3 incredible money lessons – I would like to pass on to my Kids

POSTED BY ON April 7, 2015 COMMENTS (120)

We have worked with more than 500 investors till date one on one and we have decent understanding of how financial lives take shape over the years.

Today I am going to share few observations out of working with clients for so many years and will share some mistakes which you should avoid in your financial life. I really wish if each parent could pass it on to their kids or their siblings when they start earning money.

Mistake #1 – Don’t go with the flow

It’s often said that in life – “Go with the flow and don’t worry”. While that’s a good advice for your life in general, but I think it’s not a good advice for your financial life.

Most of the times, if you just go with the flow, you might not get desired results. It’s a shortcut which you are always tempted to take in your financial life, but often that leads to a clumsy and bad financial life.

There is another saying that – “Only dead fish goes with the flow”.

I am sure you don’t want to be a dead fish 🙂

I have observed that most of the people, who today are having a very bad financial life, have just gone with the flow and never planning out things. Nothing in their financial life happens due to their careful planning or conscious effort. Whatever comes in front of them, they take it.

- Tax season arrives and they buy the policy because they have to submit the investment proof.

- They take loan because its a “Interest Free loan” and not because they needed it

- They want to buy a house soon, but then the next moment they upgrade their car !!

- They sign the documents where the agent asks them too and complain they were cheated

I just want to make a point. You can either choose to move with the flow and let things happen to your financial life OR take charge and make things happen in your financial life as per your plan. The biggest issue today is not just less income, but how managing the money in proper manner.

Mistake #2 – Don’t get attached with past and harm your future

Almost all the investors face this. One bad experience in some area and they carry it with them all their future.

When recently, I recommended a mutual fund from ICICI Prudential to one of our client. He was taken aback and very strongly told me that he does not want any ICICI prudential mutual fund because he has had a very bad experience with them.

On further enquiry, I realised that he was sold a ULIP by an ICICI Prudential Life Insurance agent, which he was not happy with and from that day he took a vow that never in his life, he will deal with ICICI products.

In the above example, did you see that the person had just labeled ICICI = FRAUD. There are so many good things which ICICI has to offer (and it’s true for every company) and just labeling things will only hurt your own future because you then cut down your own options.

Good and bad experience are part of life

Good and bad experience’s are part of life and it happens with everyone. You need to learn from it and move on. Take some learning’s from the incident and see how you can make your own self more strong to deal with a situation.

Like in the above example, the person could have said that – “I will now onwards read the documents and understand where I am putting my money” or “I will not buy something, which I truly don’t understand”. But instead he chose to take the extreme step.

I will give you another example

I see many people who bought a stock or mutual fund and it didn’t perform well and gave them bad returns. Now they are so scared to try out equity in their portfolio all their life, because they equate EQUITY = MONEY LOST

Note that in today’s times of high inflation and high taxes, having a good portion in equity class is not an option, but a necessity. You can’t build enough wealth without investing in equity based financial products for long term.

So coming to the conclusion, all I want to say is that don’t make mistakes of carrying a bad experience throughout your life and avoid the opportunities which exists, this is not a money lesson, but a good life lesson – which applies in all the areas of life.

If you buy a book on personal finance, and you don’t like it, it does not mean that good books on money does not exist. Or if you had a bad experience with a financial planner, it does not mean that all financial planners are bad.

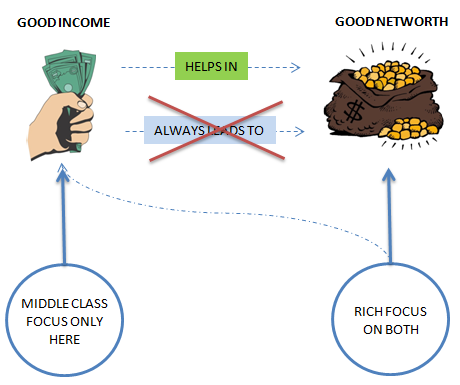

Mistake #3 – Don’t just focus on earning money, but also your networth

Do you know one big difference between RICH and Middle class ? Here it is …

“Rich talk the language of Networth and middle-class talks the language of pay-package”

What have you heard your parents ask you – “Go get a good paying job?” OR “Go and build a great networth?”

