Today we will discuss how you can convince your parents (assuming senior citizen) into mutual funds to get better returns on their investments with lower risk.

I am not saying that every parent needs to invest in mutual funds. But I have seen many parents retiring with insufficient corpus and investing that money in a very manner. It’s not tax-optimized and also earns the least return possible – all in the same of “Safety”

I understand that not all senior citizens want high returns, but in most of the cases, I have seen that there is some allocation which can be made in mutual funds.

We come across many investors, who are investing in mutual funds and they have a good understanding of the product. They have full confidence in mutual funds investments, but their own parents are stuck in the old traditional way of investments. And these children are not able to convince their parents to invest their money in mutual funds or anything closely linked to stock markets, simply because parents come with the baggage of old beliefs about equity markets and poor understanding of the concept of Risk!

Old habits never go!

Most of the parents have all their life invested in Fixed Deposits, LIC policies, PPF, NSC and postal schemes which were simple and guaranteed return products. Their focus was always on “peace of mind” and “safety”. They were not obsessed with returns like we do today!

Parents outright reject the idea of investing in mutual funds or stocks the moment they come to know that its not a guaranteed returns product and there is RISK involved in these things.

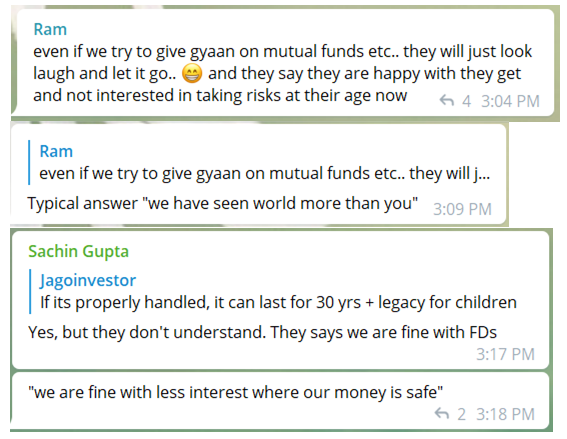

To get some idea on this subject, I asked on our telegram group how their parents react for the investments in stocks and mutual funds, and here are 2-3 responses I got!

I know it’s going to be very very tough to convince them for investing in mutual funds, and most of the people will fail in this!. However, this is my small attempt to give some pointers to you on how you can start the conversation with your parents on this issue. Maybe it will work for you.

So here are simple things we can do.

#1 – Introduce them to Debt Mutual Funds

The first thing you can do is to not introduce the word “Mutual funds” directly to your parents. Tell them that there is one investment product which is similar to Fixed deposits, and the returns it has given over last many years have been a little better than Fixed deposits and has very less taxation (we see tax part in point #2 soon)

Tell them how this new “investment product” works very much like bank deposits. It also lends money to others and gets returns. But unlike bank fixed deposits, it does not give a lower but fixed return.

Instead, it keeps a small-fees and returns all the returns to its investors (which means that its a market-linked returns). There is its own share of risks which needs to be well understood and handled.

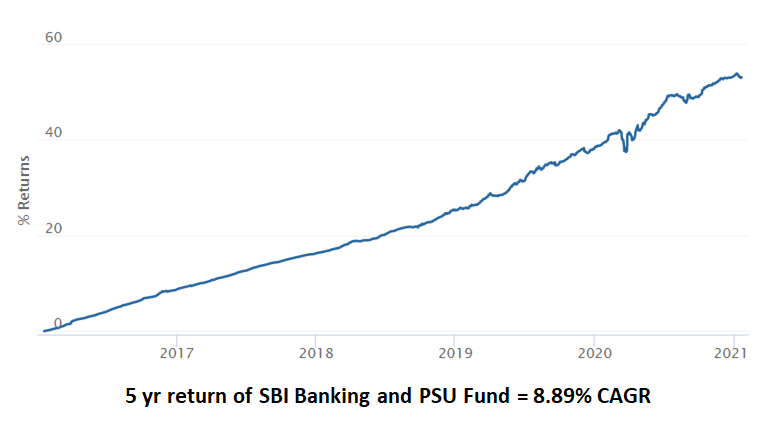

The next step is to show them how these debt funds have performed over the last few years like 5/10 yrs.

