Do you read comments ? There is huge amount of discussion doing on in comments section, however many readers do not find time or interest to dig into the comments and follow the discussions, I would say comments have more knowledge than the article itself , as there are personal experiences and knowledge from many different readers, there is a threaded discussion on some topic in comments, which are more lively and engaging. So if you are just reading articles and not comments, you are missing a lot of things . So I went through some articles comment one by one and consolidated some learning and facts for my readers 🙂 .

- RBI has changed the way of interest calculation on your saving account now, earlier the interest was paid on the minimum balance in your account between the 10th of the month and the end of the month. Now the interest is paid on daily basis , Read More

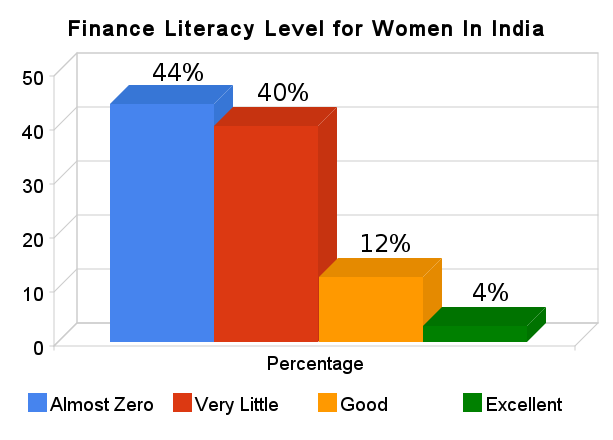

- As per research Women are better investors than men, This is because of many factors like women risk adjusted returns are generally higher than Men , women tend to hold investments in stock market for longer then men . Read in detail Here and Here

- In Public Banks the cashier or officers can tell you things like “ULIP’s are for young people , PPF is for old people” , and hence try to influence your decision-making. Once they find out that you are an NRI or from upper middle class, they can start pestering you too much because of the sales pressure or the attractive commission’s attached to it .