Over the years, the income level has risen many folds and today its not uncommon to see income levels of 10/15/20 lacs per annum and the society label them as “doing well”. But the ground reality is very different many a times. The net worth of these high earners is still not upto the mark.

When we do workshops in various cities, we often see people who are earning 10-20 lacs per year who have spend years in their job, but they don’t have enough to show off as their networth. Many of them are empty pots whose size if big enough.

Its because they have focused and worked on their income’s, but never focused properly on building networth. Just because you earn good, does not mean you will have a lot wealth, because that needs conscious effort and mindset to build wealth. It needs actions, adoption of structures in your life which many don’t act upon.

Good Income is very Important

Don’t get me wrong. I am not saying don’t try for good income. In fact, if you focus on good income, you can build wealth more easily and faster, because more income generally leads to good wealth. But often its not true and it can happen only if you choose to consciously work on it.

It might happen that a person earning less than you build;s higher networth then you because he was fanatically working towards it.

We once came across a couple in Mumbai who was collectively earning around 35-40 lacs each year. I know the moment you read this, you must have thought – “Wow .. that’s a lot of money. I want to get there”

But reality is different

But their lifestyle never allowed them to save enough. Their expenses list was so huge that I was almost numb, when I saw their datasheet.

Here was a couple who was doing extremely well from “society standards”, but still their networth was pathetic compared to their income because they just focused on consumption and only consumption. Their were so many leakages in their financial life, that money never stayed in their financial life.

They could not even arrange for 10 lacs cash in emergency situation. So poor was their allocation and planning, that it was a height of mismanagement. We then worked with them for few months and redesigned their overall financial life which they approved.

We set their financial goals, helped them to define things and systematically save for each of them and suggested them how they can improve. We put right structures in their financial life, which forced then to save first and only then spend. They are doing better now.

I know this is an extreme example, but many people can relate to it at some level.

As an investor your main focus has to be on your networth and a good income is a tool for it. A higher income which does not lead to a good networth is only a short term success story.

What I have seen in last 7 yrs ?

Today’s generation is into a deep financial depression. You meet a guy, he is going to a swanky office, his package is bloody 16 lacs per annum, you envy him and you hear this guy has just bought a house (on loan). You feel you want to be like him, what an awesome feat he has achieved.

But the reality is very different. While this all looks great from a distance, deep down a big number of investors are facing a very tough situation, which is only known to them.

They are hell scared of future. Even though they are doing well today, they are still not sure what future has for them, they are depressed and fearful of expenses lined up for future. It has destroyed their peace of mind. They have good money coming into their bank accounts, but peace of mind is missing.

I am sure many readers who are reading this can relate it to their lives. What kind of suggestion would you like to give to a new investor who has just started their financial life?

Manish You approach is very simple and easy to follow. I would like to invest around 25 lakhs which I have as NRE FD.

Can i leave it as it is or invest in someother instrument?

I am planning to settle down in India. What type of whole life insurance do you advise?

Thanks

Mani

I waa always reading your articles from a distance !. I thought it is time to join the club. Keep up your good karma.

Welcome !

Very good arcticle sir, this is really happing with many people.

Welcome .. Glad to know that Ravi ..

Very good article…

But I expected the “How to overcome part” for each mistakes and examples you mentioned….

Karthik

Thanks for sharing your views. I think the how to part is obvious once we define the problem , is it not ?

Hi Manish,

I agree with you. The comment was before reading your book… Now I am inline with you. 🙂

Karthik

Welcome

Hi,

Very well written you have been able to gather your experiences and you have made it into a very relevant story of present times,its an eye opener for many who really want to awake and start looking at a wealthy financial future.

Pl keep writing.

Best Wishes

Thanks for your comment anil kale

Nice article Manish.

This article reminded me of the book Rich Dad Poor Dad which says –

The rich first save and then spend, the poor (even some of the super educated ones) spend as they earn, and are left with nothing in the end.

