Tax saving investment declaration to Employer – How does it Work ?

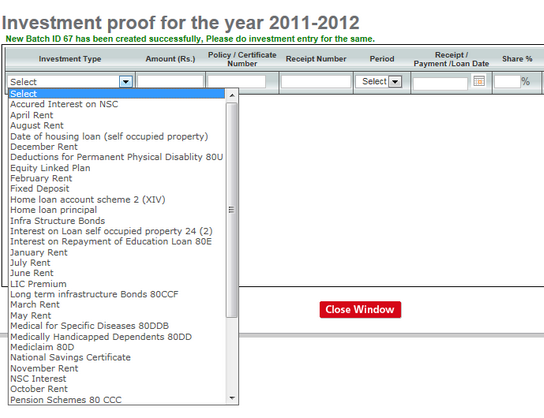

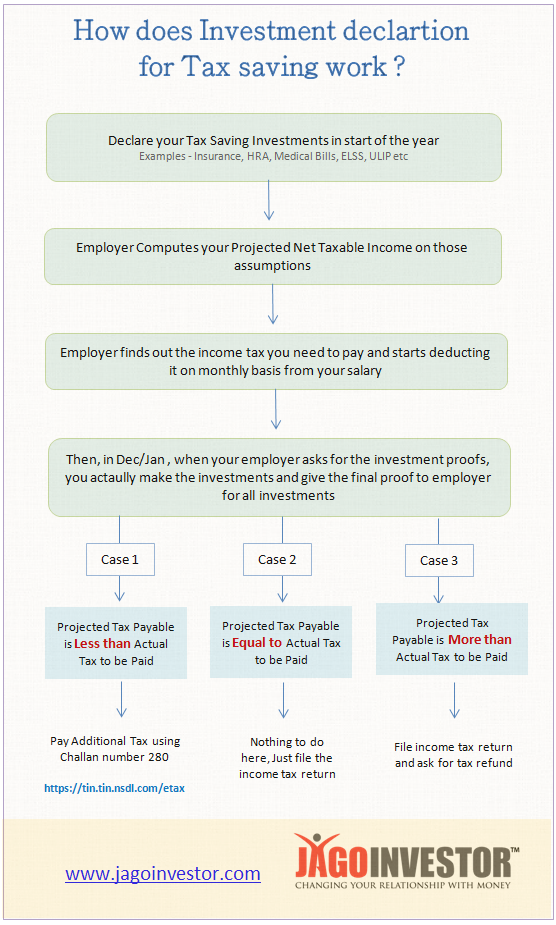

Every year, when the new financial year starts, employers ask their employees to declare their investments and give an idea about where will they invest to save the tax. There is a page on the companies’ websites, where each employee has to declare their investments. Come of the examples of the target options are life insurance premiums, ELSS investments, Rent, Ulips and home loan-related numbers.

Why do employers ask for this investment declaration?

The employer asks for this information because they want to approximate how much will be your final taxable income (after deducting the tax saved through 80C investments, HRA, Home loan and medical bills. So that they can cut a constant amount of TDS each month.

A lot of employees get a bit tensed thinking, what exactly they should mention while declaring the investments. They feel that at the end of the year, they will have to invest exactly in the same order in which they declared. However, this is not correct. All you need to do is invest the same amount declared at the start of the year into any tax-saving investments option.

For example – If you had declared that you will invest Rs 50,000 in LIC policy and Rs 30,000 in Tax saving mutual funds (ELSS). The total is Rs 80,000. Now your employer will deduct Rs 80,000 from your projected income for the year and arrive at net taxable income and find out how much is the tax you need to pay at the end of the year (projected). Now he will just divide it by 12, and find out the monthly number and start cutting that much tax each month from your salary.

Now when the month of Dec/Jan arrives, your employer asks you for investments proof. Now when you actually give it to them, they recalculate things and see if things are matching with what you declared at the start of the year or not.

There can be 3 scenarios here.