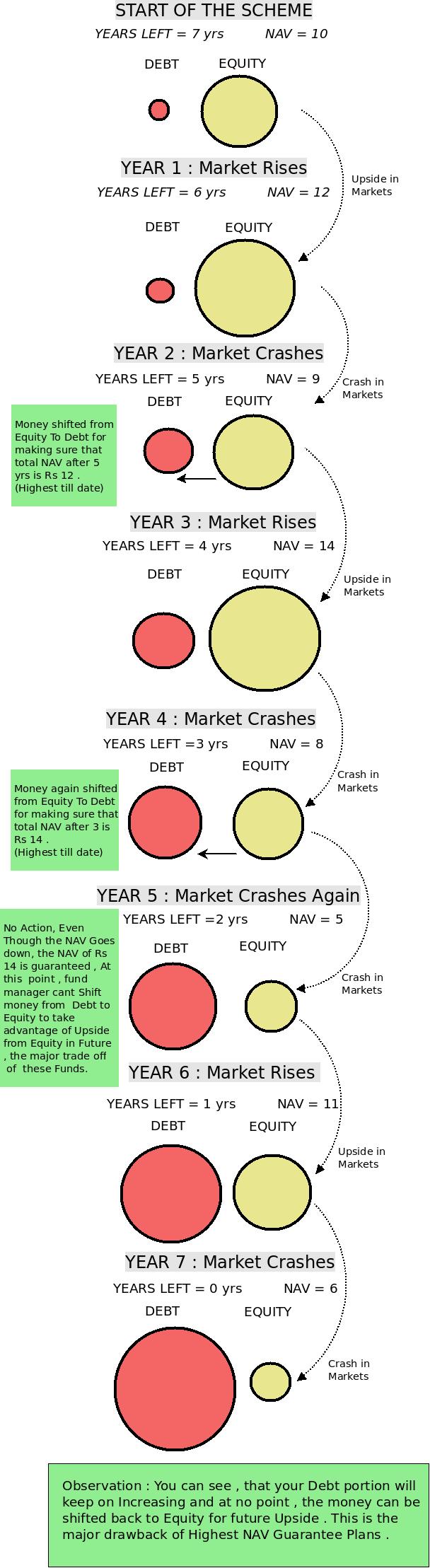

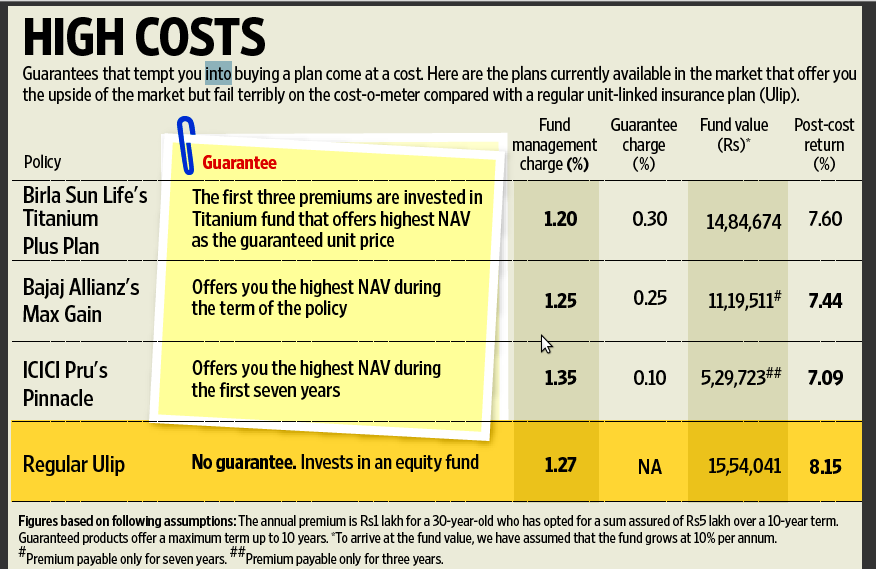

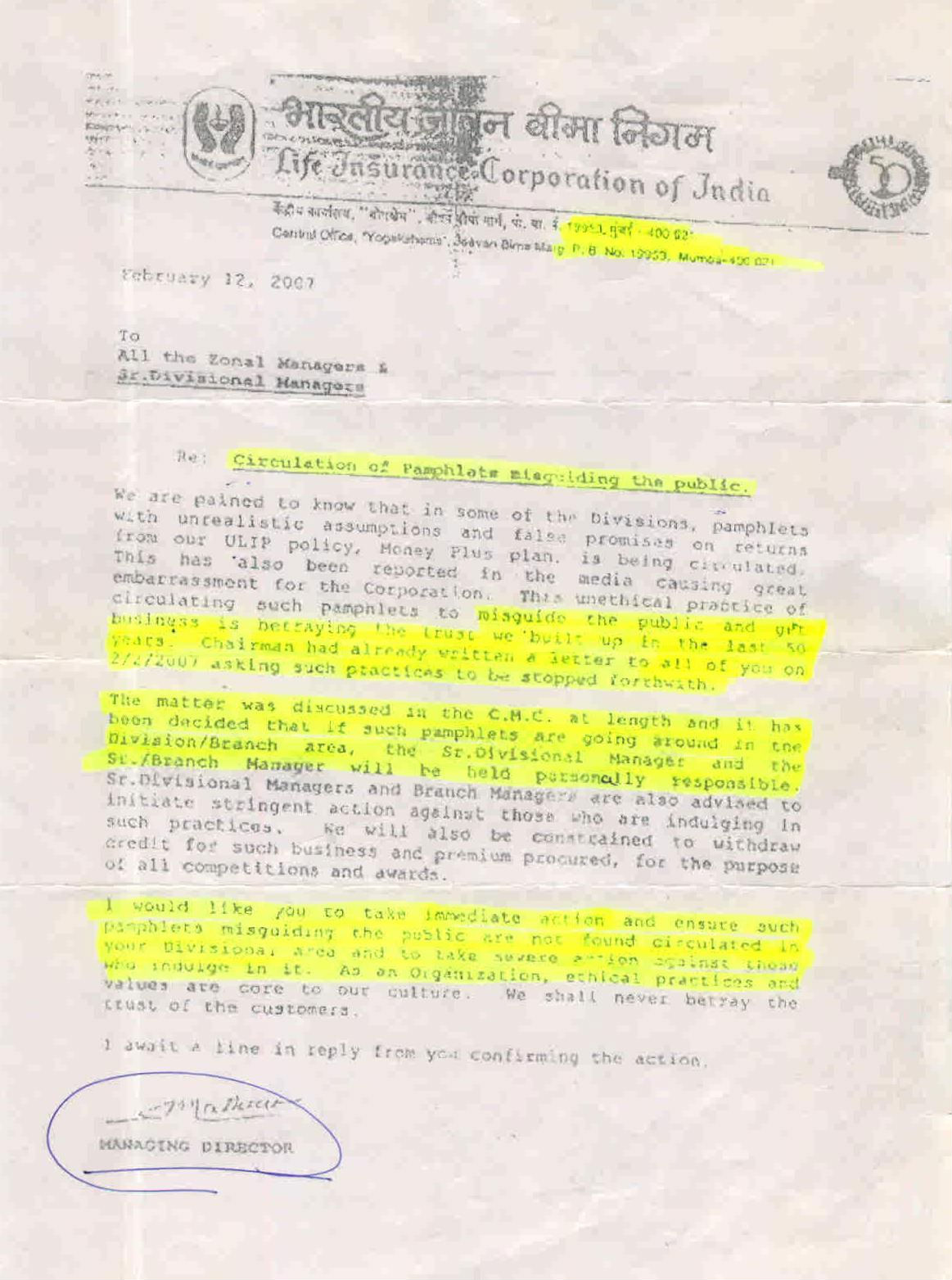

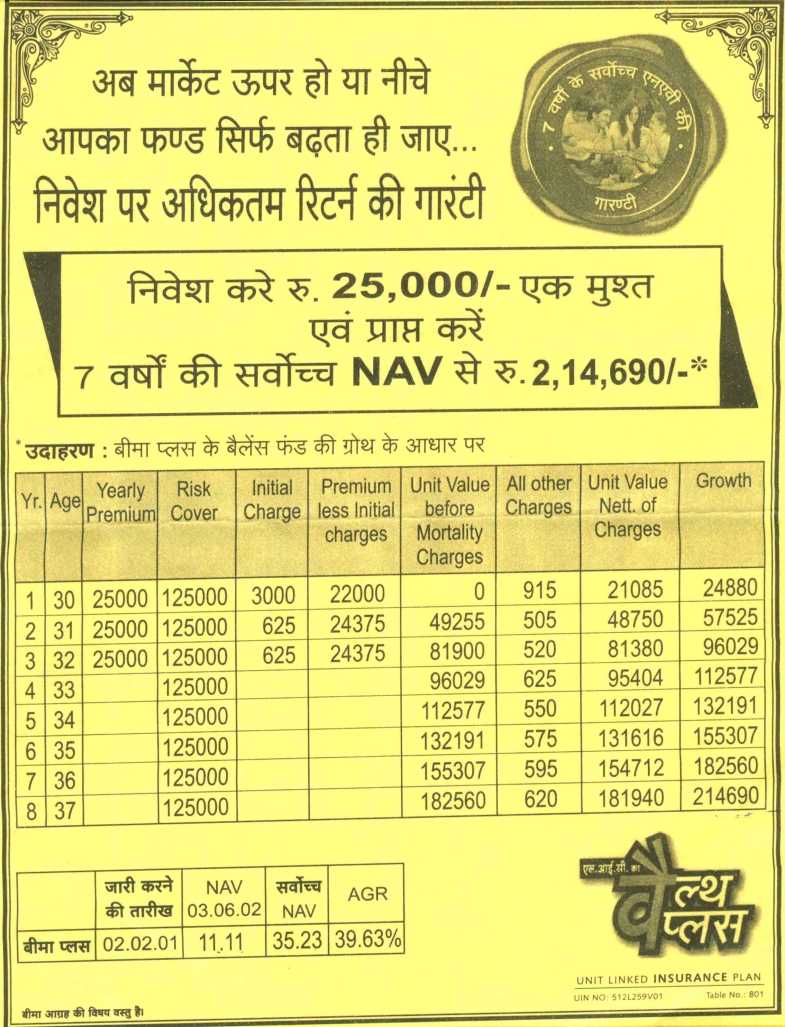

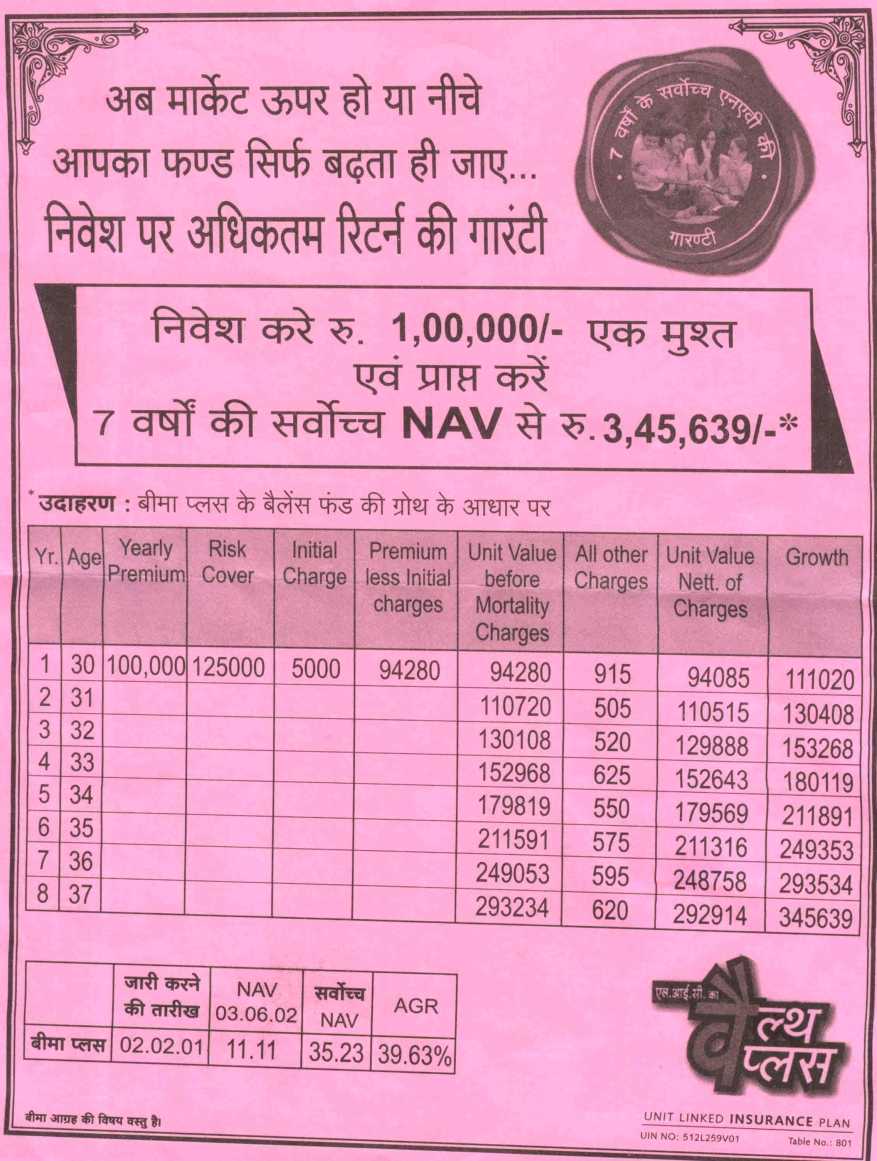

- Why the Guaranteed NAV Plans stress over number 7 ? Anoop asked me this question and my views were that the stock markets in India has been running in a 8 yrs cycle from last some decades, so after this recent crash, another big crash is expected to be after 7-8 yrs now. So they want to make sure they are giving investors “highest NAV in 7 yrs” which will be the maximum point in coming 10-11 yrs assuming markets do crash after 7-8 yr and then stay below that point for another 2-3 years . 