I implemented this advise in my financial life before a year (after carelessly spending all my earning for over 5 years, including buying a house on loan) and now the future looks much more comfortable 🙂

Hey Akshay

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Extremely informative article. I believe each and everyone of us have our own priorities and some advice that has passed down by our parents , so we try to incorporate a lot of those things and invest accordingly. But now with Indian economy things are not the same as they used to be 20 to 30 yrs back. So we need to guide our children differently, most importantly they need to understand the importance to money and how to spend money not to waste it. I have invested in tata aia life’s policy they have recently launched Smart growth plus plan which offers flexibility in choosing policy term, has good policy returns and tax benefits u/s 80C & 10(10D).

Hey Kabir

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Nice article Manish.

Thanks.

Welcome .. Glad to know that Jeevan Singh ..

Hi Manish,

Another good article!!

I think one needs to learn to look at his financial life from a distance as a third person…your experience helps us to exactly do that and take some concrete steps to make one’s financial health better…this is my feeling…Abhay

Welcome .. Glad to know that Abhay ..

Hi Manish,

Awesome article as usual crisp and informative. This article is not only to be passed to kids also for us to implement. I believe for many of us it would be an eye opener.To mention i liked your quote

“Rich talk the language of Networth and middle-class talks the language of pay-package”

Keep Sharing..

Welcome .. Glad to know that Chandrashekar Iyer ..

Superb article.

Thanks Moneypurse

Nice Article Manish.

One more nice article Manish , keep up nice work.

ex-yahoo colleague,

Bangalore

Welcome .. Glad to know that Vikram VI ..

Another brillient article by Maneesh.

Thanks Maneesh for being an indirect part of my good financial life. I have been your reader since I came across this site & never miss an article, not a single.

Thank you again.

-Niranjan

Welcome .. Glad to know that Niranjan ..

Title is thought provoking.

It is indeed required to educate our kids in the field of finance. Generally children learn by observing adults. When adults do not care about their finances and neglect planning, it is highly likely that the children also follow suit.

Hence it is required to discuss financial aspects of life with children(appropriately) and introduce them to various aspects of financial instruments as children age. In the process, parents can also explain various financial mistakes they did and how they impacted them adversely. This not only educate children on financial aspects but also makes the bond stronger.

Thus one can teach children to be frugal by demonstrating the same at home. We can use many things till their useful life is over. One can also demonstrate the bargaining process and getting some object at a competitive price

To sum up, every one should try to pass on one’s financial knowledge to friends and relatives specially to children. This will help children develop a balanced view of life.

Hi Srinivas

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Hi,

You will be surprised to know that there are people who own a car costing Rs 10 lakh, but stay in rented house. Instead, focus on owning a house first whether through loan or not. One can buy car only if required. The equation to buy a car is < 60% of one's annual income. With Ola cabs, one need not buy car. The money earned can be invested in Equity funds through SIPs. Make sure your SIP payment is done in the first week, same with insurance or loan payment, so that you get to spend only after what's left.

Any couple with good income should buy 2 houses, 1 2BHK and 1 3 or 4 BHK. Before starting family, a 2BHK is just right. As income levels increase, and kids are born, they can buy a larger house. The 2BHK can be given on rent to generate another source of income. As the kids grow and are married, the couple can stay in the 2BHK house and the 3/4 BHK house can be given on rent.

Hi Ashwin

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Super article..

Thanks for your comment ashok

My suggestion is always go for forced savings, ie arrange for transfer of fund to insurance, nps, ppf, mutual fund via electronic fund transfer. So that money is transfered without fail.

Hi kankuppi sadashivappa

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Very good article..the only problem with this article (and most financial articles) is that people who know and apply all this will read it..but the ones who really ought to read it..WONT.

Hi Anshuman Kumar

I dont think so . There are enough people here reading this, who needs it badly.

Indeed a very good article by Manish, as always, followed by a lively discussion by all the participants. My compliments.

Thanks for your comment J K MATHUR

Hi Manish kindly guide me

Expecting more articles like this…true fact…

Welcome .. Glad to know that Sabarish ..

really interesting.

Such a great topic and article. I rarely think of other options in these types of situations, and I appreciate how you have pointed them out.

Thanks for your comment Abby

Important eye opener

Welcome !

One more great article and eye opener form Manish and team. Thanks for sharing this.

