I was on Quora some days back when I came across an answer by Yuvraj Wadhwani on a thread called “How should a 22-year-old in India invest his/her money?” . It was such a beautiful answer and loaded with awesome advice to someone young to start their financial journey in life.

I instantly contacted Yuvraj, if he would like to guest post his answer on Jagoinvestor and He replied back saying he would be glad to do so. So I am putting up his answer to that question here on this blog for everyone . Read it from start till end. Its a bit different in style, but really worth .

Note : I have realigned some lines and combined them together to make proper paragraphs.

OK let’s begin with wise words I learned a while back.

The principle of “Divide Investing in 3 plans”

It took me a while to get this, but it is really empowering to understand this principle. It is wise to divide investing in 3 plans.

- Plan to be secure

- Plan to be comfortable

- Plan to be rich

Let’s take each of these in detail.

1. Plan to be secure

Buy a big term insurance policy and don’t look at market linked insurance plans (ULIPs). Set aside some money and trust that your financial planner will do a good job with it. Also, set aside some money (~3 month’s salary) as an emergency fund. Once you set this up, this should be an automatic plan that doesn’t require your time or effort.

I think everyone should have a plan to be secure. Now, before going to the second or third plans, ask yourself this question..

“Do I want to be comfortable or do I want to be rich??”

This is a very important question as it will probably determine what you do while following your plan. It’s similar to setting up your goal before buying a gym membership. You may choose to have a light jog on the treadmill, or work out heavily with weights. You choose what you do.

Now read on, I hope after reading you will make a more informed decision about which plan is right for you.

2. Plan to be comfortable

The plan to be comfortable should be pretty straightforward for everyone. If you are a salaried personnel, then you save a portion of your income. You use 80cc to minimize your taxes, invest in diversified mutual funds, SIPs, or recently infrastructure bonds, or specific stocks if you have a good education.

You also have a financial planner who can give you advice for specific funds, or who can tell you to rupee cost average your investment. You also make some money of “hot tips”. If you follow this plan, you should live and retire comfortably. There is nothing bad/wrong about choosing this plan, just as there is nothing wrong with going to the gym for a mild jog. It’s an individual choice. Most individuals would find themselves in the comfortable zone. I encourage all of those people to read further as well.

3. Plan to be rich

Extracted from a book

Q: “What’s your advice for the average investor??”

A: “Don’t be average”

Why? Because the average investor is a slave to the market.

Average investors make money when the market goes up and lose it when the market goes down. Average stock traders don’t make money. (They don’t lose, but don’t make it either). When the market crashes, the average investor loses the maximum.

Successful investing is not about the investment, it’s about the investor.

This is perhaps the least understood concept of investing. This is the reason why people ask questions like “Where should I invest my money?” and the most accurate answer to the question is the question..

“I don’t know, are you a good investor?”

Let me give you an example – “What happened during 2008-2010 in stocks worldwide? Everyone knows they crashed right? Everyone who was invested in stocks lost money right??”

WRONG!

John Paulson’s , a hedge fund manager , made more than 15 Billion $ for his company in 2007. (That’s a billion with a B). That money is almost equal to 80,000 crores.

Many claim that he made around 4-5 Billion Dollars of personal money during (2007-2010). That’s more than 20,000 crore rupees. While this was claimed the greatest trade ever, the point I am making is that it is entirely possible to make money when the market is going up and down.

So what are the differences between average and rich (above average) investors?

Simply stating, successful investors have 3 E’s that average investors don’t have.

- Education

- Experience

- Excessive Cash

1. Education

A successful education starts with a good mindset. A successful investor has much more education than the average investor. A successful investor is committed to getting better and better with their education. How do you define commitment?

Do you know that friend of yours who plays the guitar? Do you know who else plays the guitar?

Got it ?

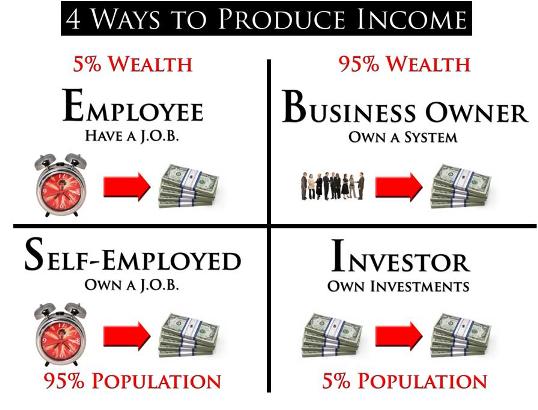

One of the differences between them is their commitment to playing. So how is the mindset of a successful investor different from an average investor? Let me draw a diagram to better explain. In the world of business, there are 4 kinds of people

- Employees

- Self Employed

- Business Owners

- Investors

Simply put, average investors think from the left side on the diagram and rich investors think from the right side of the diagram. Does that make a lot of difference, you may ask?