8 Year cycle Trend : Sensex is following an eight year cycle trend. The break of the channel lines in 1992 saw the index correcting over 53%. After eight years in 2000, the index once again fell into the grip of bearish cycle and corrected over 57%. In 2008, the faced the similar fate. Breaking the long term rising channel, the index once again echoed the similar trend and has shed more than 63.7% of its weights from the top : LINK

- If you sit back and think for just a moment, you’ll realise that there is reasonable outward evidence that the Unit Trust’s history could repeat itself with LIC. It’s true that there’s a lot that is different about the regulatory framework and the nature of LIC’s liabilities. However, the core reasons that led to UTI’s collapse also exist for the LIC today: there is an unapologetic tendency to use the LIC as a bottomless pit of money of which there wasn’t enough accountability. The blatant use of this money to bailout the public sector IPOs is only the most recent and the most visible example-given the lack of public information, it’s not possible to make any assumptions that everything else must be OK with LIC’s investments-just as it wasn’t with the Unit Trust. – Views of Dhirendra Kumar of Valueresearchonline at “LIC can be the new Unit Trust of India?” .

- The way KYC is done in banks is different from Mutual Funds. Banks KYC is to be done at time of A/c opening only. They just take your documents and the concerned form is attached with A/c opening form. Since you are signing A/c opening form you don’t need to sign KYC form seperately. Thats the reason banks only take your documents for the proof. Even later also you need to give only the proof. – Thanks to Jitendra Solanki for answer .