Welcome .. Glad to know that Ravishankar ..

Good one as always!! Thanks Manish ji!

Thanks for your comment Suresh D

very good write up

amitji pl keep it up

thanks

yours

A M Lodha

Thanks for your comment abhaymal lodha

Very Nice Article 🙂

My points:

1 You need to be a proactive. Research on various investment options.

2 Define your goals and Start early as soon as possible.

3 First major goal/target should complete in between 42-44 years.

Save Money & Save Water 🙂

Thanks for your comment Gaurav

Hi Manish,

This is good read and more important lessons to be learnt from others and elders :-).

I would like to know:-

1. how can you calculate the networth of any person ?

2. How much % of saving should be done in order to have the network in decent shape ?

3. Whether the assets ( Property / Investment ( Shares / MF/ PF ) can be consider as network ?

4. If some have worked for around 10-15 years and in these 10-15 yrs he have received CTC of around 1 Cr to 1.5 Cr and his net assets are also equal to his CTC he have received till date, in this cases, whether this persons network is good/ bad / ugly ?

I would be happy to see the answers of my question.

Thanks,

Ravindra Nerpawar

Hi Ravindra

1. Net worth means what is your accumulated worth as of today . So you just add up all your assets (real estate, shares, mutual funds, policies, gold, cash in bank, land, ppf) and minus all your liabilities (all kind of loans) . This is called your networth. If I have assets worth Rs 1 crore and my loans are worth 30 lacs, then my networth is 70 lacs

2. While its always better if you can save maximum, but as a general thumb rule, one should be saving and investing a minimum of 20% of his income.

3. I think its already answered in 1st

4. Truly speaking its a subjective thing . I cant comment on that. But having worked for 15 yrs, one should have atleast 3-4 times of his last drawn salary and also 15 times his annual expenses. Also you always know deep down your heart, if your networth is upto the mark or not compared to all the money you have earned till date !

Manish

Hi Manish,

Thank you for your answers.

When you say saving, whether home loan EMI is considered as saving or not ?

Thanks

Ravindra Nerpawar

I look at wealth from a different perspective. For me, my wealth is the money equivalent of assets I have. But all assets are not same. A house in which one lives, is an asset. However, in case of need, it takes time to convert the same into money at competitive rate. Similarly a plot of land.

I feel one has to have a holistic view of ones wealth and goals. If one does not have dependents, he can spend his earnings as he likes. If one has a family, first responsibility will be sustenance of the family.

If we take this as the only goal, for a decent level of living one needs anywhere above Rs 20000 PM. This will be required for just living. To get this one needs to have about 24,00,000 corpus which can yield an interest of 240000. But here other aspects like taxes inflation etc are to be considered which can bloat the requirement to double its size. If we add goals like children education, marriage etc, this will balloon further.

Here no one says one should not enjoy. But one should take care to see that the family survives even when one is not there.

Coming back to the article, the first point is easier said than done. It is most convenient to go with flow. This does not need mental strain and th whole group justifies gain or loss, so one need not feel bad. But mostly this will not work. One has to understand various aspects of personal finance and carve one’s financial life to the best of one’s resources.

Third point can be detailed further. Don’t stop with net worth. Make a goal to provide for the family sufficient corpus so that the family can maintain the same standard of living and more importantly educate at least one in the family on these aspects.

Life is for ever unpredictable. But with some work, one can secure the goals of one’s family. All it needs is some time to learn these aspects.

Yes, in a way you can say that its saving !

Sorry brother krishna if I have offended u

I didn’t have time to chat with Manish n this issue was giving me some tension

I thought to better write it off

Great piece, Manish. Very to the point with right examples and simple, plain, non-technical english. Must read for all new investors and a good checklist for all experienced investors. Thanks.

Hi Sarang

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Article title is misleading, the article is about mistakes that could be avoided but not about money lessons that one could pass on

Hi Krishan

So you wont like to pass on these important “not to make mistakes” to your kids ? I think they are worth sharing with younger generation !

