Today you are going to learn some valuable lessons of stock market trading from experiences of a person who traded in stock markets for 1.5 yrs and failed miserably during those 1.5 yrs. This person is no one else, but myself

Background

Let me share my story

Sometime in June 2007, I got recruited in Yahoo from campus placements. I was 23 yrs old, fresh into job and had no idea how my life is going to take shape at that time. Suddenly, I saw a huge inflow of money (salary) in my life and I was not very clear what to do with it.

I had some weird notions about “Getting Rich Quick” back then. I was good with numbers, knew about stock markets basics and considered myself to be “analytical”, so I thought I am smart, very disciplined internally and can “possibly” do better than “average” in stock markets (every one thinks like that only).

So I was ready to enter the world of stock markets.

Now, there was one more guy in our new joiners group who was equally enthusiastic about stock market (that guy is now an IAS officer) and just like a smoker finds another smoker in a big group, we found each other and became buddies.

Over the next few weeks we made various plans on how we will get rich trading in markets. We were already millionaires on an excel sheet and we thought even in worst case scenario, we will do well.

So our next step was to open trading and demat accounts.

When God Sent that guy!

Things were all set, we were about to start the race.. and one day one ICICI Direct guy was in office (targeting new set of employees to open trading accounts) and we thought he was god sent ! . We opened our trading + demat accounts in no time.

The Rs.500 annual charges seemed too small to us compared to what we would be minting in coming months. When he said its “FREE” for the first year, we were like – “We won’t mind even if you charge 10X for that in the first year” .

We got to know about “options”

While we were ready to start our journey in stock markets . We got to know that there is something called Options (derivatives) apart from regular stocks. This was something new for us. We googled and searched about options, and we came to know it’s a high risk/return thing. We didn’t focus too much on “high risk” part , the only thing we could read was “high return” part.

So next moment, 20-30 eBooks got downloaded on our laptops and we decided we will learn about it and make sure we don’t leave any stone unturned for make our “millionaire dream” a truth. It was a bit hard for us to delay our “trading” for few weeks 🙁

Learning about options was FUN

Learning about Options trading opened up to a whole new world for us. We learned that options trading is an amazing leverage tool which was very fascinating. I learned about technical analysis also and used all the office bandwidth to download technical analysis eBooks and videos (at one point of time, I had 1000+ eBooks on stock markets and I didn’t read 998.8 eBooks out of it).

For those who want to learn about options in detail, I would recommend an excellent resource on it from Deepak Shenoy of Capitalmind. He did a webinar on the topic and it was recorded and uploaded on youtube. You can see it below

After getting introduced with Options, our greed went to next level and now we became much more rich on excel sheet. Our profit margin went really high (but we didn’t focus too much on risk factor, infact we were not even clear on where we are entering into and how risky it can turn out to be).

So were all set with high energy, but could not take any action because our trading account was still not active that time and we were waiting for it.

Finally we started Trading

So, one day I got a sms – “Your Trading account XXXXXX9484 is Activated – ICICIDirect” . I logged into my account, transferred 10,000 from my ICICI bank account to ICICIDirect account (they were interlinked already) and there was one stock we were following from long time. We bought an OPTION for that stock , I had to pay approx Rs 6,000.

- We went for lunch and were back in 3o min

- I logged in my trading account and saw the current price of the Option trade

- It was Rs 8,500. I SOLD it

I made Rs 2,500 profit , a 24% profit during LUNCHTIME and now we were planning, if we can I leave our jobs ?

I realized years later that one should never make profits in their first trade in stock markets, it fuels the overconfidence in you like anything and gives you a false sense that you are really some smart guy !

Now the Learning Starts

Till now I was giving you the background of what all happened before we started our options trading journey . For next 1.5 yrs, we were very much involved each day into stock markets, made some money, lost a lot more money, got frustrated, some short-lived happy moments came in too and finally one day I put a big break on my options trading.

I learned a lot of lessons in those 1.5 yrs of my journey in stock markets and realized that I can pass on some learning’s to others who are now trying to enter the markets or are fascinated with the potential stock market trading holds .

