Haven’t we all faced this at one time or the other? The pain of staying in your job getting worse than the pain of leaving your job ? If the answer is yes, this article is for you.

I am writing this article after Sunil asked a related question on leaving a job and starting a business on his own in our questions and answers forum. He wanted to discuss few things before he can start a business by quitting his day job.

Hello Guys,

Looking at the market conditions in Indian IT Market, it is obvious that anything can happen at any given point of time… I have interest from starting to set up a business (small scale) and have a cushion to my career…. I need few ideas from learned people like you in starting up a business (with at least 3-4 lacs).

I would really appreciate your feedback and comments.

In this article, we will discuss a few things about leaving a regular job and starting on your own, developing business idea which you’ve had from long time.

Why this topic on a personal finance blog ?

Truly speaking, this is related to your financial life. A lot of people have extra ordinary aspirations and desires in life. They want to travel around the world, they want to own millions and want to have an ability to spend whatever amount they want on anything in life, but deep down they know, that it would not be easy to achieve everything they want from a regular 9-5 job.

A lot of people get into a job which they feel would be suitable for them, only to realize it later only after few years, that they have made such a big mistake in their life. But we have so much to accomplish , children education , their future, the desire and pressure to give them the best in life, parents , spouse , their dreams and their wants in life.

People who are not happy at their job, they just bury themselves under responsibilities and for entire life, keep on dragging in their current profession and job. However this not a story of everyone, a lot of people love their jobs and are really content and satisfied with what they are doing.

I had recently done a survey on how people are frustrated in their current work and some more information. Here are the full results. please go through it and look how do you fit in there.

What about those who are not satisfied in their jobs and career? I had earlier written that your financial life is directly related to your career . If you are not doing great in your career, it will impact your earnings, and hence directly impact your financial goals and the wealth you will generate in life.

So you need to decide if you want to move on and do something on your own as soon as possible, be it for emotional satisfaction or more monitory satisfaction. Unless you are happy in your work, you cant focus on wealth creation.

My Story of leaving a job and starting on my own

Some people get shock of their life, when they hear that I was a software guy once in my life.

Let me share with you, how I was once a very good student in Computer Science and then became a dull/boring/worthless/unproductive software guy and finally took charge of my career and went on to change my domain to Personal Finance and even wrote a Personal Finance Book (Read 65+ amazing review on flipkart)

My Story

I was working in Yahoo at Bangalore in a nice software job, I was considered a good student at my post graduation days but only I know what I was really capable of (like you do) .

I was good at many things like Algorithms, data structures and problem solving skills, but really sucked at others; Networks, Operating Systems and System related things. Somehow I managed to muddled through, but I still don’t understand them even today 🙂

Yahoo hired me (thanks to them) for the job which demanded exactly all those things out of me, which in my wildest dreams I never wanted to work on. I was devastated and saw my end in the first month of my job. But I had to continue the job, because of my financial commitments.

Each day the expectations in my job grew way beyond my performance, and it made sure my guilt and dissatisfaction increase at a compounded rate. I could see clearly that I am working for money only, I was not able to see myself anywhere in next 3-5 yrs, The frustration of going office without any motive and passion was really killing from inside. I was very sure and clear at that point of time, that my affair with software field has come to an end.

I had to take some extreme step.

How Jagoinvestor came into existence

I had always learned things in my life by teaching others. I was good at personal finance from start of my life and always believed it to be such a easy thing and wondered why people complicate it without any reason. This passion of personal finance and love for teaching gave birth to Jagoinvestor.

I was spending my 80% time at office towards Jagoinvestor (10% time went for lunch). Things moved at a really good speed and I was really passionate about what I was doing and loved it. I suddenly realized that this is my passion, this is something I am passionate about, this was something which was not making any money for me at that point of time, but I could have paid to do it myself.

This was something I woke for each day, Jagoinvestor was something I lived for, It was something which negated my stress and frustration as Software engineer. For next 1-2 yrs, It got bigger and bigger and I was known as an expert 🙂

I was a trusted person on personal finance which was not my field by education, but I was not even considered for something related to software field even though my education and career was based on that. I never cared.

