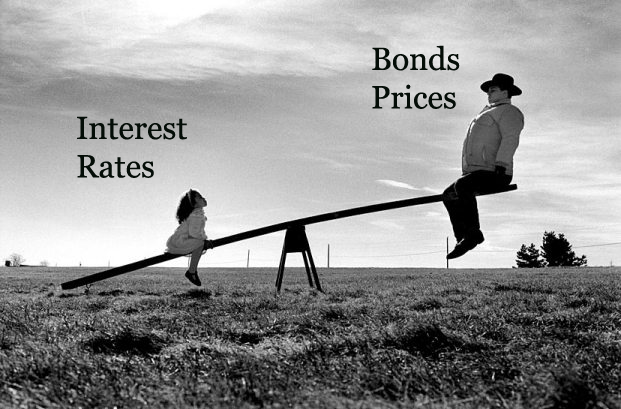

How Interest rate and Bond prices are related ?

Bond prices go up when interest rates go down! . Have you ever heard that and wondered how is it possible ? What goes behind the scene which makes it happen? It’s important for you to know this, because now a days there are enough financial products which depend on interest rates, for example Debt funds, Fixed Maturity Plans, Infrastructure Bonds and many products. In this article I will show you in simple language how bonds prices and interest rates are related.

How interest rate and bonds prices are related ?

You must have heard or read often that when Interest rates fall, bond prices go up and when interest rates rise, bond prices go down. Also in many articles you would have read a term “Interest rate Risk”, but always wondered why its is a “risk”.

Let me give you a simple example . Suppose in the market the interest rates are around 10% , Now Ajay lends Rs 1,000 to Robert for 1 yr at the interest rate of 10% , which means Ajay will get Rs 100 as interest next year plus his initial 1,000 of principle , so Ajay will get back total Rs 1,100 at the end of 1 yr. Now suppose they sign a paper where all these terms and conditions are written and we call this paper as “BOND” . Who ever has this bond at the end can go to Robert and get Rs 1,100 by giving them that BOND paper. Now imagine two situations where interest rates move up and down and a third person called Chetan wants to buy the bonds after interest rates has moved. Lets see how bond prices move in both the cases here.

Case 1 : Interest rates go down

Suppose interest rates in market falls to 9% because of government policies or some other reasons (in our country RBI keeps change interest rates).

Which means now if a person lends Rs 1,000 to some one, he can get only 9% as interest. But Ajay has a special bond! , which actually gives 10% return (also called as coupon rate) and not 9%. He is getting 1% more than what a new bond in market will give. Now if Chetan comes to Ajay and wants to buy this Bond from Ajay, Will Ajay give this bond at 1,000 ? No , This bond is worth more now, because this bond is giving more than what a normal bond in market can provide. What will be price Ajay can charge from Chetan ? It’s very simple maths.

If Chetan goes to market and invests 1,000 , He will get 1,090 at the end of the year because interest rates are at 9% only. So how much should Chetan pay for the bond Ajay is holding as he will get Rs 1,100 with that bond. It’s a simple calculation

=> To get 1,090 at maturity , Chetan has to pay 1,000 in current condition. so ..

=> To get Rs 1 at maturity, Chetan has to pay 1,000/1,090 in current condition.

=> To get Rs 1,110 at maturity, Chetan has to pay 1,100 * 1,000/1,090 today = Rs 1,009.2 (approx).

Which means as Ajay bond is giving 1,100 at the end , Its worth 1009.2 because interest rates moved down ! . So Ajay’s bond commands a premium of Rs 9.2 . You can see that 9% of 1,009.2 is equal to 90.8 and 1009.2 + 90.8 = Rs 1,100 which completes the equation .

Case 2 : Interest rates go up

In the same manner suppose interest rates move up to 12% in market from initial 10% . Now if a person lends Rs 1,000 to someone , he can get 1,120 at the end . Now Ajay’s bond is actually giving less than the new bonds in market . Why will some one pay 1,000 to Ajay to get 1,100 at the maturity , when they can lend the same money in market to get 1,120 at maturity , which is Rs 20 more .

