Buying your first car? Here is the data of 451 buyers for you to decide!

POSTED BY ON January 19, 2017 COMMENTS (28)

No, I am not sharing my personal opinion here in this article.

I am actually telling you about 451 people who have shared their personal data with us in a survey we conducted some time back and we are presenting you the data in this article. That data will help you know how others think and what are their numbers and that way you take a decision for yourself.

You mainly have to decide following 3 things when you buy your first car

- Should I buy a brand new car or a 2nd hand car?

- How much should I spend on my first car?

- How much loan should I take?

451 people shared their data about their car ownership

We asked few questions in our car survey like their first car value (when they bought it), their per month income when they bought it, If it was a brand new car or a 2nd hand one, what was the % of loan they took, and some more questions regarding what they feel about the car.

I will share all that data in this article.

Point #1 – Should I buy a brand new car or a 2nd hand car?

Most of the people who buy their first car, generally go for a brand new car, however, some people also prefer to buy a 2nd hand car to start with and then upgrade it later to a new car in the future.

In my own case, I bought the 2nd hand car because I wanted to make sure that I am aware that I make a rough use for all my belongings and its better to first buy a 2nd hand car. Also, I had my budget constraints.

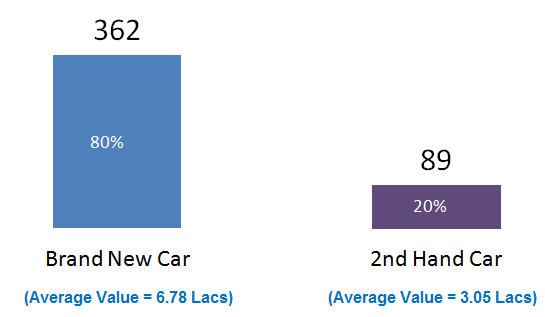

80% of buyers prefer buying a new car

Around 80% of the survey takers, shared that their first car was a brand new car, whereas 20% bought a 2nd hand car as their first car. The average cost for a brand new car was close to 6.78 lacs and in the case of 2nd hand car, it was close to 3.05 lacs.

Pros buying New Car

- The special feeling of ownership with pride

- The latest technology, with current features

- Peace of mind, as you know there are no issues with car

Cons of Buying New Car

- Much Expensive compared to a used car

- Much higher depreciation (Try to sell it in 6 months and see the price you get)

- Takes away a good part of your wealth

- More pressure on your cash flow if taken on Loan

Pros buying used Car

- Cheaper and Most of the times can be bought without a loan

- Low Insurance premium

- Lower depreciation

- Better resale value (buy for 3 lacs and sell again in 2-3 yrs)

Cons of buying used Car

- Old Technology and features

- Difficult to trace the history and find the legality

- High maintenance costs

- Inferior feeling in front of peers who own better cars)

For those who are interested in new vs used car debate can check this detailed article on Team-BHP

For how many years are you planning to own the car?

If you are planning to own a car for just 1-3 yrs, it’s better to go for a used car. However, if you have a view of 5-6 yrs or more, then better go for a new car.

Also if you are tight on your budget and still want to buy a car, you can explore the used cars and after a few years you can upgrade to a better car. However, if have the capacity of buying a new car, you should go for one.

Below is a short video which shows you what all to check if you are planning to buy a used car

Point #2 – How much should I spend on my first car?

Now comes the next important point, which is how much should I spend on the car you are buying. A person earning Rs 10 lacs a year can buy a car costing Rs 5 lacs also and 20 lacs also if they want. However what is the right amount to spend on your car purchase?

This will depend on many factors like

- Do you want to take a loan or not?

- If you want to take a loan, how much EMI do you want to pay each month?

- Is “Car” mere a machine that moves you from point A to point B, or is it much more for you?

- What is the role of the car in your life?

- How passionate you are about driving, fancy cars etc

How many times of your income should your car cost?

A good way to look at the potential car value you should buy is the X times of your monthly income. If a person thinks that he should not spend more 6 times his monthly income on the car and if he earns Rs 80,000 per month, then he should buy a car worth not more than 4.8 lacs.

If he feels it should be 10X, then not more than 8 lacs should be spent on the car. However the problem is no one really thinks this way when it comes to decision making, so let’s see what were the actual numbers for various groups!

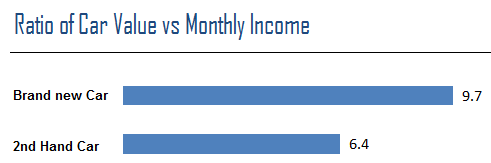

As per our survey data, those who bought a brand new car, for them this ratio was 9.7 on average (their car value was 9.7 times their monthly income)

And for those who bought a 2nd hand car, it was 6.4

Your Salary and what you feel “car” is?