Leaving Job

I and Nandish met in between and we could see how we both could take it to next level. By the end of 3.5 yrs at Yahoo, we were generating some money from Jagoinvestor, but it was not consistent. I knew it can never be consistent flow of money in business, at least in starting years.

I gathered my courage and the belief that we will succeed. I owe so much to Nandish who motivated me and coached me on this aspect, which helped in decision making of quitting my job.

It was not easy ! I had spent so much time and (little) effort in computer science, My parents had put lot of struggle and money on it, and after all I had spent 3 yrs on Computer Science, how could it go for a waste ? How could I leave a well paying job which everybody dreams of and become a blogger ? What will my relatives think , What will my own family think ? What will my future-in-law’s think (SE vs Blogger) .

There was pressure – but I was sure I was not a pressure cooker, I knew I could not risk my entire life. There was not a perfect moment to “quit my job” and I knew there will never be, on the last day of 2010, just few months before my marriage, I left my job and took the next bus to Pune from Bangalore to start the new year and new journey in life, without thinking much what’s ahead.

There were thoughts like “Am I making a right decision ?” , “Will it really be the way I am thinking?” etc , but I also knew deep down that, if I don’t do it now, it would never happen.

Now, after a year and a half of leaving my job, I can say not even a single day have I remembered or missed my job (except the unlimited sweets and the rasam-rice), though I loved the company. Each day has been a wait to open my laptop and enjoy writing articles and help people in their queries. My Work life is now 100 times better than what it was before leaving the job.

That’s my short story 🙂

So whats next ?

You don’t always have to build a multi-million dollar start up or create an empire! If you are not happy in your current job, then you just need to move to some other sector or start some business.

Nandish always says that people are so much attached to their current job that they believe that’s their destiny and life now. They don’t even get a thought that their purpose of life might be something else, if they are good at their current job, there might be something where you are awesome .

Just because you didn’t accidentally got into some profession or some company does not mean it owns you or your entire career. You can still move . If you were asked that you will never be able to work in the same sector/profession again because “god” has ordered it , what would be the next thing you will fit in ? What will interest you and you might want to give it a try (share with us)

8 things I learned by quitting my full time job

Based on my little experience and whatever I had learnt from others, here are some of the sharing for someone who is considering to leave a job and start on his own. These tips are not extra ordinary tips, they are more of a reminder to you rather than teaching something.

If you consider all these points in your planning, then the chances of getting successful would increase. Neither of the below points are perfect, nor it will be applicable to every one. These are just some observations from my side.

1. Start the background work now

Most of the people wait for the last moment till things get ugly and each day is a nightmare at job. If you are very clear that you want to head out on your own someday, start the background work right now in this moment.

Whatever you want to do, learn the game of that while you are in job, start understanding dynamics of the business you want to get into, now. The job to business transition is really a tough thing to do. It takes time, it takes effort, it takes dedication.

2. See if you can do something parallelly

It’s not always possible, but if there is any way you can run your business or start something on the side, it would really increase your confidence.

The chances of this happening is higher, if you can find a right business partner. For most of the people who work in big companies, the best thing could be to talk about it with few friends in the office group itself, who also share same kind of vision and passion.

Here is a sharing from a jagoinvestor reader on how he worked with his colleague’s after office hours and successfully started his own company soon despite having a home loan and kids to feed

Me and my friend developers who have high passion on starting up a company, we both are married and both have kids of less than 1 yr. We worked after office hours to make the setup and finally we started our company this new year officially quitting.

We made a huge savings to run for next whole year in the same life style and to pay home loans. If we have not taken home loan we would have jumped a little earlier, how ever I see it in a positive way, it keeps us pushing like a fire under belly, we have to do that little extra and that deadline of payments are always there and a huge sum I have taken two house loans including one in joint .

