Have you dreamed of your own house? Are you planning to buy your first house?

But, buying own house is not possible without taking loans and paying heavy EMI’s. However, now it is quite possible for new home buyers with subsidized loan given under “Pradhan Mantri Awas Yojana” which is an initiative by government under “Affordable Housing for all by 2022” in the country. It is also referred as credit linked subsidy.

With this scheme you can buy a new home/flat, construct a house or you can enhance your home by adding room, toilet or kitchen. Till date 15 Lakhs house has been constructed and 75 Lakhs loans has been sectioned under this scheme. The overall structure of the scheme is not easy to understand. So, let’s understand all the elements in simple points.

1. Who can opt for PMAY?

- A First time home buyer, who does not have any home on his name or in name of any family member.

- He or his family should not have availed any central assistance under any housing scheme of government.

- An individual who has a pucca house and wants to enhance it by adding toilet, room or kitchen etc.

Family includes Self, Spouse and Children. But, if daughter/son is earning adults(irrespective of marital status), than he/she will be treated as a separate entity. So, this means even if parents and earning children are staying in a house owned by parents, they can individually opt for PMAY provided he/she doesn’t have nay house own name.

2. What will be the eligibility and subsidy?

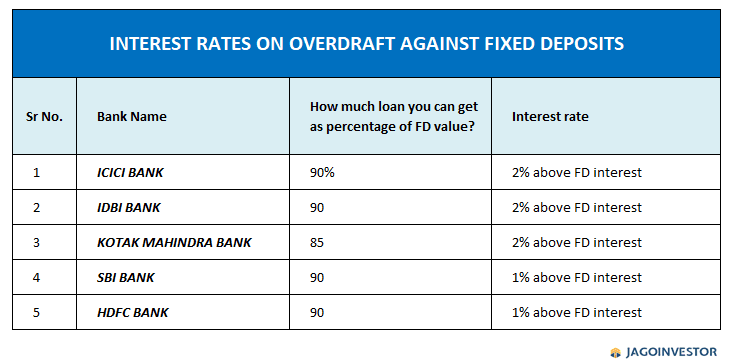

Government has categorized different groups taking their annual earning in to consideration, which will be helpful in evaluating eligibility and amount of subsidy. Following table shows different groups and other criteria.

[su_table responsive=”yes” alternate=”no”]

| Groups | Annual Income | Maximum loan amount for subsidy | Interest rate for subsidy | Maximum Subsidy Amount | Allowed Area |

| Economically Weaker Section (EWS) | Upto Rs. 3 Lakhs | Upto Rs. 6 Lakhs | 6.50% | Rs. 2.60 Lakhs | 30 sq. mt. (322.917 sq. ft.) |

| Low Income Group (LIG) | Rs. 3-6 Lakhs | Upto Rs. 6 Lakhs | 6.50% | Rs. 2.60 Lakhs | 60 sq. mt. (645.834 sq. ft.) |

| Middle Income Group-1 (MIG 1) | Rs. 6-12 Lakhs | Upto Rs. 9 Lakhs | 4% | Rs. 2.35 Lakhs | 160 sq. mt. (1722 sq. ft.) |

| Middle Income Group-2 (MIG 2) | Rs. 12-18 Lakhs | Upto Rs. 12 Lakhs | 3% | Rs. 2.30 Lakhs | 200 sq. mt. (2152.78 sq. ft.) |

[/su_table]

*1 sq mt = 10.7639 sq ft

*Maximum term allowed for subsidy is 20 years for all the 4 groups. That means subsidy will be calculated for the term of loan or 20 years whichever is less.

*Interest portion of EMI at subsidized rate will be discounted at 9% to get the net present value of subsidy.

Let’s understand the above table through case studies-

1. If your annual earning is Rs. 3,00,000 and you have taken home loan of Rs. 10 Lakhs for 15 years at 8.50% interest p.a. So, what will be the subsidy amount?

