4 FIRE levels (Financial Independence retire Early)

The FIRE (financial independence/retire early) movement has got quite famous for the last couple of years in India. Every investor I meet these days wants to achieve FIRE asap.

I would like to discuss some important points related to FIRE movement and types of FIRE today with you all.

What is FIRE?

FIRE or Financial independence retire early is all about creating enough wealth for yourself as early as possible, so that you are financially independent and free from worries of money. Once you achieve FIRE, your wealth is enough to generate an inflation-adjusted income for you which lasts your lifetime

Let me give you an example.

Imagine a 30 yr old person with the monthly expenses of 75,000 per month (or 9 lacs a year) who has 18 lacs of current corpus and is ready to now aggressively invest Rs 80,000 per month for the next 15 yrs and will increase the SIP by 8% each year. The investments growth will happen at 12% and the inflation assumed is 7% (pre-retirement) and 6% post-retirement along with post-retirement returns of 7%

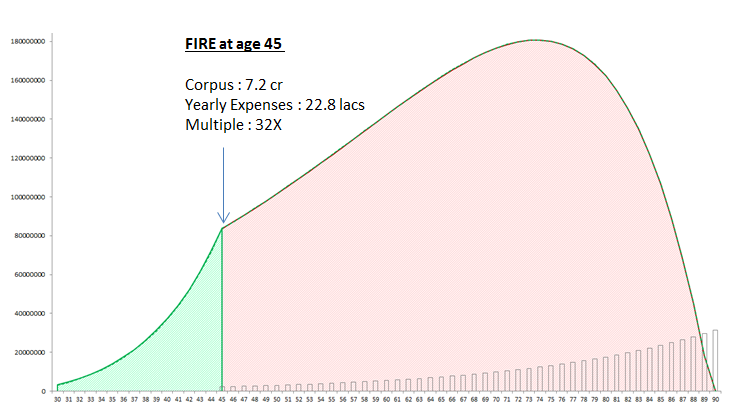

Below is how his corpus will grow and reach a level at age 45 (in 15 yrs time). He will achieve FIRE at the age of 45 with a corpus of 7.2 crores. At that time his expenses would be around 22.8 lacs approx. And his corpus will be around 32X (32 times his expenses). His graph would look like this.

Note that the above graph is based on the rough calculations and assuming that all other goals are taken care of separately.

Do you stop working when you achieve FIRE?

Actually NO

It’s your choice if you want to work after FIRE or not. You can stop working if you wish, but if you still want to work, you can & any money you earn will be a cherry on the top and will only add up to your FIRE goal.

Top 3 reasons why people want to achieve FIRE?

- It’s getting tougher and tougher to be employed till 60 these days, and hence people don’t want to depend on the fact that they will keep earning for a very long time

- Once you achieve FIRE, life is less stressful and you get power in you to live life on your terms. People want to create a situation where they don’t have to dance to the tune of their managers and employers

- People also want to get out of stressful and demanding jobs by the time they hit a mid-life crisis and that means moving to a job that is more enjoyable, even if it pays very little. This is possible only when you have already created enough wealth

But, FIRE is tough!!

Is it very easy to achieve FIRE?

NO, is the answer

Forget FIRE, even normal retirement at 60 is not possible for many people in India. We can clearly see that a big number of investors will have a bad retirement because they are not living their financial lives in the right way and are not on the path to creating sufficient wealth.

FIRE in that sense will only be achieved by a small minority.

Our team has worked with hundreds of investors in the last many years and here are some of my comments on achieving FIRE

- Most of the people who achieve FIRE do that not because of fantastic returns, but very aggressive saving and deploying that money in meaningful investments.

- If you keep your expenses in check and keep it on the lower side, it simply means that it becomes easier for you to achieve FIRE because FIRE is not just about wealth, but both wealth and your expenses

- Most of the people who achieve FIRE are those who earn quite well. If you earn 4 lacs a month and your expenses are 50k per month, You are earning 8 times of expenses every month. That helps a lot

- Most of the people who are not able to control their lifestyle and keep upgrading their life find it tough to achieve FIRE despite having good wealth as the goal post keeps shifting.

