5 Challenges which you should overcome to create long term wealth

Do you want to create a lot of wealth? Do you want to see crores of rupees in your bank account? I am sure you know that’s not an easy task. You also know that it will take a lot of time and dedication to create wealth over the long term. Do do you know that it’s more tough than you think? I will show you why?

Have you ever seen those retirement calculators online, where you punch in your numbers and find out how much corpus you will be able to generate over the years if you consistently invest a fixed amount year after year at a certain rate of interest?

The calculator throws a big number at you and you feel – “Wow … That’s looks straight forward and simple”

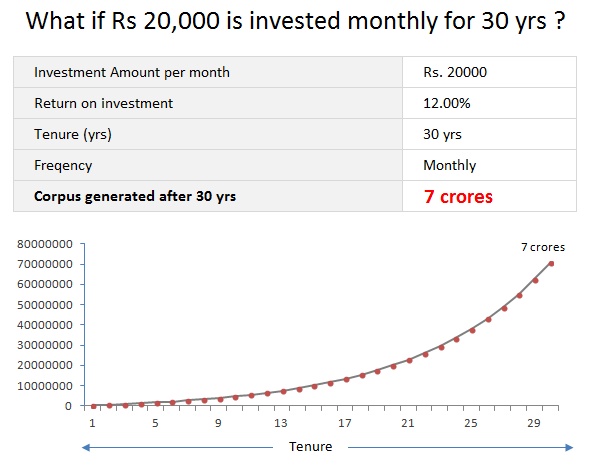

Below you can see an example.

I calculated how much wealth a 30 yr old guy can generate by the time he retires at age 60 (30 yrs tenure) if he invests Rs 20,000 per month at a return of 12% per annum. Below is the result.

It looks so simple on paper. One can generate a wealth of Rs 7 crores in 30 yrs period if one consistently invests Rs 20,000 per month.

Doesn’t it look over simplified? It definitely is!

While the calculator above makes it look like a child’s play to create long term wealth, in reality – it’s definitely not that easy and there are various things to be considered here, which I want to discuss in this article.

What are the assumptions in the calculator above?

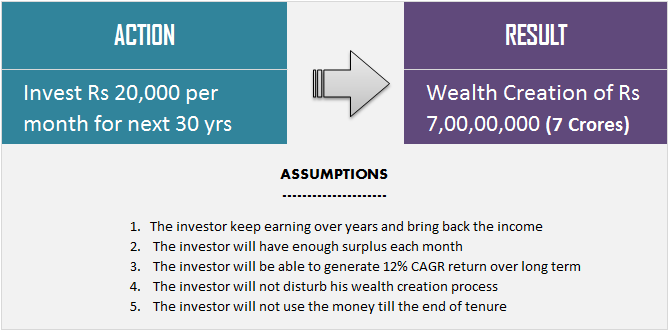

If you look at the calculator above and the numbers, you will realize that 5 assumptions which are

- The investor keep earning over the years and bring back the income

- The investor will have enough surplus each month

- Investor will be able to generate a 12% return over long term

- The investor will not disturb his wealth creation process

- The investor will not use the money out of the accumulated money till the end of tenure

Now if you look at the 5 points above, long term wealth can be created only if all the 5 points above are true or maximum of them are true. Each of the point above is a challenge in itself. If you overcome all these 5 points, you are then set to build long term wealth.

So now, if you try to capture these points as the ACTION and RESULT, then here is how it looks like

So let’s touch on each of these 5 assumptions one by one and see in detail and see what are the challenges in handling them

Assumption #1 – The investor will keep earning over the years and bring back the income

Let’s start from the most basic foundation point.

A lot of people who have been earning from many years (let’s say 5 yrs) and never faced any issues in their career seem to feel that its a cakewalk to continue doing it without any issues for the next 20-25 yrs of their life. They think that it would be a smooth ride. However, you need to know that

- There is a section of the population who are struggling in their career and will not be getting the same salaries if they switch jobs

- There are people whose income is not rising as per their expectation and a lot of people take salary cuts

- A lot of investors are out of their jobs/business due to competition, policy changes in the industry

- A lot of investors at times spend many months without bringing back any income because of health issues, layoffs, and other reasons.