Case 1 – Amount Actually Invested Less than Amount declared in the start

In-case you were not able to invest up to the amount you declared, or you were not able to submit the documents to your employer on time, it means your employer will assume that you will not be able to do so, and that means that they have over estimated your tax saving and the tax paid by employer is lesser (because you owe more tax, due to less tax-saving investments) . In which case, the employer will recalculate your tax liability and now will adjust it with the next 1-2 month salary (Feb/Mar). Which means you get less salary in the last 1-2 months.

But, If you are able to finally invest for tax saving, then at the time of tax filing you need to declare it and ask for a tax refund from the IT department. It’s always a good idea if you can avoid this situation because then it takes a lot of time to get back your refund.

If for some reason, your employer does not cut the tax from your last month’s salary, then you directly owe the tax to govt. This can also happen if you have any other income source, which is not accounted for by the employer, in that case, you need to pay the tax to govt directly. You can do it online using Challan 280 on the IT department website. Then at the end of the year, you can file the returns.

Case 2 – Amount Actually Invested = Amount declared in the start

If you invest the same amount as declared at the start of the financial year, it means that your taxable income would be almost same as computed by your employer and the amount of tax you paid was equal to what you owe to the income tax department. In this case, there is nothing much you need to do. just file the ITR at the end of the year and everything should be pretty smooth unless you have income from other sources.

Case 3 – Amount Actually Invested More than Amount declared

It might happen that you declared only Rs 50,000 investments, but finally invested Rs 1,00,000 into tax-saving instruments, which means you saved more tax. However, your employer has been deducting the tax assuming your declaration for Rs 50,000 only, which means the employer was paying more tax to govt on your behalf. Now, this means you are entitled to get a tax refund and you can ask for it when you file the returns. Generally, it’s a good idea to declare the maximum possible investments in the start, let your employer assume you will do maximum tax saving (so that less tax is paid), and then make sure you actually invest the promised amount. In the worst case, if you fail to do so, better pay the tax at the end of the year or get less salary (be prepared for it)

This article from Bemoneyaware talks about this topic in much detail. Did you get clarity about investment proofs for your employer? Do you have any questions?

June 20, 2013

June 20, 2013

Is it compulsory to the employer to take declaration of investment from its employees.? If yes, then what is the clause of IT rules,

Because My Employer is deducting my tax from my salary and not ready to take declaration of investment. Even I am ready to give declaration of Investment. I am disgusted by this issue. Please look into this.

Hi Manish,

My employer states “Failure to invest and produce investment details will attract TDS at a higher rate”

Does it mean higher ‘percent’ or penalty?

or will the deduction be the same as usual as per different income slabs?

I think it would be the rate !

Hi Sir,

I have declared investment of 15000 through my company in the month of December, 2015. I have investment 1,20,000 in PFF in the month of Feb, 2016 now. So, while filling my ITR through income tax website, should I declare both or any one?

What kind of investment you declared for that 15000? Did you submitted the proof for that?

If is was PPF and proofs were submitted then you need to declare the balance amount 105000 only, if not declare complete amount and get refund.

You need to declare both

Dear Sir ,

I want to ask you, if i didn’t submit the investment declaration and at the end of year i had given my investment proofs, then what will happen. Is it possible to do so.

Your proofs will be rejected by employer , If declaration window is still open i would suggest to declare it and submit the proof , else while filling the ITR you can show these proofs and ask for return.

Show these proofs>>>

How to show the proofs, there will be no attachments can be added .?

How to show the proof while filing ITR?

While filing ITR, you don’t need to furnish any proofs of investment. Your declaration is enough but whatever you declare must be true as it’s legally binding. You also need to maintain all investment proofs for atleast 7 years just in case you are selected for scrutiny for the IT dept.

Dear Team, Happy new year 2016 !

I have a query regarding the recent ULIP plan I have purchased on 23rd Dec 2015

I want to declare this for investment but the declaration page is now closed in my company.

How can I avail ta benefit for this for FY 2015-16? Is there any other alternative?

With tax proof submission deadline of 6th Jan for my company, I request you to please reply soon.

Looking forward for your co-operation.

You wont be able to do it with company. Now at the time of filing returns you will have to apply for refund by disclosing this.