As your earning is Rs. 3 Lakhs, you fall in EWS group. So, You will get 6.5% of interest subsidy on Rs. 6 Lakhs of loan for term of 15 years provided the house area is not exceeding limit of carpet area of 30 sq. mt. The amount of subsidy will be Rs. 2.09 Lakhs (Back calculation – considering EMI at 6.5% on loan amount of Rs. 6 Lakhs for 15 years and interest portion out of it discounted at 9% to get NPV).

2. If your annual earning is Rs.8,00,000 and you have taken home loan of Rs. 20 Lakhs for 25 years at 8.50% interest p.a. So, what will be the subsidy amount?

As your earning is Rs. 8 Lakhs, you fall in EWS group. So, You will get 4% of interest subsidy on Rs.9 Lakhs of loan for term of 20 years and not 25 years (as maximum term is 20 years) provided the house area is not exceeding limit of carpet area of 160 sq. mt. The amount of subsidy will be Rs. 2.35 Lakhs (Back calculation – considering EMI at 4% on loan amount of Rs. 9 Lakhs for 20 years and interest portion out of it discounted at 9% to get NPV).

You can refer the video given below to understand PMAY –

3. Will subsidy be given for existing home loan?

The subsidy under this scheme can be availed on existing home loans sanctioned on or after 17/06/2015 for EWC section and LIG section. And for MIG 1 & MIG 2 subsidy can be availed if loan is section on or after 01/01/2017.

So, if you have an on going home loan which you received in 2017. In that case also you can apply under PMAY to avail subsidy. And the amount of subsidy will be calculated as per your current income earning section i.e. if now you are earning 10 Lakhs then you will fall under MIG 1 and original term of loan will be taken in to consideration.

4. How to enroll to avail benefits under this scheme ?

You can enroll for this scheme online or offline. In offline mode you need to visit the bank from where you want to apply loan or where your home loan is existing, get the form of PMAY and fill & submit the same.

For the online mode you need to follow following steps –

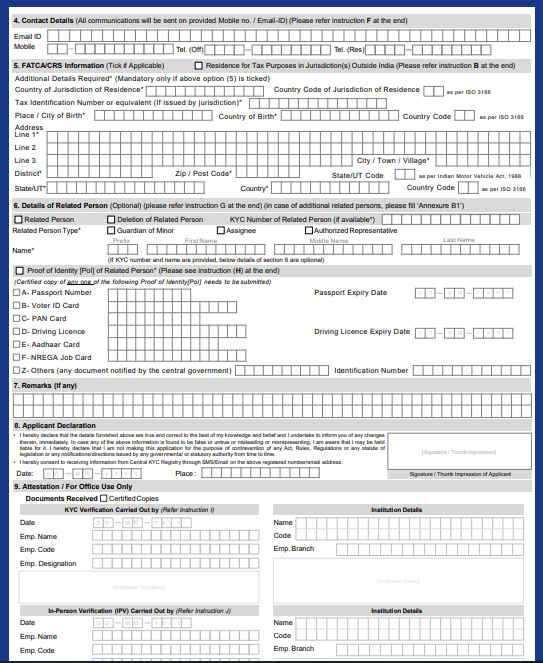

Step 1#: Go to the website of PMAY. Below given page will appear –

Step 2#: Click the citizen assessment drop-down and select the benefits under three components as shown below.

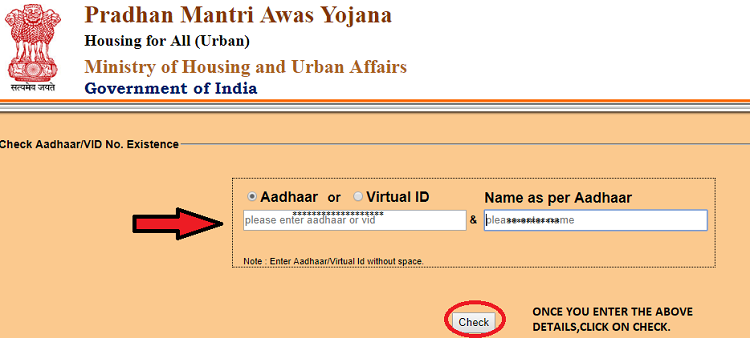

Step 3#: Once you click the benefit under other 3 components, the below window appears. Now enter your Aadhaar details and or virtual ID and click on check.