At least 3 of our clients have stopped their SIP’s in the last 6 months because their income has stopped/reduced due to some issues at their workplace. While it might be a short term problem, you never know if it can extend for a very long time for some one. One client is working in the Middle East, and his job is not that stable and he is damn scared of this fact.

Another client told me that as per his understanding, he is getting the maximum salary he can command in his industry and if he loses his job for any reason, he will have to join another company at a lower salary.

One client is hell scared because he is just surviving his job from many years and if he is fired due to non-performance, he does not believe that other companies will hire him at the same salary

Focus on your “employability” and potential to earn

My partner Nandish Desai, says a very important point about employability – “To get a job, you need to be useful for someone”

You need to make sure that whatever you do, whichever sector you enter, which ever skill you acquire – do it like a pro. Become a highly useful person in your domain of work. Be among the best. Your skills should be outstanding and you should be the master of what you do. If that happens, you will be highly sought after and everyone will want to hire you.

This way you are ensuring that all your future income is secured. If things get tough in your industry, you will be one of the last people who will face issues. If you face any issue, you will soon find a new job. And if you want to switch, you can command a better salary.

Focusing on your career and investing in your own development is one of the most rewarding decisions you can make in your financial life. Only when you ensure that you have taken care of this point, other points will come into the picture.

You need to understand that only if your future cashflow is protected, only then you can save from it and only then you can think of the returns and everything else. No income, no wealth in the future!

Assumption #2 – The investor will have enough surplus each month

Taking the example above, the 2nd assumption was that the investor will continue investing Rs 20,000 per month over the next 30 yrs without fail. For you personally, this number can be Rs 10,000 or Rs 50,000, the same is true for yourself.

Will you be able to consistently invest that much each month? Will you be left with that much each month? year after year?

You might be able to continue that for some months or years but think of the real-life issues which we all face. And you never know your life will take turns, you never know how unpredictable things are. You might have to switch jobs because of health?

When you will have kids, your expenses might shoot up, you may face an emergency which might last for many months to come, there can be health issues and you can get into the never-ending cycle of –

High income -> high expenses -> less saving.

In fact, I have seen this in reality. Forget about investing each month, one of our clients is redeeming back from his mutual fund’s corpus because there is a prolonged medical emergency at home and he is not able to handle all expenses the way he had planned before.

My whole point is that it’s very very tough to maintain the consistency and discipline in investing in real life and there will be disturbances.

High Lifestyle is making saving tougher

Now a day’s it’s more common to see people living on a paycheck to paycheck basis. The high lifestyle and the increased consumerism have ensured that even if you are earning high, it will get tough for you to save. Salaries like Rs 1 lac or 2 lacs per month are very common these days in many cities, but the savings are not in line with the salary.

Hence, you need to ensure that you after your expenses are done, you generate a consistent and a minimum 20% of investible surplus from your salary. Take it as a game and try to win it each month.

Assumption #3 – The investor will be able to generate a 12% return over the long term

The next assumption is that the investor will generate 12% return over long term from his investments? Now where do you invest your money to get more than 12% returns over such a long term?

Any guesses?

The answer is equities !. It has to be in shares, equity mutual funds, ETF’s, Index funds, etc. This is not an easy thing for the majority population in India, because most of the people in India do not understand how equities work and banking products are their lifelong favorite. They are earning 8-9% (6-7% post-tax) from years.

So for them to earn 12% would be very tough because first, they need to get clarity about how equities work and get comfortable with it.

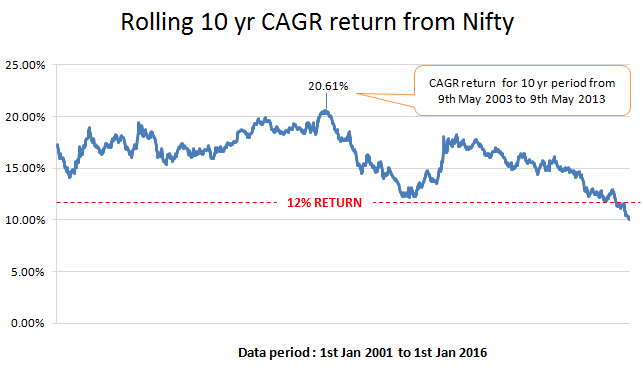

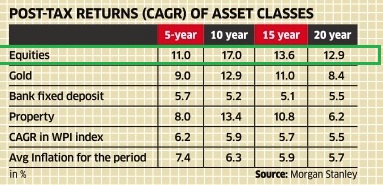

Data and chart:

Now let me show you some data and charts which will convince you why you should be in equity to earn a 12% return on your investments.