I am not saying my learning’s are some hidden secrets which are very new, but I can share what all I learned in my style , I am sure it will help someone who wants to learn from my mistakes.

These few points will help you to not make mistakes I did and help you overcome some myths and notions associated with stock market trading . Just a request – Note that these learning have come from my trading in Options (which is derivatives) and not regular stocks, but that does not change the learnings you are going to read below.

Mistake #1 – I focused too much on Knowledge

When I entered into stock markets, I was of the impression that I need to acquire a lot of knowledge on how things work, how various strategies work ? How technical analysis can help in trading ? I learnt all the technical indicators, back tested them on the past data, wrote lot of programming scripts to test my hypothesis.

I even went on to download lots of videos online and watched it over and over for many months and I realized that my knowledge had gone up significantly. I now understood lots of concepts, strategies, complex terms .

I could see a chart and instantly see lots of hidden patterns and could tell more than a normal person who does not know how to read a chart.

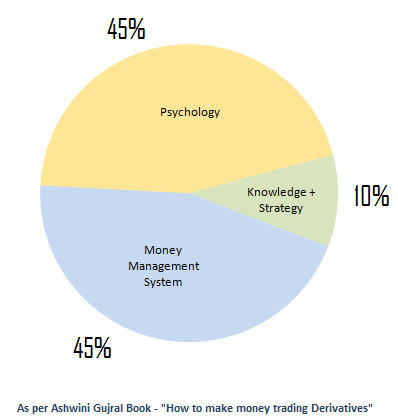

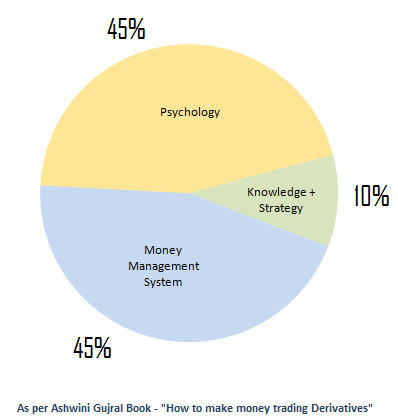

But then, over the months, I realized that “knowledge” is just a secondary element to trade successfully in stock markets. Almost all the good traders around the world agree that “knowledge” does not contribute more than 10-15% in being a successful trader. It’s an important thing , but certainty not the holy grail

I am not saying that one should not focus on “knowledge” part, all I am saying is that it’s not that KEY thing to succeed. Over knowledge will only create problems for you.

One of the famous stock trader Ashwani Gujral says in his book – “How to make money trading derivates” – that as per his experience over many decades, he feels that knowledge of charts etc contributes to just 10% of success for any trader. Here is the chart which explains what he mentioned in the book

So, learn things in stock market and then concentrate on the other important elements which you will learn in some time. Dont overthink about knowledge part.

Mistake #2 – I went against the Trend

What I have seen is that all the new traders somewhere want to challenge the markets and want to predict when markets will fall and when it will rise. They want to predict when the trend will reverse. They want to catch that top or bottom.

This is the essence of where most of the failed traders are stuck . If markets are rising , somewhere inside me, I wanted to catch the top and wanted to prove as if I “almost” know that now markets will fall OR if markets were going down.

However in this process, I realized that all the time I was just trying to swim against the trend, If markets were going up, I tried to predict when it will fall and how much and vice versa, and in that process I never stayed with the trend. There was some kind of fun in going against the trend. It was very tough to accept that markets can be simple (not easy)

Below you can see last 1 yr graph of NIFTY Index and see that there has been an uptrend in market and it has risen from 6000 in 2013 to around 8000 now . That’s 33% increase , but imagine someone who didn’t stay with the trend and always tried to predict when will market fall and looked at markets with suspecting manner and never got in the trend itself.

So just make sure that you never go against the flow in general. If I have to compare this trend following with some adventure sports, then I will compare it with Surfing, where you ride on the flow of the water. The flow of the water itself will take you with it, you just need to stay with it. Imagine what happens if you try to go against the water flow, the chances of you getting crushed is high.