So now if a person has to buy Ajay’s bond they will pay a less price (discount) . Using the same process you saw above you can find out that the new value of bond will be 982.2

=> To get 1,120 at maturity , Chetan has to pay 1,000 in current condition. so ..

=> To get Rs 1 at maturity, Chetan has to pay 1,000/1,120 in current condition.

=> To get Rs 1,110 at maturity, Chetan has to pay 1,100 * 1,000/1,120 today = Rs 982.2 (approx).

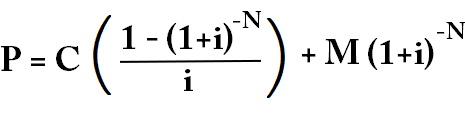

Now both the examples I showed you was a very simple example, considering maturity after 1 yr. It was just to give you a brief idea about how interest rates and bond prices are interconnected. However in reality bond pricing is much more complex as maturity can be much more than 1 yr. It can be 5 yrs or 10-15 yrs (SBI bonds). In that case finding a new bond price become a little complex . However the overall funda remains the same . You see what are the future cash payments you can expect from the bond and relate it to the current interest rates and find out the Net present value of the bond in today’s term. We will not go into how the complex formula is arrived at , but I am giving you the formula below which you can use incase you want some time.

Here is the formula which you can use directly for Bonds New price after change in interest rate .

Where

P = New Bond Price

C = Yearly Interest received from the Bond

i = New Interest rate

N = Number of years for bond to mature

M = Maturity value of Bond (generally its same as face value of Bond)

Real Life Example

Recently SBI came up with their Bonds issue. Lets say you invested Rs 1,00,000 in those bonds with maturity of 15 yrs and you are getting 9.95% interest on it and lets say that after 3 months SBI again comes up with another bond issue but this time they are giving interest of only 9% on those bonds. In this case your bonds will become more valuable now as your bonds give more interest that whats going on currently in the market . So now if you want to see your bonds on stock exchange it will quote a higher price which is P in the formula above and lets calculate it. Also lets see what are different variables in this case as per the formula above .

P = This what we have to find .

C = 9950 (9.95% of 1,00,000)

i = 9% (new interest rate)

N = 15

M = 1,00,000 (value you get at the end in maturity)

Now if we use the formula above we will get

P = 9950 * {( 1 + 1.09^15)/.09 } + {1,00,000 / (1.09^15) }

P = 1,07,657.7

Which means you will fetch 7.6% premium in market because of decrease in interest rates . Now you find what will be bond price if the next SBI issue comes with 11% interest ? Tell me in comment section . The example I gave you is based on the formula only and small details are not taken care of which can further affect bond prices in market.

Note that in your life, you make many investments where interest rates come into picture but it’s behind the scenes . I will talk about some of those here .

Infrastructure bonds and other Bonds

You know that we have infrastructure bonds offered in markets , Weather tax-saving or non-tax saving , most of those bonds are going to be traded on stock exchange, so if you bought any of those bonds in future when interest rates fluctuate , you know 2 things , what is the current interest rates and what is the final maturity value , using just 2 of these factors you can discover what is the current worth of those bonds and incase you want to buy/sell those bonds in stock market , you can command the right price .

Fixed Maturity Plans and other Debt funds

When you invest in Debt funds or Fixed Maturity plans , you give money to mutual funds and the fund manager uses this money to invest in bonds issued by Companies, government and other bodies . Based on the interest rates fluctuations in market they fetch good or poor returns based on their judgement . You as an investor would have more clarity about whats going on behind the scene . Just don’t be an ignorant investor who does not know how things work .

What you should learn from this ?

This article shows you how an investment can become attractive or unattractive based on interest rates, so incase you are planning to buy anything which depends on interest rates , better look at interest rates and study a bit on how it can move in future . If you are planning to buy some bonds today and there is anticipation in markets that interest rates are going to be raised at some time in near future , Your investments today in those bonds will go down in value because interest rates have moved up . At the same time if you feel interest rates will move down , It’s the time to buy those bonds !

