Non Convertible Debentures – What are NCD in India ?

We recently saw few Non convertible Debentures coming into market like Shriram Transport Finance NCD, Muthoot Finance NCD and Manappuram Finance NCD. A lot of investors wanted to invest in these NCD’s and many did. But does each of the investors understand what NCD is and how it works? What are the risk factors associated with NCD in India? Let’s look at it…

To understand non convertible debentures, it would be a good idea to understand convertible debentures first. As the name says convertible debentures are those debentures which are converted to normal equity shares after a specified term. Till that time these debentures earn regular income in form for interest but once they are converted to equity shares, they are just like normal shares.

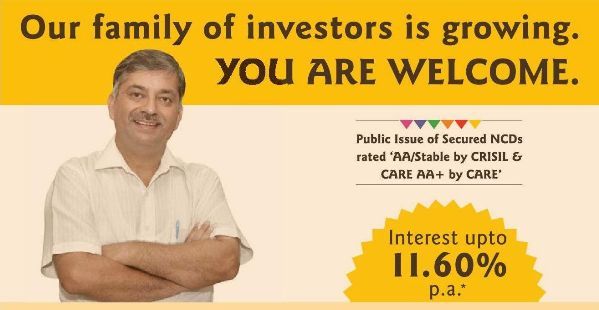

Hence non convertible debentures (NCD’s) are those debentures which are not convertible to equity shares. NCD in India more or less work like company fixed deposit, where you are lending a company to get some interest income and your money back after few years. You need to check the rating of that bond. Such debt bonds are normally rated by credit rating agencies like CRISIL. A good rating indicates reasonable assurance of safety and return of principal as well as interest.

Non convertible Debentures can be secured or unsecured

A NCD can be a secured NCD and unsecured NCD.

Secured Non convertible Debentures (NCD) are backed up by some assets which can be liquidated for paying off the bond holders incase something goes wrong. For this reason, the returns on secured NCDs are lower than unsecured NCDs. See a discussion on Tata Capital secured NCD on our forum

Unsecured Non convertible Debentures (NCD) are the ones which are not backed by any assets and incase company is in financial crunch, there can be an issue in paying back the bond holders. Only after the payment is made to every entity which has some security, the unsecured NCD bond holders have any chance of getting back their money. So that’s the reason why these NCD’s have high interest rates.

The transparency in NCD is another issue, a lot of companies have come up with NCDs to raise capital, but a common man does not have time and ability to study the NCD and how safe it would be. Look at the following comment:

Can an NBFC disburse all the money it raises? Investors also do not know how much the company has borrowed. The only document for analysis is a (dated) balance sheet. In addition to public offerings, NBFCs constantly tap the ‘private placement’ market for debt. So investors don’t know the total debt burden. There was a subsidiary of India Infoline which raised money through the NCD route. How could investors know that the proceeds were going to be utilised for a subsidiary? In the 1980s, there was a craze for fixed deposits from leasing companies, thanks to high interest rates and fancy incentives paid to investors and intermediaries. The lure was the promised rate of return and not credit quality. The same herd mentality is on display now. At some point, there will be some defaults. – via moneylife

Features of NCD’s

- They are listed on stock exchanges. Hence, provides liquidity to holder.

- The tenure of NCDs can be anywhere between 2 years and 20 years.

- NCDs are rated by rating agencies such as CRISIL.

- If you buy a NCD that pays interest then the interest will not attract TDS

- The debentures are generally offered in four options: monthly, quarterly, annual and cumulative interest

Taxation on NCD

Taxation on NCDs is just like debt funds. If you sell your debentures before a year, the profits will be added to your income and you will pay taxes at the same rate as per your income tax slab. But for any profit made by selling it after a year, you will pay tax of 10%, if indexation is not done, or 20% if the indexation is done.

Did you invest in any NCD ? Did you knew how NCD worked ?

October 24, 2011

October 24, 2011

This is a great intro. How can we find out if check the NCD is secured or unsecured? Are there any resources to check the performance of these NCDs?