So, try to identify the overall trend (upside , downside) and then make sure whatever is your trading style , be with the flow itself.

There is nothing wrong in having a contrarian view and predict when the markets will turn its direction, but be sure you know how you will take that decision. You can surely take a call against the trend , but make sure you accept that you were wrong in case you fail. Don’t try to prove yourself right if you are wrong, because it’s only going to harm you.

Mistake #3 – I didn’t realize that Money management is supreme

I personally think this is the most important part of being a successful trader . The biggest reason for my failure was that – I was very casual about money management and made the biggest mistakes in this area. Money Management in context of trading is all about managing your overall money and how much part of your overall trading capital you put at risk in each trade.

I will give you an example – Let’s say you have set aside Rs 10 lacs for stock market trading . Now let’s say you make 2 rules

Rule 1 : You will never use more than 20% of your capital in any given trade, no matter how promising it looks to you. Which means out of Rs 10 lacs you have , you will not put more than Rs 2 lacs on any single trade (so even in worst case, you will lose only 20% of your capital)

Rule 2 : The maximum loss you will allow on any give trade is 10% , which means that if you put Rs 2 lacs on a trade, you will not let the loss cross 10% , which is just Rs 20,000

If you see these 2 rules, you can see that the maximum loss in any single trade will not be more than Rs.20,000 which is 2% of your overall capital. So assuming you make 1 trade each month, you have 50 months of quota with you to go wrong fully

No one is so bad that they will make bad decisions every time, you make good and bad both decisions , but important point is that you should survive in markets till that time when you start taking right decisions .. Hence it’s important to be in the game and unless you take money management very seriously , you are bound to get out of the game some or the other day.

This is exactly what happened with me. By the time I started realizing that I am moving from “bad trader” to an “average trader” zone , my capital was over and I was already in loss and I never went back to the game itself.

Why one should use Money management ?

The biggest reason why money management should be used is that it does not expose you heavily to the risk on a broader level, even if there is very high risk on individual trades.

And the next big reason why money management is crucial is that it brings some kind of consistency in your growth overtime.

