What’s the worst that can happen? A lot of my friends and readers ask me this question. What if I’m not disciplined? What if I buy a house beyond my means? Or invest money based on what my trusted family & friends tell me (even if I don’t have a clue)? What’s the worst that can happen?

Well, rather than sitting here and crunching numbers and showing you my results with incomprehensible tables and then trying to convince you, let me tell you a story. Remember Arush? Akshay Kumar’s ‘panauti’ character from Housefull? Let’s play God with Arush’s life.

No more strokes of good luck for him, unlike the movie, no good/rich friends or acquaintances. No exotic locations or countries either. Instead, let’s put him into our shoes, – our average, Indian, everyday-joe, shoes. And let his panauti streak run its course.

Let’s see what happens when life becomes brutal and how he pays for his ignorance and bad luck.

The year 2011

Arush is a happy-go-lucky 28-year-old. Perfect education, close-knit family and a great job, with a salary that’s better than 95% of other people in our country take home. Newly married to Sandy! Great job! DINKy income! Life’s great! The sky’s the limit!

He has just taken a home loan for a spanking new 3 BHK in a cushy, lifestyle complex! A house is obviously needed! He needs to keep up with his cousin Ajay’s lifestyle too! Ajay has a duplex, dammit! And to think, his old friend and classmate Manish, suggested he rent a smaller house… Damn you, Chauhan! What do you know?

“Renting is so beneath me! And it’s not the done thing either! Such a cheap idea! What would people think? Forget people, what would Sandy think? Forget Sandy, what would her Anna think?! I’d be a laughing-stock, I tell you, laughing-stock! Nothing wrong with a big house. Nothing has gone wrong yet! Nothing can go wrong! Everybody does it!”

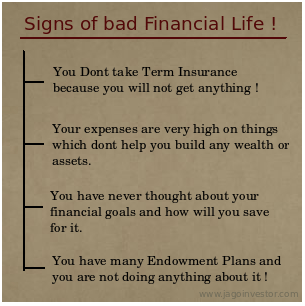

Harish mama’s sold him a few money-back policies. OK, a lot!

Arush doesn’t quite want to invest. He doesn’t understand the fundas. But, his pappa made sure Arush bought them & helped his mama out in his bad times. Akhir Apne hi Apno ke Kaam Aate Hain! and come on man, everyone has invested in money back plans.

They are “safe”. They provide the “best returns” (Agent mama’s words obviously). Pappa’s bought it, Pappa’s pappa bought it, Kaka bought it, heck even Nana has it as a part of his portfolio! All of them, obviously cannot be wrong! And Mama obviously won’t charge commissions on it, will he? It’s a gift for Arush, he’s family after all!

Is his Insurance Cover enough?

Arush feels his jaw drop, when Manish tells him, his insurance cover should be worth 1.5 crores because his family expenses are 40k/month. (It can be reduced to 30,000/month if he really tries, but who cares? The salary is going to increase yearly & he is the top performer of the team).

It hurts sometimes, that he hasn’t built a good corpus yet, but that’s fine! Anyways he is going to “invest systematically” next year onwards. It’s his New Year resolution! (This incidentally was last years resolution too).

Listening to Manish for once, Arush goes inquiring about the term life insurance plans. Guess what he finds… He has to pay only Rs. 20,000/year as premium for Rs.1.5 crores!, find your premium here

“Wow! & Double Wow! My family will not have a single worry! So much security! But wait! What if, God blesses me with a long life and doesn’t kill me before the tenure ends? What happens to all my hard-earned money, I paid as premiums at the end of tenure? I don’t get the money in the end if I don’t die? Ridiculous!

What’s the use of the product then? Total waste! (read more on this). Better save 100% of my money then! Best ROI”. Suddenly his probability of dying has come down, I am not sure HOW! Arush doesn’t want to lose 6 lacs in these 30 years. But he doesn’t realize that 6 lacs won’t amount to anything at all by 2040!

What about health insurance?

“Health Insurance? What’s that? My company already provides cover to me and my family! 2 lacs for everyone! Combined! OK, I know its not much, but I am so healthy, I go to gym and I drive safely, almost no chances of accident”

What about other people’s driving skills? Arush will feel smug & smart as long as nothing untoward happens. All it takes, is one minor illness, one small accident… to turn the whole thing upside–down! What if the expenses run to 6 or 8 lacs? (It very easily could!) Every one of Arush’s ‘plans’ for his family & himself will be really messed up.