- A horrible Credit Card Experience from Brij Mohan

My Experience with HDFC CC is very terrible, I paid all my dues before I left for UK, and this was a free CC, after one year when my CC expired, they sent me a new CC and made some charges of around 300-400 rs (approx). Since I was not in India so I was not able to receive the Credit Card, I sent them a mail first few mails I did not get proper reply as I was referring to my old credit card number. I also tried to call on ISD rates to HDFC call center they said we can’t help you as you do not have valid Credit Card. When after around 2 years I returned I found my bill is blown up to 6000. I tried to convince them, at last they told that they have their office in Bangalore too you can go and settle there, as they have added my name in defaulters database also. I went there and literally they were blackmailing that if you don’t pay all the amount they will not remove my name from the defaulters database, and finally I paid whatever the amount they said. I thought it’s all over. Finally last year when I tried to apply for car loan, it was rejected by ICICI Bank and few other bank, fortunately it was approved by Axis bank. But still just to check I applied for ICICI Bank CC, and CitiBank credit card they rejected my application without mentioning any reason. I am feeling like I am a terrorist or they have banned me in this country for my life time, even though I paid off all the dues(which was all illegal). Just last week only i came to know about CBIL properly, so I have sent a snail mail to them for my credit record. Just to check my credit record. but still I don’t know what will be the Next surprise. I will only tell if you are using CC use it very carefully and never take anything lightly, even if it is a single paisa, just clarify this and clear it off and make sure it is really done. In short I feel using a Credit Card is like walking on the Sword or Fire. It’s very dangerous thing.

- Difference between Auto-Debt and ECS : ECS is a facility to credit/debit funds between banks using clearing house. However Auto-debit is the facility within bank.

- Tip from Partha Iyenger : If you want to complain about some products, the customer care is generally not helpful and they do not care, However the CEO’s and MD’s of the company are helpful and are very sensitive to customer feedback, they are generally responsive. The problem lies in contacting them, so here is a Tip : If you have a complaint against dell computers. First find who is the CEO of the company , for example its Michael Dell , now simple write to [email protected] , [email protected], [email protected], [email protected] and [email protected]. One of them will work. Please use cc while addressing to the CEO, the person you are addressing will get jitters and before he can act, he will get a call from the ceo’s office to sort it out asap. This trick can work most of the times .

- Again an info from Partha Iyenger : Many people know that our credit cards and other credit history is stored and tracked by CIBIL, but do you know now even your other utilities bills get tracked and reported to industry associations and in turn to cibil ? for eg, if you don’t pay your mobile bills by moving to other city, you can be easily tracked or for that matter if you do not pay electricity bills of reliance, your phone connection would get cut and your rating system would go for a toss, its all happening In india now , but you don’t know 🙂 . That means when you apply for your home loan or car loan or personal loan, you would be disqualified. so every one, please pay check your bills, resolve any payments with the bank or respective firms (file complaints with the ceo, don’t ever talk to call centres. It doesn’t work ) and clear it . Read A close look at Real Estate Returns in India

- Personal Debt to GDP ratio has tripled in 5 years in India. Personal debt includes – credit card, personal loan, auto loan, home loan and consumer durable loans. To be precise, India’s personal debt to gdp ratio has moved from 5% to 15% and micro finance institutions adding to this kitty in a ferocious pace, of course its nothing compared to america’s 120% ! but we could get there in the next 10-15 years, if we don’t watch ourselves. The onus is on us to be prudent in our spending. Today, most youngsters swipe the cards through emi schemes to buy consumer durable and electronic goods as if there is no tomorrow. Our older generation saved first and then bought it, today we don’t wait, we want everything now. The credit cards is a great tool for instant gratification rather than saving and buying it.

- We feel ECS is very convenient and safe, while that is true, but anything which is good can turn out to be very bad also. Read a horrible experience on How a customer faced Experience like Hell with Kotal and ICICI for stopping his ECS facility . Here is another article on ECS from PV Subramanyam , a must read .

- Jitendra Solanki shares a shocking story on how you can become an LIC Agent. “Around three years back I went to an LIC DO to talk to him for an agency.After submitting the required fees i was given a question paper and the answers of the same and was told to just ratto the answers and start generating business.Is this how an agency of LIC is given? ”

Conclusion

All this wealth of knowledge is present in Comments section and different readers provide these information when there is discussion , so please ask questions, those questions will lead to discussions and in turn it will lead to more information from other readers who have faced an issue or have some experience .

Comments , Let me know how you liked this “Learning from Comments” section ? Is it a good idea ? What are your experiences with comments overall ?

%20works.png)

.png)