Do you understand the meaning of Instant gratification and its affect on your financial life ? We will learn that today. How did we become a generation that “wants things now!” no matter what?

Think about this – both, our parents generation and ours, save , invest and spend. What then, is the difference between them and us? It’s mainly that they used to first earn money, save & invest that money and then spend it on things they needed.

They got ‘delayed gratification’; this quality of waiting before they are able to buy. However, we have reversed the equation. We first buy, and then pay for it later; without having a clue if we will be able to earn that money in the future or not!

And that’s is where the problem lies — Once we buy something, the deal is done! Then we have to live with it because we can’t change our minds about it later.

We love ‘the thing!’ & We need ‘the thing!’ . Our life is not complete / not possible without ‘the thing!’ . ‘The thing!’ can be a home (debate on buying ve renting), a car, some household item, the latest gadget or 3 pairs of jeans from the big Sale!

I’m not talking about the planned and carefully thought out spending we do in life, rather I’m referring to the spending which ‘just happens’, the spending that does not add much value to our lives. Even if it adds any value, it’s mostly short-lived and makes us feel happy for just a while.

This ultimately, weakens our financial life, since we do not concentrate on our major and important financial goals, chasing the smaller and futile wants in life. A lot of this phenomena is result of the impulse called “Instant gratification!” which is what, we will look at in this article.

It’s important to realize, that the more we give in to Instant Gratification, the more we sink into the dal-dal of debt & misery. Sooner or later we’re in upto our neck and it gets too late to fix things. The biggest example of this was the recent sub-prime crisis in the US. “BUY NOW! Pay later” was the attitude!

Let me tell you a short story to give you an idea of what I am talking about.

Two small children Anita and Ramesh, lived in a small village with their parents. Their father gave Rs 5 to each of them to eat a watermelon. Both of them visited a farm and asked the farm owner for a large watermelon.

“A big one will cost Rs 20 and a small one would cost Rs 5”, said the farm owner pointing to the watermelons in the field. With the irresistible urge of having the sweet and juicy fruit, Ramesh bought the smaller watermelon and started eating it. Anita however, wanted the big watermelon.

“OK, I too will buy a smaller watermelon”, she told the owner. “But can you please leave my watermelon in the field itself, I will be back in a month and take it at that time!” The little girl knew that her patience would be rewarded. By waiting one month, she could have a big, ripe watermelon for the price of a little green one. She got the bigger fruit, because she controlled her “Instant gratification” and waited patiently!

What is Instant Gratification ?

Instant Gratification is the habit, of always wanting to enjoy now, and not having the patience to wait for future benefits (an experiment). Anything which gives us temporary happiness or excitement, but is not actually a good thing for your life, can be put in this category.

For example…

- When you sleep till late in morning and do not take pain of getting up and exercising.

- You eat those unlimited sweets in your office cafeteria.

- When you eat that burger with EXTRA cheese !

These were some examples to just give you an idea about what Instant Gratification is, – mainly concentrating on the immediate result and not thinking about its outcome in future or how it will affect us later in life.

If you can control yourself and concentrate on “delayed gratification” , your life can change! like anything , But we just are not bothered about it and do not have motivation. Do you know why this is? Let me be straight & blunt! The challenge is that most of us do not have to face life or death situations, or seek food and shelter and defend our territory everyday anymore ! (like these people)

The result, is that we can’t see the impact of our spending in the future. Think about a poor person who struggles daily for food. If he has to spend Rs 100 on something, how will he think? If you offer him a burger, he will instead ask for the same amount in cash, because he knows that the money will help him get food for next 3 days.

He’s not focused on taste in this case.

We however, are privileged, blessed even. If something bad happens once in a while, our next meal or next place to sleep isn’t in danger. Hence some of us have just lost that attitude of looking at things without instant gratification . If you have seen bad times in your life financially, you will know, what I am talking about.

6 Examples of How Instant Gratification affects our Financial Life

Many a time, what we do in our financial life makes our future, dismal and weak, and we have no idea about it. We aren’t even aware!

#1 Not surrendering Endowment/ULIPs

This one is my favorite. “What should I do with my Policy? Should I Surrender it or make it Paid up?” is one of the top most queries I come across. It feels bad, accepting and acknowledging that you’ve made a mistake, and it hurts psychologically when you lose by not continuing the policy. But what is the effect, long-term?

You still continue paying huge premiums and it earns you very, very little.

So you don’t take any decision on your junk policies, ergo you do not have to face a tough situation! It’s Instant gratification in a way! But for your own good though, you should take action and take that loss now because right now it’s a whole lot smaller than if you stick with the policy and try to quit later!

#2 Keep losing Shares and selling your winners

Have you ever bought a share which gave you instant profits? What was your reaction? Most of the people want to sell it off and take that profit right now, otherwise the profits can vanish! But what happens in most of the cases?