Hi Manish it’s because of ur articles I started investing and started taking interest in my financial goals

thanks for being there for me

I have invested in hdfc progrowth plus 3000per monthfor 15 for study of my kid who is 7 months old

bajaj allianz future gain plus 3000per month for 20yeardfor his marriage

ppf 20000 per month 10000 each as my wife is also working

we earn 100000per month in government sector(defence)

our medical and life insurance is covered by govt

I want a pension plan I which will build corpus of arround 5.5cr after 30 years as I am 30 now n willing to invest 20000per month my life expectancy 80 years I suppose at present u spend 30000per month approx so I will need around 200000per month for rest of the years after retirement

kindly suggest me some plan

I have zero on aegon religare I maximizer

And also I want to invest in gold for my son’s marriage should I go for gold etf as I am willing to open a demat account so that with ur kind suggestion n through the knowledge by ur articles I can invest my surplus money in large ccap ind. Time to time.

I think you are doing well as of now .. What you need is a proper financial planning

Hi,

This is a very nice article and this has come at a very good time for me. Currently i am in the process of setting up my business. I have interacted with lot of businessmen and they always advise me INCREASE YOUR NETWORTH. I would have heard it from them probably 10000 times They say that even if you are earning billions of dollars and your Networth is less then you are always at a big risk but even if you are earning less and your networth is huge then you really have a very big potential.They even say that Networth does not mean money alone, it can be in human capital that you might have or may be the asset you have. Today most of them have lot of fear and one bad experience with some product or service then they assume everything else is bad. Even i had invested my money in many things and lost them as well and i had the same notion but by interacting with few brilliant people i realised that things can go wrong eventhough you might have taken some decision that is truely awesome but you actually failed to execute it properly and you screwed it on your own but finally blame the product or the investment firm. I had lot of negative thoughts within me before but now i have lot of positive thoughts going on in my mind that i have dared to take another chance in my life but this time it is with proper planning and execution. Hope things will go as i expect

Regards,

Satish

Hi Satish

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

These are facts to the core…

Thanks for your comment Virendra Kushe

Another unique and very good article.

After reading this article I realized that I am on correct path.

Thanks Manish Sir.

Thanks for your comment Chandra Kishor

Hi

I am just a first time writer here..

I can so very well, relate to the article being just a year old in the profession. The kind of lifestyle we youngsters are leading in demands a high pinch to our pockets,which as a fact is not proportionate to our savings. This era demands to invest and save in an organised way compared to previous times.

##LIFESTYLE## The Idea to grab all the latest gadgets, style clothes is the mantra for this age even though we end up getting them on installment which means paying a much higher price for the same thing that too so many times. Perhaps, EMI/Credit cards is a very good mode for people who cannot shell out large chunk of money at one stance, but it is should be planned atleast ,but we end up in spending and then planning!!!

##PROCASTINATION##

Just a relative text I got-

“Daru and Cigarette hamesha aaj se khatam hoti h

Padhai and bachat kal se shuru”

Our generation really needs to start thinking and planning our finances in the early years of earnings, rather than delaying it and losing out the opportunity of letting our wealth grow..

Hey Priti Agarw

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Would also like to add that a penny saved is worth a penny earned.

I classify my needs into following criterias:-

1) Emergency Fund (Medical, Parents, Accidental, Unavoidable) – Save for it.

2) Need Fund (House, 2/4 wheeler, TV, Fridge, Washing Machine, Expenses) – Work for it

3) Comfort Fund (AC, 4 wheeler, ) – Plan for it

4) Luxury Fund(Frequent dining out, second car,Holidays, Expensive cloths/mobile phone) – Thrive for it.

The basic manta I follow is:-

Be in the position when situation : money ,

“Emergency : Spend it”

“Needed : Plan and Spend it”

“Useless : Don’t even think about it”.

Exactly. I agree.

I think the mistake that Manish and many others make is to always think for everyone from their perspective but forgetting that everyone’s approach to life itself is different and that plays a big role is someone’s networth.

Money is not the be all and end all for everyone and to me that’s perfectly fine. Some people just like to live life to the fullest instead of planning how to spend/save every last penny. In my mind there is nothing wrong with it and such people are some of the happiest people I have ever met. Such people also tend to be down-to-earth as well.