And guess what? To top these hijinks, he goes out and buys the “Best Mutual funds” How does he know? He did a lot of ‘research!’. Research consisted of looking at bright shiny ads on billboards & on TV & in the paper, googling it, and checking out its performance over 6 months. (56%!) Arush is so happy! He’s already making vacation plans!

But wait? What about actual, boneheaded mistakes?

He recently bought Reliance shares a couple of days back at Rs. 2000… & now it’s at Rs. 1959. “Oh man! I feel so bad! I’m such a loser! Darn, all this tension has made me skip lunch! Think I should sell them tomorrow itself!”.

Arush doesn’t need the money tomorrow. He knows that equity gives good returns in the long run. Yet, he will still sell his shares tomorrow, because he doesn’t want to be a loser. “Ugh! Still feel so bad! How could I have bought something like this? I’ve been a winner all my life!

In studies, job interviews, work… I have always won! I cannot make mistakes. So this is how Arush is! Confused, yet unable to listen to good advice, unable to ask for help, a little too lazy when it comes to his own future, too impulsive, always wanting to be instantly gratified, a little too proud. Let’s leave Arush now, & play catch up with him at some time in the future…

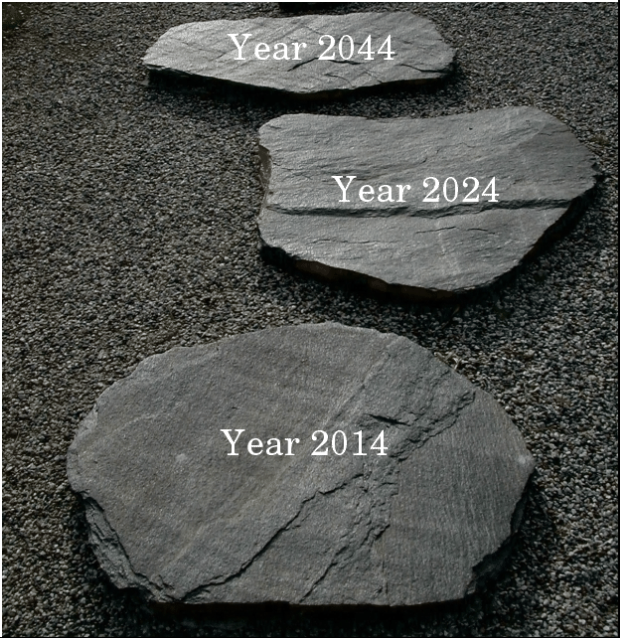

The year 2014

Booya! The markets are zooming… The Sensex has crossed 40000+!!!. “I always knew this ‘Sensex’ company would rock! Just look at it! See its performance! Wow! I’m so good. I’d like to see the look on Manish’s face now! Calling my decisions, ‘unplanned!’, ‘with no understanding!’, ‘random!’ & what not! There! I showed you, Chauhan!

Investments have tripled. Just one more week now, and I will sell everything, and cash out!”. Oops! Something bad has happened! Markets are crashing!

15% down in a day. “It’s just ‘profit booking’”, Arush justifies to himself. “India is bound to shine in the long run!”. 1% up next day! , “See! I told you!” , 10% down again the next day! , “Chinese real estate markets are the reason! Our markets are de-coupled! It’s FII!” (that’s Arush talking through his hat, trying to show off!) . He tries to justify to himself and others around, that things will soon be better! But, his investments are now down 50%! Arush wakes up and scrambles wildly. Arush is in a blue funk!

Denial Mode

“I can’t sell right now, dammit, but I want my money back!” (Your money?) “It was 10 lacs some months back and today its just 5.1 lacs! Manish says even now, my investments are have given more than 25% return on a CAGR basis… But, I won’t take it! I am a ‘winner’! I won’t take less than what it has touched previously!”. Markets tank another 5% after that.

“Oops! I should have taken that 4.9 lac loss earlier, now its 5.1 lacs down the hole! Anyway, what’s the use of selling now? Whatever could have happened, has already happened!

Let it run its course. I know it will come back to it’s earlier level! And anyway, I am a long-term investor! Manish also says I should invest for the long term! (feels so nice somewhere in my heart, when I said that)”

A few months down the road… Arush suddenly needs the money for some reason in the next month or two. He decides to surrender get his endowment/moneyback plan money back now, since the matter’s urgent. Finding the agent is like tracking a lost animal in the forest… in the dark!