The same stock or portfolio gives huge returns in future if it was left untouched and that feeling of instant happiness is so powerful sometimes that so many can’t control it. It also happens, if one does not have proper understanding of how equity works.

Many people who understand also fall for instant gratification though!

In the same way, you might be holding some stocks which is not performing well, but instead of getting rid of it and investing in better stocks, we keep on holding on to the loser in the hope that some day it will go up! (Read 5 mistakes I did in my first stock investment).

It’s another case of instant gratification as you seek temporary comfort. You don’t taking the tough decision of selling the loser, because the moment you sell it, it gives you a feeling of loss, but if you just keep it as it is, it’s a case of “I still have some hope !” Don’t do it!

3# Getting into wrong products for Tax saving

When we talk to lot of our paid clients on why they bought the Endowment/Moneyback policies or even ULIPs, the only reason turns out to be “Tax Saving”. Millions of people, get into the wrong products which they don’t need, & don’t understand, has no power to meet their financial goals in future, just to save tax!

I some times feel how much tax saving one does! If one invests with a premium of Rs 50,000 in a ULIP for instance, and if that person is in the 30% tax bracket, he will save 15,000 in tax. But if that was a ULIP with 50% premium allocation charges (as so often happens), 25,000 is lost the moment you sign the documents!

So you save 15k and lose 25k as charges! And yet,these are the same people who say “20k for a financial planner—too costly!” 🙂

#4 Not Paying a Financial Planner or a counselor

Now you know what stops you from paying for advice? Do you immediately get any instant results from advice which you can see? Does your portfolio return suddenly become higher than earlier? Do you immediately see the results which you wanted in your financial life ? No !

And that’s the reason most of the people are not excited about it . But now you would realize that, if years before you had paid some adviser and taken right advice, you could have saved a lot by not getting into wrong products , you might have got better results or same results with lesser risk than what you have got at without right advice!

The benefits of financial planning are always “delayed” as the planning will show the results years later.

We get a lot of inquiries for our paid services from readers who want more personalized service and paid guidance from us. We talk to them and they are very excited when they hear how their financial lives will get transformed working with us, however when we talk about the fee part, some of them just don’t come back!

Price is not a barrier for them as they are well earning, but the problem lies somewhere else which even they are not aware of, and that’s Instant gratification!. They can’t see the immediate results from it and hence they choose to live with their messed up financial lives instead of getting out of it.

I am sure they will lose 10 times more than what they tried to save in fees by not have proper advice over the next couple of years. What do you think ?

#5 Shopping for things you don’t need

How many times, have you bought things which you don’t need? But you still buy it, because it feels good! For example, you might buy another jazzy mobile phone even though your current phone is working well. You buy a nice new shirt – It was on display, which can be your 24th shirt but you actually don’t need it.

Women know very well what I am talking about here and if you are married, even you know what I am saying 🙂

Most of the instant gratification happens at “Sale”. Resist Sales. Sales tend to our minds into buying more than we need. We start justifying to ourselves, that we really do. If the “Sale” decides what you need in your life, then there is a problem!

6# Spending due to Peer Pressure

Suppose there was no one in this world except you and your family, would your life still be same ? I am sure not! People around us affect our mind and make us feel that we are lagging behind. If they buy House or car , we start feeling the need for it. Peer pressure is one of the top reasons why people spend a lot of money.

You are persuaded to join or pay for an activity that your friends are participating in. Whether you are interested or not, you go with the flow because they tell you to. There are occasions where you have to join them and you should!

But not always, and not in everything.

