I am sure you must have shopped online very recently. In last 5 yrs, the whole dynamics of shopping has changed, We have more online for most of the things ranging from electronics, clothes, groceries and even movies ticket booking :).

We are fascinated with the discounts and offers we get online. However I am sure even if you know a lot of tips of saving money online, still you might not be exploring its full potential.

Hence, I am going to list down various points and how you can save more money. Detailed description of these points is after this table.

[su_table responsive=”yes” alternate=”no”]

| Tip #1

Install Buyhatke extension |

Tip #2

Go a bit extra mile in search for Coupons |

| Tip #3

Get cashback with specific credit cards and debit cards |

Tip #4

Wait for the special days like Diwali and New year |

| Tip #5

Use Comparison Websites to find the best offer |

Tip #6

Set Price Alerts |

| Tip #7

Leave items in your cart and wait for few days |

Tip #8

Use wallet payment methods like paytm, mobikwik and payumoney |

| Tip #9

Use different emails for Shopping |

Tip #10

Get extra cashback using Cashkaro.com |

| Tip #11

Industries like airlines and hotels give huge discount to there old customers |

Tip #12

For used products you can get huge discounts on OLX, Quikr websites |

| Tip #13

Check prices on website pricebaba.com to know which brand is selling at discounted price or on MRP |

Tip #14

To get the best deals keep checking the offer section of all website before you shop |

| Tip #15

Register on websites where users post great deals & discounts from here and there |

Tip #16

Don’t get into the trap |

[/su_table]

1. Install Buyhatke extension

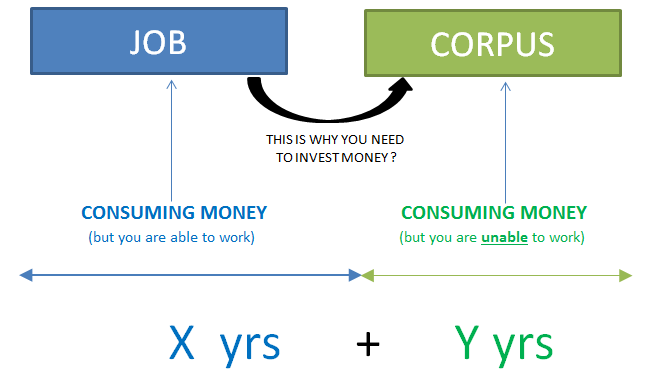

There is this website called Buyhatke.com which offers a chrome extension, which shows you the other website where you can get the best deal while you are looking at some product.

You just need to install it in your chrome as extension. This way, you will be able to see the price offered by some other website.

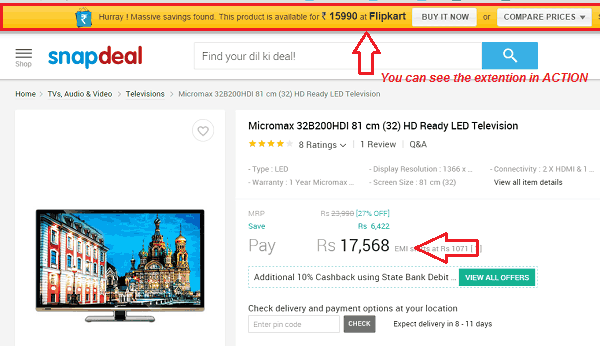

Below you can clearly see, when I went to Snapdeal to find the price of its one of the LED tv, the price it showed me was Rs 17,568. However, the buyhatke extension at the top showed me that the same product is available for Rs 15,990 on Flipkart.

I didn’t had to go anywhere to compare the price. The extension automatically searches the best deal and show it to me. You can also compare the prices of the product by clicking on “Compare Prices” tab on the top right.

However note that the extension does not take into consideration all the coupons and cash back. So take the decision after factoring in all those points.

Another amazing feature of this extension is the historical PRICE changes which you can see on the same page a bit below the product description (automatically it comes when you use the extension). You will be able to see how the price has changed over previous few months. You can see the maximum and minimum and judge if the current price might fall further in coming days or it can do up.

2. Go a bit extra mile in search for Coupons

This is the most basic thing you need to do when you are buying online. Sellers know that coupons are a great way to excite customers and make a faster sale by making buyers feel that this is the best moment to buy. Given the huge competition in the e-commerce space, every other company wants to give you a great deal somehow. Either the web site from where you are buying something may show you the coupon or you can find it on coupon sites.

On an average, I have always found some of the other kind of coupon which reduces the price by at least 5-10% . Some websites can have a variety of coupons depending on various categories (20 category = 20 different type of coupons). Something like “Buy above Rs 1,999 and get 20% discount” applicable on furniture.