He finds Agent Akhiri Pasta after nearly a week of persistent hunting and calling…

Arush : Hi Pasta, remember me, Arush here, where are you man?

Pasta : (Obviously, I remember you, you dolt! You were my 1000th policy buyer which helped me win the bahamas trip)

Of course Saar! How can I forget you saar?

Arush : Hey Pasta, I need a favor yaar, I have a financial crunch right now, so I’m wondering If I can surrender my policy and get my money back .

Pasta : Oh, why not saar? We are always there to help you saar! You can take your money back… Come to my office in a week and lets surrender your policies (the initial years of high commissions have already passed, so I’ve already made my money! Hehe!)

Arush : Wow! You guys rock! Uh, how much will I get back?

Pasta : 60,000 saar!

Arush : No no no, hehehe! I am not taking about the interest part yaar. What is the total amount I get?

Pasta : (Sigh… Yes you idiot!) Its 60,000 only saar, Total amount saar!You are aware of surrender value before maturity, right saar?

Arush : Hey man! But, but, I paid 1.5 lacs in premium in last 5 yrs, what are you talking about ?

Pasta : Saar, didn’t you sign on those documents where we clearly mentioned that surrender charges will be blah blah blah… Have a look at your Documents saar. We are not doing anything against our rules. It is as per our policy saar, which we believe that you have cleared read and then took the policy ! .

Arush : Hmm, let me go look at those documents! (while wondering which part of the world are those documents in now)

Let’s just hope Arush copes with this panauti and catch him 10 years down the road

The year 2024

Arush’s life is going on, as usual, chal Raha hai, lots of expenses now! Children have grown up, a career that was “awesome” around joining and then “great” after a few years have turned “ok ok” right now.

After about 4 yrs into his ‘awesome job’, he finally realized that he was at the wrong place and couldn’t truly excel, but then it was too late. Can’t take any risk now, can’t rock the boat! Who will pay the Home EMI, the Car EMI, the jeans EMI and the EMI for the vacation they took last year?

So… chal Raha hai, chalne do! He drags year after year in the same job, which is now drab and uninteresting.

His home loan interest has gone to its highest level (which he never thought about, while taking the loan) and hence EMI’s have crossed their budget (the one he had originally planned.) While all these issues are haunting him, with all that tension, another serious incident happens!

An auto hits him while coming home. He’s critical! Arush is rushed to the hospital, there’s a month of Rona dhona, 9 lakhs of expenses, (come on guys, we are in 2024 now, not 2011). The company pays 2 lacs (doesn’t seem like a lot now, does it?), and Sandy organizes 7 lacs from his own wealth by breaking a Fixed deposit and selling some mutual funds.

But hey, look at the brighter side too! He saved 1.5 Lacs in Health Insurance premiums all these years… Did he not? (17 most asked questions in Health Insurance)

The year 2034

Life is really cruel to Arush, He never returns to home one day, He dies in another accident, a victim of a mishap. His insurance policies come to rescue. The company settles the claim of 10 lacs very fast. His family is in a deep problem though, Sandy cannot work, 1 Child is in 7th class and the other one is ready to go to college!

There are 20 lacs fixed bank deposits, but wait, the home loan still runs for 10 more years! All the money in Fixed deposit goes towards paying off that debt. There are other investments, worth 30 lacs. Let’s use that money now! The family life-style has sky-rocketed like anything in the last decade, & monthly expenses are around 80k per month. How will they manage?

I personally see just one solution. Lets them eat once a day and stop the kid’s education, if they want to survive with that leftover money!.

30 lacs in the Bank generating a monthly income of 25k per month (Only if interest rates offered on FD’s are 8% in year 2034!, which is very rare !), all they just have to lower their standard of living, such an easy thing to do! . But hey, look at the brighter side too!

Arush did a very good thing, He saved so much in his premiums by not taking Term Insurance! Smart Husband, I wish every woman gets a husband like this and every child should get a Father like Arush.

Its called being mean, who will suffer now, Arush? NO!

The year 2044 (an alternative scenario)

Imagine if Arush didn’t die! That panauti didn’t happen and he just grew old like the rest. Its Retirement time, the time to reap benefits of one’s investments throughout life! Arush hasn’t actually accumulated a lot of wealth for his retirement! He didn’t take it seriously all his life.