What will be your car value will surely be

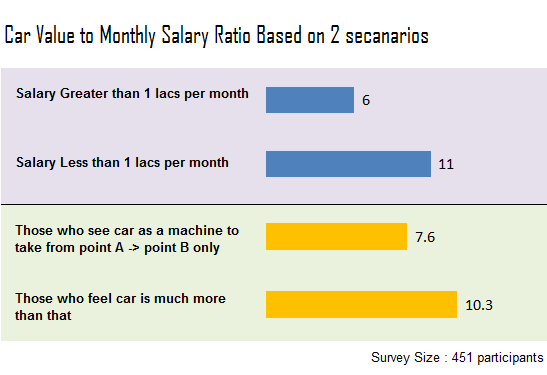

We also calculated the same ratio for those whose monthly salary was above 1 lac and below 1 lacs.

If you see the whole data above , you will figure out that if you are buying a brand new car, or if your salary is above 1 lacs per month or if for you a car is much more than a machine which takes you from point A – B, then you ideal money to be spent on your car is anywhere from 9-12 times your current monthly income, else if none of the above is true, then you can go with 5-7 times of your monthly income.

It’s just a benchmark and a rough direction based on what hundreds of people do.

Point #3 – How much loan should I take?

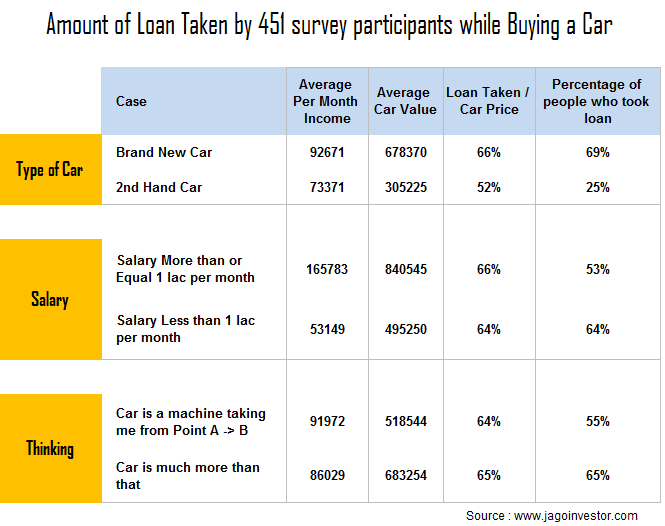

Do you know that as per our survey 75% of the people who bought a 2nd hand car, did not take any loan?

Only 1 out of 4 people took a loan which was on average half the value of the car (to be exact, it was 52%).

However, when it came to those who bought a new car, 69% of them took a car loan and their average loan was 2/3rd value of the car price (rest 1/3 was down payment)

The amount of loan you take will depend on the price of the car, your capacity to pay the downpayment, your views about debt in life. I personally think a person should have the capacity to pay for full car value and only in extreme cases one should go for a car loan as its a depreciating asset anyways.

Burdening yourself with more EMI does not fit my philosophy that too for a car. This is truer if you still don’t own a home or if you have not yet started investments for your long term wealth creation.

Below is a detailed information salary-wise and also thinking wise.

You will find two kinds of car buyers. One who feels that car is nothing more than a utility which does a job of taking you from point A -> point B. They are not that passionate about cars in general and view the car as just another possession.

Where as on the other hand, there are people who feel CAR is an important part of life. There are various life moments that are linked to your car. Your exotic vacations, long drives and many events in life will not be possible (most of the times an expensive one).

Who is right or wrong?

None of the groups are wrong or right, its a view and everyone has the freedom to express what they feel about cars.

Coming back to car loan, I feel you should first try to avoid the car loan totally if possible for you, and if not, then you should take less than 50% loan only.

Otherwise, a big chunk of your monthly salary will go into paying your car EMI and your wealth creation might take a hit due to that.

Let us know what you feel about this topic in below comments section.

Manish – Very useful article. One small clarification. The monthly income referred in the article is the take home income or the gross monthly income?

That we dont know . We just asked Monthly income , so mostly people must have put the take home income only !

Am a 46-year-old and can get an 8 lakh loan from my employer. My first was an M-800 second hand in 2003 (Ahmedabad). I could not get a 2nd used car in 2012 when I wanted one more (locational issues). In markets like Gujarat, Chandigarh, etc. easier to get a good second hand at very good rates but not so in some others – either rates are high or the quality is not reliable (do this work first and see if you can even go to those places and get a used car – worth it if you know someone there to help you and your car is of a certain make, etc.). So got a first hand Alto K10 – of course, took the loan and pre-closed it. Will think of my next car in 2022 or later. Will do an SIP for 4 years and buy another in Alto category?

