One of our readers Yogesh asked on our Jagoinvestor forum, about the claim process in case of multiple health insurance policies. I then realized that this is one the biggest doubt in the mind of investors and it needs to be cleared. Another doubt which is there in many minds is what is the claim process and the documents required if one wants to claim from multiple health insurance companies.

In this article, I will explain you the rules regarding heath insurance claims from multiple companies and some important points, along with the claim procedure too!. Recently IRDA came up with IRDA (Health Insurance) Regulations 2013 and overall it has made the claim process more easy and customer friendly, which we will see in some time.

A lot of people can end up with multiple health insurance policies with them. It may happen that they have a health cover from employer, and side by side they have taken a separate health insurance plan (which is a good thing) . Also there might be a case that a person had a old health insurance plan taken years back and now he has taken extra cover through a different plan . Another case can be when a person has taken more than two health insurance plan so that parents are also covered and immediate family like spouse and kids are in another policy. So these are few reasons why a person can hold multiple health insurance plans.

Declaring your existing Health Insurance while buying a New Policy

Before we move forward, its extremely important to understand that when you take a new health insurance policy, you always have to declare your old health insurance policies which are currently in force. This would include all those policies for which you are paying the premiums yourself from your pocket. If you are not paying the premium from your pocket and if your employer is paying it, then you don’t need to declare it in the new policy. Note, there are certain Insurance Companies which do not demand such information. In such cases, you are not required to inform about this.

This is extremely important because if you do not disclose this fact, you are violating the terms and conditions of the health insurance contract and in case of investigation this could be termed as mis-representation. Now we will discuss the rules regarding claiming from multiple health insurance policies .

Claiming from multiple health insurance policies

A lot of things have changed few months back. So we will discuss both “before” and “after” rules, so that there is no confusion left.

Before the Regulations (Previous Rules)

Before the regulations came into effect , there was something called as “Contribution Clause”, which said that a customer has to inform all the health insurance companies he is insured with and all the insurance companies will contribute the cover amount in the ratio of their sum assured (read how much health insurance is good enough). Obviously the assumption here is that the insurance companies are aware that you also have a cover with someone else , which you must have declared with them at the time of taking the policy .

For example , if earlier you had two health insurance plans with 3 lacs sum assured from company A and 1 lacs sum assured from Company B , and if you had a claim of Rs 2 lacs. Then you had to ideally inform both the insurance companies about the claim and they will settle your claims in the same ratio of the sum assured. So 1.5 lacs (75%) was to be paid by company A and 50,000 (25%) had to be paid by company B because of the “Contribution Clause” . Its a different matter than customer never told one insurance company about the cover with another companies and the company which got the claim request happily settled the full amount, even if it was not supposed to . This kind of rules earlier made sure that it was not in customer interest and lot of hassles was there if he had more than two policies. But after the regulations it has changed !

After the Regulations (Current Rules)

Now after the regulations are into effect, the claim rules are very easy . Now the contribution clause will not be applicable if your claim amount is less than the sum assured of the insurer where you are claiming. However , if your claim amount is above the sum assured of the policy, then the insurance company will impose the contribution clause. You are free to choose which insurer to catch for your claim. So let us revisit the same example we took some time back.

- 3 lacs sum assured by company A

- 1 lacs sum assured by company B

- Claim amount = Rs 2 lacs

Now with the new regulations , you are free to catch company A or company B to settle your claim, but now

If you go to Company A for settlement – Then your claim amount (2 lacs) is less than the sum insured (3 lacs) , so company A has to fully settle the full claim of 2 lacs and they cant tell you that the contribution clause will apply.

If you go to Company B for settlement – But, if you choose to go to company B for settlement , then your claim amount (2 lacs) is more than the sum insured with them (1 lacs) , so company B , has the right to apply the contribution clause and then they will only pay 50,000 to you (25% of their share , remember they have only 1 lacs sum assured out of your total 4 lacs) and will ask you to claim the rest from company A .

Now imagine the different scenario where your claim amount is 4 lacs

In-case here in this same example, if your claim amount is 4 lacs, then your the contribution clause will apply because your claim amount is more than the sum insured of 3 lacs and 1 lacs both, so it does not matter which company you approach first, the contribution clause will come into effect .