Overall investments in mutual funds were never left to rest so that they could compound well, major investments in Insurance Policies and Fixed Income instruments never actually gave a better return than inflation. Even though his wealth has grown to close to 1 crore, it’s actually peanuts now, in 2045!

His expenses are Rs. 2 lacs/month! How did he forget about Purchasing Power? Even though this 1 crore looks big enough all those years ago, this will not give him more than 80k per month. Even if he lower’s his standard of living, he can’t live comfortably! He is retired now. Too late worry about these things!

Everybody wants to enjoy their life after their working years!

But for poor Arush, there are few choices! None of them, good! He can be dependent on his children, or he could lower his standard of living or cut off a big part of his desires after retirement or worst case, convince himself that he is interested in some part-time job which he can do comfortably. God forbid if there’s an unforseen medical problem which he didn’t account for, at this stage in life!

Conclusion

With this article, I have tried to show you how things can go wrong at each point in life and what your financial life can look like if you mess up with your money. It’s the time to take care of your finances and plan for it well! . Yes!

Situations are exaggerated in this article. It was just to show you the worst that could happen. Beware! Be Prepared! Be Wise!

Share your comments on what do you think about the story?

Cribbing Investor : This investor always find problems with the system, he keep on blaming Regulators, agents, companies and everyone else but not himself! He cribs at every one and about every thing around, from how he was

Cribbing Investor : This investor always find problems with the system, he keep on blaming Regulators, agents, companies and everyone else but not himself! He cribs at every one and about every thing around, from how he was  I-want-everything-Free Investor : This one needs everything for free or at throwaway price. He’ll say “It’s very expensive, Will get back to you later” to a

I-want-everything-Free Investor : This one needs everything for free or at throwaway price. He’ll say “It’s very expensive, Will get back to you later” to a  Lost Investor : These are the investors who have literally no idea about anything! He gets confused between Filing Tax returns vs Paying Tax. They get confused between IRDA, SEBI and RBI! If an agent comes to them and shit jargons on their face, they will most probably buy it as they feel bad to admit that they are dumb in the area of personal finance. This guy also thinks that 80C is compulsory and keeps buying unsuitable products every year with personal loan.

Lost Investor : These are the investors who have literally no idea about anything! He gets confused between Filing Tax returns vs Paying Tax. They get confused between IRDA, SEBI and RBI! If an agent comes to them and shit jargons on their face, they will most probably buy it as they feel bad to admit that they are dumb in the area of personal finance. This guy also thinks that 80C is compulsory and keeps buying unsuitable products every year with personal loan. Fun-Making Investor : These investors are very naughty. They are experts and make fun out of situations. If they get a sales call, they ask tough questions like “Can you tell me

Fun-Making Investor : These investors are very naughty. They are experts and make fun out of situations. If they get a sales call, they ask tough questions like “Can you tell me  Virgin Investor : These are fresh entrant in the area of money, who don’t even know what’s

Virgin Investor : These are fresh entrant in the area of money, who don’t even know what’s  Not Interested Investor : They are just not interested in Investments. Only at the gun-point you can force them invest and even then, they will start an SIP of Rs 1000/per-month and start skipping their breakfast ! . They dont claim their LTA, medical bills & even HRA, it’s too much of documentation and you have to physically move from one place to other, not worth the effort! And why take

Not Interested Investor : They are just not interested in Investments. Only at the gun-point you can force them invest and even then, they will start an SIP of Rs 1000/per-month and start skipping their breakfast ! . They dont claim their LTA, medical bills & even HRA, it’s too much of documentation and you have to physically move from one place to other, not worth the effort! And why take  Fantasy Investor : These investors live in fantasy world when it comes to money. Even in today’s world their aim is to become a “crorepati” (

Fantasy Investor : These investors live in fantasy world when it comes to money. Even in today’s world their aim is to become a “crorepati” ( Pissed-Off Investor : These investors get pissed off with everything. If Insurance company increases the premium because they are smoker, they get irritated . If their demat account charges him a yearly fee, he is irritated. He is also irritated because his mutual fund now ranks 3rd, which was a top performer when he bought it. They get pissed off at ICICIDirect site for not opening at right time and they are forced to sell their stock at Rs 156 instead of Rs 157 sometime back ! .

