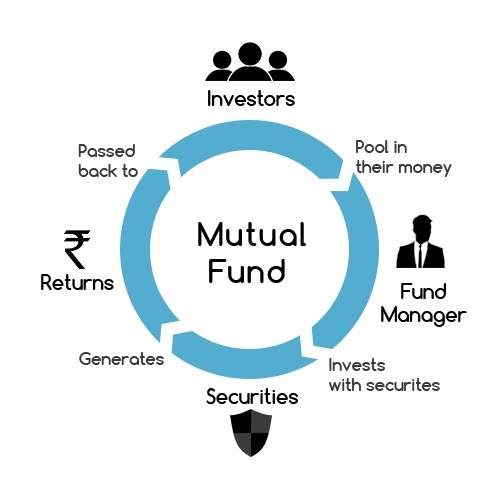

In the world of mutual funds, there are various kinds of categories for different requirements and risk appetite. One of the categories I want to talk about today is the “Balanced Advantage” Category.

What are Balanced Advantage Mutual funds?

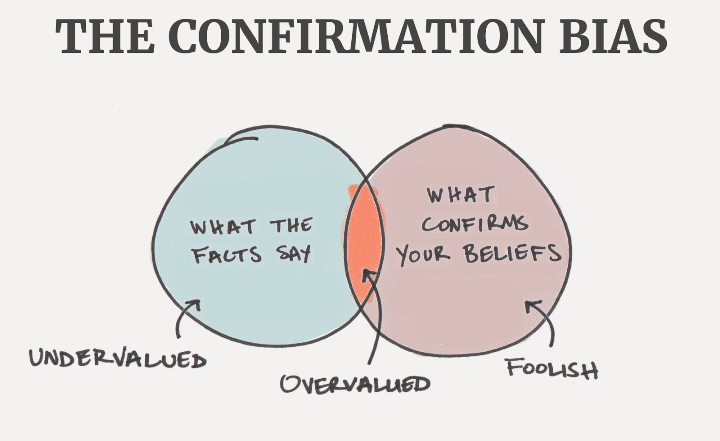

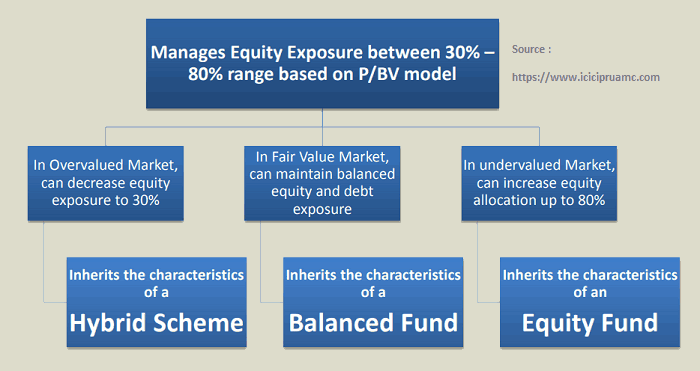

In one line, a balanced advantage fund dynamically shifts between equity and debt depending on the market valuations. What it means is that when the markets are over heated and high, the fund decreases its exposure to equity and move the money into debt, so that if the markets fall, the down side is protected.

In the same way, when the markets are on the lower side, the fund increases the exposure to equity and reduces the debt side.

This strategy significantly reduces the volatility of the fund compared to an equity fund and at the same time, the returns potential also comes down.

A lot of funds in this category also name their funds as “Dynamic Asset Allocation Fund” rather than “Balanced Advantage”

Some of the examples of the funds in this category are

- ICICI Prudential Balanced Advantage Fund

- Motilal Oswal Most Focused Dynamic Equity Fund

- Aditya Birla Balanced Advanced Fund

- Kotak Balanced Advantage Fund

- Reliance Balanced Advantage Fund

- HDFC Balanced Advantage Fund

How does a Balanced Advantage Mutual fund work?

A balanced advantage fund uses a predefined algorithm and based on Market PE or P/BV or some other internal indicator to determine if markets are on the higher side or lower side and then based on that they keep increasing or decreasing the equity exposure.

To explain you more about this, I will take an example of how the ICICI Prudential Balanced Advantage fund which was the first fund of this type in the mutual fund Industry and very successful in that category.

Disclaimer : I am taking the example of ICICI balanced mutual fund only because it’s the biggest in the category and quite old one in Industry and we have some data to show. It’s not a recommendation to buy. We have some equally good funds from other AMC’s also.

They use P/BV (price to book value) as an indicator to decide is markets are over heated or not.