Hi Manish

I have made investment declaration under HRA and Public provident fund. Now, i can show proof for HRA but i have not made any investment under Public provident fund. Now, what are the consequences and what should i do to avoid any problem. Iam totally new to this. kindly help

THe only effect is that now in the last months of the year, your tax will be deducted more (recovery of that part which you saved) and you will get less salary in last 1-2 month. Thats all

Manish

Hi,

I have missed the deadline provided by my employer for Tax. What should i do ?

1 – Can I pay the tax after the deadline

2 – If i can pay the tax then what is the penalty for the same.

3 – My IT deducted was 2.5k in Sep

Please suggest some solution on the same

You can still pay it, if there is any penalty it will be levied

Hi Manish,

We declare our tax saving investments for the complete financial year.(Apr- Mar)

At the time of proof submission in Dec/ Jan , we would not be able to submit the proofs for the last remaining 3 months Jan- Mar for, let’s say, the investments which have are deducted on a monthly basis as of course they are not yet done.

I wanted to know how do we submit the remaining proofs that we have missed.

Shall we send them while filing ITR ? OR do we have to seperately send those proofs.

Hi Manan Mathur

You dont give the investment proof for that. You just give the declaration that you will be investing for the 3 months and what ever you say is taken as your words 🙂 .

Hi Manish,

I just wonder how are the investment proofs verified and mainly the loan proofs of housing and education.

do the IT department get the data from banks?

and the donations to political parties? would they be cross verified with the records of the political parties?

thanks in advance,

Alok

Hi Alok

They are NOT VERIFIED 🙂 ; They are just assumed to be correct and are processed .. The onus is on you in future to prove things if things are opened back and if there is any scrutiny ! ..

Hi,

I have a small concern that, why we have to submit investment declaration in the beginning of the year? If we do not submit that then do companies pay monthly taxes to govt.? Or they put it in reserve and submit at the time of financial year closure? What is the process behind this? Please clarify.

Thanks,

If you dont declare your investment proof in the start, then company will cut the taxes and pay it to govt each month . Its called advcance tax, which companies pay on your behalf, so what will eventually happen is that you paid more tax in start and later when you actually invest for tax saving you will have to ask for refund . So that adds to your work .

Manish

Hello Manish,

What will happen if i miss the deadline of my employer to provide an investment declaration, means now the software does’t allow me to fill any declaration. In this case my employer will deduct the max TDS possible.

My question is, can i at the end of the year, ask my employer to get me a Tax Refund if i pay some House Rent or make an LIC policy?

Will be thankful to you for your help

Regards

Piyush

Piyush

In that case, you have paid higher TDS , but in reality it might happen that your actual tax is less than paid, so you will have to apply for tax refund. When you file your income tax returns at the end of the year, you have to apply for refund in that. Employer is not suppose to do all this, you will have to do it on your own , either online or with help of CA

Manish

It really depends on the employer. Employers do not have any obligation to refund TDS already cut but some employers still do it if you can submit investment proofs in time. Some employers will give you a small windows (say 2-3 days) in March to submit your proofs one last time so that they can refund the TDS with the March salary. Unless you work for a very small company with few employees, you usually cannot ask your employer to take all this headache.

If Projected tax payable is less that the actual tax to be paid… Then they will collect the remaining amount from Jan/Feb/Mar. Thats fine… So my question here is… If I project more investments in the month of Apr for that particular financial year and I dont show up any proof’s on Jan Month… will there be any fine ??? or it will be just deduction of tax amount from rest of the months (Jan/Feb/Mar)

It will be deducted from Jan/Feb.Mar .. there wont be any penalty as such !

hi

I have no employer who will declare my investments.So how do IT department will deduct my tax and if ever they will deduct where can I declare the investments and expempt from tax ? My salary is 6 lacs per annum how much the TDC will be deduct if I will not show any investments ? And if I want that my TDC would not deduct then how much I have to invest?

Kindly reply.

Sareeta

If you dont have an employer then who is paying you 6 lacs of salary ?

Manish

I have declared my home loan investment in last company. Also declare the same investment in current company(February) also. Can I declare the investment (declared in last company) to current company? If I do so do I need to specify the difference of amount as other income while filing form 16?