The answer is YES.

Let me put forward a few myth busters to put it in perspective.

(Avg Investor): My house is my biggest investment.

(Rich Investor): A house is a liability(Avg Investor): Diversification reduces risk

(Rich Investor): Diversification is de-worsify-cation (Warren Buffett quotes)(Avg Investor): Stock market is risky

(Rich Investor): Risk comes from not knowing what you are doing(Avg Investor): Avoid risk

(Rich Investor): Take more control and manage risk(Avg Investor): Real estate never comes down (extremely popular in India)

(Rich Investor): All markets go up and down(Avg Investor): Saving money is good

(Rich Investor): Saving money pays maximum ~8% before tax, inflation is ~10%, so saving money is a guaranteed loss.I could go on, but hopefully you get the point.

I am not saying what the average investor is saying above is bad advice, but it is average advice. As I mentioned, average investors make money when the market goes up and lose it when the market goes down. And if you have been reading till here, then you might be interested in making money whether the market goes up, down or sideways.

Also, if you find yourself arguing against the Rich Investor statements, that means you too are thinking from the left side of the quadrant.

So, how do I educate myself for being a rich investor?

- Books

- Tapes

- Workshops

- Mentors

Remember, successful people have coaches, amateurs don’t. Sachin Tendulkar may be the best batsman in the world, but he still has a coach. In case you are wondering, then investing is a subject that you may never be perfect in. Just like there is no perfect batsmen in cricket (everybody gets out), there is no perfect investor. But the more education you have, the better your chances are.

2. Experience

This should be a no-brainer. How do you get experience? By applying what you learn. Start small as mistakes will happen. If you stay on track it will become easier and easier. It might feel like trying to eat with your opposite hand. In the beginning, you will spill your food, you will be frustrated and probably won’t be satisfied, but in time you will learn it eventually.

3. Excessive Cash

This is the tricky part, but if you have educated yourself well, and have gained good experience, then excessive cash (or some cash) should already be rolling.

A note on the ultra rich

The rich investors invest in assets (stocks, bonds), but what do the ultra rich invest in?

The ultra rich don’t buy assets, they create assets. This is the secret how the richest people in the world created their wealth. They created an asset which millions and millions of people want to buy. Bill Gates created Microsoft, Larry Ellison created Oracle, Warren Buffet created Berkshire Hathaway.

Final Words

Q: “How should a 22 year old Indian graduate invest money?”

A: “I don’t know, are you a good investor?”

All right, you have my attention, now how do I get started?

Cool, this is what I would recommend.

Knowledge begins with words.

What does that mean? Let’s take an example. Many times when you travel, you meet people or are around strangers and you hear them talk. Most of the time you can guess their professions. Have you wondered how?

It’s by the words they choose and say.

I evaluated the students and the grades are good.

(Teacher)My boss is not a good person.

(employee)I shorted that stock as the P/E ratio was high.

(stock market trader)That patient had to be given a muscle relaxant.

(Doctor or medical professional)

So the lesson here is that if you want to excel in any field, you must learn (hopefully master) their words. And you know what, words are free! (yeeiiiii)

So tell me if you understand any of these words.

- P/E ratio

- Volatility

- Bull Market

- Bear Market

- CAGR

- Y-o-Y growth

If not, then this is your first step, to learn and understand these words.

How?

- Read your business newspaper.

- Listen to the market news.

- Use google.

Let me tell you a secret

Most of these complex sounding words are actually simple concepts. Really???

Let me tell you the job I had previously. I was Production support analyst for a retail POS application for a telecommunication company which sold products in multiple verticals. Only the job title is complex. So why do all these finance companies and news channels use these fancy titles and words? Because they want to sound smart, and want to sell you stuff.

So when you start learning words, you’ll understand the bullshit most TV channels and financial advisers preach as “investment advice” is really sugarcoated salesmanship.

So when the next time you read an investment advice column and say, “That’s nonsense”, Congratulations, you are making progress. If you are reading this, that means you don’t want to be average. So I encourage you to take the next step in your education and start learning words. I’ll try to help as much as I can.

Thanks Yuvraj Wadhwani for giving permission to publish his quora answer on this blog and share his knowledge