3. Create the buffer

One of the biggest deterrent for starting on your own is “what if things go wrong” kind of questions. This happens mostly if you are weak on your buffer amount. The buffer is nothing, but your emergency fund, in-case things don’t work out for initial few months or 1-2 yrs . It should pay for your basic expenses at-least, if not luxuries.

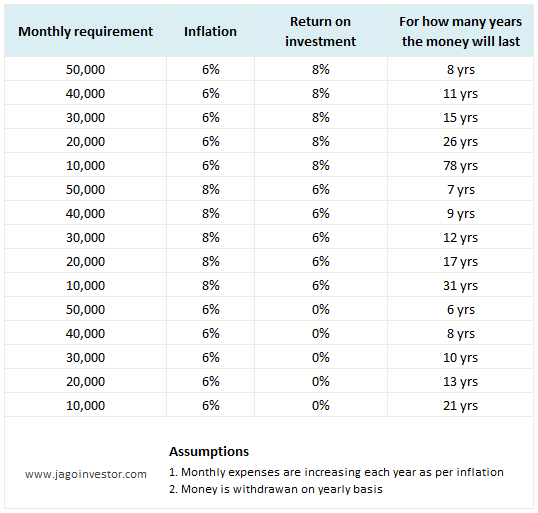

The larger a buffer you can create, the better it is and it will happen only if you start now at this moment, otherwise not. I would say a 3 yrs buffer is a good number, but most of the people are ok with 1 yr buffer too. If your current expenses are 40,000 per month, you would need 5 lacs per year (40,000 X 12) is what you need for 1 yr and 15 lacs as your 3 yrs buffer.

See how you can generate 5 lacs as first milestone and then 15 lacs. Note that your buffer is inversely proportional to your confidence and how ready you are for your new venture, and a direct function of how ready you are overall.

4. Double income will help

Software guys have this advantage like no one else, a lot of them are DINKS (double income no kids), husband and wife both are earning good money. This situation is ideal for those who want to give it a try. While one person can earn and make sure things are on track, the other person can give his/her shot on entrepreneurship.

If things go wrong, you still have something to fall back upon. I see this situation as “one is earning the money and the other is burning the money”, but at the end it’s more easy than a single earner case. So now if you are about to get married and want to leave a job and start on your own in next few years, you know you will have to give more preference to someone who is earning money. That’s a choice you need to make.

5. Get rid of liabilities

If you already have some kind of liability, like a home loan, it really becomes a pain to even think about leaving a job. You might have to postpone your decision, but don’t bury it . Yes, you have a liability, but once you complete that liability you will have your own home, & that would be a great support mentally. You know in the worst case you have something to fall back on.

Also another advantage would be that once you complete your home loan, you will have one expense less (rent) to pay in life and as you still have many years left to take the jump, its an ideal situation to plan. When you know there are many years in job, you can give your maximum time in planning, getting ready and if possible “increase” the size of your buffer!

6. Imagine the worst case and find ways to deal with it

This is the biggest reason why most people do not budge from their jobs and keep dragging. The worst case scenario really scares them to death. In the book How to stop worrying and Start living, the author Dale Carnegie says that one can reduce the worry by mentally accepting the whole worst case scenario, and really write it down and then see what will be his actions at that point of time.

Imagine you are a software guy. What is the worst case which can happen if you take a calculated risk of leaving the job and starting something on your own after lot of planning?

This is what I can think of – You will blow all your buffer you have created, your venture will not work out and you will lose some months or years – what next? Worst case, you will have to get back to a job. It will be tough, you will face difficulty to get back to the same level of salary. In worst case, you will start lower than what you earn today, but that’s what is the cost you will have to pay for the desire of starting on your own.

7. Don’t quit the job !

Just because you are reading this article does not mean you start feeling that you also want to leave your job and start your own venture. No ! .. We are just talking about those, who are “dragging” , they are unsatisfied with their jobs and want to do something else in life.

Its perfectly fine if you are just in your job and move on with the same thing for life. A quite lot of people really excel at their work and earn really big bucks, its all about your love for the work and how far you can go with it, you can always move to next job, go abroad and earn more money.