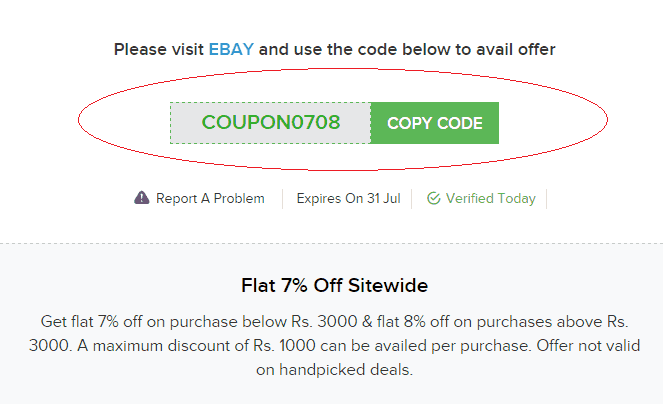

Then there are websites like Ebay, which have generic coupons like “Buy above 750 and get 7.5% discount”, These coupons are easily available on the majority of the coupon websites.

I know most of the people who buy online do search for coupons, but I don’t think a lot of them go an extra mile to search for the best coupon and settle with the first one which they get. If you are buying an item with a high price, it’s worth the effort to spend extra 5 min to search for the best coupon available. You can keep applying 3-4 coupons and see which is giving you the best deal.

3. Get cashback with specific credit cards and debit cards

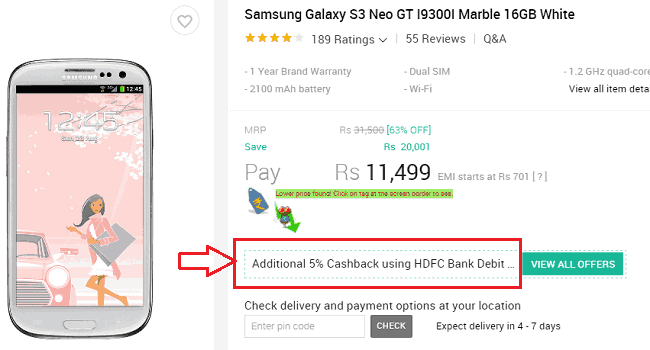

At times, you can get a good cashback or discount on paying from a specific bank credit or debit card. Banks tie up with the website, so that maximum payments go through their channel. This can be for marketing purpose or just to increase the sales of a particular credit or debit card.

Like Amazon may be giving a 10% cashback when you purchase by an SBI debit card or Snapdeal providing an additional 5% cashback on HDFC debit card

4. Wait for the special days like Diwali and New year

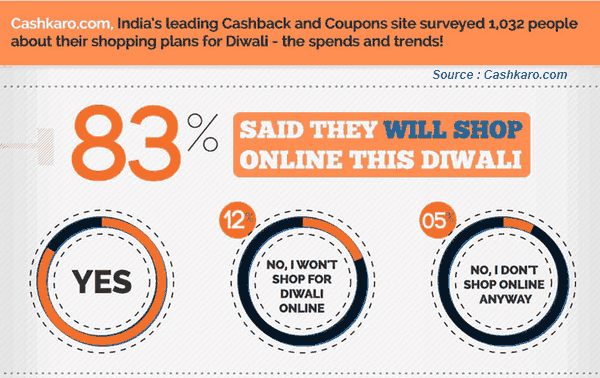

There are extra discounts and offers during Diwali, New year and many other Indian festivals. If you can wait and postpone your shopping, its always recommended to wait for these days, especially Diwali. Its a known fact that people in India buy high ticket items because of the auspicious festival. You might get a much better deal and cash back offers given the cut-throat competition between e-commerce companies in India.

Also, there are events like GOSF (great Indian shopping festival) where you can get good deals (not always). Last year, I made the same mistake. I upgraded my TV in the month of Aug and didn’t wait for Diwali and saw the same TV selling at 15-20% extra discount. If you can wait a bit, it’s always better to plan your purchases, especially high ticket purchases.

Another great benefit of waiting for some weeks or month is that you may realize that you actually don’t really need the product and it was a decision in haste to buy the product.