Better to have a Large cover with single insurer

Which now explains why its advantageous to have a big enough cover from a single insurance company (like say 10 lacs sum assured from one company) , rather than having small covers from multiple insurance companies like (4 lacs , 4 lacs and 2 lacs from 3 companies) . You will face a lot of documentation issues if your claim amount is large because then the contribution clause will apply. ( Read 17 Most asked questions in Health Insurance)

I hope these examples has made it clear to you about the the rules for multiple health insurance policies claims . In-case you have more than 2 policies , still the same rules will apply.

What is the Claim Process in case of multiple health insurance policies?

Here there can be two cases – Reimbursement Claim or Cashless Claims , but for this article, we are looking at reimbursement claims procedure. Even in case of cashless claims , if its from more than one insurer, reimbursement is involved anyways, because – The final approval for any Cashless claim comes at the time of discharge. Hence, only one claim can be made through cashless. All the other would have to be made through the reimbursement mode. Now lets see what is the procedure involved in claim process.

In case of single claim

- Intimate the health insurance company at the time of hospitalization

- At the time of actual reimbursement, fill up the claim form

- Attach all the bills, receipts, discharge documents, prescriptions, diagnostic tests, including films required by them in ORIGINAL

- Keep tab on the claim status. The TPA or Insurance Co. could ask for additional documents for settlement of the claim. You need to provide such documents.

- You will get the claim in around 30-40 days depending on Insurance Co. to Insurance Co.

Incase of multiple claims

- Intimate all the health insurance company at the time of hospitalization

- Now you first have to choose the company from which you will claim first.

- Fill up the claim form

- Attach all the bills and documents required by them in ORIGINAL

- Take additional attested copies from Hospital for the no. of insurance companies you are likely to claim from.

- Insurance company will issue you a statement saying that they have all the original proofs and documents and they have settled the claims

- once the claim is settled by first company then you move to the next company, you need to get a claim settlement summary (which mentions about the claim made, deductions made, and claims settled etc.) then you move to the next company

- Fill up their claim form

- Attach the claim settlement summary

- Attach Attested copies.

- Create a covering letter explaining that you have earlier claimed from Company X, and the details of documents enclosed.

- If you still want to claim it from more companies , take the claim settlement document from 2nd company also.

- Repeat the process with all companies from which you want to get the claim. You will get the claim in some days or weeks

How will the claim be paid

- The first Insurance Company will apply deductions and limits as per the terms and conditions of the policy against the claim made and make the payment.

- The second Insurance Company will also apply deductions and limits as per the terms and conditions of the policy against the claim made as if the claim is originally made to this Insurance Company, and arrive at the payable claim amount. Once this amount is arrived, it will deduct the amount already received from first insurance company.

Does Sequence of Claim matter in-case of multiple companies ?

My friend told me that the amount of claim you get back at times can be different depending on the sequence of claim. Mean if you settle your claim from company A first and then Company B , it might happen that you may get less money back compared to when you first approach company B and then company A .

But there is a catch here, this situation assumes that the insurance company does not apply the contribution clause, which actually happens in reality. Mahavir Chopra shares with me that in real life , the claim cases they handle, they have observed that companies do not bother to apply contribution clause even if it applies. So the companies in real life in maximum cases, the health insurance companies settle the claim or reject it as per the situation and condition.