Below is the chart which shows the CAGR return for 10 yrs periods if the money was invested in NIFTY. The data is from 1st Jan 2001 to 1st Jan 2016, so there are many 10 yrs period like

- 1st Jan 2001 – 1st Jan 2011 (first point)

- 2nd Jan 2001 – 2nd Jan 2011

- —

- —

- 1st Jan 2006 – 1st Jan 2016 (Last point)

We then plotted the CAGR Return for all these periods and below is the answer. The CAGR return almost always was above 12%, however for few months towards the end it was a bit below 12% .

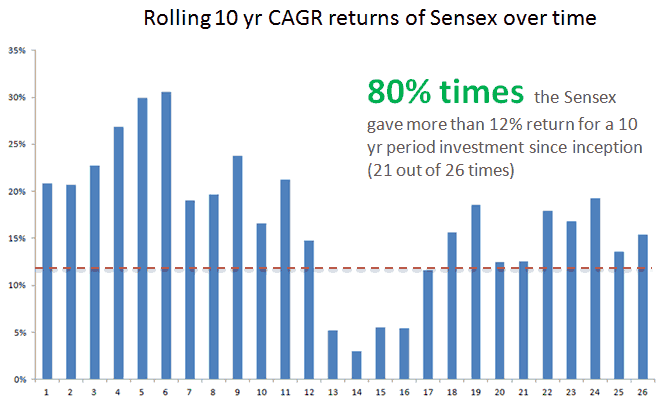

Another graph which I want you to see is the 10 yrs CAGR return chart from Sensex, which is for its 36 yrs of existence.

So there are 26 different “10 yrs” tenures and we calculated the CAGR return for all the 26 data points and below is the result. Around 21 times out of 26, the return was more than 12% and at times it was very high like 20%-30 %. Few periods had fewer returns like 6% or 11 %, but then if you look at the overall 36 yrs period, the CAGR return converts to 17% return.

Now while it’s very easy to conclude that if you invest in equity over a long term, you will get required 12% return, its very tough to practice in real life, which we will see in next point very soon.

Lets me share with you that a very small percentage of our India population invests in Equity.

The major money lies in FD, Gold and insurance products and even real estate. And it’s going to be very tough to generate a 12% return from these asset classes. In fact, Morgan Stanley’s Research has clearly shown that equity has beaten all the asset classes in the long run and below is a snapshot of that research.

So if you want to build wealth over the long term and you are investing the majority of your money in FD, understand that your post tax return is lower than the inflation.

Your money might be growing in numbers (Rs 10 lacs became 20 lacs in 9 yrs), but the worth of your money has come down (20 lacs today can buy less of what 10 lacs could have bought 9 yrs back). You are in fact getting poorer in a slow-motion and you are not realizing that.

Assumption #4 – The investor will not disturb his wealth creation process

Read the following question and answer.

Q – Do you know what is the biggest challenge for an investor if he has invested in equities (mutual funds or Stocks)?

ANS – To remain inactive and sit tight without doing anything and let his wealth grow.

Making money in stock markets is challenging, not because markets have any issue, but because we investors have a behavioral issue. We can’t handle the uncertainty and volatility which comes with the stock market. It’s not for weak-hearted.

For some one who has been with FD’s and has the habit of seeing his investments grow in a linear fashion, he can literally go crazy with mutual funds because it brings so much of ups and downs and volatile movements.

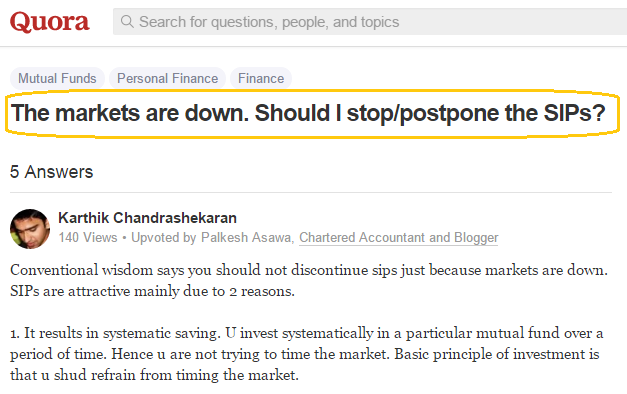

Should I stop SIP when the market is falling?