It would be mentioned in the brochure. Find out online

let me know whether selling NCDs in secondary mkt or opting for buy back programme from the issuer company,the tax treatment would be the same i.e. Long term for bond held for 5 years

yes

Edelweiss has come out with Secured NCD. Coupon rate is 10%. There are options of yearly, monthly interest payout and also an option of FMP… I am a bit confused about FMP.. Is this Fixed Maturity Plan?? Can anyone shed some light on the same.

Its not FMP ! .. Its NCD , they are different !

नमस्कार सर

मैं एक कंपनी option one industries के बारे में जानना चाहता हु जो की NCDs बेच रही है जोकि भारत सरकार की 100 प्रतिशत सुरक्षा का दावा करती है और इसके लिए mca में 1 हजार करोड़ की संपत्ति को गिरवी करने का दावा कर रही है और (FD) जिसको fs, (RD) जिसे RI तथा MIP मंथली इनकम प्लान कहा जा रहा है ये 1,3,5,7 साल के RD का प्लान दे रही है तथा 1,3,5,7,10,14 साल FD का टर्म तथा 3,5,7 साल के mip कर रही है।

इस कंपनी के दावे पर कहा तक विशवास किया जा सकता है।

plz बताएं।

धन्यवाद

Hi Manish chauhan ,

I am having a capital of 1 Lakh, please suggest the best secure NCD to invest. Also I would like to get inputs of Indiainfoline NCD. Many Thanks.

BR, Sundaram

We cant recommend NCD’s to you currently

Hello ,

Thanks for the late reply.

I am surprised why can’t you able to suggest suitable NCD for Middle aged & Senior citizen with respect to age and risk factor which really help investor. Also we do accept that we (investors) are responsible for the investments decision made by us, seeking you advise since you are expert in this area. Happy New year wishes to you in advance

Because I am not aware about the current NCD going on . IT will take time to research on that.

How to get NCD investment back after the death of the holder, in case he is single.

Hi Rangarajan

You will have to claim it from the company from where NCD was bought. They will help you on that

Dear Manish Chauhan,

I have a query regarding the Issue of Unsecured Non Convertible Equity Linked Debentures by a Private Limited Company.

01. Is there any maximum limit upto which a company can raise funds through debentures.

02. Can we issue the ELD in 1:4 ratio (1 part equity 4 part Debenture)

03. Can the rate of interest be linked with the profits earned by the company i.e. higher returns in case the profits are high and lower returns in case the profits are low.

Thanks

Hi Mir

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

I am interested to invest in Kosamattam Finance as NCD for 36 month

They offer 11% monthly

is it worthful?????

If you are ready to take the risk. Then go ahead

Hi,

My parents purchased Partly convertible debentures of “The Tata Iron and Steel Company Limited” in August,1989. I have the letter of allotment specifying the holders name, folio no., allotment no, etc. I want to redeem these debentures but don’t have any clue about how to do so. All I have is a paper of an investment they did 26yrs back. Can you please guide me about how to redeem them?

I suggest contact the company in question here ..

im new in debt market, so can u please explain me NCD in simple words, as my knowladge is zero about this instrument!

Thank you

Hi Ritesh

We have already explained that only in article !

bhai mujhe ye puchna h ncds jo bonds h jo convert nai hote equity me vo ncds bonds secured h chahe company crupt bhi hojae

hi, i would like to invest 50000 muthoot finance NCD, for 2 years, but they said still not started NCD, so pls letus know where i can invest NCD..

You can leave your details on their website, they will connect with you !

If i have invested Rs 50000 in muthoot finance for 3 years then what amount i will get after 3 years.Please explain me.

interest rate 12%

Hi madhu

You can do the calculation and get that amount is roughly 70246.4 (50000*(1.12)^3)

Thanks for the prompt response! My understanding of your reply is that even if we do not sell the NCD but simply redeem it at the time of maturity, it is necessary to declare the income from cumulative interest only at the time of maturity and there is no need to show income every year, unlike in case of cumulative bank FDs. Is that correct?

