Finally many people like me have chance to take take plunge in the rising and booming Real estate sector , Any one who does not have Crores and Lacs to invest in flats , plots etc , to earn the capital appreciation will to be able to invest even small amounts like 5,000 or 10,000.

What are Real Estate Mutual Funds ?

They are simple close ended mutual funds which will invest in Real-estate , as simple as that … The lock in period will be 3 yrs. These REMF will invest in properties and they will be owners of those properties , they will also rent out these properties and pass on the rents to the investors as dividend. And when the mutual fund matures , it sells its holdings and pay us the returns.

REMF’s will be listed on Stock Exchanges and they will be traded just like shares.

How do they work exactly ?

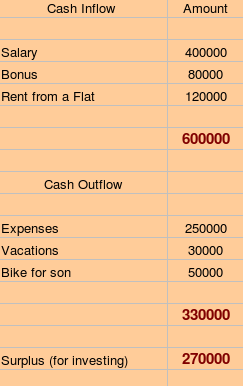

Lets take simple example :

You invest Rs 20,000 in some ABC REMF and one unit costs Rs 10 at the start , so you get 2000 units. many people like you will also invest and Suppose the total money they get from investors in 10 crores. Now they invest this money as per the laws defined for them. Suppose they receive 50 lacs as rental income from their investments in a year and the total investments has grown to 12 crores (because of rise in value of properties and other factors).

From this 50 lacs they will distribute dividend and you will recieve your share for 2000 units and the unit value will be around Rs 12.

Rules and Restrictions for REMF’s

– They will have to invest atleast 35% in completed projects , ready flats , shops , houses etc.

– At least 75% should be invested in real estate and related Securities.

– They can partner with real estate developers and invest maximum of 15% in the project (not in company).

– The NAV will be published on daily basis.

– Most probably they will be in category of debt funds. Tax treatment not clear at the moment.

– Further caps will be imposed on the fund on investments in a single city,

project or securities issued by associate companies and sponsors. Funds are not allowed to invest in assets owned by the sponsor or the asset management company or any of its associates during the last five years the aforesaid entities hold tenancy or lease rights.

– The cities for investment by real estate mutual funds would include 35 cities in million-plus urban agglomerates and 27 under the million-plus category as per the Census 2001

They are still to be launched , keep a watch !!!

I would be happy to read your comments or disagreement on any topic. Please leave a comment.