We would like to share one of the recent interactions we had with one of our past clients. There is something important to learn from the interaction we had and so we thought of sharing the same with all of you.

Client: Hi Nandish, This is Sam (Name changed), Do you remember me, I joined your financial planning service 2 years ago.

Nandish: Yes, Sam I remember you, tell me how can I help you?

Client: You created my plan and suggested some actions to me but I did not listen to you at that time. You tried hard to push me but I did not take required actions. I am still at the same place where I was and also I feel I have lost two precious years of my financial journey. With god’s grace, my salary has now increased and I would like to once again start the planning journey with jagoinvestor. I have realized that to have a good financial life you need a have a mentor like you. I am sorry for not listening to you.

Nandish: That’s great Sam, I am happy to see you have regenerated your commitment, and you just had a wonderful realization and insight which can, in fact, change entire DIRECTION of your life.

The most important ingredient in living an awesome financial life (or life) lies in how coachable you are. Add this little ingredient ( of being coachable) to your financial life and see what happens to your financial world. Last time you paid fees to us, this time along with fees just be 100% coachable.

Sharing from my personal life I have a fitness coach, a music coach and a business coach to help me in different areas.

I owe my heart to them as they are my backbone. They coach me, stand for my success and they help me to move to the next level. I do not question my coach, I do what they ask me to do and the way they ask me to do. I surrender myself to them and allow them to mould me in their respective area of expertise.

It’s time to make a fresh start and fix your next 10 years; we are fully there to help you and to serve you in taking your financial life to the next level. The only request I want to make to you before starting the planning exercise is “Be Coachable”.

Start the planning exercise with an open heart and mind and take the required actions. People who are not coachable always remain stagnant in life. I and my team can help you if you are ready to be coachable. A lot of people think they are coachable but in reality, they are not. Our growth in life is directly proportional to how many teachers we have.

Client: I agree and this time I am ready to surrender and I promise I will take required actions.

Nandish: Great I will send the next actions to you.

Are you Coachable?

Let’s get out of Sam’s life and look into your own financial world. Are you coachable? Are you ready to take external help to plan your financial life? Are you ready to take external help to take your financial life to the next level?

If you are managing your own money are you qualified and experienced to take personal finance decisions on your own. A lot of people think if I can earn money I don’t need to learn how to manage money or they think paying for advice is foolish when everything is available online and you have bank relationship manager to provide free advice to you.

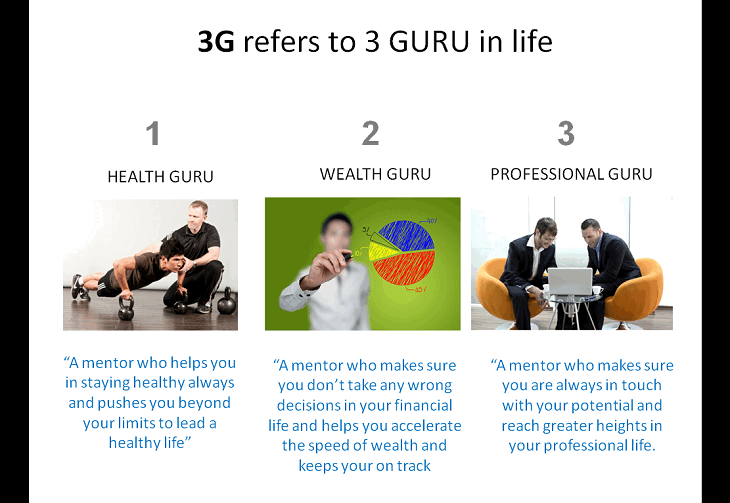

3G theory

I would like to share one theory with all of you; it is called 3G theory. Before leaving this world if I have to share one last theory then it will be “3G theory”

3G stands for having 3 Gurus in Life

1. Health Guru

We all know health is wealth but most people do not take good care of their health. They have valid reasons why they do not exercise and live an unhealthy lifestyle.

Health is an area that takes back seat very easily and when something goes wrong with the body they start to realize their mistake.

Having a health guru is extremely important because that is how you will get accountable in the area of health. I get 10 minutes late and my coach will call me to keep my promise. I have a fitness coach and I feel it is one of the best investments I have. He is a no-nonsense guy, he just believes in action and he helps me to stretch my limits. If you do not have a health guru go and find someone at the earliest

2. Wealth Guru

Wealth creation is a game and you really can’t play this game alone. Before taking any important money-related decision even I do a short discussion with Manish so that I can have an external agreement. Personal finance takes a back seat very easily and it is extremely important to have a wealth guru.

I have coached hundreds of people and I can clearly see how their financial life has gone to the next level. I am not saying go to a wrong advisor and make him your guru, go to the best, pay the highest fee as that is how you will derive value from your association.

3. Professional Guru

You need someone who helps you to expand your body of work. Your work has to nurture you rather than pulling you down.

We at jagoinvestor have a business coach, we do regular sessions with him and he guides us on how we need to shape our blog and business. He has taught us many things and it has helped us to grow our business. We really love what we do, we are passionate and running a business is a skill that you can learn from someone.

Conclusion

People who have these three gurus’ will always have an edge over others. You need a guru in all three areas to get accountable in the area of money, health, and work. The 3G theory is extremely simple, it says to find 3 Gurus and surrender to them. I have given the highest weightage to health guru because if health is not in place the other two areas will lose its meaning.

If you need help we are ready to COACH you

If you want to bring a shift in your financial life feel free to share your concerns with us and we will help you to design a wonderful financial life. Get in touch with our team and allow us to make a difference in your financial life.

[su_button size=”8″ radius=”square” background=”#D8180A” url=”http://bit.ly/pro-article”]YES – Connect me to a Coach[/su_button]

Share your details only and only if you are ready to be coachable because we can only help those who are ready to be our partners in the process. We believe that only a partnership can lead to magic.