Yes – people ask me what my car is when we meet first (quite a few think we are misers, some wonder if we are poor [and get confused when they realise what I and my wife do}, a select category of strangers raise eyebrows as well) – but I and my spouse don’t laugh it off – we rather look forward to it and enjoy it later while alone (she says alto is more than enough!!).

As Manish diplomatically said – it’s a personal thing. I and my wife will not think twice about picking up a book and don’t look at the price – but car? CAR?

Now – my 10-year-old daughter says she will never buy a car (from talking of buying a BIG car) and my son talks of Audi, BMW, Merc, ………………… (but concedes that it does not make financial sense to buy them but they give a KICK). I agree with him (for me, it kicks my finances).

There – that is finally, a personal thing, like every thing comes to be.

Thanks for sharing your personal case here 🙂 .

Manish,

Why we should not take car loan if we can earn more than the interest rate? In my case I recently took car loan of 5 lacs @ 9.6 % in sbi. I am doing SIP in equity mutual funds with that 5 lacs so that i can get more than 9.6% and can earn more as 5 years is a long period.

Thanks,

Srihari

if you can make more than the car loan, then you can take it !

Taking a second hand car is best option as per my opinion and after reading the article from team bhp I am allmost with this opinon now. Being a mechanical engineer I am passionate for cars, but still I think its better to go for second hand car. It will be there in your mind a inferior feeling but once you start to use it after sometime you will feel that you took a right decision.

Glad to know that Nikhil Gaikwad ..

Thanks for the article it clarified my thoughts and I can trust on your article as it was actual survey and not something from somebody’s mind. Good work sir.

Glad to hear that 🙂

Nice article .

I still think that instead of taking 50% loan ,one should go for 75% to 80% loan even he is in a position to afford 50% loan .He can keep the balance 30% in FD which may reduce his interest outflow .Also it may help in case of emergency fund requirement

Thanks for your comment santonu

Technology is never old. Even if we buy a new car, then after 2-3 years new cars with new features will come like a mushrooms. So, better to opt an used car without any loan. However, if one is a salaried employee then better not to go for a new one, whereas for business people, it can be negotiate as they travel often to meet various clients, they feel car as a status.

It’s my personal opinion. Also, thank you for the post, even I am planning to take a car and was in dilemma.. after reading your article, I decided to go for used one 🙂

Glad to hear that Fayaz !

I have a third view. Compare the costs with NOT buying a car and moving around in only taxis…even all the family members individually also…the total expenditure per year may be cheaper than owning, maintaining and fuelling car, plus the savings on cost of car-parking in your housing society…you can hire a car with driver for that once-in-a-while trip to nearby picnic spots.

Yea thats also a good point for discussion.

Interesting survey and results, as usual.

I am a votary of used car and I am looking for a third used car. My previous two cars were used cars and worked fine. The advantages I am getting in a used car are 10-15% flat discount on upfront costs, less waiting period(currently some cars have waiting periods up to 10 months) etc.

The things I miss are loss of show off(i do not care), feeling of taking a new car from dealer(I am not particular). One does not have much problem with running of the vehicle as the new age cars are running with almost no maintenance for the first 4-5 years.

Also, one should note that car is a depreciating asset. As soon as a car is brought on the road, it looses value anywhere from 10-20%. This is a fact. Can one use it to one’s advantage? Point to ponder.

As with any other issue, one needs to select carefully for easy transfer of papers and long and trouble free ride.

Thanks for sharing your views on this topic Srinivas 🙂

Cons of used car, it is still very much unorganized, only few genuine and trustworthy players are there, limited finance option for used car .also inyerest rates are different for loan on used cars

Thanks for your comment Amit mishra

Typo: “Peace of mind, as you know there are issues with car”

Thanks 🙂 . Fixed !

Hi Manish, hope all is well. This article has come at the right time as am planning to upgrade to a new car… However am still confused with the budget. I can afford 7.5L car w/o loan while 10L with loan… Wondering what to opt for… What would be your suggestion?

Hey Abhijeet

I hate to say this, but there is no right answer for this as you are not me and I am not you 🙂

For me its more important to be loan free at this moment, so I would have gone for 7.5 lacs car itself.

For you if a better car with better features ranks higher, than you should not mind car loan (assuming its a small loan and you can take care of it easily)

The answer is already there in your priorities. Not sure if I was able to answer it !

Manish

If you want a car within 7.5 lakhs go for now.

If you want a car of 10L wait for few more days/months to save another 2.5L and then purchase the car without loan.

If you take loan, now after loan closure you have to run to Bank , RTO to remove Hypothication and need to pay interest.

Talking about monthly invare we talking about gross income or take home income?

We are talking about take home income !