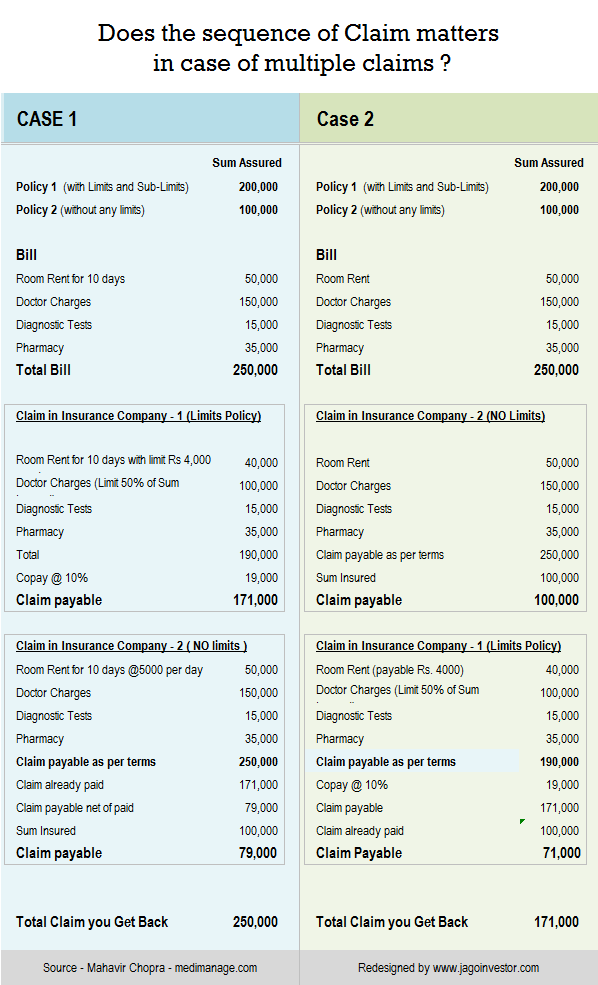

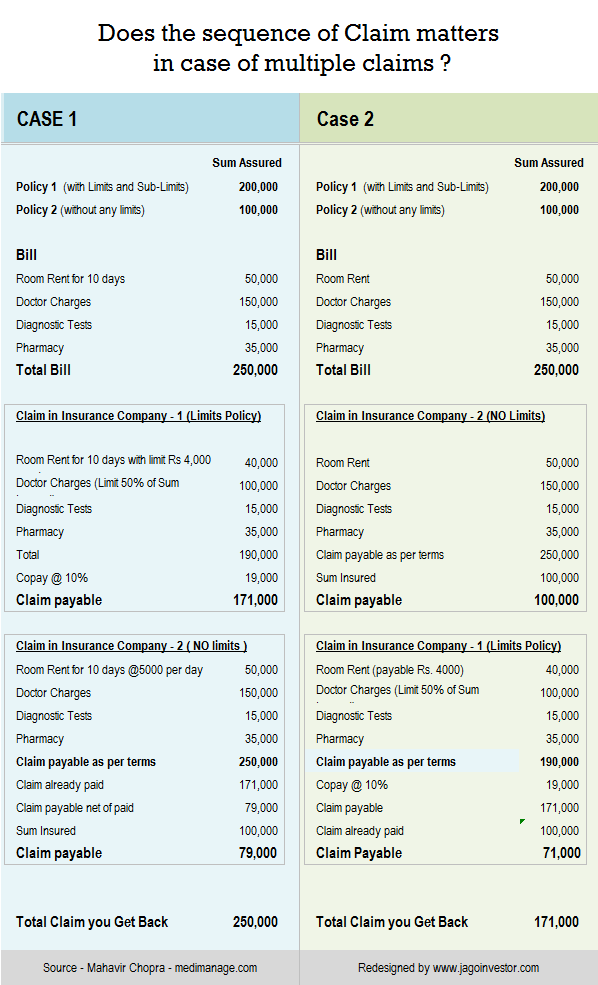

Now coming to the main point which I wanted to tell you. Lets say that someone has two health insurance policies with him.

Policy 1 – 2 lacs sum assured (but with some limits and sub limits applied)

Policy 2 – 1 lacs sum assured with NO LIMITS or restrictions

And lets say that his hospital bill was 2,50,000 in total as explain in the chart below. So now he has two choices , Either claim from Policy 1 and then Policy 2 , or reverse that order and first claim from Policy 2 and then Policy 1 . In both the cases he will get back different amount. Lets see those.

Learning – In case you have 2 policies , and there was a case where you have to claim from both of them, always claim first from the company which has LIMITS and restrictions, and later from the company which does not impose any limits, this will maximize your claim amount in total.

Important Note – In case where contribution clause is applied, even in that case the conclusion remains the same, the case 2 claim amount in that case is 1,14,000 (unlike 1,71,000 without contribution clause) . You can check out the workings yourself.

Some Good practices and points to remember

- If you have a group cover from your employer, it would be a good idea to apply for the claim from them first, because the claim process is faster with group cover , the preexisting illnesses are also covered there in initial years and lastly, the number claims there is not going to impact your premiums .

- Its always a good idea to have a single company cover of a higher amount, rather than having small covers from many policies, If you have small covers from different companies, it would be a good idea to consolidate your cover in a single policy or maximum 2 policies, not more

- The same thing claim rules will apply in-case of Top up and Super Top up health insurance policies, because there you claim from more than 2 health insurance companies.

Conclusion

At the end, I would say that its always good to have a big enough cover for yourself so that you don’t have to deal with multiple health insurance companies. You can have the separate cover along with your employer cover if you want. So, How many health policies do you have currently ? I hope you are now clear about the claim procedure from multiples health insurance policies ?