Pissed-Off Investor : These investors get pissed off with everything. If Insurance company increases the premium because they are smoker, they get irritated . If their demat account charges him a yearly fee, he is irritated. He is also irritated because his mutual fund now ranks 3rd, which was a top performer when he bought it. They get pissed off at ICICIDirect site for not opening at right time and they are forced to sell their stock at Rs 156 instead of Rs 157 sometime back ! . Informed Investor : Tele-marketers really cut their name from their lists, as they get embarrassed each time in front of these investors by talking something non-sense. These investors happily let their

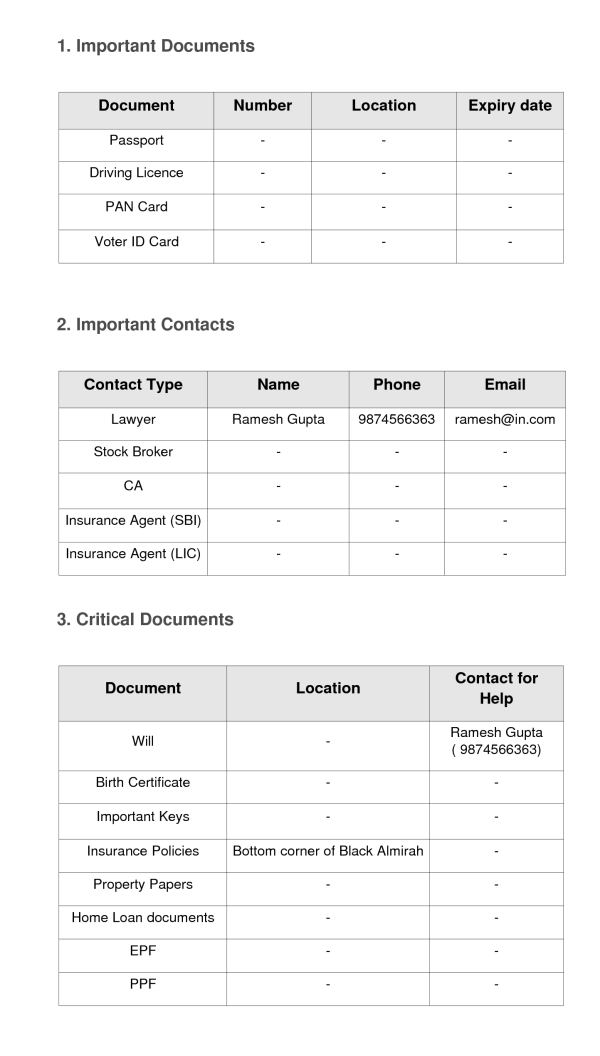

Informed Investor : Tele-marketers really cut their name from their lists, as they get embarrassed each time in front of these investors by talking something non-sense. These investors happily let their  No-Idea Investor : These are investors who have no-idea about things in their financial life. they often find their insurance policies and other important papers here and there. They struggle to mention the funds name in their portfolio . Their Policies get lapsed often,They have no idea why they are saving, Their demat accounts are active from years and they have no idea that they are paying yearly charges . They never match the actual spending and their credit card bills, ever!

No-Idea Investor : These are investors who have no-idea about things in their financial life. they often find their insurance policies and other important papers here and there. They struggle to mention the funds name in their portfolio . Their Policies get lapsed often,They have no idea why they are saving, Their demat accounts are active from years and they have no idea that they are paying yearly charges . They never match the actual spending and their credit card bills, ever! Tax-Saver Investor : These investors are really mad about tax-savings!. Their financial life is at mercy of tax-saving products. You can suddenly see a new energy in them after Jan 1st each year. If you need blood, you can get it from these investors provided you convince them that they can get a tax exemption on that. Mention a section like 80K or 80Z for faster response. His last wish in life is to find out everyone involved in designing Direct tax code and then kill them to death one by one, slowly!

Tax-Saver Investor : These investors are really mad about tax-savings!. Their financial life is at mercy of tax-saving products. You can suddenly see a new energy in them after Jan 1st each year. If you need blood, you can get it from these investors provided you convince them that they can get a tax exemption on that. Mention a section like 80K or 80Z for faster response. His last wish in life is to find out everyone involved in designing Direct tax code and then kill them to death one by one, slowly!

Conclusion

Conclusion