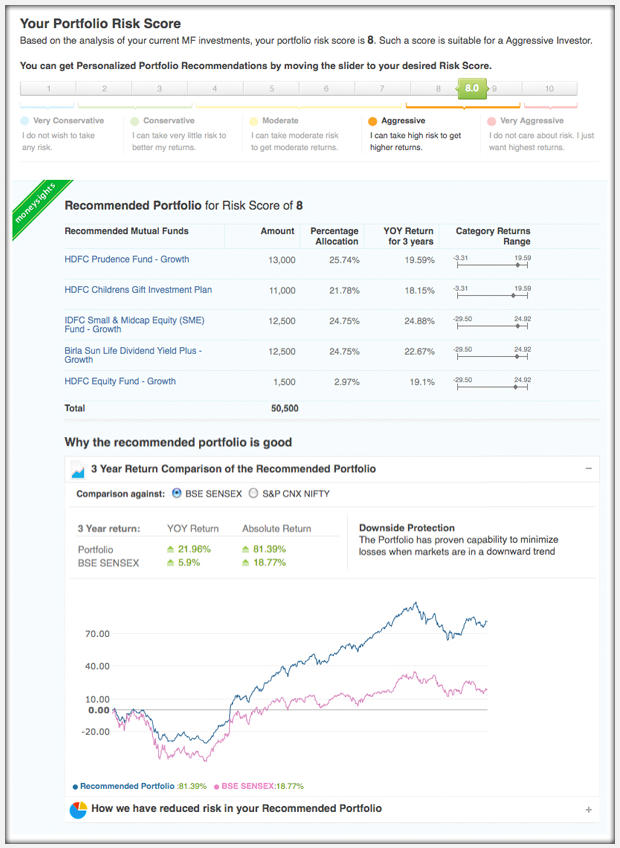

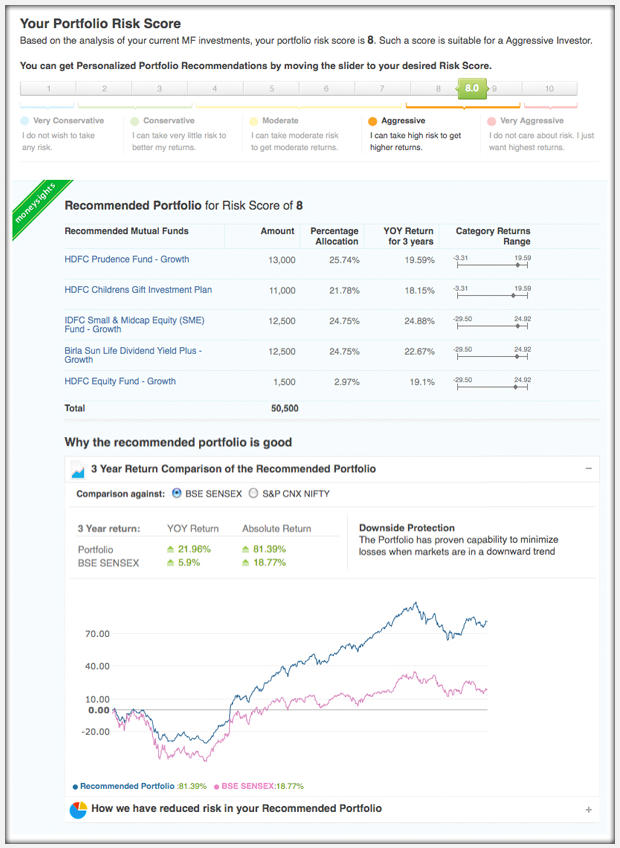

3. Get a Portfolio

This is going to be useful for readers who want to start their investments from a scratch all over again or re-align their portfolio to their risk appetite. All you have to do is select a risk profile you can identify with & moneysights displays a portfolio of Mutual Funds which is appropriate to the risk profile selected along with how much exposure you should take in a specific scheme. I personally spoke to moneysight’s team & they mentioned that they give more importance to downside protection capability while choosing the funds & portfolio is constructed following best practices of portfolio management that control portfolio concentration risks. They also recommend funds which have proven history of performance & have a minimum AUM under their belt.

If you play around with this engine you would notice that higher your risk score more is the allocation to Equity. You would also notice that the resulting portfolio is always diversified across schemes, fund houses, sectors & stocks. They also show portfolio’s break-up & its past performance against SENSEX & NIFTY that help you understand why the portfolio is being recommended to you & how it’s good.

Other Small but Significant Features that you may like –

While the above 3 stood out for me, you may also like the many things they do differently like –

- Letting you enter the amount of Investment & SIP day for accurately tracking your SIP investments.

- Annualized returns of the schemes you invest in as well as the Portfolio when your investments are more than 1 year old – a very handy feature for readers who have been looking for XIRR returns.

- Dividends that you may have received for your investments.

- Updating missed SIP details – You can also update if you missed investing in a specific month for one of your SIPs. Doesn’t it happen sometimes intentionally or unintentionally with us?

- By allowing you to redeem Mutual Funds partially or fully, they also let you build history of your booked past profits/losses.

Wishlists for moneysights

There are some of the things which I would personally like to see in future releases . They are

- An advanced comparision tool which can show the past performance of the current portfolio

- Comparision of two or more mutual funds/indexes in much more detail.

- I wish if a user can create his own strategies and run it over the portfolio and see how the strategy would preform over long term.

- I also wish if there was a download your Portfolio report in xls and PDF format which I can download and keep it for my record from time to time or just offline viewing . That report can give the overall Report in nice format which is just awesome to look at and worth showoff .

Area’s of Improvement

- For most of the return analysis and comparision , it can be done only for the last 5 yrs , I hope if it can be maximum possible .

- Their UI is great and neat , but I still feel there are much more things on UI than required and some of them can be displayed on demand (on a click) . What do others think ?

Conclusion

To conclude, if you have feel that you can relate to even 1 of the above problems that I mentioned at the beginning of the post, you would agree after using moneysights that it’s an answer to those problems. I would love to know your opinion on this. Please share it in comments section.