Let us all try to accept that everyone needs and priorities are different. For example, you have listed Holidays as a “luxury”. For me, Holidays are not luxury but a necessity because I love to travel more than anything else in the world and if I have to spend every last dime I have to meet that need, then so be it. Atleast I’ll have my peace of mind.

Hi Anjan

I agree everyone has a different approach to life and for everyone money means a different thing. I have listed down the trend in the society and what we observe with most of the people when we work with them.

Manish

Hi Rohit Joshi

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

I am a married software professional from Pune and my package is 16 Lacs pa.

I have bought a house costing 75 Lacs.

But that does not make me sleepless at night or nervous to speak.

Reason is, I am following the very advice of planning for networth since I started my career 12 years back.

So, while I take homeloan for tax exemption purpose, I plan to repay it using my salary and also maintain a good liquidity of 16 Lacs in addition to the down payment of 15 Lacs I have already poured in.

I know its still quite a risk but I have diversified my portfolio with money in PPF, PF infrastructure bonds, FDs and in 2 of my earlier purchased property back in my hometown.

I hope I too can help in financial planning if needed.

Hi Rohit Joshi

We are not talking about 100/100 people here . But a section of people and how they are leading their lives . We have shared our observations out of working with clients and what we see them.

We know there are many people in India who are doing well moneywise and also thought wise 🙂

Most of my friends and relatives of my age (I am 27) want to livc life to the fullest.

By fullest, they mean to spend on or to enjoy each and every luxury be it as big until it can be buy with their last penny.

The reason for such behaviour, which I concluded, is peer pressure. And they think it’s not the right time to take action over these topics.

So it is something that need to be rooted in mind from the day they start using money.

Welcome .. Glad to know that Vikram ..

Hi Manish,

This is very true. Im 45 yr old, have been fortunate to have a decent job so far yet Im extremely fearful of the uncertainty and future. I have commitmments of Rs. 1.5L/M (my take home is currently 2.6L/M)and have a corpus that can geneate it @7% interest. However, all my savings are in FD and Im a loss on how to play the debt and equity fund to have month fund flow that would meet my requirment. I can parhaps reduce the month expenditure significantly but that woud mean significant compromises which my mind and heart is unwilling to undertake. I know if I invested prudently, my situation would have been more secure and peaceful. Thanks again for all your helpful articles.

Cheers,

Manish

Hi Manish

I know its always a battle between rationality and practicality .. We can help you incase you want our professional advice on this – http://jagoinvestor.dev.diginnovators.site/services/financial-planning

Nice Article….Now I will also talk (or atleast try to talk) about networth.

Welcome .. Glad to know that Sam ..

Well guys, it is so difficult to believe someone earning over 10L per annum and yet unable to invest a decent amount and squandering away money in lifestyle i.struments, loans etc. We are in real threat o consumerism. Only thing lackin in preventing a high income guy from becoming a high networth guy is just the lack of self control…

and forced investments 🙂 and right structures !

What a wonderful description of reality ,But most of the people are not ready to understand the depth of situation which they are going to face in future.

Great Keep Continue writing .

Thanks

Thanks for your comment Manoj Kumar Gupta

As I am follower of Manish, I liked the content but end of article is inclined towards sprituality or typical Indian satisfication fobia.

Guys, I am sorry but uncertainty is life. If you accept this fact then no one will get fear of job loss or future expences.

And last but not least: one need to decide the line between necessity and luxury. its un-common common sense. I am IT person, with 8 Yr. experience built bunglow worth of 40 Lakh (zero loan today & takes rent of 8K) , baught 1 BHK (37 Lakh Home loan) this year and enjoy trip every month with my 4 yr old Maruti 800AC!!

I know real estate is REAL and car is not real estate. I am glad and can drive 800 for next 4 Yrs. happily. Its negative statement Manish (“They are hell scared of future. Even though they are doing well today, they are still not sure what future has for them, they are depressed and fearful of expenses lined up for future. It has destroyed their peace of mind. They have good money coming into their bank accounts, but peace of mind is missing.”)

We are NOT scared at all. We are well matuared about our future.

If we are frightened of our future then everyone in the world is so!!