5. Use Comparison Websites to find the best offer

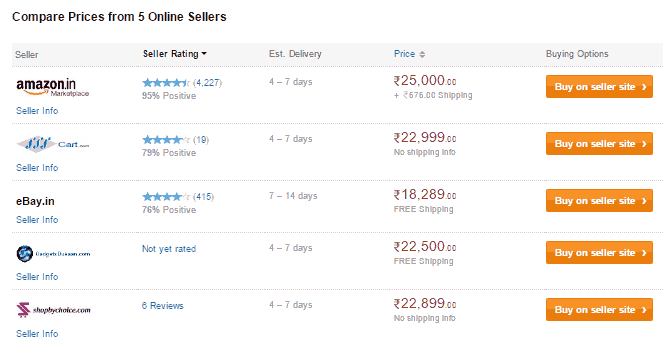

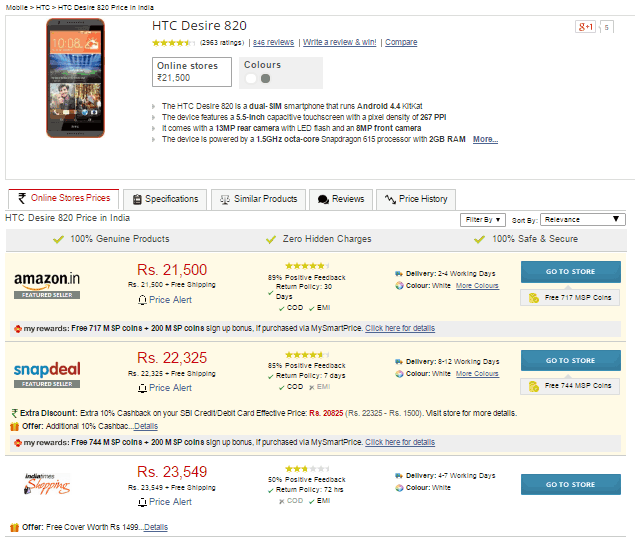

There are various websites like Junglee.com, mysmartprice.com and shopmania.in (and many others) where you can compare the prices of a product on various websites at one single place. You can see their shipping cost, estimated delivery time and also the rating of the seller.

It’s one window from where you can choose the website you want to buy from. At times, there is some mismatch in the main price on the website and the one shown on the comparison website. Below is how it looks like..

Mysmartprice gives a comprehensive comparison with various details and also the facility to set the price alert at the website level. It also gives section for price history, specification etc in a single page. Here is the snapshot

Scandid and pricebaba are some other good comparison websites you might want to try.

6. Set Price Alerts

At times, you are not in a hurry to buy some product, but you never know when the price of a product was reduced to a level where you become highly interested in purchasing the product. So in that case, you can set a price alert for a particular product and when it touches that price limit, you will be informed about it over an email

For example, if you want to buy a product which costs Rs 5,000 at the moment, but you are very sure that its price will come down to Rs 4700 and that time you would buy it, then you can set the alert and you will be informed about it.

How to set up the price alert?

- You can use cheapass.in to set the alert. Just paste the url or the product and your email and your price alert will be set up

- The other way is to use this google docs tool created by Amit Agarwal. It will notify you on email on any drop in prices.

- You can find the product you want to track on Junglee.com. You will see a “Set price Alert” link just near the product name.

7. Leave items in your cart and wait for few days

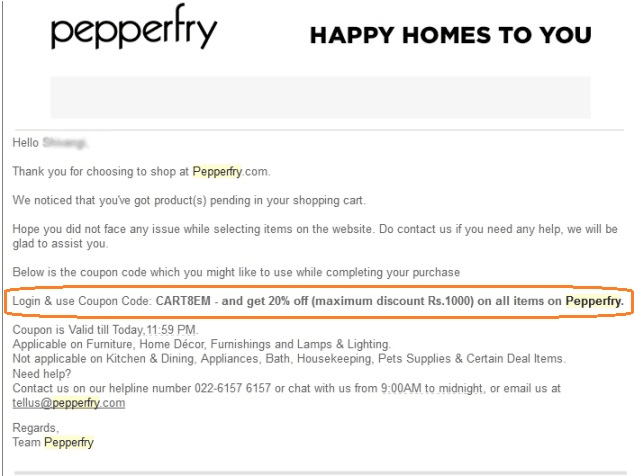

This trick might be working only with few websites and not all, but it’s still worth the try. You can first add all your items in the cart and then don’t check out. Just leave the items there in the cart. This is a big issue for e-commerce websites where the customers add the products to the cart, but at the final stage do not make payment and leave.

In technical term, this is called “shopping cart abandonment” and for most of the websites, its one of the biggest pain point, because a huge amount of sales is stuck there in the abandoned cart. As per the business insider report, globally out of every Rs 100 worth of products which is added to cart 71% is abandoned, means more than 2/3rd sales which can potentially happen, do not happen.

So, various companies in order to close that pending sale, will remind you about your cart and ask you to complete the sale. And some of them will often try to lure you with some extra discount with coupons etc. In the best case, you will be able to save a bit more and in the worst case, you won’t save anything extra.

Below is a sample email from pepperfry which was sent to some customer who didn’t complete the sale.

Note that this trick will mostly work for new customers who have recently created their account, because companies are in the race to acquire new customers to show it to their VC on how they are growing. So do not expect this will well know and big websites where you are already buying from many months or years.