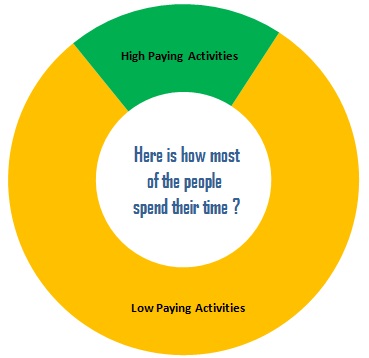

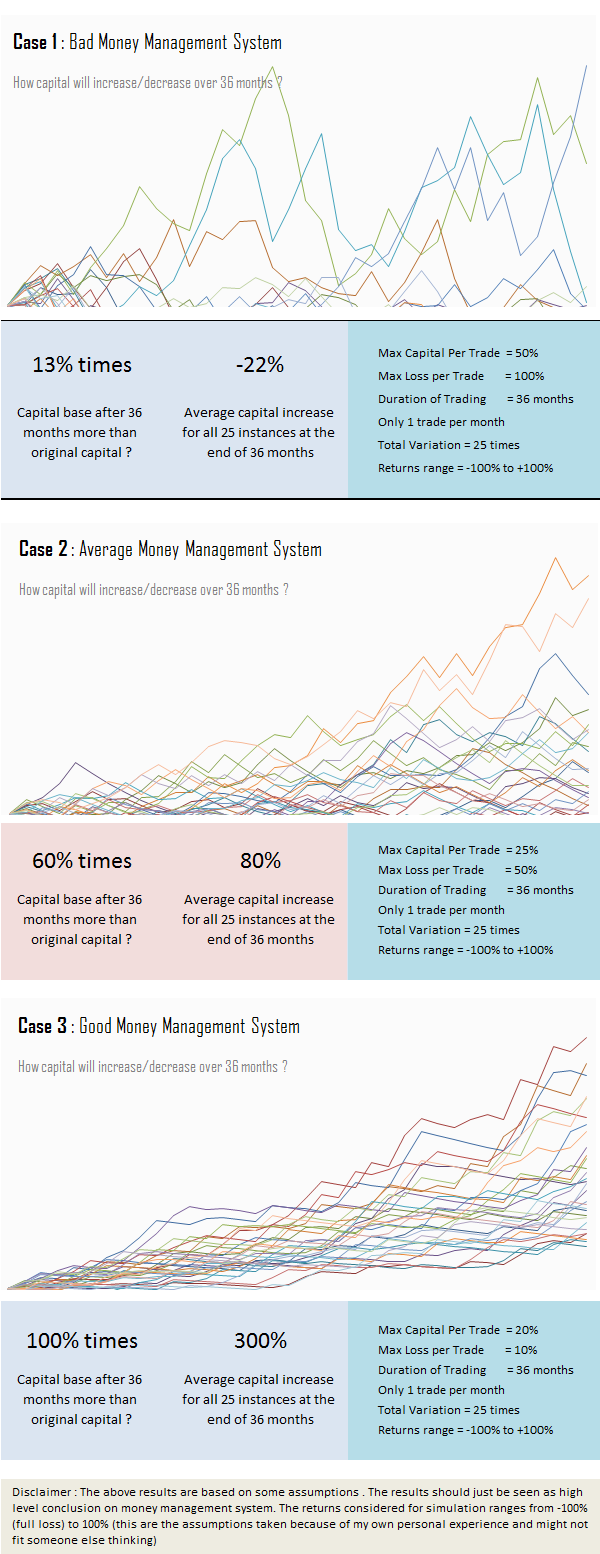

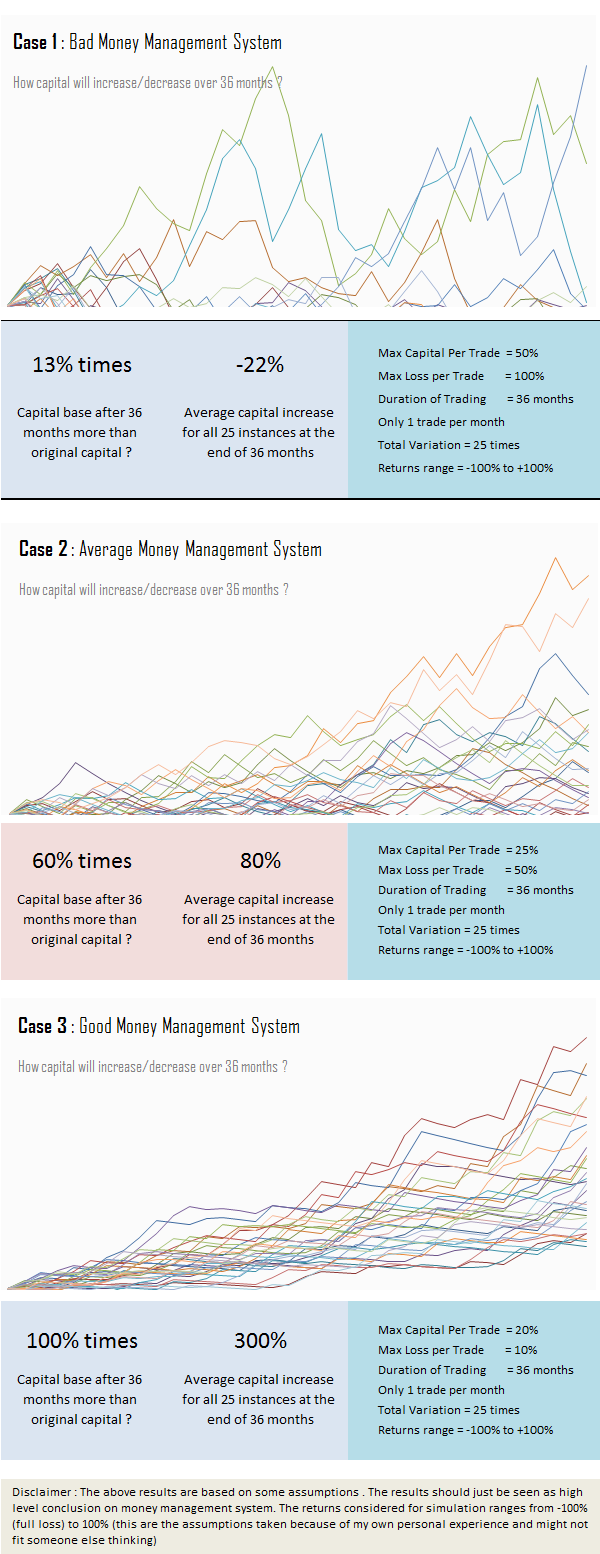

Below you can see 3 versions of money management, which is BAD , Average and GOOD money management, where the overall risk taken on a single trade is moving from high to low.

I did some simulation on excel where we are measuring how capital will grow over 36 months (assuming 1 trade is done in a month) . I ran 25 tests and plotted them on a graph together. You can see how in case of bad money management the growth of capital is very random, unpredictable and varies from very high (lucky) to very low (unlucky)

But in case of good money management , the growth of capital a trader has moves up over time and with high consistency .

So to sum up , I would say money management system is like having a great stamina . If you are there for longer time in markets, in a way you win the battle to some extent.

Mistake 4# – I thought trading is all about WINNING

Psychology plays a big role in being a good trader. From the childhood we are programmed to WIN and that same mindset takes over rational thinking in stock markets trading too. We want to WIN on all the trades , It’s hard to accept that you were wrong , being wrong means taking a LOSS . LOSS equals FAILURE and we are never taught properly how to take failures. And that’s exactly what happens in trading, novice traders don’t cut their losses fast, they let them grow (ego) and keep hoping that they will WIN

