With this bonus article, our increasing income series comes to an end. Over the last few weeks, we have been writing articles which focused on increasing income and also shared lots of ideas around it. We decided to end this series by sharing some interesting real life stories.

We also take this opportunity to thank each one of you, for your participation during increasing income series. We received some amazing comments and numerous emails in which, people shared their unique attempts on how they actually increased their income. Each email sharing has flavor of success in it and you will love reading them.

Below, We have shared 5 real life success stories (name changed at some places as per request). Few of these success stories are sharing from our readers who attempted and succeeded in creating an alternate income. They took right amount of risk, they figured out a unique way by which they can share their talent with more and more people, they converted “increasing their income” into a project and the results have been amazing. Here they are!

Success Story #1 – How a Dentist worked on increasing his income

One of our readers who is a dentist by profession runs his clinic in Mumbai. He read the article on increasing income and decided to take some committed steps by which he can also increase his annual income. He has been practicing from last 4 years now and has good number of patients who visit his clinic on regular basis.

He took some professional help and designed a good dental kit, which can be of help to his patients and their family members. The dental kit includes some books, video CD, some products and some other educational material in it. He priced the kit for Rs. 1999/- and showcased the kit in his clinic’s reception area. In the last 15 days, they have sold close to 10-12 dental kits and he is happy to see how some extra money is coming in with his creative effort. If you look at the yearly numbers, you can see that a good alternate income would be generated.

With this new offering he is able to serve his patients better and he could also increase his daily and monthly income. Some of his patients have also started sharing the kit content and material with other family members and friends. We congratulate Dr. Ajay (Name changed) and also thank him for sharing his success story with us.

Success Story #2 – Come back of Yoga Teacher

This story is of a marketing professional who turned into yoga teacher. His sharing brought tears to our eyes (Manish was really touched by his sharing and money story). He is in the field of marketing and works as medical representative for a well known pharmaceutical company. His expenses are higher than his income and so every month he finds it difficult to manage his payments. He wanted to increase his income from a long time so that he can start his investments. It has been 9 years in job but because of EMI and other compulsory expenses he could never invested on monthly basis.

He read the second article on increasing income series and he decided to increase his income by 50%. He is a certified yoga teacher and after a gap of 5 years he decided to once again teach yoga to people. He decided to take some private yoga sessions in morning hours. He started sharing this idea with people and he got 3 students/clients in Nov first week. Though he has not yet exceeded 50% of his income as per plan, but he is now very close it. With this action he will be able to serve others and at the same time he will also be able to earn additional income from his students.

We congratulate this yoga teacher for his come back and for the success. We are going to assist him in starting his monthly investments from Jan 2015

Success Story #3 – Real estate agent who started leading real estate workshop

Real estate is an area where very few quality programs are conducted for investors. For those who want to invest in real estate it is important to understand the dynamics of real estate world. There are some very simple ad effective strategies which you can learn to make money in real estate world.

This guy from Bangalore took on a project to increase his income and out of his commitment he announced his first workshop for his close friends circle and clients. He got 12-15 participants for his pilot workshop and the feedback has been very encouraging. This workshop is not sales driven or just to showcase new properties, it actually educates investors on the legal front and other aspects of real estate buying. He has priced the tickets at Rs. 5,000/- for a one day session, which would bring in a good amount of secondary income. He is even planning to conduct it in various cities if it works out well in future.

We congratulate this real estate agent for starting such wonderful and informative program for real estate investors. As and when we receive full details about this program we will share the details with our readers.

Success Story #4 – Lady who started preparing dog food

This lady’s story is truly inspiring and so we thought of sharing the same with all of you. She is considered to be an expert when it comes to dog food preparation. She has been in this business from last 3 years now.

She is fond of dogs and on one fine day she found that her dog was not happy with the dog food products which were available in market. She tested some recipes on her own and prepared some dog food packets which she also shared with other dog owners in her city. This is where others could see her talent and her first order came in, slowly she started becoming more and more popular amongst other dog owners in her vicinity.

Today she supplies dog food to almost 50 plus Dog owners and she also owns and runs hostel for pets. We congratulate Latha for sharing her talent with more and more people. We also take this opportunity to thank her for being our reader and for sharing her story with us.

Success Story #5 – From homemaker to cooking expert to bestselling author

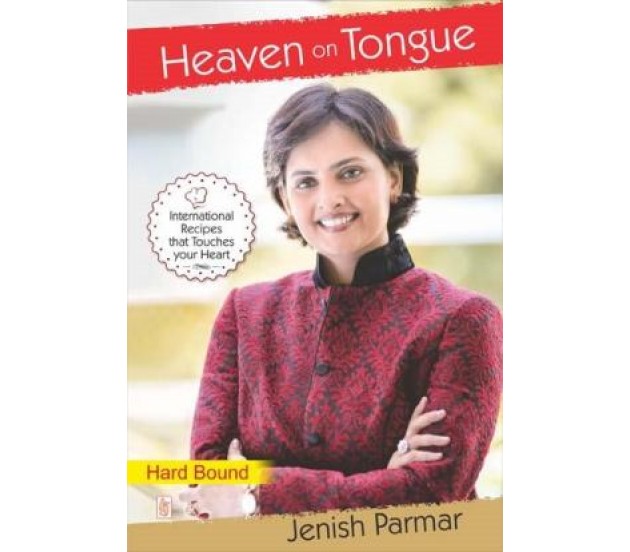

This story is of lady called Jenish Parmer (Real Name). She happens to be good friend of my wife. I recently attended an event where she launched her book called “Heaven on Tongue”. My wife insisted on sharing her story with jagoinvestor community.

I (Nandish) and my wife (Himali) have witnessed her professional journey and success so far. She loves cooking and has always been passionate about cooking. She started her journey by participating in one national level cooking competition, she won the competition and a big turning point came in her life. She continued to teach and share her passion with more and more people and slowly she started her catering business.

She recently authored her first book called “Heaven on tongue” and right now she designs menu for some of the most popular restaurants in India. Her story is real, inspiring and easy to relate with. She is not a reader of jagoinvestor but still we have included her story in this article (we called her and took her permission)

FREE Ebook download

Our “Increasing your Income” series has ended with this article. We have compiled all the articles and created a nice eBook which you can download and read it offline on your computer or on your mobile (it’s a pdf file) . Download it by clicking here (right click -> save as) , or by clicking on the image below.

Please share your views about these 5 real life stories. Do you get inspiration from these stories ? Do you want to share your thoughts?