In simple words, if you want to know how does a person who achieves FIRE looks like, its like this

- The person has a very good income

- The person saved a very big portion of that income (often more than 60-70%)

- The person is not extravagant and mostly lives a frugal and simple life (but not compromising on fun and desires)

- The person makes sensible investment choices (often earning at least more than inflation)

- The person has mostly created liquid assets and not blocked his money, because you need to generate cash flow at the end

- The person is quite confident of managing the money post FIRE and earning decent returns (he won’t keep all money in FD)

So what are various types of FIRE?

Let me now talk about various types of FIRE. You can pick which type of FIRE you want to work on and you will get some ideas

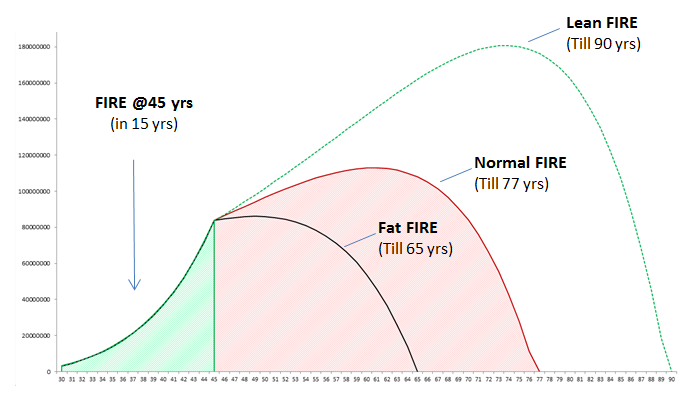

Normal FIRE

Normal FIRE is when you want to create enough wealth which can sustain your current lifestyle and desires for all your life. Note the word “Current lifestyle”, which means that going forward your expenses, your vacations, your spendings, your outings, your desires will be maintained at roughly the same level. This I think is the default mindset and something which most people will like to pursue.

A very high-level thumb rule says that if a 45 yr old has achieved approx 35X corpus (35 times of their yearly expenses), you have achieved normal FIRE

Lean FIRE

Lean FIRE is a concept where you are ready to compromise on your expenses and lifestyle, and ready to live lower expenses. A lot of times it may not be possible for a person to achieve normal FIRE. In which case you can say – “I am ready to live with just 75% of my current expenses, but I want to FIRE faster.. I can’t wait”.

This is like a little compromised version of normal FIRE.. but hey, it’s still some kind of FIRE!

A very high-level thumb rule says that if a 45 yr old has achieved approx 25-28X corpus (25-28 times of their yearly expenses), you have achieved Lean FIRE (Living with 75-80% of your expenses)

Fat FIRE

Fat FIRE is exactly the opposite of Lean FIRE, here you want to spend your life like a king and want to want to freely spend money after FIRE. You don’t want to restrict yourself and take expensive vacations etc. In which case obviously, you need a much bigger corpus to last all your life.

A very high-level thumb rule says that if a 45 yr old has achieved approx 45-50X corpus (45-50 times of their yearly expenses), you have achieved Fat FIRE (Living with 125-140% of your expenses)

What is COAST FIRE?

There is one more concept called Coast FIRE, which is something many of you may have already achieved.

A person is said to have achieved Coast FIRE when he/she has enough corpus already which will grow to FIRE corpus in the future without the need for any new investments. This simply means reaching a point, where you just have to earn money equivalent to your monthly requirements and wait for 5-10-15 yrs to achieve the actual FIRE

Example of Coast FIRE

Let’s say a 30 yrs old person is earning Rs 2 lacs a month. In order to achieve FIRE at age 50, he has to create a corpus of Rs. 6crore. The person aggressively invests his 60% income (ie Rs 1.2 lacs) and starts his wealth creation journey.. In the next 10 yrs, when he turns 40 yrs old he has already created a corpus of 2.5 crores.

At this point, his income is let say 4 lacs a month and he is still saving 2 lacs out of that (his expenses are 2 lacs a month). However now, if he wants to reach his original target of 6 crores in the next 10 yrs, he does not need to put in any new investments. His 2.5 crores will anyways grow to 6 crores in 10 yrs @10% returns.

So his direction and speed is already set in such a way that he can reach his target without putting in any extra effort. If he wants, at this stage of life, he does not need to create an income of 4 lacs.. If he wants he can move to another low-stress job or something else which he wishes which pays less. All he needs is to create an income that can take care of his expenses for another 10 yrs and let his existing corpus grow without touching.

I am sure many of you who are reading this have already achieved Coast FIRE in your life and you are unaware of it. Try to do the calculations

Which category of FIRE you Are Pursuing?