This simple information is used by companies and govt to issue bonds , in the recent issue of SBI bonds even though SBI is giving 9.95% interest , if after 5th year they feel that interest rates can move down , they have kept their options open to kick you out of bonds and close the contract. Where as if the interest rates move higher , you can’t do nothing but you are stuck in those bonds for all 10 yrs , unless you choose you get rid of it by selling it on stock markets .

Share your comments about this and don’t forget to forward this article to any of your friends who were always confused about interest rates and bond price relation 🙂 .

March 10, 2011

March 10, 2011

A very informative article. I was always confused about bond prices going down when interest rates go up and vice versa. Your article explains in very easy language. Thanks. I normally invest in Bank FDs but now I will think about investing in Bonds. One question though. What is the difference between investing in company FD and NCD from the point of view of risk and return?

Not very different actually. NCD are tradable in secondary market ..

simply amazing …. i wounder how u fetch so much info ….. ur blog is addictive….. keep it up Manish

Thanks Rohit !

Nice article and it helped me to understand about the bond prices. Many times i dont know how bond prices can move up or down while watching on TV. But this article helped a lot

Thanks again.

Deiva

@ Manish

Wat an explanation…Really Impressed Bro.. It ws my v first Topic in the blog.

Thaanx a lot.

Can U plz give me 1 more info…

HOW 2 TRADE IN STOCK MARKET WID BONDS ?

WHAT ARE D FORMALITIES / REQUISITES?

Since I m still a NewBie , hence lukin 4ward to ur help and suggestions ..?

Suman

If you have done trading ,it should be same . You can buy and sell the bonds on market just like a stock

Manish

Hi Manish,

Again you came up with very informative article.

Thanks for sharing, it will help people like me to increase their financial knowledge. Keep it Up 🙂

Pradeep

Thanks , Keep reading

Hi Manish,

You have explained the things very well. Good informative article. I would like to know if thease bonds can be traded on exchages?

Abhijit

Yes , they can be traded in exchange !

Manish

Simple and lucid way to explain bonds Manish.. Good article from you again

hariharan

Thanks 🙂 . Keep reading !

Manish

@ Manish,

What we can do in the Interest Rates if goes up and down its simple and understandable but how to buy bonds or sell it ? Its via FMP or Debt Funds !!!

And what are all this Short Term Debt Funds or Long Term Debt Funds and which are the best of them pls write a article on that also.

Vinay

You can buy bonds which come in market like SBI bonds , Infra bonds

When you buy FMP or debt fund , you dont have direct control over bonds , its invested in behind the scene

Manish

five year plan, fixe returns

I have a slightly related question regarding debt funds here: http://jagoinvestor.dev.diginnovators.site/forum/how-to-choose-a-debt-fund/1380/

Dear Manish Ji

Which are those potential companies listed on exchanges which will give me dividends as well as price appriciation in long run ?

How can I find them as being retail investor I all the time may not have sufficient suorces for timely & right information but then I wont like to even leave the opportunity of asset creation in equity.

So what I should do ?

Please share.

Regards

Atul

You will have to dig out those companies , see other sources to find out which are the companies which have given good dividends from last 5 yrs ?

Manish

Hi Manish,

Nice refreshing article. Would refer this article to friends/colleagues.

Regards

Atul

Atul

Thakns 🙂 . Keep reading

fantastic article !! it does a lot more for beginners like me !! thanks a ton !!

Bigtimeloser

Thanks 🙂 . Keep reading 🙂

Manish

ofcourse,other things like credit risk,spread risk etc also matter.

BONDS ARE LONG TERM INSTRUMENTS, WITH ATLEAST 10 YEARS MATURITY PERIOD. YIELD I.E. INTEREST RATE IS FIXED ON BONDS FOR LONGER TERM. WHEREAS INTEREST ON OTHER INSTRUMENTS LIKES FDs KEEP FLUCTUATING. SO, WHENEVER, INTEREST RATES ON FDs FALL, PEOPLE START BUYING BONDS. LAW OF DEMAND AND SUPPLY WORKS AND BOND PRICES START GOING UP.

MANISH HAS AGAIN CHOSEN A VERY GOOD TOPIC. WELDONE!. QUITE INFORMATIVE.

Rajiv

thanks , Yues you can see some one above breaking his FD twice in three month becauase of interest rates 🙂

Manish

Very good article. Simple, lucid, accurate and informative. Any layman will understand it.

