Ability to take Risk vs Willingness to take Risk

A readers tell me : ” I invested 4 lacs in Sectoral Funds and now its down by almost 45% in one year. Now I need the money for my Sister Education in next 1 month, Should I withdraw it or wait for 1 month ? Manish , please advice ..”

I asked “But why did you invest in Sectoral Funds or even Equity” ?

Reader : “Because I am a High risk Taker, that’s why”

I call it breach of trust with your common sense. My hands were literally itching to slap this idiot when I heard this. We have to re look “Risk Taking” all together again . I have already talked about Risk here at How much risk you should take and Understanding your Risk Appetite .

[ad#big-banner]

What are the two elements on Risk Taking?

In our country most of the people are willing to take risk. They will say that they are risk takers , they have high Risk appetite , they love challenge, and all kind of nonsense. But they forget to consider their “Ability to take risk”. Its not important enough whether you are willing to take risk or not , your situation should also allow you to take risk. Ignoring your “Ability to take risk” can lead to situation like above example.

So mostly there are two components of taking risk .

- Willingness to Take Risk : This depends on our inherent nature, our attitude towards life, finance domain , Knowledge of financial products etc. Our whole upbringing will contribute towards this, because our willingness to take risk will depend on our inherent self , who we are from inside . So you can either be extra cautious by nature and may not be willing to take risks or you can be a big risk taker who is willing to sell his pants and bet money on anything. This is answer to “Can you take risk ?”

- Ability to Take Risk : This is the next Important part in Risk taking. Does your situation allow you to take risk or not ? It has nothing to do with your willingness to take risk , you can be very much a risk taker and dieing to bet on the next multibagger or invest in that 100% return a year mutual fund , but you have to consider a worst case at the end. You have to visualize the worst case as if it has happened after you take that risky decision . This is answer to “Shall you take the risk ? “

Let us have a close look at definition of RISK .

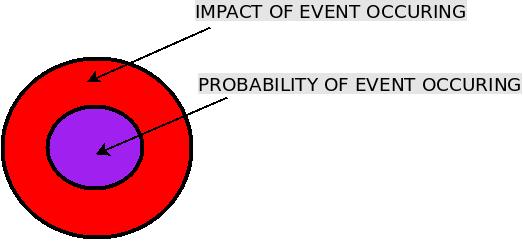

Boom !! .. So Risk is composed of two parts . Probability of Event occurring should be the secondary thing one should look at and Impact of event occurring should be primary. See the picture below to understand it visually .

[ad#dark_link_unit]

Probability of Event occurring : Most of the people unconsciously think about this. It happens a lot in case of Life Insurance , a general argument is that the probability is very less for them to die and hence they take the risk of not taking adequate risk cover through Term Insurance because they loose money if they don’t die , idiots! (See this post to understand the reason) . Same case with buying a mutual fund which has no credit to itself apart from a 100%return in last 1 yr even though its 8 yrs old fund and have a return of 8.7% since inception. The probability of these mutual funds giving return may be high, but in-case they fail, the impact it can have on your investments can be fatal , especially if you have not considered its impact on your short term goals. So the person in the example above never thought of the impact on his short term goal of Sister Education . He only considered that chances of event happening, which was low (mutual funds going in losses) and if he is a risk taker or not , but he never considered how it will impact his goal. Even though the chances of something bad happening is low and he is personally fine with it mentally by taking risk, the right decision was to better not take that risk because the goal associated with it was very important and the impact is severe overall .

Impact of Event occurring : This is the primary thing one should look at and then take a decision. Until an event happens its very tough to imagine it, that’s the reason you should literally close your eyes and try to visualise a situation and try to feel about it . So if you want to avoid a Term Insurance just because you never get your money back and you want to settle down with a money back policy (Like Jeevan Tarang from LIC) which gives you 10% of the insurance cover you actually require for a premium you can really afford, try to visualise a situation that you died and now your family needs the money after you are gone . Visualise how are they managing , Visualise how your dependents are already emotionally terrified and how they will fulfill their financial goals without you ?

Does it mean we should not take Risk ?

I am not against taking Risk . I love risk taking personally (but my ability to take risk is limited) . We are only talking about taking calculated risk here and being aware of what is the outcome of what we do. Risk comes from not knowing what you are doing. So take calculated risk. Know what can be the impact of taking a decision and be ready to face it when it happens. if you are not happy with the impact, don’t do it . “Not taking a risk” is another very severe risk people do. “Not taking a risk in your life if you are ok with the impact” is equally bad . So not taking risk can also have a drastic impact in your life . Below is a nice video i found for you to get motivated to take Calculated risk .

Conclusion

Recently I came to know that one friend of mine met with an accident while crossing road in Bangalore. He used to cross roads in hurry, because waiting wastes time and meeting with a small accident was not a high probability event ever. Though he was a probability genius , he forgot the impact part of this event . He is safe after this accident but impact could be much worse. Mathematics can never win infront of logic .

