We are going to discuss today, a huge wealth creation by investing with discipline over long period of time. We often think that investing a small sum of money will not be able to generate huge Wealth and we need to invest huge amount of money.

Creating Wealth

Its obviously true that more money will create more wealth, but we are going to see today that we underestimate small savings and how small investments over a long period of time can generate fortunes.

How much wealth you can create, if you earn around $1000 /month (Rs.40,000 per month) and can invest 10% of that amount every month for next 30-35 yrs. I am assuming you are a 25 yrs old and retiring at the age of 60 (though i want to retire at 40). Total dependents are 3-4.

And monthly expenditure is Rs.25,000 ($600/month).

What kind of wealth can this person create?

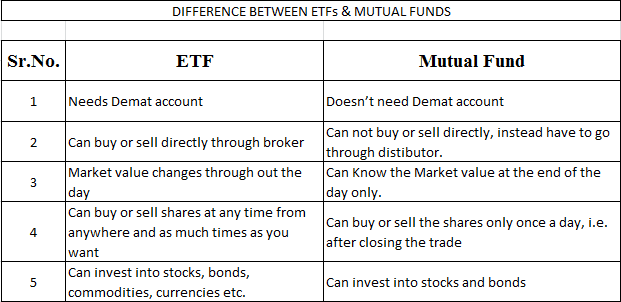

Can he invest Rs 5000 ($125) in a diversified Equity Mutual fund per month till his retirement. I hope the answer can be YES

As we said that he is investing in Equities, What kind of return should we expect? 5% , 20% or 50%, but Wait … Equities are risky, it can be negative also !!! that’s very true … but People may not know that Equities are extremely risky in short term, but its almost not at all risky in long term, and if the long term = 35 yrs, then forget it, you can get some great returns.

Risk in Equities are inversely proportional to the investment tenure. Well that’s a different topic to talk about (And i will post an article on that soon , keeping an eye !!!) Just for the data, Indian Stock markets have given return of 17%+ CAGR return in 28 years, from 1979 (inception) to 2007. We are talking about Sensex.

So, to be safe we can easily consider 15% CAGR return in Long term (remember LONG TERM).

Coming to the point, It may happen that during initial years, our investor may face difficulty investing this much money considering, he may have other important things to take of and later he may have more responsibilities. But during is career life, his salary will also rise and then 5000 will be a small percentage of his salary.

So assuming he can do the investment we are proposing, what kind of retirement corpus he can build? Guesses?

I am sure most of the people will be thinking the following way:

He invested 5000 * 12 in a year, which is 60,000, and then he does it for 35 yrs , so he invests total of 60,000 * 35 = Rs 21,00,00 0 (21 lacs). And he will get some return of 15% every year. if we take 15% of this 21 lacs, it will be around 3,00,00, so total corpus = 24,000 and also as this is compounded , his interest will also keep growing at 15%, so it will be more than 24,00,000 , so lets take it 50,00,000. Fine …

Ok , let take 70,00,000 (70 lacs) to be safe. This is a calculation done not exactly by the proper annuity formula, but a workaround, which a general person can think of.

How much does he generate with this strategy

You can also look at my another article on Early investing and power of Compounding to get an idea about early investing and how compounding is a great tool. But keep going ahead if you are enjoying this article.

So the question is What will be his corpus , can it be anywhere near to 70,00,000 . The answer is that his actual Wealth will be way beyond this amount. After doing the actual calculation i can see that it will come around 7.43 Crores (Rs 74 million) .

But how is it possible , such a big amount !!! .

That’s because of compounding power . The interest earns interest and that again earns interest and this keeps on going. Initially the interest earned is very small , but as the time passes , the amount keeps growing and the interest also grows at an unbelievable amount.

Can you believe that this investor will earn more than 1.04 Crores only in interest in his 35th year (last year) , more than 4 times the money he actually invested whole his life. That’s all possible because of systematic and consistent investing with out fail and because of Power of compounding.

That’s the reason why one of the greatest Scientist Albert Einstein said “Compound interest is the 8th wonder of the World”.

So it that all we are going to talk about today , NO !!! We have more to talk on this topic.

Why does this investor takes pain of investing that 5,000/month all this life. What if he invests just 10 yrs and leaves that money to grow for another 25 yrs. What if this is his plan till retirement.

The sudden thing which will come to your mind is that he invests for 35 yrs and created wealth of 7.43 crores , What if he just invests for 10 yrs .. it should be 10/35 * 7.43 crores = 2.12 Crores . Is that true ?

Will it actually be 2.12 Crores only. The answer is NO !!! . Then the question is how significantly different will his Wealth be in this case. The Answer is 5.88 Crores. Yes it will not be significantly less but just 21% less .

So Just by not investing for 71% tenure he actually gets 21% less money , that’s not a bad deal !!!

But wait , What if he wants that same 7.43 crores at the end , and still wants to invest for 10 yrs. the obvious way out is to invest more than his regular 5,000 per month . The question now is HOW MUCH MORE !!!

The answer is Rs 1420 more . Instead of 5,000 , he should invest Rs 6,420 per month for 10 yrs and then leave the money to grow for rest of 25 yrs. And he can generate wealth of Rs 7.43 Crores.

Watch this video to know how one can use Equity to create wealth over long term:

What we can learn from this

So there is a learning here and a very important thing to note , that more pain we take in the start , the better it is . In the initial years of career , its possible for people to invest more , as they have less responsibilities to handle and less dependents.

So it may be feasible for them to invest heavily in the initial phase of there career, which will benefit them for long term . Now see this person . Instead of investing 5,000 for whole of 35 yrs , If he chooses to take a little more pain in the initial 10 yrs and manages to invest Rs 1,420 more per month, then he can save investing for 25 yrs of his life and still can generate same Money.

One great question now !!!

What if our investor is ready to invest his 50% salary (20,000) per month for starting 2 yrs and then let it grow for rest 33 yrs. He is ready to heavily invest first 2 yrs of his career and do some sacrifices like not spending too much , no vacation , no fancy spending and all.

Can he still beat the target !!

Will he be able to generate the same Wealth for himself like in earlier examples !!

So here you go !!! , He will not only achieve the target , but exceed it.

His Wealth will be 9.24 Crores (Rs. 92.4 million) at the end of 35 yrs. I know that’s an Eye-opener . So now you know that the best time to invest was 5, 10 or 20 yrs ago , but if you missed it , don’t worry 🙂 . there is another golden chance and that’s NOW !!! .

please let me know what you feel about this article , that helps me to refine and write better articles.

Thanks, Happy Investing.

Note: The formula used for calculation is called Annuity. https://en.wikipedia.org/wiki/Annuity_(finance_theory) See formula under “Annuity Due” on this wiki page

If you have any query related to this topic you can leave your reply in the comment section.