Yes, thats correct !

Hi,

In case someone invests in NCDs at the time of first offer, goes in for cumulative option and gets the maturity amount. Should the interest added every financial year be declared as income the same year? Or is it okay to declare as income the total accrued interest at the time of maturity?

Secondly, in case of secured NCDs offered by govt. enterprises like IFCI, to what limit are investments insured? Or is there no insurance for those, but the company is liable to pay back the amount by selling its assets if such a situation arises? Can secured NCDs from IFCI be considered almost as safe as FDs in nationalized banks?

You dont need to declare the cumulative interest each year . YOu will have to declare it once you sell the NCD and realise the profit !

Hi Manish

We are intending to invest in NCD of 7 lakhs in Kosamattom Finance ltd, which promises a return profit of 14 lakh after 5.5 yr. I read your article and from what i’ve understood, a good rating for the company can be trusted for such investments.

I wish to know certain things like …1) Is KF Ltd a good rated cooperation and how to find out its ratings? KF ltd is not registered in SEBI but is registered under RBI.

2) Should we put this amount in secured debunture or unsecured NCD’s?

3) What are the ways of getting the balance sheet of the company as you had mentioned.

4) Is there partial secured NCD’s and are they better alternatives than the other two?

For example …… Incase of an NCD where a total of 5.5 yr included 39 months of secured NCD’s combined with the remaining 27 months of unsecured NCD, can you suggest what is the amount paid in return with respect to any bankruptcy or adverse state for an amount of 7 lakhs ?

Your suggestion would give me an insight into this and looking forward to your reply

Milli

A simple thing to understand is , higher the promised return , higher the chances of risk !

So if you are looking at doubling the money in 5.5 yrs , note that it might also happen that you do not get the promised money at the end of 5.5 yrs ,what if the company defaults ?

Manish,

With due respect , Youe answer to my query regarding cumulativ NCD seems to be wrong,because Indexation benefit isn’t available in case of NCD as per section 112 of Income tax act. Anyway my query is whether I should show my interest income/ capital gain income year wise or total income will be taken at the time of maturity or selling NCD at secondary market and under witch head CG/ or Income from other sources.

Yes, it was my mistake

Long term capital gains from NCDs are always taxable @ 10.30 per cent (including education cess of 3%) without indexation. I think you should open a thread to discuss on your topic at our forum, which will attract more people to put their views – http://www.jagoinvestor.com/forum/

What Is the tax treatment of Cumulative NCD? Suppose I Purchase 100 NCd of Rs. 1000 each and after 6 years I get 2000 Rs. Per NCD from company? How It will be taxed? And suppose after 2 years I sell NCD for Rs. 1300/- Per NCD in secondary market How taxed in this case?

The indexation will apply , see this – http://jagoinvestor.dev.diginnovators.site/2009/05/how-to-calculate-capital-gains-and-what_7801.html

Dear Manish,

My mom has invested some amount in not so known company Uro Agro India Ltd., which is registered in Kolkata but now collecting money from Mumbai as well. It is in the form of Non Convertible Secured Debenture and they are paying interest in cash every month regularly till date.

Now, I have come to know that this company is fraud and black listed by Ministry of Corporate Affairs. I want to get money back (the maturity is 9 years) prematurely. I have contacted company via mail but I have received no response, local agents flatly denied as it is for 9 years.

How can I get my money back, can you suggest some way out.

Thanks in advance,

Chhaya S.

the next step for you should be registering a POLICE complaint !

Thank you for the article.

I was told of Shriram Transport NCD by my agent. When I tried to find other NCD’s on the net (which is how I came to this article 🙂 ), I could not find any info.

How do I know of NCD’s coming into the market? It seems that timing is very important as the good / safe ones get oversubscribed quickly.

Regards

Roshni

NCD come into market as and when companies come with it .