In the last 2 weeks itself, we have got many emails from our clients whose SIP’s are going on in equity mutual funds, asking if they should stop their SIP’s as markets are falling? I have told them to act like a ninja investor and see it as an opportunity and pump in more money because in the coming years we might see a very good bull run? (any body remember what happens for the next 2-3 yrs after 2007 crash ?)

Note that all these clients SIP’s are running for very long term goals like retirement or children’s education which are going to arrive only after 15-20 yrs. There is no problem as such with that behavior.

It’s very natural, but I am just trying to tell you that it’s not that easy to handle the pressure which comes from the volatile nature of markets and very few investors have that dedication and understanding of how things work in the stock market.

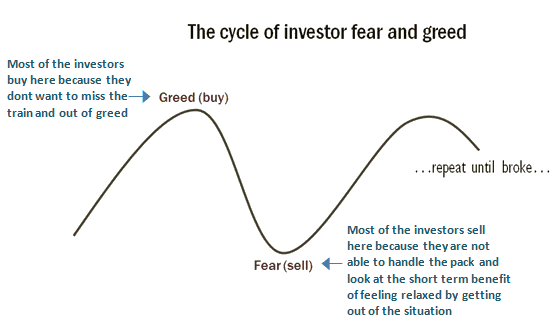

Very few people can control their greed and fear and that’s the reason very few people are able to make the most of the returns from the equity markets over the long term. Below you can see a snapshot of kind of queries which start coming up if markets show any kind of fall for a long time like 6 months or a year.

The cycle of Greed and Fear

If you see the stock markets right now, you will realize that we currently are in that same phase where investors panic and take out the money from their portfolios. Markets are falling from last 1 yr and especially this month it has gone down by a big margin.

So even if an investor is investing a good amount each month and he has read about how equity markets work and they understand the game of equity, still it’s very tough for an average investor to stay calm and stay with markets consistently for a very long time.

Some stop their SIP’s, Some redeem their money and shift it to FD’s thinking – “I will again be back, when the markets will calm down and start going up”.

However, you never know when that up move started and by the time you realize, you lose the next bull run. The below chart clearly shows how 99% of investors think and behave in stock markets.

So what is the solution? What should you do?

Remember that if you are in equities with a long term view like 10-15-20 yrs, then you are going to see many cycles of ups and down. You can’t escape it. You need to think of the down market as the “sale” where you can accumulate more stocks or mutual funds units at a cheaper price so as to gain from the up move later.

And when markets are going up, don’t redeem your money or try to “book the gains” because you will most probably miss the bigger up move trying to redeem the smaller up move. You need to understand that you are not there for “trading” or short term profit booking (incase, you are there for trading, then this does not apply to you)

Just sit tight, keep your SIP going and make sure you are in right mutual funds (not the best, because it does not exist). Review them in a few years and let the process of wealth creation take place. It requires patience and only a small percentage of investors are going to reach the final destination. Be one of them.

Assumption #5 – The investor will not use the money out of the accumulated money till the end of tenure

Having 5 lacs in your bank account is very different from having Rs 5 crores. You might think – “What’s the difference? it’s just 100X, rest everything is same”

No, your feelings about your money, your risk appetite, your thoughts around money, your desperation to do something will be at a very different level when you have 100X money in your bank account.

It’s a very tough thing to “not do anything” when you have so much money getting accumulated in your account. Once your corpus reaches a respectable limit like 80 lacs or 1 crore, you will start thinking in these lines

- Let’s shift some money in FD now.

- Let’s upgrade our house now, I can surely take out 50 lacs from my portfolio

- Now I deserve that dream car I always wanted, I have good money now

- Let me have a grand wedding for my children, after all – I have a good corpus now

Your lifestyle will go up, your vacations will get luxurious and you will get all the reasons to spend the money and take a dip in your portfolio.

Let me be clear, that I am not saying there is anything wrong with spending your money or using it for yourself.

please do that. After all, if you have managed to earn so much money and accumulated the good corpus, you surely deserve a better lifestyle.

All I am saying is that it’s a challenge to let your portfolio grow and not disturb it. So in our example at the start of the article, you might not reach 7 crores as per calculation, but may be 4.3 crores or just 3 crores, because you keep taking out the money out of your corpus many times in between for various reasons.