Start with Banking and PSU Category

You can start with a debt fund which comes from “Banking and PSU Fund” category because I have seen many senior citizens are very comfortable with the portfolio of that kind of debt fund/

Take for example SBI Banking and PSU Funds

Its a debt fund from SBI Mutual fund which invests a big portion of its money in bonds issued by various banks & PSU companies in India. The definition itself will be worth attention and parents may listen because of the word SBI (maybe!!)

That fund has given 8.89% returns in the last 5 yrs. The Journey for a fund has not been as a straight line, but it’s not wild like an equity fund. To a senior citizen who is struggling to get a 6% return in FD may be interested in looking at the past returns of this fund.

Apart from Banking and PSU category, you can also tell them about short term debt fund in case they want to invest their money for short term like a few months to a few years.

The stability of returns for short term debt funds category is quite strong as they invest in short term debt papers (incase this is technical for you, dont worry, you need to learn about debt funds)

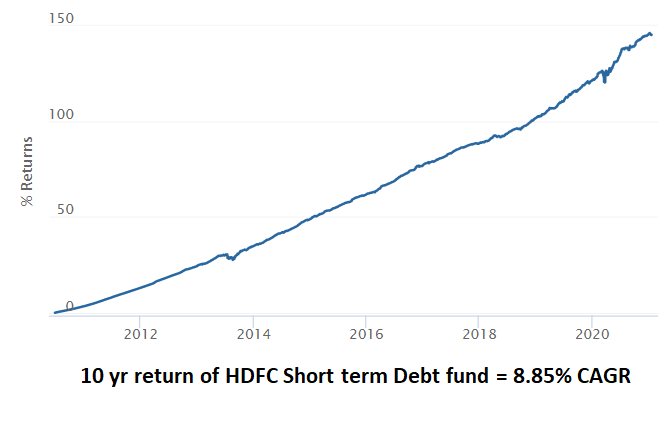

Here is an example of HDFC Short term debt fund which has given quite stable returns over many years. Its return in the last 10 yrs is around 8.85% cagr! . No doubt that the fund is little volatile in short term, but over long periods you can see the line going up and up!

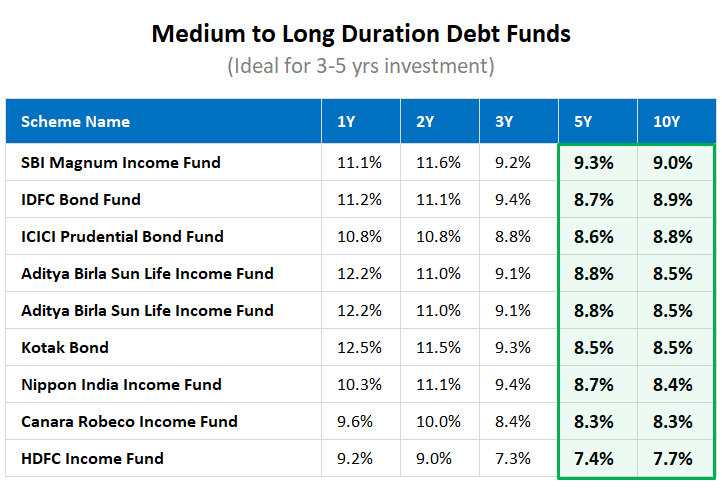

One more category is of Medium to Long term funds which are suitable for 3-5 yrs investment period and one can expect an 8-8.5% returns based on historical performance only (past returns are not a guarantee for future returns)

Here is a table showing what has happened in the last many years (Some funds with very low AUM is removed from the table and only bigger brands are taken)

So as the first step just show them these returns and low volatility of debt funds. This will be the foundation step.