Please share your detailed explanation

Rasik

I think a CA will help you on this matter properly

Hi Manish,

I was travelling when my employer asked for investment proofs. I have missed out on the window to declare my investments. What other alternative do I have to declare my investments? What will be the result on not declaring my investments?

Please enlighten me on this aspect.

Regards,

Aditya

The result for not declaring would be that your tax will be cut more than what you need to pay, because your employer has no idea how you saved the tax. But now at the time of filing your income tax return, you can claim bank your excess tax paid. The only problem now is that it will take months and years to get back the money . So overall the problem is that unnecessary headache of claiming back the same money which you could have saved at your end, by declaring your investments !

Thanks for the timely Article Manish,

For an under construction appt, can I ask the bank to give an approximate amortization schedule & based on that can I declare the income tax investment proofs for upcoming FY ?

But unless you have the Possession , you cant claim tax benefit, at least not for principle !

Thanks Manish, can you pls explain more or give a link if this is already answered.

what document marks the possession, the occupancy certificate ? my question is I can claim I have occupied the appt, but actually I can occupy at later stage. So you mean that i need to calculate the effective interest in FY & then do it one fifth & this will be pre-emi which can be claimed over upcoming 5 years in equal parts?

If you have occupancy certificate and complition certificate , then YES, you can claim the tax benefit ! . You dont need to be “physically” present inside the flat 🙂

Manish

Dear Somnath, i had this doubt, my LIC premium is due in march 2014, but the website is not allowing to pay the amount early. even confirmed from LIC official that premium can be paid few days before due date online. After that I came to know that such insurance premium are considered exception & you can attach previous years or relevant proof & instruct the company to compute tax accommodating that x amount will be paid in feb & dec. ofcourse when dropping the proofs , there is a declaration & one has to sign – Do read this carefully for any extra conditions !

Dear Manish,

Thanks for nice article. Actually I have doubt i.e. I bear two policies for that monthly premium is paid through ECS. now our company is asking to give the investments proofs in month of Jan. How can i claim for the Feb. & Mar. premiums?

When I used to work in YAHOO, there was a declaration form to be given, which we promise to make payment .

Manish

Hi Manish,

I have a query on when exactly I need to start paying EMI for my home loan. I bought a flat recently which is under construction.I took loan from SBI and opted to pay the EMI from May2014 onwards. My question is -Should I start the EMI immediately or later; which one would be better. Please note that I don’t have any other commitments as such currently.

Regards

Asha

If bank allows you to start the EMI later, then its the best thing .. so start the EMI later only

Hi Manish

Your article sparked me to think differently about this. Assume my salary (minus my HRA etc; i.e. what we put in ITR form) is 5,00,000 and I declare 1,00,000 in 80C and another 2,00,000 as something else (say donation to PM relief fund). So here my tax liability is ZERO.

Later on in the month of Feb/Mar; I’ll document it correctly and pay tax as TDS. OR else I pay it to govt in the month of June/July.

I see a benefit here: I will be getting ~ 2.5k extra each month (which I wouldn’t get had I declared everything correctly). In the year end I had to pay 12*2.5 = 30k as Tax. But I need not pay any interest. I can make an RD of 2.5 monthly and make around 32k (2000 extra) at year end.

So I have 2k extra at the end. And it is completely legal. Small scale entrepreneurs don’t pay any TDS. They pay at the end; so why not us ???

—

Nikhil

True , you can do this . If you feel 2k is worth it, go ahead !

Dear Nikhil, I’m not sure that you are aware or not but you can not claim tax benefit on merely declaration of 2L Rs. donation in an eligible fund. There is more to it, the section 80G benefit is restricted to 10% of your income. So for 500000 Rs. income you can not claim benefit on more than 50000 Rs.

Thanks

Ashal

Yes Nikhil, this is a good idea. In other words you are just postponing the paying of tax, but ensuring that you definitely pay it within last date of FY. to extend this one can declare 1L savings under 80C & during dec/jan when company asks proof one can submit say Rs 80K investment proofs. the tax will be adjusted in coming months easily.