So, which category of FIRE are you pursuing?

I can’t comment on which category of FIRE is right for you because only you can define how kind of life you want to pursue going forward. What money means for you and what level of comfort you want, however, I think Lean FIRE is not for everyone. Lean FIRE is surely some level of compromise and there is almost no margin of safety there. If a few things go wrong, your FIRE goal can go for a toss.

Hence I think one shall target normal FIRE as it’s more realistic and practical. However having said that, one shall try to first reach Lean FIRE and target normal FIRE 5-6 yrs after that.

If you are quite lucky and have enough interest left to earn and invest more money, you can try moving towards Fat FIRE too..

Important Disclaimer

FIRE is a concept and based on mathematical calculations. A small difference in inflation or returns assumption can change the target amount or target year by a big margin, hence look at the discussions above as just an example. You need quite a good level of calculations and discussions with a good financial planner to project your calculations. Also, these are all complicated topics in reality, but for discussion’s sake, these points look simple.

To give you a simple example, if your calculation says that you achieved FIRE and your money will last till age 90 yrs. It’s more of just mathematics. Now if you increase the inflation by 1% and decrease the return by 1%, this may tell you that now your money will last only till 73 yrs (a reduction of 17 yrs) which tells you that these calculations are very dynamic and sensitive to assumptions.

So please take precautions which doing any kind of calculations. This discussion above is just for basic knowledge.

I would love to know what you feel about FIRE and what are your thoughts about it?

December 14, 2021

December 14, 2021

This is a great article on FIRE. Although I am not someone who indulges in such practice since I am pursuing my studies plus I don’t buy the concept of retiring early at all, but still I do understand the importance of being an aggressive saving strategy.

At the end of the day it boils down to discipline and living within the means. I concentrated on investing and did not do any goal based planning (FIRE can be one goal in the goal based planning) – basically a single bucket strategy. Now at 43, I am at around 55X-60X in terms of liquid net worth and may be another 10X-12X in RE which is debt free.

A single bucket strategy like mine would not be clear when money has to be taken out for individual goals but the port folio will be very simple where as there is good clarity in goal based planning but port folio may be a little more complex. But underlying principle is always what is the savings rate. Rest is just book keeping. With consistent 70-80% savings rate through out my earning days I could achieve this.

Thanks for sharing that Kalyan!

You have created great wealth for yourself . Saving a big part of your income is surely the top most reason why most people get FIRE!

Manish

Nice Article. I have already achieved coast fire, where I just need to ensure that I don’t touch my current corpus for next 13 years and post tax returns from my investment should beat inflation by 3%. ( Assuming inflation to be 12%).

Thats great.. I think you shall consider inflation of not more than 10% .. 12% is high I guess

Thanks for reply. I am considering 12% as the average figure considering the fact that cost of education, medical expenses buying house for self use generally tend to be on higher side.

Yes .. it can be 12% for some part .. but not all . My personal opinion is average of 10% is ok as there will be many things where inflation will be 5-7% also ..

Please check the copy paste error in fat FIRE definition. It says 25X and lean FIRE.

Fixed

it still says you have achieved LEAN fire under under FAT fire section. “A very high-level thumb rule says that if a 45 yr old has achieved approx 45-50X corp”us (45-50 times of their yearly expenses), you have achieved Lean FIRE (Living with 125-140% of your expenses)

Fixed now

I think the first step towards any type of FIRE is to know and understand once expenses. as that’s the number against which 30x,45x etc needs to be calculated. And saving / investing should always be a percentage of one’s income. So my view is in which ever age bracket one is in, this being the last month of the year, we have excellent choice to analyze exact income and expense numbers of 2021 and accordingly decide on which type of FIRE one can target.

Excellent post Manish. The graphs in the article are worth so much more. Thanks for your efforts in educating us.

Welcome Sunil

Good point that one shall first work on finding the expenses

Let’s say a 30 yrs old person is earning Rs 2 lacs a month……..how many of Indian people are earning 2 lac per month ?

Lets assume how many of your Jago Investor reader are earning this amount …can you get this number ?

Sometimes I feel this figures are unrealistic.

