Will you become RICH in the future?

I know it’s your aim and you want to become rich, but there might be many things you are doing which are increasing your chances of remaining poor or middle class going forward. These are clear indications or signals that you might not become RICH and it’s time to do something about it.

I want you to read each point I am going to talk below and check if it’s applicable for you or not. Rather than an intimidating article, I want you to see this article as a wakeup call for yourself and redesign your financial life.

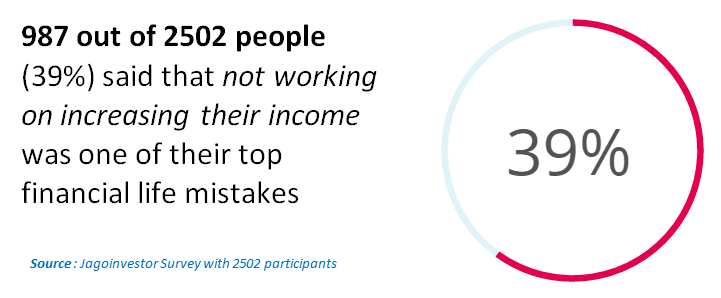

Signal #1 – Your Focus is not on increasing your income

Is your focus on increasing your current income? Do you think about it, fantasize about it and try to take any action? No, it’s fine if you are not succeeding right now, but the main question is – “Is it on the conscious checklist that you need to increase your income?”

A lot of investors are just going with the flow of life and treat their income increase as fate. They feel they do not have much control over it and hence don’t do anything about it.

Given the way expenses are increasing these days, it’s almost a given that you will not be able to create wealth if you do not work towards an increase in your income.

Signal #2 – You depend too much on credit cards and loans

Are credit cards and personal loans your lifeline?

Are you consuming most of the things like Car, Bike, Vacations, Mobile on EMI? If that’s the case, you are in the EMI trap already and coming out of it is not easy.

Time will keep passing and it will be difficult for you to get out of it. This is a big signal that there is something seriously wrong in your way of life. Other than a home loan and the Education loan, or any emergency personal loan, if you have made taking loans and swiping your credit card every now and then for trivial things, it’s a big signal that you will not end RICH

Signal #3 – You are unable to save anything from last many years

Past performance is not an indicator of future, BUT past indicator is at least signal of what can happen in the future. If you are unable to save much from your salary from the last many years, it’s something to worry about.

There is a great chance that what has happened in past will continue unless you give it a direction yourself.

[clickToTweet tweet=”Once you reach #retirement, your income will stop, but your expenses will not. ” quote=”Once you Retire, your income will stop, but your expenses will not, That’s the reason you should start your retirement planning”]

It’s time to meet a good advisor and work on your financial life. Either you seriously need to work on your income potential or take some drastic steps to reduce your expenses.

There is huge number of investors who think that – “From next year, I will start saving” and this is not happening from the last many years. It’s a signal that you might not get RICH in the coming decades.

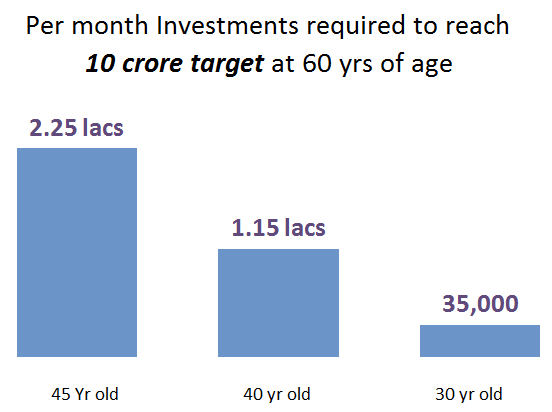

Signal #4 – You are already very late in saving

Just because you are late, does not mean that things can’t change now, but the effort you will have to put in will be a lot now. It’s like a game of cricket. If you have to chase a big score and you have lost some wickets before 25 yrs and have not made many runs, now you need to show the extraordinary game to win the match. The run rate required will be quite high.

Let’s take an example of 3 people who started saving at 30 yrs of age, 40 yrs of age and 45 yrs of age and they all want to retire at 60 with Rs 10 crore corpus.

The one who starts saving at 30 yrs, will have to save Rs 35,000 per month throughout his life. However, the one who was late by 10 yrs will have to now save Rs 1.15 lacs, around 3 times more.

And the one who is late by further 5 yrs (at 45 yrs) will have to save Rs 2.25 lacs (almost 7-8 times more).

In the same way, in your financial life, if you have lost a good chunk of time already, you will have to save much more and take more risks to reach the goal of wealth creation.

I anyone wants to start their wealth creation, then you can open a FREE mutual fund account with Jagoinvestor.

Signal #5 – Every month-end is a struggle

If every month end a struggle for you financially?

If it’s happening from the last many years, you need to understand that this is not a good sign for the future. You first need to get into a situation, where your month-end is not a struggle, then at the next stage you need to move to a stage where you save some month each month and finally, you need to work towards a situation that you save substantial money each month.

Signal #6 – If your job opportunities are very limited

Are you into a business or a job where it’s very tough to survive to find another job easily? In short, are employed in a sector that does not have enough opportunities? If that’s the case, and if you rank yourself “average”, then you might find it tough to search for other jobs that pay better salaries.

Also if your skillset is limited, your main challenge is of “survival” and that’s not a great aim to have.

Signal #7 – You seek too much “safety” in your investments

Finally, if you are an investor who does not want to take enough risk with their investments, means they just want to get predictable near inflation returns, then it means you are a Fixed deposit or PPF lover. Nothing wrong in that, because it’s your design internally and you have got developed as that kind of investor, but you need to be clear that you are earning only near inflation returns.

Check out the video below where I talk about why investors should avoid fixed deposits for long term investments.

If you invest in FD’s or equivalent products, your corpus will become bigger and bigger in number over the years, but it will not increase your purchasing power. Unless you invest very huge amounts, the corpus you will create will not be enough to be called RICH in the future.

How many signals are present in your financial life?

Out of these signals which we discussed above, how many are true for you? What are your thoughts on the points above? Can you share them in the comments section?

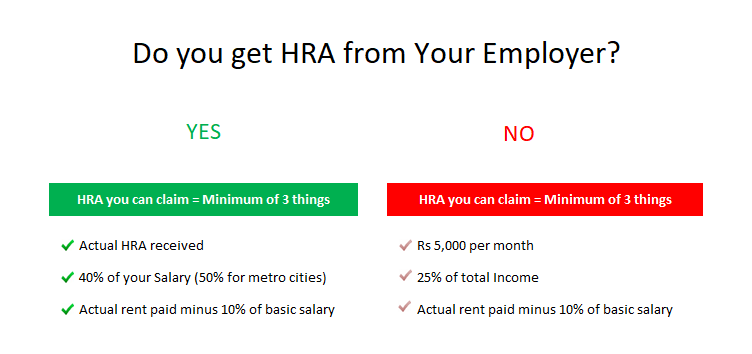

Important points regarding HRA?

Important points regarding HRA?