Equity Exposure changes with Market movements

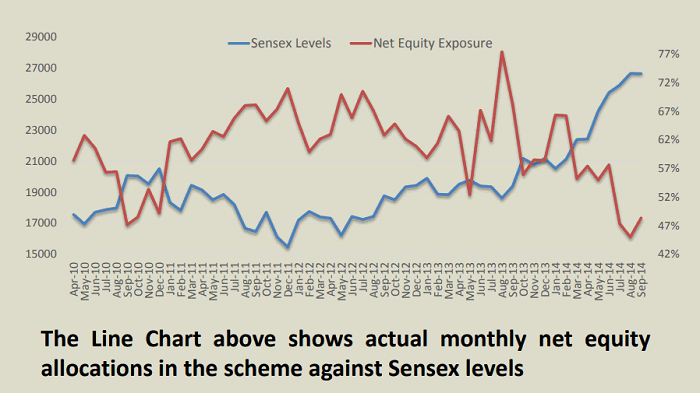

Below you can see how the equity exposure has changed over time from Apr 2010 – Sept 2014. You can see that equity exposure increases when Sensex levels go down and vice versa.

Limits downside and upside

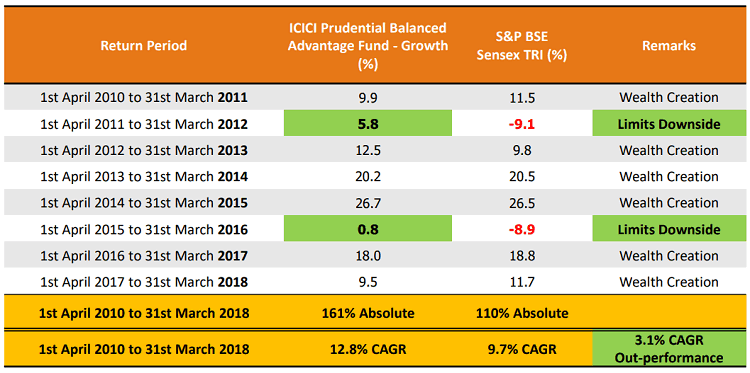

The main benefit of Balanced Advantage funds is that it controls and extreme upside or downside. So you will not see very deep losses, but at the same time, you will also not see very high profits.

However, the balanced advantage funds will provide decent market returns (but not comparable to pure equity funds)

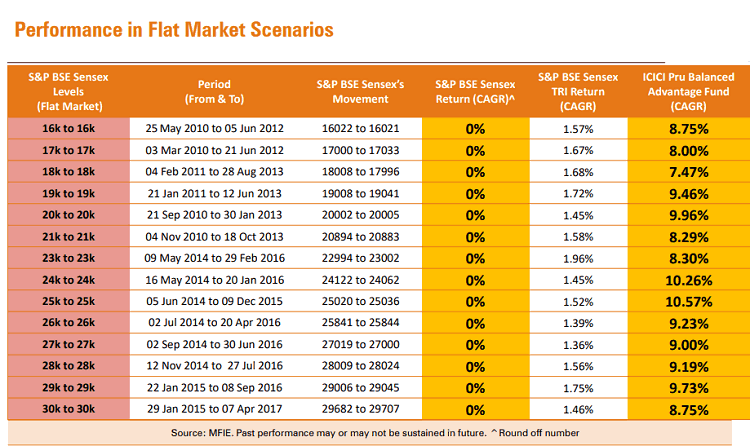

Even in the flat markets, you can see that the balanced advantage category has generated positive returns by taking advantage of the volatility.

Who should invest in Balanced Advantage (or Dynamic Asset Allocation) funds?

Now the big question is – Which kind of investors should invest in Balanced Advantage fund and When?

Who should invest?

It’s mainly for those investors whose focus is on reducing the risk, but at the same time enjoying better returns than Fixed Deposits. The fund value will still be volatile, but the intensity will not be as high as a pure equity fund. From Returns point, it will give decent return of 2-3% above FD returns, but that is all you should expect over a long term.

When to Invest?

As you have seen that the equity exposure is already controlled by the fund itself, you can actually invest anytime you want. There is no need to time the market, because the fund itself times the market internally. There are no issues if you want to put lump sum or SIP.

Who should not invest?

An investor who wants higher return potential and can take the higher volatility, should not be ideally investing in these funds. However, if you are unsure of the markets levels and want to play safe, you can invest lump sum in balanced advantage fund and then setup a STP (Systematic transfer plan) to an equity fund. This will reduce the risk to some extent.

Important: Don’t confuse this category of funds with “Balanced Funds”. Balanced Funds are those mutual funds that have a mix of equity and debt in their portfolio with equity exposure of around 65-70% and rest Debt.

A good choice for Retired Investors

I think these kinds of mutual funds are a very good choice for retired investors who want returns better than the fixed instruments and at the same time, can’t handle too much volatility in their portfolio. So some part of their portfolio can surely be invested in balanced advantage or dynamic asset allocation funds (same thing, but different name)

If you want to invest in balanced advantage mutual funds, you can contact the Jagoinvestor team to know the process and get a well-designed portfolio.

Let me know if you have any questions regarding this fund of a mutual fund? Was it clear enough?