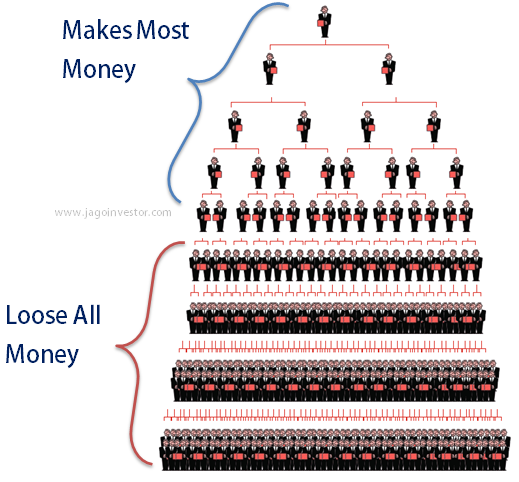

Today we are going to talk about MLM or Multi Level Marketing Schemes which have a pyramid kind of model. For years and decades, these kind of schemes are active and a lot of people get trapped in these Pyramid Schemes and lose their hard earned money. In this article, we will see the common mechanism they work on and their characteristics. We will also create a dummy Pyramid scheme to show you the traps & pitfalls. Before we move ahead, get this fact that we are talking about those pyramid schemes which also have different levels of people one on top of other and where one guy pays money which gets passed on as reward to another.

How Multi Level Marketing schemes work?

Multilevel marketing schemes are generally network based marketing schemes, in which a person has to add more people under him. The people obviously pay some money to “join” the business and then they add more people under them. In almost all the schemes, the person is incentivized for adding more people under them.

You all must have heard about the AMWAY business model, which is nothing, but a great example of Multi Level Marketing, while the business is legitimate and there is no fraud in it, still it also falls under a pyramid model. Even I have attended its meetings once when I was novice child :). The business model looked so easy, just pay Rs 5,000 to join the business and then keep adding more people to “business” and you get some percentage from the entire sales under your Tree. There are various ranks like Silver, Gold , Diamond etc., and the higher your rank, the more you make. Lot of people make money in it through legal way, and more you work harder , the money you can earn, but the point is , people who get in early make more money and the people at bottom struggle a lot.

Why most people lose money in Fraud Pyramid Schemes?

Guess what?! A lot of people make money in these Multi Level Marketing business models, and they become the ambassadors of the business. They flaunt the cheques and the money they make and believe me, some of them are real!. They really do make money and we will quickly see more on that, but the point is, that the majority of the people lose lot of money and struggle in these kind of get rich quick pyramid schemes. And that happens, because there is a limit to adding people. You can’t add more people in the tree after a certain point and when the tree becomes bigger, than it’s trouble point, it’s reaches a kind of saturation level when the biggest chunk of people who are at bottom lose all the money. Here is an example graph which will give you a good idea of what I am talking about.

Example of SpeakAsia

You must have heard about the latest craze called Speak Asia Online! I will really not be surprised if you tell me that you were part of it! I will not be even surprised if you tell me you made lot of money too! That might happen if you started earlier! Because then, the scam was still in the making! If you joined at the end, you were at the bottom of the tree you lost your money. This is how it worked!

A person can join SpeakAsia by paying Rs 11,000 and becomes a “panelist.” He then starts getting 2 surveys per week and getting Rs 500 for filling up each of them. That’s around Rs 4,000 per month and 48,000 per year and that was how Speakasia was promoted by its member to lure other members. This was at the start and though the amount of money coming IN was less than the amount of money which went OUT, and the whole model was unsustainable in long run, it was definitely sustainable in short term. Just think about it! Is it not easy to pay 10 smaller bakras if 100 bigger bakras join the next batch?

And after all that, it crashed! But still there are innocent people out there who claim that it was genuine and it worked for them. They are not wrong! It really worked for them and they made money, but that was part of the game. They wanted you to make lots of money so that you can bring more people in and then one fine day when they make a really big pile money that they can just vanish! Poof!

Breaking Relationships !