So not quitting a job is also an option. You need to think about it, evaluate the pain and pleasure attached to both the options and choose what you want to do. There is nothing right or wrong decision, its only “your decision”.

8. Make it as a project

When we get on call – Me and Nandish sometimes talk about the concept of Dreams vs Project. You complete your office work because its a Project, you complete your college practicals and exams because it’s a project, and you also prepare and present a presentation at work because its kind of a “project.”

You fail at getting up early in morning and exercise because its a Dream, not a project, you are not able to save enough to pay down-payment of house as planned, because its a Dream, not a project.

In much the same way, most people do not achieve the transition of leaving the job and starting their venture because its a dream, not a project. If you want to understand more about the difference between Dream vs Project, listen to this 12 min’s audio

Idea’s for starting a new venture

A big challenge in leaving the job and starting on your own is “what will be the next venture?” It leaves an open question in many minds and people are not able to take the decision. We can all collectively share some idea’s on what kind of small or big business can be done with small and big capital .

You must have one good idea to share , Please share it will all and I will publish the list of all idea’s on this same article once they start floating.

Real Life Sharing’s about how they feel at current job ?

Experience 1

Following the herd culture ,i.e, after 12th doing engineering and then software job irrespective of one’s branch and now life looks like to be more of a mechanical where everyday you do mundane things and on top of it some crap , foolish and utterly junk lowly intellectual managers govern your appraisal and hike.

I want to get rid of this junk industry where human emotions get dissolved in thin air and people are moving towards making themselves machine oriented trying to achieve efficiency of typical machine with elusive numbers.

Experience 2

I am working with a pvt limited Bank.Though the Bank is employee friendly and has a great future but I feel my vertical is very boring and stagnant.My supervisors are very rude and insult me in front of everyone.My job has no challenge and stagnant.Though my knowledge is better than other colleagues but I am given job of a doc executive.

With no knowledge involve in it.I wanna go 2 other dept.but my supervisors are not allowing me for that.It makes me helpless.My productivity is getting decreases but I ve not lost hope may be in future I ll get a better work related 2 my knowledge.

Experience 3

Not much to share. Not just enjoying my job. Its not satisfying. Its not what I wanted to do in my life. i’m a bank Manager now, but don’t really feel so, being in one of the largest pvt sector banks. There is a lot of gap between what is written in offer letter and what is being offered us to do daily in office.

The number of hours we give to office, is just too much. Usually more than 11 hours a day, all through the year. What I and most of the colleagues believe that, if we give this much dedication and passion to some venture of our own, then we can reach pinnacle of success on our own.

Why should we give so much to another company? Will it give us a justified share of its profit if we give so much to the company. NEVER.

Experience 4

Basically, i am a drummer and interested in the Music domain. By chance or by mistake i have come to this bloody Software Industry, which is full of diplomacy and politics, which is never suited to my type! So planning to be back with my musical nature and rocking mode.

Experience 5

I am a post graduate degree holder in Mechanical Engineering (Research) from IIT Madras . I was chosen by one of the biggest software companies from campus for my employment. I am being employed in the IT outsourcing division. Company recruits were bragging at the time of placement.

I am doing some type of maintenance and enhancement work of some client’s mainframe software which up to a certain extent is challenging due to the analytical and logical skills involved. My current job does not leverage my scientific and mathematical knowledge acquired during my studies and that feeling keeps me dissatisfied in my current job.

I did not take a honest and serious effort in moving out from the situation as I got very much comfortable with the current position and also due to other family commitments. A 2-3 year onsite work opportunity is looming and I am hoping of saving a corpus and proceed for a career change.

Can you relate to the above cases ? Is your story very much on same lines ?

How did you find this article ? Do you think it was valuable for you ? Are you in that situation where you want to leave the job and start something on your own ? Share your experience or views with all of us .

You can calculate this in many ways , but one of the ways you can do is by calculating it in excel sheet. We have this calculator on our upcoming

You can calculate this in many ways , but one of the ways you can do is by calculating it in excel sheet. We have this calculator on our upcoming