Disclaimer: Debt funds are not as simple as what you are seeing above. There is credit risk and interest rates risk because of which the returns can be fluctuating. However, I am not going into the details of how debt fund works as it’s out of the scope of this article. If you are not clear on how debt fund works or chosen, its recommended to look for an advisor.

#2 – Show them the impact of taxation

One of the most overlooked aspects of investments is Taxation.

People do not think much about optimizing their tax-outgo while making investments. Investors still talk in terms of “Returns” and not “Post-tax Returns”.

When you invest in Fixed Deposits, Senior Citizen Saving Scheme, Saving Bank etc, you pay the tax on the slab rate. Which means that for very high amounts the tax will be at 30% rate for investors in the highest tax bracket. The worst is with FD, where you pay the tax on the entire year Fixed Deposits interest, not on how much you have redeemed!.

Can you believe that this tax can be lowered to 10% or 5% and sometimes even 2-3% for longer tenure investments (some cases). This is because the returns you get from debt funds are not categorised as “Interest Income”, but capital gains.

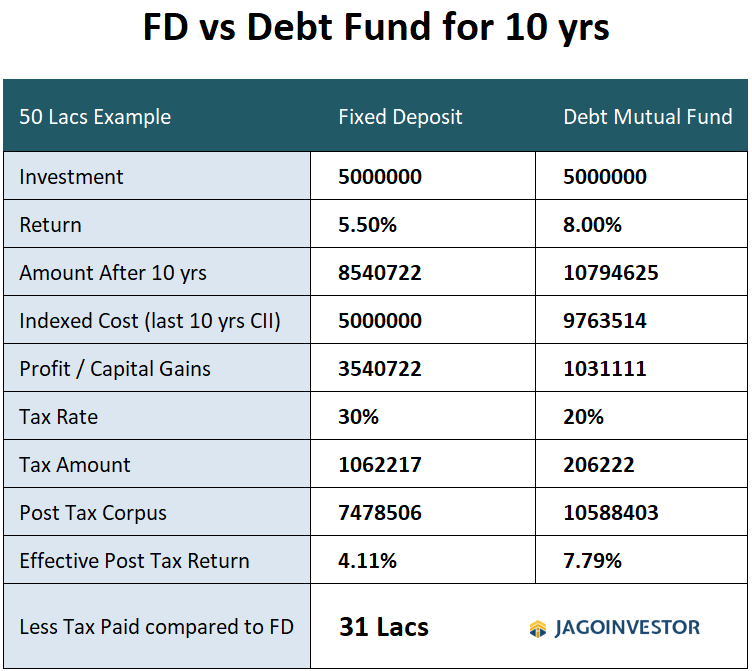

Let me show you a simple example of what happens when a Rs 50 lacs of money is invested for 10 yrs in a fixed deposit vs a debt fund. I have taken FD rate as 5.5% and debt fund returns at 8% as per the current situation and I have taken the last 10 yrs inflation numbers from CII Index.

You can clearly see that your FD becomes 85 lacs and Debt fund becomes 1.07 crores (indicative, but historical returns), Still, you pay 5 times more tax in FD than debt funds simply because of Indexation benefit.

The debt funds are surely not as predictable as a fixed deposit, but over 10 yr period, you can surely create a very strong portfolio and also diversify your investments across some quality debt funds. I think it’s worth taking that extra risk for the sake of making 31 lacs more!.

It’s not a small amount, it can mean 5 yrs extra money for retirement.

Most of the poorly designed portfolios lag on taxation. If you can just fix that part, that itself can mean alpha of 2-3% sometimes.