Ok in that case you can take it as “lets say a 30 yr old person is earning 60k per month.. or 80k per month”

It was just an example …

Although I am not totally at FIRE, my journey has begun. I have not went through corpus route as such. To begin with, I calculated my expenses and right now I have passive income which is equal to expenses. So technically I have achieved FIRE but in practice it is not. If I have Rs.100 as expense then my passive income is also Rs 100. So there is no buffer at all. This buffer is required for natural and lifestyle inflation. While my passive income will grow and take care of natural inflation, I need provision for lifestyle inflation. So I do earn some active income but put in less hours that I used to put in my day job. This way, I was able to get more time for myself.

Great.. its a wonderful situation to be in actually..

JUst see that this passive income is stable enough to be called as a real passive income. IT shall not happen that its too fragile !

The FIRE corpus can be invested in safer asset class (Debt fund/Fixed Deposit) or even balanced mutual fund to generate income regularly, this income will be long lasting than 90 years.

For sack of calculation. 7 crore corpus at 5% return in FD will give 35Lakhs per annum (before taxes) and corpus will be intact FOREVER. You can pass on this corpus to your children for their life.

If you would like to save taxes on interest income (which is 35lakhs from FD) then non-risky equity mutual funds can be safest bet, like Arbitrage funds or balanced fund, where you can invest 7 crore rupees and withdraw on monthly or need basis. This will help to grow your money and you will pay taxes on capital gains on withdrawn amount which will be 10% quite less compare to 30% on FDs.

True .. thanks for sharing that Amit !

Can you share the percentage Excel for this calculation

I am not clear what you are looking for !

It is a very thought provoking article explained in possibly the easiest way particularly the coast fire concept. Every individual should take some time out and ponder on this and do some basic calculations in this regard. A good one guys and an enjoyable read.

Welcome Vinay!

It is best knowledgeable about fire and how to control expenses and achieve your goals thanks to author for such a valuable experience shared

Great to hear that!

nice concept…couple of points:

1) 45-50X corpus (25 times of their yearly expenses), there is a typo on the Fat FIRE paragraph.

2) Just follow the simple principle, earn as per your talent and have the thinking of your parents while spending money, you don’t have to worry about right or wrong.

3) I have achieved Fat FIRE, and I can easily say that the goal post shifts by the time you reach any level. Desire for Villa from 3BHK, Big branded car ( for space and safety), better schools for kids, vacations from once a year to twice a year all these becomes normal to have ( this is how our human brain is coded and is evolutionary process) and again you think we have not reached there yet and all calculations fail or starts again.

4) I am a big supporter of living a simple lifestyle, saving enough, proper investments,no showoff/comparison with you peers concept. But, always have this in your mind that you have to keep working ( no choice), otherwise all calculation will fail like falling house of cards. The only benefit of achieving FIRE is that you can have a job of of your choice/location which pays you less and you can spend what ever you earn with current life style or inflation adjusted , as saving part is already achieved and you just need to keep invested properly. Kaam to kerna hee padega, even if your are Ambani. This was very well highlighted as one of the points in the article. Nice work.

Quite an extensive comment Vikram.. Thanks for sharing in detail !

Most of the people who have attained FIRE, i see continue to work, but work to pursue there passions and interest, and i have seen there earnings go 2x to 10x of there earlier job incomes within next 3-5 years, as they become mostly entrepreneurs or consultants or trainers

Good obervation

FIRE is a worthwhile goal to pursue in life—the most important reason being job uncertainty in the private sector.

Many private sector companies pay huge sums as salary, which is unthinkable in government jobs. But on the other hand, it comes at the cost of tremendous pressure and uncertainty, which is equally unbelievable in government jobs.

Hence for these private-sector employees, FIRE is necessary. For government employees, FIRE is optional.

True !

There is a different(easier) way to look at FIRE.

At 60, all are forced to be on FIRE. You have no more salary income and you have to manage all your life with your corpus(created).

Now consider this. If one can achieve that(sufficiency), at least one day before retirement, he met this FIRE goal. What people are yearning is to achieve this 5,10, 15 years before 60. Though it is not easy, it is a worthy enough goal to keep and aspire for.

One aspect which can help in this effort is to keep children on their own. The corpus kept is for the post-retirement period of one and spouse. The children can be brought up and educated as they want. But they should be brought up in such a way that (after says 25), they stand on their own legs and do not look for inheritances. This needs to be planned properly for an easy post FIRE or post-retirement life.

True 🙂 .. valid comment Srinivas !

Rightly said. FAT Fire can be difficult to achieve and you also take on risk of easily running out of your corpus.

Thanks for your comment