Note: I think you got word with someone loaded with negative energy while ending the article. Never mind & I am sorry if my language is offensive or criticising.

dear DK,

you are absolutely right, but manish is also not wrong. whenever we think, say or write a thing or idea, it is how ‘we percieve’ it about the majority of the population within the category we are talking about and there are many exceptions to any thoughts always. so you are an exception not a rule. but look around you, are all your friends , collegues or known or unknown people in same boat ( or in maruti 800 !!!)(i am driving my maruti 800 from last 17 years and wish to drive till death) as you. i am sure most of them are in the situation which manish has described (unless you are that lucky to have known only financialy literate and financialy intelligent people like yourself).

keep it up. best of luck

baljit

Hi Baljit,

With due respect, I agree with writer and you too but I am just afraid of negativity that “last paragraph” of article. It should not say that good income class does not get a good sleep, they are afraid always, they are depressed and worried about future!! I do not and will not agree and I smell it differently. There is a class in our society (I am afraid to use word sprititual – may create riots) who are jealous about good income class and they always say: money is not a good thing. Money breaks humanity and bl-lub-lub. And the last paragraph of article fits in the mouth of such people. Generally they hate IT people and blame them for increased living cost in the city. Again you got right to disagree. Thanks.

DK,

Just talk to one of your friends / colleagues who has been fired recently and you will know that Manish is right. As long as the high paying job is there everything is hunky dory. What he is trying to say is that most people do not think of the rainy day.

Hi DK

I am not talking about 100% here . I am sharing our experience out of working with clients and the trend we are observing. I assume its very clear that when we make a conclusion or share a point, the rule of “its applicable to a section, and not everyone” always apply 🙂

Manish

Hi DK

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Nice article.

one More Excellent Article and very True.

People spend more as their net earning increases and keep them at same place but Savings is so important that you need to plan it as a first priority.

Thanks for your comment Ganesh S

Nice article Manish and Thanks a Ton!!

For young generation in todays techno world, a huge income is flowing towards their bank accounts but they never know how they are spending.

I have seen my friends who are getting 30k+ monthly income but still at the end of month they need to borrow some money from others as they dont know where the hell their money wasted!!

Nice eye opener article for all of such ppl.

Welcome .. Glad to know that Happyinvest007 ..

Hi Manish,

As always one more introspective article.

I totally agree with you…I think that the current generation people more focus towards wants than needs which creates panic of future life because the pvt jobs are not secure and more over the high income people if they don’t start saving for future then they have to lead life in uncertainty.

I definitely teach these lessons to my kids.

Thanks,

Shravan

Hi Shravan

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Amazing article, put in very nice n simple words.

Welcome .. Glad to know that Harinath ..

Very good article as usual! The simplicity of the graphic is stunning and effective. It is indeed worth 1000 words!

Along with this, you could’ve added some Do’s at the end of the article, to complete the ideas of what “to do” for each “not to do” item. This is to reinforce the ideas, and will clear doubter’s minds.

Hi Bharani

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

nice article. specially I liked the last Para. the same situation many people are facing. bcz today the companies paying high but not using SKILLS of person. the business is CLIENT oriented which ruins their future manier times.

I like your website very much and good thing is its guiding and helpful.

Thanks for your comment Manish

Wonderful and apt article. Here are my suggestions: the first step after earning the first pay cheque should be to save at least INR1000 (the min. amount) by either opting for a RD/SIP. It is because building a decent corpus is a must. Once a sizeable amount of money is saved as emergency corpus, then one can save for other goals such as a car, house and so on. And I do think it is quite simple to achieve this, if one wills to. 🙂

Hey Nivedita

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Another awesome article Manish.

I think the problem with today’s generation is that they just don’t want to think whatever life we are living now, can we be able to live the same life after 30 years? I am totally agree with you that people are happy that they are earning huge money today, but will it continue for long term?

In daily life we should teach them the meaning of saving, when to get reward, how to utilize old stuffs/toys in a better way instead of buying new one every time. If we are able to follow a good money management at home, then kids are bound to learn those good things. As kids learn from home only whether good or bad.

Thanks for sharing your experience once again. 🙂

Hey santanu

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Another masterpiece…

Thanks for your comment Dinesh jain

Wow. Manish.

Good article.