The biggest other bad thing about these pyramid schemes are how the relationships become sour and messed up when the person who is part of MLM tries to add all their friends and relatives into the MLM, suddenly they start looking at humans as “targets” , Here is one incident which happened with Shantanu

I know about this as I faced these offers couple of times from my very close friends and relatives. And I know how hard it was for me to tell them “I am not interested”. Those who is a very extrovert in nature and also convince people more, like insurance agents can get success. But most people are in the other side only. In fact one of relative faced very tough challenge later on when people found his scheme a scam. Anyway, I think after such articles also these schemes will come in future and again many will trap in them also.

In one other incident, one of the Fraud scheme called as “Japan Life” made someone lose his girlfriend

Long time back in 2000, my girlfriend got stuck up in a similar scheme called “Japan Life”. They used to take 80,000 Rs. and will give you a magnetic mattress. She tried to get me in as well and I was almost about to get trapped but sanity prevailed and I escaped, however since I did not join, I lost my girlfreind forever. I remember this fraud came up in Star News and I could see so many people getting cheated. This was around New Delhi and surrounding areas

Some other popular Multi Level Marketing and Pyramid businesses which were actually a scam were GoldQuest, StockGuru , UniPay2U etc etc (add more name in comments section if you are aware about them). Moneylife has also done this story on Multi Level Marketing companies in Forex trading, Have a look at it.

Jagoinvestor MLM Scheme – Lets create a SCAM Plan right now

Let me know you how simple it is to create a pyramid scheme and it will look so attractive . You all know I have written a Personal Finance Book called “Jagoinvestor – Change your Relationship with Money.”

Now here is a scheme

- Pay Rs 1,000 and become a member of the scheme

- You get the book FREE on signup

- Make a person join the pyramid scheme and get Rs 250 for each person

- You can add any number of people to this scheme

You realize that if you add 4 people to the group, you will get a 1,000 bucks and a Free Book! So it’s extremely easy for you if you join the scheme early.

Let’s say 10 people join under me.

Level 1 – Add 10 people

So 10 people will pay 1,000 each and I will make Rs 10,000 total , and I will send back a FREE book to all the 10 people. I incur Rs 5,000 expenses and make a cool profit of Rs 5,000.

Level 2 – Add 100 people

Now let’s see… Each of these 10 people persuade 10 more people under them, and 100 more people join the scheme. They will pay Rs 1,000 each to me;, that means Rs 1,00,000. I will spend Rs 50,000 for the 100 books , and I will be left with Rs 50,000. But out of this 50,000, I need to give a share to each member at level 1, for 1 person the incentive is Rs 250 , so for 10 people, the incentive is Rs 2,500 for each person at level 1, and because there are 10 people at level 1, I will have to pay Rs 2,500 to each at level 1, and I will have to share 50% out of 50,000, that’s Rs 25,000. But I still keep Rs 25,000 with me.

So now you can see, I made a total 5,000 from 10 people at level 1 and Rs 25,000 from 100 people at level 2. And each of the 10 person at level 1 made cool 2,500 from 10 people they added under them, they not only recovered their 1,000 back, but also got extra Rs 1,500 and a FREE book! Wow! This business model is amazing!

Level 3 – Add 1000 people

So the business is expanding and the word is spreading and my book ambassadors are in the market advertising this scheme and showing the kind of money they are making and the free book they get! Dude! They also have a valid cheque with them! No fraud! . So the word has spread like wildfire now and everyone wants to join this business.

Now, lets say each person at level 2 adds 10 more people under them again, because the word is spreading about this awesome business. There will be 1,000 people at level 3, paying 10 lacs to me and I will incur 5,00,000 expenses. I will pay 2,500 to each person at level 3, that means 2.5 lacs in total, but I will still keep 2.5 lacs with me.

Level 4 + 5 + 6

Can you see, how it’s growing? And how people are making money? From 1 person to 10 people, and from 10 to 100 and them from 100 to 1,000? But what next? Level 4? Level 5? Level?

When this reaches level 6 , there will be 10 lakh people under this scheme and they will be paying 100 crores to me! . You guys are going to hate me at that level! . Because you will never see me again! . Neither will I send any more books to anyone!, Nor will I send any share to anyone. I will just run away and you wont be able to trace me! . Any person who would have joined in at the start would find it easy to grow and spread the business. But people at bottom will just not be able to do anything, they are the last batch of fools!