Here is a tweet I did a few weeks back where I was sharing how someone who retired with a big corpus (let’s say with 10 crores) will pay taxes in equity/debt fund/ FD

Power of deferring #taxes

Imagine 10 crores invested for 1 yr & withdrawal of 40 lacs in 1 yr (4% corpus)

Assume the last year returns as

~ Equity Fund: 10%

~ Debt Fund: 7%

~ Bank Fixed Deposit: 5.5%Tax Paid

~ Equity Fund : 26,000

~ Debt Fund : 78,000

~ Bank FD: 15 Lacs pic.twitter.com/XkfOk0u34V— jagoinvestor.com (@jagoinvestor_) January 20, 2021

However, note that a smaller corpus can be still divided between husband and wife and then the taxation may be NIL or less due to the income not reaching the taxable limits. What I am referring to is mainly for big corpus.

#3 – Educate them about mutual funds in general

In case you fail in the 1st and 2nd step mentioned above and if your parents are still adamant about not changing their mindset of sticking with Fixed deposits or LIC policies etc, I must say you can’t do much and you lost the game.

However, if you feel they are showing some interest and will hear more on this subject, then its time to sit with them and educate them first about mutual funds in general.

I think most of the people who just reject mutual funds dont have a good understanding of the product and how it works. Here are 33 myths about mutual funds incase you want to look at them. Is time to educate them a bit about mutual funds industry and how established it is.

I feel there has not been a good attempt to educate senior citizens about mutual funds in the right way. Tell them a few things like.

a) Mutual Funds does not always mean the stock market

Firstly, tell them that not all mutual funds invest in the stock market.

There exists something called “Debt mutual funds” which do not invest in stocks and only invests in the debt market (bonds of companies and govt securities). Use the word “Bond” and “Debentures” as they might have heard these words and can relate to these.

Tell them that there are GILT funds (which only invest in govt securities) and then there are Corporate Bond Funds (which invests in big corporates) and in a way, they are comparable to corporate fixed deposits

b) Tell them about mutual fund industry size

Do you yourself know that Indian Mutual fund industry is one-fourth size of the banking industry? Yes – we have around Rs 30 lakh crore of assets invested in mutual funds which is very very big in itself.

A lot of senior citizens still feel that mutual funds are some kind of scam or not a well-regulated product. It’s your job to tell them that it’s a 25 yr old industry (actually much older if you look in the US and other counties) and a very well designed and well-regulated industry. Crores of investors invest through mutual funds now in our country and its growing at a very good speed.

Over the next few decades, my guess is the mutual fund industry will be bigger than retain banking Industry.

Dont force your thoughts on them at this point and just hear them out. If they have any apprehensions or issues with any point, do find the answer and go back and share with them about it. It can take them a lot of time to digest all this. No rush!

#4 – Tell them their corpus may not be enough for future

Not many people are retiring with huge corpus these days. Most of the parents are retiring with a smaller corpus than what they actually need for their long retirement. (Read why one needs 30 times their expenses as retirement corpus)

In your own way, you need to convey to them that their money may not be enough for future, and some part of their portfolio (if not all) has to be invested in equity too.

A lot of senior citizens are investing money in a way that it’s giving them terrible post-tax returns because of high taxes and low returns. All this in the name of “safety”. I know people who have put all their money in pension plans or just kept it in FD. They dont think about things like the liquidity of money or low-post-tax returns.

One issue is that in our country people think that once they cross 60 yrs, they have to just move every bit of their money into 100% safe products. This is not true for most of the cases.