Anil

Thanks 🙂 . The focus is always on simplicity 🙂

Manish

Manish,

This is really nice post regarding bonds and interest. It is nicely written and very well explained. Keep it up dude!!!

I thought of investing current boom of infrastrure bonds in this year for tax saving, but i refrained from investing. I thought if 20K investment in such bonds will fetch 6K tax saving for time being for such long lock-in period. Rather pay 6K tax on 20K and effectively 14K can be invested in other avenues like MF or any other form which will give more flexibility in terms of returns. Let me know your views.

Navin

You know that , thats exactly how I think , If you are in 30% bracket and dont want any damn risk in life , then its fine to invest in those infra bonds , but if you are in 20% or 10% bracket , I wonder why people dont think before buying those bonds ;.

manish

Well if you fall under 30% bracket than i think infra bonds can be given chance as it gives better returns.

I went through all my old investments and i found out that in some fds i got 18-19% cagr whereas in another 10-11-12 cagr.

Ofcourse i found out my problem lied that i invested all at once and not in falling market .

But for 30% tax bracket i think it comes around 12-14% cagr which also is not bad.

Sorry i meant MF not fds……

Sohil

Yea .. 10-12% CAGR is also nice return considering you can get it for long term 🙂

Manish

yes but i feel one should try his best to bring it to 16% as i consider first 8% to inflation and the remaining you deserve for your hard work tracking that.

I was always confused about Bonds and Interest Rate relation, whenever i used to read ET , I never used to get it. Thanks Manish atleast next time i will be able to understand something. Can you put one more article on currency valuation moving up and down and factors affecting it and also on resistance levels of nifty that cones in ET.

Kamaljit

Thanks , I will try to see if the article you wish can be done some time soon 🙂 . Spread the knowledge ! , send the article to your friends

Manish

Manish,

Nice post, very well explained.

I have invested in Infra bonds and FDs.

But the fun part is i had to break my FD twice in 3 months since interest rates kept rising. But the best thing was the bank did not charge me any penalty.

Rakesh

Rakesh

Oops 2 times in 3 months is quite fast 🙂 . So as you are invested in infra bonds , is this information a value addition to your knowledge ?

manish

Banks didn’t charged penalty?Are you any classic customer(i mean most preferred type customer) for your bank?

ALso did you got the same return as the fd interest was or did they give you return according to the period by which fd was broken(in sense you have kept fd for 5 year at 10% and you broke it in 3 years .Bank was giving 7% for 3 years at the time when you made fd.SO did you get 7% return or 10%)

Rakesh,

I think, bank must have charged 1% penalty for premature closure of FD on your interest on said rate. I have invested 1lac in icici FD for 590 days having 9.25% rate and 1lac in SBI for 555 days with 9.25%. What they communicated is that, only 1% penalty for premature closure and I will be getting interest till that days where I will be invested in those FD.

Sohail / Rakesh,

Yes that’s right my bank did not charge any penalty. I am a preferred customer there, Moreover its not a schedule bank, its a credit-co.op bank. I had just invested for one month when the interest rates went higher i decided to cancel my deposit. It paid me interest at savings bank rate for the one month.

Rakesh

@sahil & Naveen

Levying the penalty charges for breaking FD is at discretion of the bank manager. You can negotiate hard with bank manager if u r account holder in the bank for fair amount of years. Say if u locked ur fixed deposit @ 9% p.a. and if recently bank increases interest rate to 10% p.a., then u can ask manager that u would like to break previous FD and want to lock money in new FD with current interest rate. My experience is as long as u keep ur money in same bank, they wont charge. But there will be charge of 1% if u want to break FD and move the money out of the bank account.

Regards

Jagadees

I agree that most banks doesnt charge penalty when one breaks fd.Specially as they are facing liquidity crunch they provide same as facility to customer.

But one point still remains whether interest rates are charged on days for which fd kept or the same % which i doubt they wont.

Very nice article.. I used to think.. but you have explained in a way a layman can understand…

Sriram

Thanks 🙂 . Did you invest in anything which is related to interest rates ?