If you are just taking out a portion of your corpus and reinvesting in something else which you can redeem back later, it’s still fine. But if you are “spending” the money and consuming it, then it’s GONE. That part will not reflect in corpus now and you will have a lesser corpus to that extent.

If you can make sure you have that ability to stay calm and see your wealth grow without disturbing it, then you are bound to see a good amount of wealth in your life.

So here is the final checklist before you start your wealth creation journey

- Spend a good amount to time to understand how equities work in the long run. I have explained about equity in the 3rd chapter of my 1st book – “16 personal finance principles every investor should know”. Get a copy and read it

- Work on your career strongly and become very very good at what you are doing. Make sure you are highly employable even if the bad time comes. This will make sure your cash flows are more or less ensured.

- Spend 10% time on cutting down your expenses if there is any scope, and spend 90% of your energy in increasing your income. Remember, reducing expenses is tough and has a lower limit. Increasing income does not have a ceiling.

- Make sure you start the SIP in equity mutual funds with a long term perspective. When markets fall, rejoice ! and keep adding more money. Be a tough hearted and you will be rewarded over long term

- Make sure you plan for other goals separately so that you do not use your main corpus in between for small things

Let me know if your way of looking at long term wealth creation has changed or not by reading this article. I would love to hear your views.

January 21, 2016

January 21, 2016

I have a query regarding amount earned by investing in mutual funds,whether the final amount is taxable????

No ,if its in equity mutual funds and completed 1 yr of investing

Hi Manish and Nandish!!

Great to see that many people have started reading your blogs and could see many new members asking lots of queries.

Wishing you both all the very best.

One request is why don`t you plan one of your workshop in Hyderabad and i think you haven`t done any in chennai till date.

Hi

Nice article.

I m new to sip and not actually familiar with financial terminology. I seek advice from you on below aspects.

1. I have a daughter of 3 yrs old and I want her to become doctor by profession. Currently it takes around 10 to 15 lac for the course in India in Govt Colleges. In private college its around 30 -35 lacs. Corpus would be needed when she gets 16.

2. I m a businessman with an average income of around 40000 per month. My wife is a homemaker. How should I plan for secured future for both of us. I don’t have any loan.

3. How should I invest in SIP. 5000 Rs per month or 2000 on my name 1500 on wife’s and other 1500 on daughter’s.

Please help me with best advice. 🙂

Hi Shahid

Our team can resolve all these issues and also help you to invest in mutual funds . Kindly leave your details at http://jagoinvestor.dev.diginnovators.site/solutions/invest-in-mutual-funds

Thank you Manish.

Really an eye opening article. I have 32K salary (with much expenses) and I was thinking to do same kind of stuff. But then I realized the cons of blind investment. So I will start investing small amount for long term.

Can you please suggest how to invest in SIP for such a long period and good fund.

Hi Swapnil

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://www.jagoinvestor.com/solutions/invest-in-mutual-funds

Manish

Awesome article Manish. I think the most challenging part people are facing these days is controlling the life style expenses and increasing surplus amount every-month for saving. Creating long term wealth is a must and one have to start investing money via investing stock market + PPF way.

True ..

I agree with your views..

Nice article

hi

this is very good site for investors

Thanks for your comment sanjay

I was thinking of a long term investment. Now will think of it more wisely after reading your wonderful article.

Glad to know that Anirudh ..

Hi Manish,

You are simply awesome. i am new to SIP n equity and to be frank quite apprehensive also. I would like to take some more guidance from you regarding investments with SIP as another 6-7 years I am planning to switch my job.

Regards

Arindam

Hi Arindam

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://jagoinvestor.dev.diginnovators.site/start-sip

Manish

well I tried to register with your website but there was some issue with settings n password, so could not register.

What issue are you facing exactly !

Very nice article for a amateur like me. Real eye opener.

Thanks Manish.

Thanks for your comment Mumtaz

Great Great Article.

Thanks for your comment Pravin

Hi Manish,

Great article and very good insights for the long term investors. I have been a regular investor in MFs myself and now look at long term goals rather than short term fluctuations of the market. BTW from personal experience, reviewing your MFs performance in 2-3 years will help a lot.