This is what also happened with me. When I bought an option for a stock, every time I wanted to WIN, every time I wanted to make profit on that option. I thought I will become a great trader , if I WON more and more ..

I was so WRONG

Winning MORE times is not same as making MORE money in stock markets trading. I know some of you who are reading this are confused with this statement , but let me explain this important point

So when it comes to stock market trading, you can’t choose how many times you WIN or LOOSE, but can control HOW MUCH you will win or lose !

All you can do is 3 things

1. You can control how fast you can get out of loosing trade (getting out of a bad decision)

2. You can control how long you will stay with a winning trade

3. And You can control when you will take the decision using your knowledge.

WINNING MORE , but still LOOSING

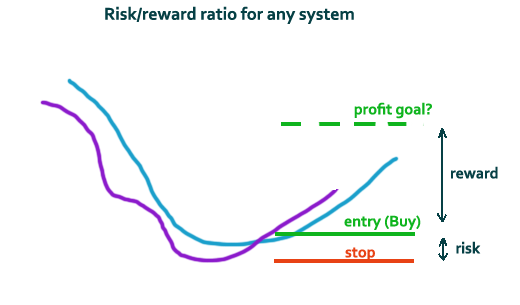

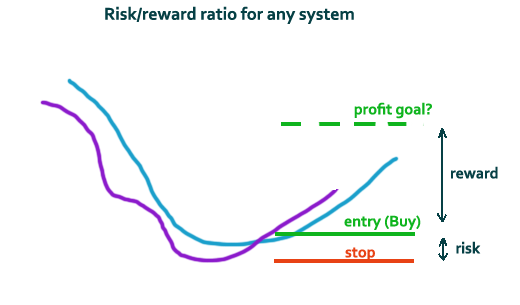

Every trade you make in stock market, you should make sure that your profits potential is generally much higher than the risk potential. Here is how it should look like

