Today’s article is not about which health insurance you should buy for your parents or how much health cover you should buy, the intention of this article is to help you to do something special for your parents health than just buying health cover for them. This is something that no insurance company or website ever taught you or told you about.

Health Insurance is Important, but …

Health cover for parents is important – but a lot of people miss out on something very important, which I am going to address in today’s article. After your parents reach a particular age, do they really need health cover or is it something else? Do they need your money for paying premiums or is it something else? If you buy health cover for your parents – Is the job done or something more needs to be done?

I was thinking about these questions and they really made me think hard. I and Manish invite each one of you to add this new dimension to your financial life.

7 Special Things you can do for your parents apart from buying health cover

In my view buying health cover for your parents is just 30% job done. The rest 70% is where you can do something special for your parent’s health and we want all our readers to focus on that 70%. Now lets see each of those 7 points below.

1. First Give Them Total Assurance

Your parents need assurance (some kind of confidence) from YOU and nothing else. And so go and have conversation with them that makes them feel confident. Tell them, with or without health insurance – you will take care of them. Make a promise that you will provide them with the best medical facilities no matter what, if required put 2-5 lakh aside and dedicate the corpus/fund for your parents health.

This will build your parents confidence and may be this assurance and confidence will add a few years to their life. Assurance is one of the best gifts you can give to your parents. They got to see, experience and feel your rock solid stand that you hold for their well being.

2. Having Loving Conversation

Parents want one simple thing from you and that is LOVE. Love is the best policy you can cover your parent’s whole life with. I invite you to block some uninterrupted time for your parents every day or every week. Loving conversation will act like therapy to your parents. We all reach at a point in life where money and financial products takes a back seat and all you want to receive is love and nothing else.

I know life is hectic and we are loaded with different kinds of responsibilities and it is difficult to take out time, but see that you do something in this area and have loving conversation with your parents. It can be a small thing like calling them from your office and asking them if everything is fine or not? Caring is 1000 times more powerful than any health cover or policy.

3. Help your parents to connect with their friends

This is one of the most special things you can do for your parents. Do something so that they stay connected with their friends or with people they love to spend time with. When they are surrounded by their friends it means they are surrounded by energy and enthusiasm. Friends are the best support structure for your parents. It helps them to keep their old days and memories alive.

Make list of people your parents would love to meet but they have not been able to see or meet them from a long time. And arrange a meeting for them. Old friends do one thing very nicely and that is they will bring a smile on your parents face.

4. Go on a walk with them

How many of you go on walk with your parents or grandparents regularly? It is important to understand your parent’s inner world. What are they thinking, what are their concerns and worries or what is it that they want to share but are afraid to share. When you go on a walk with them you get a chance to understand their world better. You get a chance to be with them fully and you are able to understand them.

Giving such quite time to your parents is worth millions. Your parent’s health will start improving with this simple step of yours. After all health is a conversation that one indulges into and you have to empower them with respect to their health.

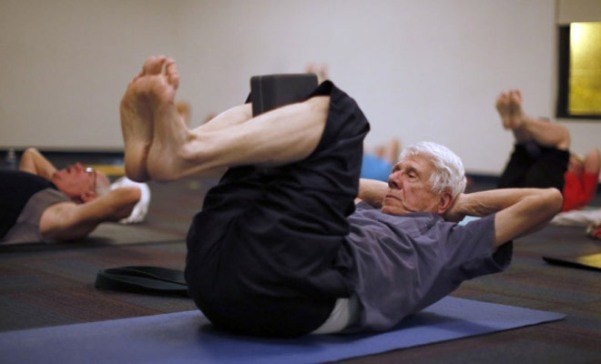

5. Help them engage with some light physical activity

My parents go for evening walk every single day. They go to a nearby club for their evening walk and they have been doing this from last many years now. Evening walk has become like a ritual to them. I think any kind of such light physical activity is extremely important. It can be going for walk, or doing light yoga or some simple kind of simple activity.

Help your parents in this area if they are currently not engaged with any kind of physical activity. Body, mind and spirit is all connected and for sound health of your parents see that some light physical activity is part of their routine.

6. Keep a Check on their diet

It is our responsibility to take care of our parent’s diet. Sometimes our parents are not very particular about their diet or about their food intake. For 3-4 days observe your parents diet, are they drinking enough glasses of water or not? Are they having raw vegetables and fruits in their diet or not? If possible get a dietitian to design their diet plan and help them to stick to their diet plan.

7. Yearly full body check-up

This is extremely important task. If possible place this task on your calendar. After crossing 50 ask your parents to undergo full body check-up every year. One of my close friends mother is detected with last stage cancer which is now hard to cure. Body is the most complicated vehicle god has ever created and such regular check-ups are a must to keep this vehicle running.

Sharing from my life, my father gets his yearly check-ups done but my mother is scared of going through such check-ups. After writing this article I am going to enroll my mother for the same.

Some Final Words

It’s high time you think beyond parents health insurance cover and do something special for your parents. It’s not like you have not been taking care of your parents health, I am sure you must be doing your level best in this area. Your time, care and respect are three greatest gifts you can give to your parents. Your parents need YOU more than health cover and always keep that in mind.

Please note that we are not stopping you from buying health insurance for your parents (It can be of great support to you financially). The words put into this article are not new, but still a lot of people are not able to think beyond buying health cover for parents and think that once they buy it, their job is 100% done.

Do share with us in this week or month what special you are going to do for your parent’s well being or health?. Also do share your thoughts with us on this and please share this article with all your loved ones.

This article is written by Nandish Desai