Real Life Examples related to Fraud Schemes

During my College days there were 2 such schemes ( 7000/- & 1200/- each) introduced to me by my friends & asked me to join them. I explained them that they are highly unsustainable by using simple exponential formula (2^e). But still they thought i am a fool & not making money out of this wonderful Golden “Pyramid”. Thanks to God for that!!!. I just want to say that “User Pure Maths” before entering or dealing with any thing with your hard earned money. Be on your foot not on air.

In 2007, one of my good friend called me when i was out of station. “Sam, i have something great to share with you, when are u coming back? i cant wait to meet you etc etc”. I was kinda surprised and was very curious what he is gonna talk about. He took me to this office where many others showed cheques explained business model, asked me to buy some product and become a member. People were so promising that they will help me , let me grow & earn lots of money and all.. It was ‘Gold Quest International’. That day i made the biggest mistake of my financial life. They made me buy some Gold & Silver coin for Rs.38000 rupees using my credit card. After i joined i tried to reach out to some people in my circle and most of them are already part of it & others are not interested. To pay this credit card bill, i had to take a small personal loan. It was the initial days when i got into job and all these incidents made my financial position worst.

I lost 20 K in this MLM bullshit … it was with the name Cossets in Delhi . They arranged a huge pomp show in Siri Fort to show off the happiness of the people who had made money and became millionaires. There were multiple stores in Delhi where u cud purchase if u were a member Then some Ex army also got fooled joined in and invested smthng like 4-5 Lakhs his life savings got duped and then he made a case on the company . Phew Cossets was like GAYAB.

My brother was a victim of it late in 2002 in scheme(scam) called netkhazana.He lost around 17k at that time.And from that time I have got recommendations from freinds(?) and relatives(?) in to hell lot of schemes but never got into any because of the first bitter expereince. I suppose this schemes are gr8 if you have selfless people involved but that does not happen as the corpus grows to crores of rupees and people at top tempt to cut the goose.

Other Models of Scam

There are many other multi level marketing scams, which are not in a pyramid model, but they ask for money for some awesome investment based on some logic and then they really give back awesome returns to handful of investors, who spread the word about the scheme and them more and more people join the investment scheme and once it becomes very big, the person who started that scheme vanishes. The Govt is going to take some tough measures on these kind of fraudulent schemes. Here is a nice video which explains more about this.

Beware of these Get Quick Rich models

There are a hell of a lot of schemes and businesses running which show promises of making awesome returns from gold, stock market, real estate and many other kind of investments. They mostly will look really attractive and credible, but always remember that if someone is offering you anything better than bank fixed deposits, there is no doubt that there is some of the other risk involved. The bigger the potential return, bigger the risk.

Disclaimer : Note that we have just discussed how Network Marketing works and the basic mechanism. There might be various businesses and models which are making money, and might be good. This article just wants to bring awareness among people on the concept of pyramid schemes and they fool and loot majority of people in our country .

If you come across any Business like this, first make sure you check that its a member of India Direct Selling Association, which kind of gives a legitimate name and also they follow certain code of ethics. If its not part of this, I would say better stay away from it. Amway is part of it. So, not all Multi level marketing models are fraud, a lot of them are genuine also. Here is what Sunil shares about this

A Multi Level Marketing is different from Direct selling. Any company selling directly to the customer, removing all the supply chain management commissions behind, will be governed by Indian direct selling association, http://www.idsa.co.in (within India) and world federation for direct selling association, http://www.wfdsa.org . There are many companies like Avon Cosmetics, Amway, Oriflame, Herbalife, Tupperware etc.. registered under these federations. These companies work under the ethics defined by the IDSA or WFDSA and are very harsh on the people who dont adhere to these ethics. Many people reading this article will agree that the quality of the products they produce are amongst the best in the world. Many people are under the impression that these companies are similar to the other ponzi schemes.

Let us know what do you think about the concept of Multi Level Marketing and associated businesses. What is the biggest reason you think people fall for them and get trapped?