Finally at the end I would like to summarize this article in short. We take all sort of decisions in life regarding money , relationship , marriage , health and all of those decision have two parts, First is our willingness and how we feel about it and second is the impact its going to have in our life. This post is to build your FPQ (Financial Planning Quotient , I coined this term 😉 ) and that’s the most important thing. Taking a decision is last thing , understanding what you are doing is of utmost importance . So now their are some questions unanswered , which i will leave to you if its applicable to you .

- If you have a Endowment policy , its totally safe and secure , but have you thought of its impact in our life when they mature at the end ?

- If you are avoiding Health Insurance of your elder parents because of high Insurance premium , Do you also understand that the Probability of them getting some health problem is very high and the Impact is pretty severe . So when it actually happens you will wonder why you were foolish earlier.

- Is the travel Insurance of around Rs 110 worth when you go for air travel within India from one city to another or for that matter from one country to another (charges are not Rs 110 in this case) ?

- So if a mutual fund has given 150% return in last 1 yrs, has it happened without taking any risk? and are you ready to face the other side of coin ?

December 14, 2009

December 14, 2009

Hi,

Have you given answer to Yogesh Tiwari’s comment on December 14, 2009 at 9:42 am??

If yes, can you provide the link for the same??

Thanks.

The answer is “Term plan is not for those who already have enough assets which his family can use” .. many people who do not need term plan also buy it, its a waste of premium ..

yes, correct.

Thank for reply.

I had started reading this blog 15 days back and felt very bad when I thought that I had wasted so much of time in loafing around so many junk places and could not find a very good site JagoInvestor.com since 3-4 years while being a daily user of internet. But now I have an addiction to read atleast one or two or your article like a morning cup of tea to refresh myself and feel good. This is the place where I can get genuine and accurate information what I wanted to know.

Thanks for your honest appreciation Shailendra ! 🙂 . Keep reading

risk taking ability is just natural and it comes inheritly to one.some poeple calculate the risk before taking it and some not.its the basic difference.wise risk and fool risk.just same like wise and foolish descision.i like your post .keep up.

taranjit

i agree 🙂

MANISH

[…] established and are highly reputed, however you can’t take it at face value and ignore the risks involved. If you want to park money for short-term and are comfortable with the risks which come […]

[…] Age and risk appetite […]

Dear Manish Sir,

It is really brillent article, the way you explained the risk takings two component (willingness & ability) nicely explained…………………………………………………

Thanking you,

Rameshwar

Rameshwar

Thanks for the appreciation , Do you realise this is a big problem with people in India , we dont concentrate on ability part , did it happen all these years with you ?

Manish

I recently attended one training program on PMP and learnt the definition of RISK ie.

RISK = Probability of event occuring x Impact of event occuring.

It was explained in terms of managing RISKs in Project.

But the same definition is so nicely explained in terms of ‘Willing to take risk’ and Ábility to take risk’ in terms of personal goals.

Really Good article explained both in mathematical and logical ways.

Regards,

Yogesh Kanna

Thanks Yogesh

Keep coming .

As always good post…you are doing good job.. i hope this will create a lot awareness for newcomers..

thanks for your words 🙂

Manish,

A very good article on Risk Taking..

I need your advice on Critical health insurance because I am already having Term Insurance, Mediclaim and accidental insurance. Should I have to take Critical Health cover also if yes then how much and if I will not take what are the risks ….

.-= Vivek Rastogi´s last blog ..कमजोर ह्रदय वाले न देखें अगले साल (२०१०) की छुट्टियों का कैलेन्डर देखकर सदमा लग सकता है….. =-.

Check with your insurance if you can add the riders of Cirital and Accident .. If not , consider stopping it and starting a new one .. compare the cost in both the cases .

Manish

Great post as always.

Lovely explanation with in-depth analysis.

~Manickkam

Thanks Manickkam

Thanks for regular commenting .. its appreciated 🙂

Manish

Good article indeed.. can be used outside of the investing realm as well .. You are a ‘smart boy’ 🙂

🙂 Yes , very correct ..

The article just does not deal with finance but also general life

Manish

This was by far one of the best article on Personal Finance, I have read in a long time. The risk return trade off dilemma could not have been better explained than what you did and in such a simple terms and hence could not help posting this message. Kudos to you. Will forward link of your blog to my family members, friends, wellwishers and acquaintances.

Sansarchandra

Thanks for appreciation 🙂 . Thats would be wonderful

Manish

Hi Manish,

Excellent Article as always…Nowadays I begin and end my day by checking your website ….

I have one question

I have a health insurance cover from my company for 2.5 lakhs (floater including my dependent parents)

I am contemplating about taking personal health insurance for me (5 lakhs) , my wife (5 lakhs) and my parents(for 1 lakh + 2 lakh critical..this is the max available) in additon to the company policy

( What happens if I switch jobs.. or some other eventualtiy)

Is this taking too much insurance and being scared and conservative ..