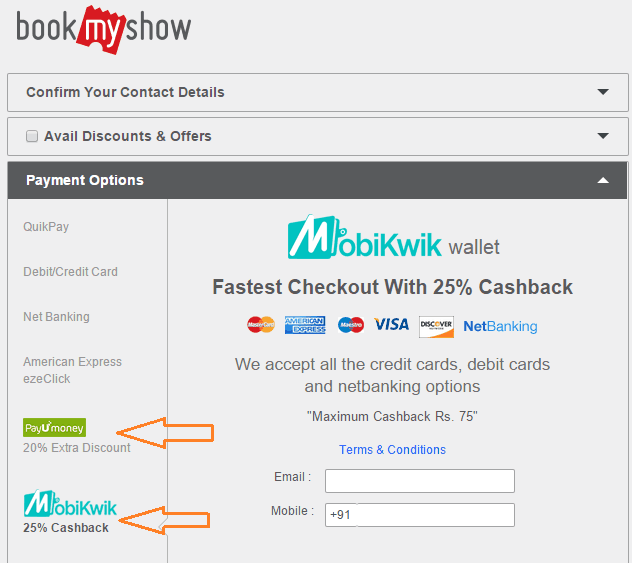

8. Use wallet payment methods like paytm, mobikwik and payumoney

On top of your regular discounts which comes from coupons, you can also get additional discounts if you use the e-wallets these days. If not discount, you will surely get some kind of cash back. The best example, I can provide is from bookmyshow website where you get the extra discount when you use movie tickets.

Pro TIP for Bookmyshow: If you want to book X tickets and each ticket cost is as high as Rs 200-250, book 1 ticket X times, that way you get maximum cashback :). Just that you need to make sure you be fast enough to book all tickets you need.

9. Use different emails for Shopping

Almost all the companies offer some kind of discounts to new users. A lot of them offer coupons codes on email when you register for the first time. You can see this clearly on Foodpanda or Ola Cabs, where you get huge discount being a new user or get a FREE benefit for the first time.

A lot of companies are now offering the bigger discount if you order things using their mobile app, but you can’t use multiple phone number’s unlike emails, so that’s not easy enough. But if you have many people at home with smartphone’s, you can take this benefit too, for some limited time.

10. Get extra cashback using Cashkaro.com

On top of all the discounts you get, you can also get some cashback if you buy things from cashkaro.com links. Its a website where you have to create an account and then use their links to visit the actual website where you want to buy things.

This way, cashkaro website gets the commission from the seller and they share a part with you and it accumulates there. You can take the money in your bank account via NEFT once it crosses a limit. Below is a simple video which shows you how it works.

You can register on CashKaro using this link

5 more tips when buying online (tip number 11-15)

- There are some industries like airlines and hotels which shows dynamic pricing to their old customers based on their history and location using your cookies. So if you use Incognito mode in the browser, they will not come to know that you are an old user and treat as a new customer.

- At times, you might want to check websites like Olx and quikr because you can get the same product at a very heavy discount, but for a used product. In some cases, it might fit your requirement and you will save a good amount

- You might want to try out websites like pricebaba.com which can find out a better deal for you from an offline store. so you can compare prices online and then inquire for prices offline. This would work out for those products, where you are not getting any kind of discount online and its selling near its MRP.

- Almost all the websites have their own offers and deals pages, you can keep a watch on those pages too. An example if a offer page from flipkart or the deals page on ebay

- You can register on the website called Desidime.com, where real users post great deals and discounts they find here and there. You can also interact, ask questions to other users.

Last and more important tip – Don’t get into the trap (16th)

Now the last and the final point. All the tips which are mentioned above would be helpful and in your interest if you don’t lose control over yourself and be a responsible buying. Only buy things which you really need. These discounts and coupons are just extra benefits.

Don’t let these coupons and discounts become the carrot for you to buy things which you just don’t need. The sad reality is that, even though you feel that coupons are benefitting you, it’s actually helping sellers more.

These coupons and discounts are often funded and sourced by the sellers only to make sure they increase their revenue’s. Yes, in some cases, it will surely benefit the customer’s, but at a higher level these are mainly the marketing tricks of the seller and nothing more than that.

Let me take an example of Foodpanda, If you had to order food from outside, then foodpanda coupons are the added discount you get. But a lot of people are now using foodpanda on those days, when they didn’t had to order from outside, but just used it because there was a discount. Can you see how these deals manipulate your behavior and your way of spending?

Don’t browse for fun

Doing time pass on e-commerce websites is not good for your wallet :). The basic principle of economics is that “Supply creates its own demand” and with the mobile apps retailers are trying to create an ecosystem where you can purchase on just one click. With discounts, they are creating an environment of instant gratification and by giving money back guarantee and replacement guarantee, they are removing the fear for online shopping.

But the at end due to all these factors, people are buying things which they just don’t need at all and creating the big pile of junk at their home. So just make sure you do not browse for fun, because you will surely come up with some reason on why you need that product you just saw.

Let me know what do you think about this article? Also share some more tips which you personally use and you think can be shared with others as well 🙂