I have just a few questions. I want to invest another ~4L in equity mutual funds. I wanted to know if i should invest it through SIP route (~20k per month in various MFs) or lump sum when i see a dip in market or a combination of both. Some of the MFs that i have shortlisted are:

1) Axis Long term equity (ELSS)

2) Birla Sun Life MNC

3) UTI MNC

4) UTI transportation and Logistics

5) Mirae Emerging Bluechip.

Would love to hear your views on the SIP vs lump sum investment and choice of MFs.

Seeing the current market conditions , I would suggest putting a lumpsum in 2-3 chunks (distributed in 2-3 months)

Mr.Manish, Was a low profile investor in equity but was never serious.lost good amount of money still dint feel worried.Never tried sips on mutual fund nor was so much interested in fixed deposits.invested for the last 5 years in real estate and land property.

But now things have changed for me and I have invested about 5 lakh currently and keen to invest 5lakh more in equities by this month.this time my investments are serious and for long term perspective.

Am doing lots of research on equities. However,I want to know whether am wrong in not chosing me and ETF’s.Please advice…..my plan currently is to push some good investment into equity market may be a portfolio of 20l and then think of MF and Others…

Its fine if you are into Stocks . But the only issue if that you should have a good diversified portfolio ..

Hi Manish,

I am 28. I don’t have a single policy or investment made as of now. I want to start with investment 6-7000 rs per month. In a year 70k. Please suggest what plans (LIC, mutual funds, sip, post office plans etc). What and how should diversify it. Please help.

Hi Gaurav

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://jagoinvestor.dev.diginnovators.site/start-sip

Manish

Hi Manish ,

A good article ,I understand equity is a long term investment and markets mirror economy but i have one small question.One fact from the great books of peter lynch and other value investors is to invest in the stocks of products which sell in the markets and which we use day to day to have an idea of the company growth.But in india i observed lots of fmcg comapnies whose product we use a lot , who have ads in tv channels are not at all listed ,are our markets a good barometer of our economy really when lots of high growth companies are private and not at all listed .

As I dont have much idea of value investing , I think I am not the right person to comment on that !

What is better ? Investing X amount as SIP or investing same X amount to repay your liabilities like Home loan etc?

Please suggest.

INvesting in SIP is better

Would your answer change if it was a personal loan instead of home loan? Given that home loans are around 9.5% and personal loans can vary from 12-14%?

Yes, loan is a loan !

thanks Manish… Its a great eye opener and helps me to understand why investing in ones career is so important for meeting other goals. My 8% of income go to SIPS’s in Mutual Fund and and I invest the remaining savings to the same funds monthly. My thought process is, in case of any temporary issues, still I will be able to invest this 8% SIP’s. And even I will be able to invest more, if there are any additional income like bonus etc.

Hi Praveen

Thats great to hear !

Hi Manish,

Great article , as usual.

But I’ve long had some doubts. I generally trend to be distrustful of statements that are repeated by all and is believed as a dogma.

My doubts are :

1. Are your numbers really true? I just calculated the CAGR from Sensex (1996-2006), and it comes to only 10.68 %. So, what that means is that, a person who had invested in 1996, and retired in 2016, had only made gains of 10 % ( assuming he invested in the right stocks/MFs) I hope I have not made any mistakes in the calculation . Ive used the calculator at http://www.investinganswers.com/calculators/return/compound-annual-growth-rate-cagr-calculator-1262

Please recheck it

2. How can we be even reasonably sure that equity will continue to give the same returns over the next 30 years, based on past performance? Another ‘truth’ that I keep reading is not to buy stocks/MFs based on past performance, but on the structure & quality of the venture.

3. What if, when I retire after 30 yrs ( I’m 30 now), the market is bearish. Considering that we see booms & busts every 6-10 years, and considering that each ‘bear phase’ lasts 1-3 years, am I not going to be in a difficult situation then?

I’d be grateful if you could clarify these.Thanks

Hi Niyaz,

Fair questions.

Let me try and address your concerns, especially, point 2 and 3.

As I had mentioned in my previous comment, it is important to revisit your investment strategy based on the prevailing market conditions and relevance of your goal. This needs to be a regular activity and not a one time activity. Accordingly, you tend to balance your portfolio and investment strategy at regular intervals, may be once in every year. Such a re-balancing approach will help you to achieve your goals and not create a difficult situation at the hour of need.