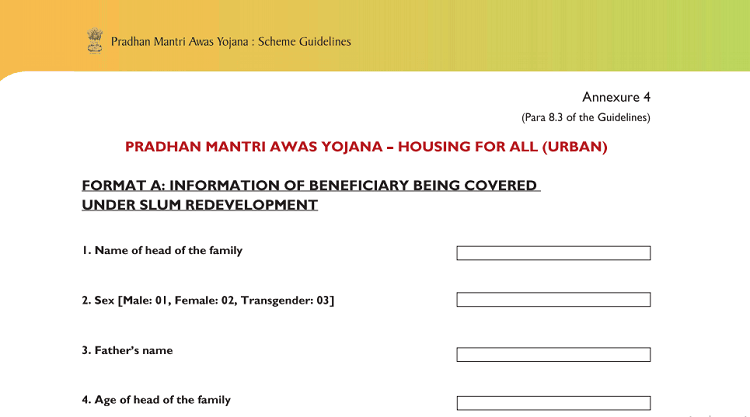

Step 4#: Once you check your Aadhaar card existence, the below page will appear. Fill the form with required details. To give you a glimpse, screenshot is attached.

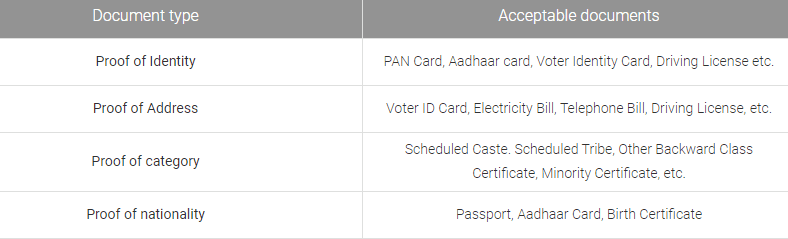

Step 5# Attach required documents

Once your application is submitted, after due examination if you are a eligible beneficiary under PMAY, you will be added to the list of beneficiary. You can find it on the website of PMAY in beneficiary tab. If your name comes in beneficiary list then you need to inform about the same to the bank from where you have granted loan.

5. How will I receive the interest subsidy benefit under PMAY Scheme?

The Bank (where you have applied for a loan under this scheme) will claim subsidy benefit for eligible borrowers from National Housing Bank (NHB). The NHB will conduct due diligence to exclude claims where the customer has submitted multiple requests. Then all the eligible borrowers will receive the subsidy amount to the Bank.

Once the Bank receives the interest subsidy, it will be credited upfront to the loan account. Therefore it is called credit linked subsidy. For example, If the you avails a loan for Rs. 8 lakh and the subsidy received is Rs. 2, 20,000. The subsidy amount (Rs. 2, 20,000) would be reduced upfront from the loan amount (i.e., the loan would reduce to Rs. 5, 80,000) and then you would pay EMIs on the reduced amount of Rs. 5, 80,000.

And also in case your EMI is on going and you are eligible for subsidy. Then you may be offered by your bank for using subsidy as credit so your EMI will be reduced or for reducing the term of loan. I would suggest to go with reducing term of loan.

FAQ OF PMAY SCHEME:

Is woman co-ownership is mandatory for availing subsidy?

Yes, for EWS and LIG class of subsidy woman co-ownership is mandatory whether it be the case of new house or addition of kitchen/toilets etc. And for MIG 1 & MIG 2 it is not compulsory to have a woman co-owner to the house property.

Can I do renovation/up-gradation in an existing house with the help of this scheme?

Yes, you can if you fall under MIG 1 or MIG 2 section. You can not avail subsidy for renovation if you fall under EWS or LIG.

Is it mandatory to fetch Adhaar card details for all the members of the beneficiary family?

Yes, for processing the subsidy under PMAY for MIG 1 and MIG 2, it is mandatory to furnish the Aadhaar card details of all the family members.

I hope this article has helped you in understanding that how one can avail benefits under PMAY Scheme. Please feel free to ask your doubts or queries the in comment section.