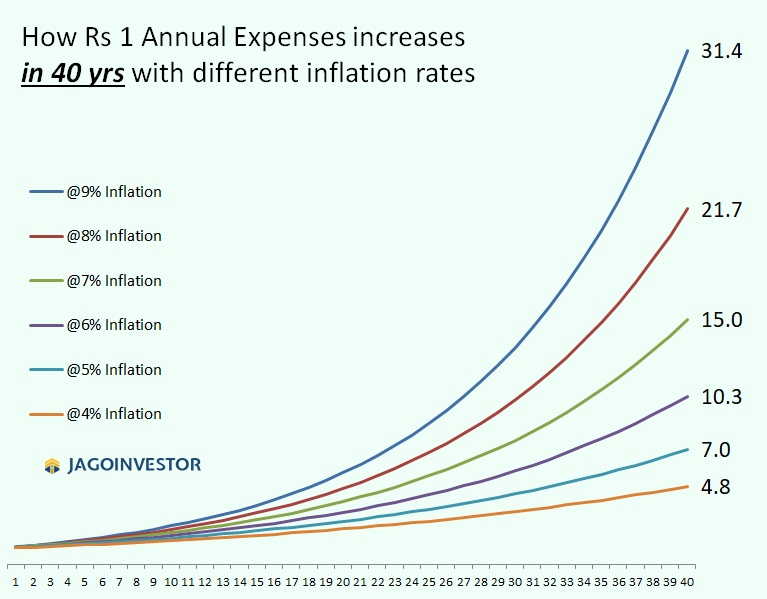

A 60 yr old person can live up to 100 yrs also and that means they may have 30-40 yrs of life ahead. IF they make bad investments decisions which are not taxed optimized and do not create a positive real return, the wealth may get consumed pretty soon then they realise due to inflation.

So, if a retired person has Rs 30,000 expenses per month at age of 60 yrs, then by the time they turn 70 yrs, it will increase to 65,000 per month. However, a human mind is not able to access the impact of inflation over long periods of time.

In short, you need to convey that they need to generate a higher return on their investment and need to have a balance between safety and returns. Yes, some expenses may go down, but many other expenses may come up too. This is more true for those whose children do not live with them and they may end up living all by themselves.

A lot of senior citizens may not be thinking about these points.

#5 – Get them started with a very small amount

The next step is to get them started with a very small amount.

If they have 50 lacs of wealth, maybe you can invest just Rs 1-2 lacs in a short term debt fund and let them see how it’s moving in next 1-2 yrs. Show them the statements every 3-6 months to reinforce the thought that mutual funds are one of the options and they can diversify some part of their portfolio in debt mutual funds too.

I did the same thing when my mother in law wanted to invest a very small amount. She told me that she wants to put a small sum in Fixed Deposit and I told her that I will choose something better for her. I invested it in dynamic bond funds as the money to be put for the long term. Right now the fund CAGR in last 4 yrs have been around 8.8% CAGR.

Why Children should Educate their parents?

I also want to convey two points to you (the children) on why you should educate your parents about mutual funds.

1. Parents money may not be adequate

If your parent’s money is not enough and invested in a wrong manner, then the money will finish off sooner than they imagine and that would mean that you will be dipping into your own corpus to fund their retirement needs after 10-15 yrs.

Nothing wrong in that, as our parents have raised us and we are all successful because of their blessings, but when its possible to do better than what they are doing currently, there is no harm in pushing a bit into right retirement planning. A robust and tax-optimized portfolio shall be created which also generates better pension for them.

We at Jagoinvestor has been helping many retired or close to retirement clients (with corpus in range of 1-5 crores) to design and manage their retirement money. You can check out our retirement services brochure to know more

2. Legacy will come back to you

A lot of people do not get inheritance as the wealth is mismanaged by parents and is not put to the right use. If you make sure that your parent’s wealth is properly invested, that also means that a part of it may come back to you as an inheritance. And this may mean your own retirement corpus may get a bump.

If you are in your 30’s or 40’s right now, then your parent’s wealth will come to you as an inheritance after another 30-40 yrs and those many years of compounding can do wonders to your own retirement planning.

Conclusion – It’s not easy, but worth a try!

I know this is a tough nut to crack and many people may not be successful, but still, you can give it a try.

You never know if parents may be ok to invest some part in mutual funds. Just avoid asking them to shift all their investments to high-risk funds. As and when they get comfortable with mutual funds concept

Do let me know what are your thoughts on this and if you can share any tip on how to convince your parents to try out mutual funds investments?