As far as the return of sensex is concerned under point 1 of your comment. I am still to evaluate your and Manish’s calculations. However, my immediate view based on previous studies and historical analysis of similar data suggests that one should expect a return of around 12%-15% from equities. Ofcourse, this will depend on the quality of one’s selection.

Regards

Krishnan

Hi Niyaz

A very good question I must say. Let me answer

1. You have correctly done the calculation. Consider a restaurant, which serves good/amazing food, but then out of 100 times, there is always 2-3 days, when the food is just average or not that great. Do you say that the restaurant is bad or not that great ? Or you look at the total number of instances and then say how many times it has been bad ?

In the same way, the 20 yrs period which you have taken , is the worst of the worst 20 yrs tenure, In the same way take another instances of 20 yrs, like 1979-1999, or 1980-2000 . Like this there will be multiple 20 yrs tenure , do it for 18 yrs tenure, do it for 15 yrs tenure

See what results are you getting .

Also another point is that this is SENSEX returns, do it for a mutual fund which is actively managed and you will see that the return for a 10/15/20 yrs tenure is never less than 15-17% over long term

2. We cant be . Because there is a potential to high return , there is always a risk that returns might not be there . If you want stability and consistency, mutual funds are not the place to be in .

3. Do you think you will be sitting idle for 30 yrs and wake up only at the end day ? It does not work like that, once 70-80% of the tenure goes off, you should be slowly shifting your money into more balanced/safer funds . Its not always the end day when you act !

Manish

Hi Manish,

Thanks for your reply.

i take your view on point 3.

But about point 1 , you are right…True, 1979-1999 registered a growth of 20.61%.

But…Growth during : 1992-2012 = 9.7 %. and 1994 – 2014 = 10.22 %

Is it reasonable to compare the pre-liberalisation market with what it is now?. Is it likely that the markets would grow at such a rate in the future? By what I understand, the rapid upswing in the indices during that time was because of the opening up of the markets, new manufacturers entering, lots of foreign capital etc etc..in short, a thoroughly ( and well justified) buoyant mood among investors, which was matched by industry production ( until the next crash of course). I feel that the examples which you mentioned – Growth during 1979-1999, or 1980-2000, may not be reproducible in the future

Well, what I’m basically asking is , do we expect the markets to keep going up indefinitely? Will it / Can it touch 50000? Is that how it works? There has to be some ceiling right? I’d be grateful if you or someone could explain in some detail

Forgive my ignorance. Finance is not my specialty 🙂

Very good point . I know its a general question in every investor mind , after all a higher level ceiling should be there. This is how it will come to mind . But you need to understand that markets are nothing but a barometer of economy. As simple as that. Its like a thermometer. It will move as the economy moves.

So when you say that markets index has to have a higher level ceiling , that means economy has a higher level ceiling ..

A stock price is exactly like index and it reflects the company growth. So stock price will keep on rising as the company grows.

Now coming to the point, yes, it can happen that markets might not perform in the same manner like it did in last 20-30 yrs, but then still its still going to beat traditional products like FD and bonds etc over a long term.

All you need is 2% more than the inflation and thats the capacity of the equity in long term. And to end this conversation, I would say that one has to take that risk if one wants higher return . If you want 100% assurity, then you need to stay with FD etc.

I hope I was able to clear up some doubts ..

Hi Manish,

I am recent addition to your large reader database. First of all let me congratulate you for a detailed and excellent article. I am also a practising financial planner. In my opinion, the above 5 assumptions are surely the pillars for an effective financial planning. The only worry is the fact that most of the investors do not understand the nuances of effective investing. I have many clients who blindly invested in mutual funds and in fact also stayed invested for a reasonably long period (above 5 years). Unfortunately, neither their planner nor the investor undertook a periodic review of their investments. The result is a big Disaster. As reflected in one of the charts above, markets are going to have a cyclical trends. The challenge comes when cycle is downwards at the time of your goal achievement period and the investor is continuously taking a higher exposure to equity while nearing the goal. Re-balancing of the portfolio is in my opinion the 6th important pillar for effective achievement of goal.

Hi Krishnan

Very true 🙂 . Thanks for sharing your experience with all of us !

Hi, manish commendable work. Do let me know your views about SIP AND sbi mutual funds.

SBI has hundreds of funds :). Which one are you talking about ?