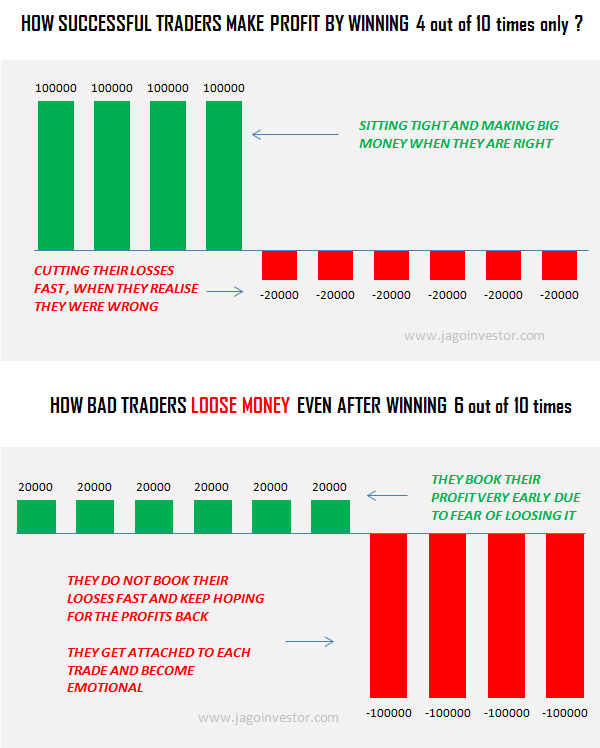

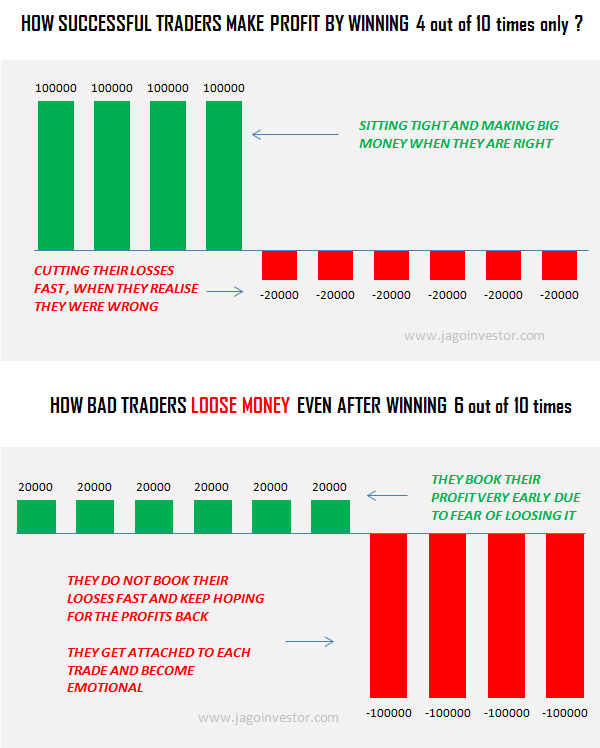

It’s very much possible that a trader wins 6 out of 10 times and still looses the money and in the same manner, it can happen that a trader wins just 4/10 times and still makes a lot of money.

Let me explain this with an example. Let’s say a person has Rs 10 lacs to start his trading .

A good trader wins just 4 times, but he makes sure that he will make big win and every time he makes a bad decision, he cuts the loss fast.

And in same way, a bad trader might win 6 times , but every time they are in hurry to book their profits (so they earn small every time) and when they are in loss, they do not book their losses fast (no money management rules in place) and hence let their losses grow because they can’t accept they made mistake (Ego) . The chart below will explain you this .

This is the only big difference between a good trader and bad trader .

Conclusion

Today I have shared my mistakes I did when I traded OPTIONS and I hope you will learn from my mistakes . But this can just be starting point only, you will only learn when you get on the ground and do the real trading. Till then it’s just a practice no matter what you do.

It’s extremely addictive to trade and if you are like me, you will feel a great thrill trading either stocks, futures or options (or any other instruments) , while I didn’t succeed in trading, I at-least know why I failed, I at least came to know my weakness and now I can improve upon it. I can at least help others to not make the same mistakes I did.

Also in future, if I get into trading again, I am sure I will be 10X better compared to earlier version of mine. I know it will still be very though, but I can try at least and when I stopped my trading, somewhere I felt bad about leaving it. I felt as if I am turning my back and got a feel of leaving the battle ground, but it was a right decision because I could have damaged my own net-worth to a big extent had I not stopped.

I would love to hear what you feel about the points I shared and if you would like to share your own experiences