Around December last year, ICICI Bank launched a flexible Recurring Deposit scheme called “iWish”. Customers with an ICICI savings account and who have access to Internet banking can use the iWish facility. Here’s how

- Login to the iWish section in your ICICI saving bank account

- Define a goal (like buying a laptop, vacation, down-payment on a house, etc.)

- Define the amount and tenure

- Make the starting contribution and the iWish goal starts

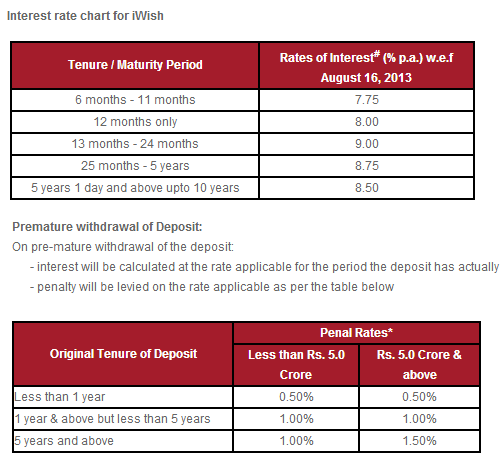

After this point, you are free to deposit additional money in your iWish account anytime you have surplus funds. Also, you can clearly see how much of goal is completed in % terms at any stage of the process. Interest rates on the iWish scheme range between 7.75% and 8.5%. Rates depend on the tenure of your goal – which can be between 6 months and 10 yrs.

To learn more about ICICI iWish Scheme, please watch the video below.

How its different from normal Recurring Deposit ?

Compared to a standard Recurring Deposit, the iWish scheme does not make it compulsory for users to make payments on a fixed date and also gives them the power to categorize savings into goals – which is a more human way to visualize and save your money.

Personally, I see iWish as a mechanism to define goals and save for them through Recurring Deposits. While standard Recurring Deposits just help save money for an unlabeled goal, iWish helps you define and prioritize your goals – helping you decide which goal to save for first. It also helps build a focused saving approach as once someone defines a goal, they are more likely to be serious about achieving it.

The scheme is clearly going to benefit the young generation, who are new to investing. For a generation who rely a lot on visual stimuli, the ability to see defined goals and a visual image of progress towards that goal (e.g. 34% of your ‘new car’ goal has been achieved) is a huge plus.

Fine Prints and things to know

While, on the whole, the iWish Scheme is good, there are few things one should be aware of to avoid a mismatch with expectations.

- One can create maximum of 10 goals (wishes) and the maximum goal amount can be Rs 10 lacs

- The minimum installment amount per month has to be Rs 500

- If you want to withdraw the money on maturity or even before maturity, you need to open a request online for that.

- There is no compulsion of making payments each month, so you can skip the installments if you want

Disadvantage of iWish from ICICI

By now, you must be wondering what the downsides of the iWish scheme are? Simply put, it is the problem of “manual intervention”.

I am convinced that it takes a great degree of resolve and discipline to properly manage one’s personal finance and investments. Unless the saving process is automated, people are tempted to be a little relaxed about saving in every period. While iWish touts its ‘flexibility’ as an innovative feature, in real life it might not help, as people are more likely to stop ‘voluntarily’ paying into their goals after 2-3 contributions.

With a traditional recurring deposit, the process of investing is compulsory and forced on you and in essence, you are compelled to make payments on a fixed date. Furthermore, the knowledge that there is an auto-debit leads you to ensure the monies are there in the account on the designated date. All this means that over 1-2 years, the Recurring Deposit really works and creates the money pool you need. While iWish is a fancy product, I do not see it as an improvement over the traditional Recurring Deposit.

Only in selected conditions and situations, iWish seems to work better than normal Recurring Deposit. An example would be when the investor’s income is not stable (one does not know if the bank account will really have the required balance on a certain date). For all other cases, I would prefer using traditional Recurring Deposits. Choose a goal, fix the amount, divide it by number of months and just start the RD for that amount. That should get the job done without needing my involvement every month.

What’s your verdict about iWish Feature and its utility? Do you think it’s any better than traditional Recurring Deposits?

UPDATE : Just realised later and came to know that you can have funds debited from your account automatically just like traditional RD, but it was kind of hidden and I never realised it . So mainly iWish has both, traditional RD features and innovative flexible way to accumulate your money and hence is better than what I have projected above.