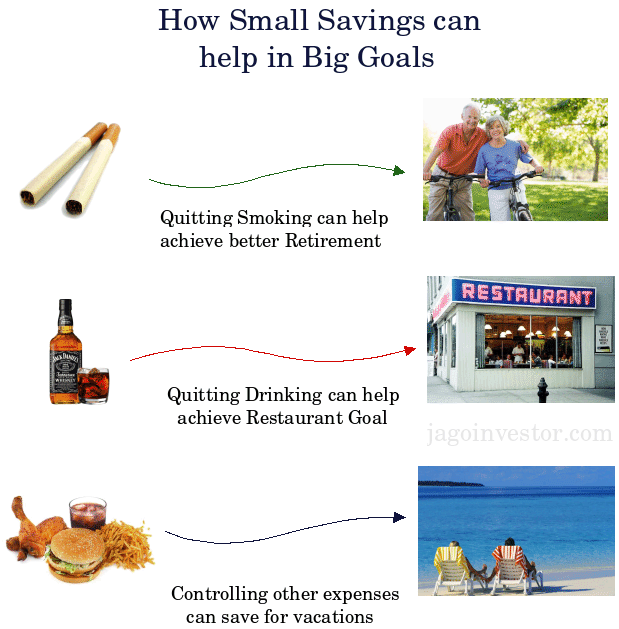

Develop a “Need Mentality” to save your self from Instant Gratification

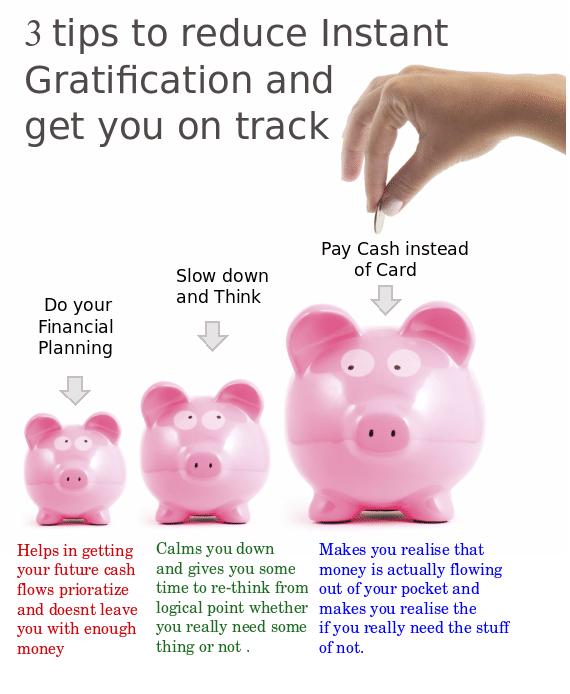

Here are 3 solutions which can help you reduce or avoid instant gratification in your financial life.

Do your Financial Planning :

You should do your financial planning and have a full plan on how you will invest your money for your future financial goals. Once your Insurance, child related goals and retirement are planned, you will have to commit the investment for these goals which are more important in life than other things which come along the way .

You will be more responsible and think twice before you spend on other unimportant things.

Slow down :

Don’t be impulsive, whenever you have to spend your money on anything, call some family member and tell them 4-5 reasons why it’s a good investment and is worth buying for, tell them enough reasons why it makes sense to buy it. If you are able to pass this process, then you can buy it else, reconsider.

What happens when you do this, is that you slow down and take a logical approach in deciding if you really want to want something. Let me give you a personal example. I recently did this for myself, when I wanted to buy a high-end Nokia phone.

I started counted the reasons why I should buy it and how it will add value to my life, I was very convinced that it’s an important and a valid expense for me.

Try to pay cash for your purchases :

When we don’t feel bad about paying, we tend to buy unimportant things and credit card is the main culprit here. You buy and you swipe your card, you don’t see the cash going out, so at the end you just make a single payment. It don’t hurt much.

Try paying with cash, and when every time you see those cash notes go out, you become more concerned and more logical in thinking about your expenses.

Other area’s in Life which where Instant Gratification affects us

Some other areas in life which we mess up are Education , Marriage and Career .

Education:

If you have seen “3 idiots” and “Tare Zameen Par”, you will understand better what I want to say here. Lot of people do not carefully plan their education. There are many people who have pursued something which looked easier to complete or seems to be paying well without understanding, if it aligns with their liking or not and thereafter suffer all life.

Marriage :

Marriage is another thing where people mess-up due to instant gratification. There are many couples, who are not happy after few years of marriage, because the whole situation didn’t turn out the way they imagined.

A lot of times people judge their partners within hours or few days of meeting them, where they like them a lot because they are handsome of beautiful , have lot of wealth, things which impress them at first. I am in no way saying that only love marriages are successful because they are NOT !

It’s the same case some times with love marriages too . The only point I am making is that even in marriages , their is this thing called Instant gratification which creates issues for many people.

Career :

Career is directly linked to Education, so if you mess up your education, you’ll certainly botch your career. But even after people do their education correctly, many mess up while choosing their jobs.

When I completed post graduation, many of my friends went for companies while showed the highest CTC, were the best known companies in IT, but they are shedding tears of blood now as they can’t see any growth for themselves after a point or it’s not something they really wanted to do in their jobs.

However some people who controlled their emotions and planned to choose their companies considering the work they will do there are very happy and excelling now. So don’t just see what makes you happy right now, see what will make you happy all life.

Conclusion

The whole point here, is that we don’t think much about long-term aspects of our spending and hence make bad investments and mess up our financial lives. Instead, we should use Instant gratification in our favor. One way we can do it is start SIP’s for your Financial goals now, and take action. Get a financial Planner and pay him to give you best advice and transform your financial life.

As 2010 is about to end now, dont let this year go waste as you learned a lot of stuff this year . Start your new year with some commitments and resolutions for 2011 which you will honor and not just write down !.

Share your comments if you’re a victim of “Instant gratification” at any point in your life? Also share how we can use this Instant gratification in our favor ?

At the end wishing you all Happy New Year .