Becoz this would probably cost me 30K annually .. Should I invest this money instead in equities and build a health corpus?

Whats your thought on this?

Karthik

protection is the first step of financial planning . So getting health insurance is right thing . Take a family floater for your self and your wife and take two individuals plans for your parents . the amount of cover depends on you .. what is the average you can expect 🙂 . 2 lacs may be less if you need 8 lacs for something critical . so this is more or less , its difficult to answer .

If you have seperate policies , then you will be covered till you defualt your payment , there is no relation with your jobs and if you are changing it .

Check on apnainsurance.com

Manish

Manish,

Nice article on investors risk, which is driving force of individuals financial planning especially while investing money in secondary markets and MFs. Most of the people will be under impression that, they are personally ready to take huge risks and fell themselves as so called “HIGH RISK TAKERS”. But unfortunately, they will igore their risk taking ability.

This article made the difference between risk taking ability & willingness to take risk very clear.

It will take more time for individual to understand their risk appetie by considering all these realistic measures. One should consider their financial limitations and worst case scenario before setting up their risk taking levels. They should revise time to time atleast in the interval of 1 year to reflect their actual risk taking capacity.

Great job Manish … Keep writing and focus on this kind of areas which are really useful and reach out to common investors like us.

thanks Mahesh

I appreciate your views 🙂

Manish

Couple of things I feel buyers of Term-Insurance could do:

1. Check out the terms of the insurance.

Whether it covers all kinds of risks – basically in addition to death whether it covers other risks

like disability, critical illness etc..

What are the terms for receiving sum-assured when such an unfortunate event occurs.

Terms and conditions should be READ COMPLETELY .

Also the application form should be filled only after the insurance form is either completely

filled by the applicant or the agent to help yourselves from getting taken on a ride.

2. Instead of buying a single cover at one instance, keep adding regularly say every 5 or 10 years

as your current income, expenses etc go up.. basically as dependency grows….

Always have some buffer cover for the intermediate interval period.

3. Instead of buying a single term plan from a single insurance company,

spread the cover across policies/companies..

4. And also check if that person has any dependents or dependency at all.

I was asked for taking an insurance for a person who is 60 yrs old and

who does not have any dependents.

Nice points .

Manish

Unfortunately agent or financial consultant sell only those products which will mutually benefit both investor and them or in the worst case their own interests. However these articles by Manish and discussions/ comments by readers help the propective investors to take proper decision at proper time.

Good article and good points of discussion.

REgards

Yogesh

Generally most of the Financial Planners also get commisions from the products sold , thats the reason its always better to go for a Financial Planner who is pure fee based . He charges only for consulting . thats all. you are free to buy product from any shop 😉

Manish

I think by financial consultant he is not referring to real financial consultants,

but rather agents who are either tied to one particular insurance company/bank/agency. I would not call them financial consultants at all.

As Manish pointed out financial consultants who provide advice for a fee and where advice is completely delinked from the customer buying/choosing products from him should be preferred..

A good financial consultant is one who also explains risks associated with it and also gives complete details of various charges involved, explains the impact of default of payment , corner cases etc..

One can trust if the above consultant can also provide comprehensive comparison among various plans/policies and makes his suggestions/conclusions and leaves it to the customer to make a decision without pushing the customer to take a particular policy/plan.

A agent who tries to focus/emphasize only on returns/benefits etc should not be trusted and customer should not waste his time by listening to him.

I feel above is applicable to investment products in general and not just insurance/ULIPs.

Hi Manish, Hope I am not spamming your comment section.

Nice points Praveen ,

You are correct. I am pointing to Financial Planners , not financial Consultants from various Companies , They will be biased to some level no matter what they do 🙂

Manish

A very nice article. This article clearly captures the important part which every one misses to see:

“Though changes might be low, what is the impact when that event happens”?

“How well would one be able to handle/absorb that impact”?

“Risk should be taken keeping into view ones ability to take that risk”..

This is something which is very important when doing financial planning.

Thanks for the appreciation Praveen ,

manish

Hi Manish,

Recently, I read this article , http://www.subramoney.com/2009/12/term-life-insurance/ , I am not sure what he meant with

“Yes term life insurance is an inexpensive product, but if you buy it without application of mind, it could be very costly, even if you bought it cheap! Best of luck. Think hard what can go wrong in a simple product like Term insurance?”

All I can make out is, if one buys insurance less than his total worth(amount that should replace him for his family, incase he dies) just to save money.

Kindly enlighten me.

Regards

Yogesh Tiwari

ok , i have a good reason 🙂 . But I cant tell here .. Have to save the answer for some thing exciting in coming days on this blog 🙂

Ask me this same question after 15th Jan

Manish