I took a personal finance quiz last week, in which close to 1,000 people participated. It was amazing to see the participation and the way you guys took the survey. I am now publishing all the questions with correct answers and the explanation for the answers , along with some observations (results and how different income group, profession performed in it) . Each answer had a 1 mark , so someone who answered 4 right out of 10 , has a score of 4/10 .

Personal Finance Quiz was tough

I did not want to make a simple quiz, so I had designed the questions in such aq way , that the answer which comes to mind immediately was not correct , the right answer was a little hidden one and not easy one . Hence you might see that the answer which naturally came to mind was actually a wrong one , the right answer was a little tricky one.

Some Observations from Personal Finance Quiz

- The average score of all the quiz takers was 3.48/10 .

- 94% quiz takers could not score more than 5/10

- 50 people who were extremely overconfident and said “All 10 questions are correct” , all of them scored below 5 , and the average score was 2.84 out of 10

- The high income earners were the worst performers with average score of 2.69/10

- One of the worst performance was from software professionals with average score of 2.91/10

- Only 27 people were able to score more than 7/10 and just 4 person scored 8/10 . Most of these people had income less than 5 lacs and they thought they had “more than 5 correct answers” , but not all correct.

Answers for the 10 quiz questions

Here are all the 10 questions from the quiz and their answers with explanations. You know what was your answer and hence you can find out what was your score exactly.

1. If you have a bad remark in your cibil report ? What is the maximum tenure it will be there and after that it will be removed ?

Right Answer was There is no upper limit on this . I was sure that a lot of people will choose the answer as “7 yrs”, because they had heard that number “7 yrs” as being the limit after which the bad remark from CIBIL is removed, but its again a myth ! . Yes – you will be shocked to hear this, but 7 yrs is the MINIMUM time-frame for which bad remark will appear, its not maximum. In the question, it was asked for the maximum limit, and right now there is no maximum limit. I was on a phone call with a senior person from CIBIL, and she told me that right now there is no decision on what will be the maximum limit, so on the higher side, the bad remark on CIBIL can be for even 15-20 yrs , you never know , but for sure it will be there for minimum 7 yrs . Now understand that this is when you do not do anything about your Bad remark , if you pay off your outstanding or pending debt , then it will be cleared of, Read this article on how to improve your cibil score and Report

2. CIBIL score is calculated based on past how many years credit history ?

Right Answer was 2 yrs . I was not very surprised when most of the people chose 3 yrs as answer. It must be because they are aware that the CIBIL report contains your last 36 months of history , it has all the data about how much was outstanding and how much you paid. But your credit score is only dependent on past 24 months credit history only, whatever would be the algorithm for calculating the credit score, only past 24 months of data is used.

3. The money you withdraw from your Endowment policy after the 3 yrs lock in period is Tax Free

Right answer is True. As per the revised rule, any surrender value from Endowment plans are tax free after 3 yrs, but earliar it was 5 yrs, now its changed (This answer was updated later)

4. If EMI for 20 yrs – EMI for 25 yrs = EMI for 25 yrs – EMI for X yrs , what is X

Right answer is None of the above . The other 3 options was not a right answer because X will depend on the interest rate value, If the interest rate is a number which is like 10% or something , then the X value will be infinite, but X can actually be 100 yrs or 200 yrs , if interest rate is very small like 3-5% (test your self), hence the answer is it purely depends on the interest rate. You can check this using the this EMI Calculator .

5. Ajay bought a house in Nov 2011 and paid stamp duty of Rs 50,000. Now its June 2012, and his friend recently told him that stamp duty can be claimed under sec 80C. How much of Stamp duty out of 50,000 paid can be claim now ?

Right Answer – He can not claim Stamp Duty Under 80C now . The simple rule is that Stamp duty can be claimed under 80C, only in the financial year its paid. If you see the question clearly, then you will see that Ajay bought the house in Nov 2011 (that’s 2011-2012) , hence the 80C benefit for stamp duty can be claimed only for 2011-2012 . But the question says that now its June 2012 when Ajay’s friend tells him about the stamp duty thing , now the time has passed, he cant claim it back now .

6. Father creates a Fixed Deposit on his child name for Rs 10,000 @10% interest rate. Next year who will pay the tax on the interest amount of Rs 1,000 , if child has no other income source

Right answer – No one will pay income tax . I was sure people will confuse this with the income tax clubbing rules, which says that income of minor will be clubbed with the parent who actually invested the money, but here if you see the income for the year is Rs 1,000 which is from the Fixed Deposit on child name, and what many people might not be aware is that, as per section 10(32), income upto 1,500 per child is exempted from income tax clubbing . Only income above Rs 1,500 will be clubbed, which means that a person can make FD’s on their child name and interest upto 1500 will be treated as purely child income and no tax will be paid on that. This is one of the tip you can use to save small tax on the income from investments .

7. Ajay’s age is 25 yrs right now , His birthday is coming next month, but he will not be able to take his term plan before 3 months, Why should he worry !

Right answer was There is nothing to worry about . Its because Life Insurance calculations considers the “nearest” birth date, not the next or previous one. So in this case Ajay’s birthday was coming next month, so whether he takes a term plan before 2 months of his birthday or after 2 months, it does not matter, his premium will be same, because his age will be considered as same. Now this has become a standard way of calculating the age, but there might be 1-2 insurers who are still calculating it on the completed age.

8. Ajay sold his land after 9 yrs, but still suffered a capital loss of Rs 8 lacs, In order to save the tax on that, Ajay had also bought some shares 2 months back which have appreciate a lot . He sold them at a profit of Rs 3 lacs, Which option is correct now?

Right Answer was Ajay can carry forward 8 lacs of capital gains loss for next 8 yrs . The first point is that a capital loss can be forwarded for next 8 yrs, not 6 yrs. The other point is that most of the people must have offset the 8 lacs long term capital loss with 3 lacs of short term capital gain, and thought that he can forward only 5 lacs of capital loss, but they forgot that a Long term capital gain loss can not be adjusted against Short term capital gain (a short term capital loss can be adjusted against both short/long term capital gain) . Hence he can fully carry forward total 8 lacs of capital loss for next 8 yrs.

9. You can file an RTI and get information in respect to ?

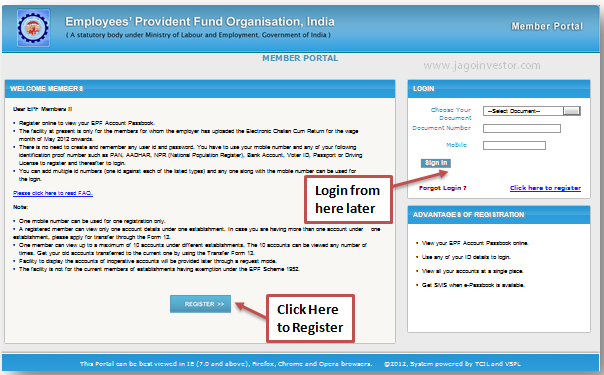

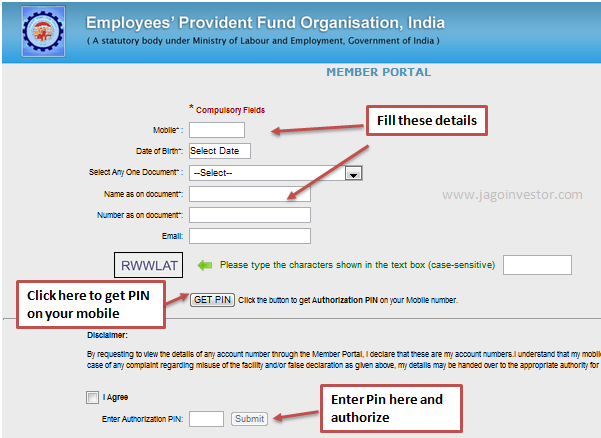

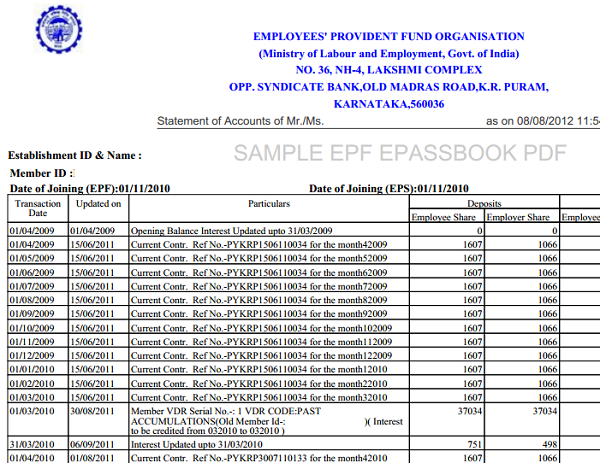

Right Answer – Both SBI and PPF . All the govt departments comes under RTI act . As PPF comes under Post Office (Govt of India undertaking) and SBI Bank (a govt bank), both come under RTI , and in the same way all the PSU banks like Bank of Baroda , Canara Bank, Bank of Maharashtra etc also come under RTI , in-case you are facing any issues which you wants answered, you can file an RTI application and get your queries answered. Look at this example of how can file RTI for your EPF (Employee provident Fund) queries.

10 Ajay family consists of Brother, Wife and Mother. Ajay holds a Demat account (nominee is brother) and a Joint bank account with wife (nominee is mother) . Now Ajay and his brother both died in an accident , Ajay had not written any WILL . Which of the following is true ?

Right Answer is Demat will be claimed by Mother & Wife, but Bank account will be claimed by Wife Only. It was simple, but confusing. When a nominee dies, its as good as no nominee. Hence The demat account will be considered to have no nominee, which means the hindu succession law will apply in this case as there is no written will, and the demat account will be equally claimed by Wife and Mother (both class 1) . However the bank account will just go to wife because its a joint account, hence the second holder reserves full right on the bank account after primary holder death, the nomination or WILL has nothing to do here, because nominee and Will comes into picture only after both the holders death.

Prize for Top winner of Jagoinvestor Wealth Club

Out of the 4 people who scored 8 , We are picking one random winner , who is Mr. Rajasekaran, and we would like to offer him 1 yr free membership of upcoming Jagoinvestor Wealth Club, which is a paid product . Not disclosing much on what it is exactly, wait for it ! .

How do you feel now

Truely speaking, the personal finance quiz turned out to be very good and I really enjoyed it . You must have see how you quickly answered few questions and got them wrong, you must have spent some time to read them carefully :). This quiz was also designed so that you can see yourself that where you stand when it comes to personal finance and understanding the internals of it. Would love to hear how you feel after knowing the answers, do you feel you were overconfident with your knowledge ? Do you have any confusion in the answers of these personal finance quiz questions and would like to understand more ? Please leave your comments .