4 important things to complete when you Close your Home Loan

POSTED BY ON March 16, 2015 COMMENTS (145)

It’s a dream of most of the homeowners to own a house without any loan on their head. It’s a great moment in their life, when they pay the final EMI of their home loan or pre-pay the full outstanding balance and clear the home loan fully. It’s a moment of pride and happiness. It’s a great relief for someone who was paying the EMI from so many years continuously.

However in that excitement, a lot of people do not take all the required actions and later suffer because of small things they didn’t complete after closing their home loans. In this article, I want to share few things every home owner should complete, when they are closing their loan.

While I am focusing totally on home loan closure in this article, but whatever I am going to share also applies when one closes a car loan, education loan, personal loan or any other kind of loan.

Point #1 – Take back your original Documents from Lender

This is a no-brainer.

Make sure that whenever you close a home loan, you take back all the important document you had submitted at the time of taking the loan. Original documents are really important to collect, because in future if you want to sell the house or want to take loan against property, that time you would require all the documents. Some of the documents we are talking aboout are …

- Original Sale Deed

- Original Conveyance deed

- Power of Attorney

- Possession Letter

- Your Payment Receipts

- Any Cancelled Cheque’s given

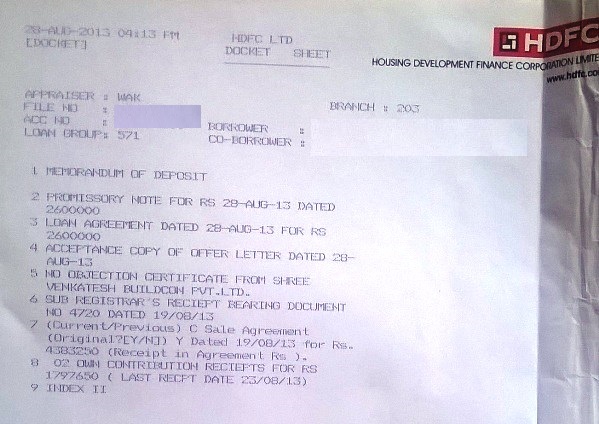

Some lenders even give you a copy of letter, mentioning what all documents were submitted by you to the lender at the time of taking the loan. Below is a sample list of documents mentioned by HDFC LTD to one it’s loan takers. It clearly mentions exactly which documents were taken by the bank at the time of giving the home loan. This really helps, because there is no confusion later and lender is also accountable towards the customer.

Make sure you personally go to the branch and collect all the documents yourself. Do not ask the lender to send the documents via courier or speed post. There are tons of cases where the documents were misplaced and investors had to run from pillar to post to get them back.

After getting the documents, you should also check if they are in good condition and no pages are missing from between. Also – If you can’t collect the documents yourself for some reason (like when you are out of country) then you can give an authorization letter to someone trusted, who can collect the documents on your behalf or ask bank to wait till you come back yourself and then take the documents.

Point #2 – Take NOC from the lender

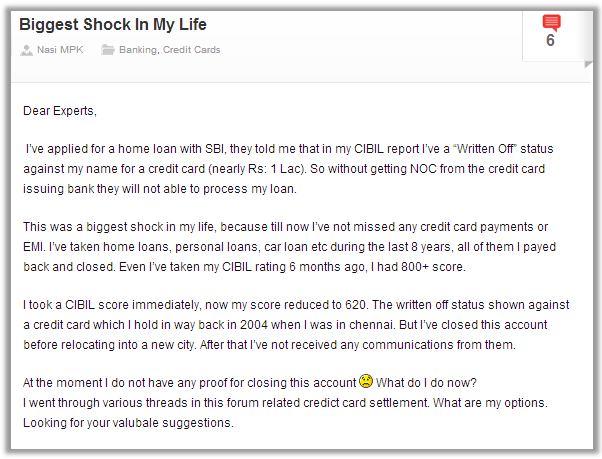

NOC or No Dues certificate is a legal document provided by the lender, which certifies that you have repaid the full loan and no outstanding balance exists. The document will have the lender stamp of the lender. It’s extremely important document, which you should collect from the lender. Below you can check out the experience of one investor who had no proof of closing the loan and how he faced issue due to that.

Usually, NOC/NDC is dispatched by the lender after the loan is fully paid. But if you do not get it by default, then you should talk to your lender. I have already written in details about the NOC and its importance

Point #3 – Remove Lien from Registrar Office, if any

Let’s first understand what is the meaning of “Lien”?

Lien means “a right to keep possession of property belonging to another person until a debt owed by that person is discharged.”

What is means in simple language is that, the lender will keep the right to sell the property themselves, if the loan taker is not able to pay back the loan. These days banks do not put a lien on property, because they anyways check the background of the customer properly and keep the original documents in their custody. But at times, it can happen that due to customer background or on a slight suspicion, lender wants to put a lien on property, which is done in registrar office.

So you should surely check with your lender, if they have put lien on your property or not?

And, If they have – then you should ask them to help you to remove the lien and overall process. Some people will ask – “What happens if I do not remove the lien?”

If you do not remove the lien from your house, then you will face difficulty at the time of selling the house in future, and at that time you have to visit the lender again anyways. So please make sure you complete this part as soon as your home loan is closed.

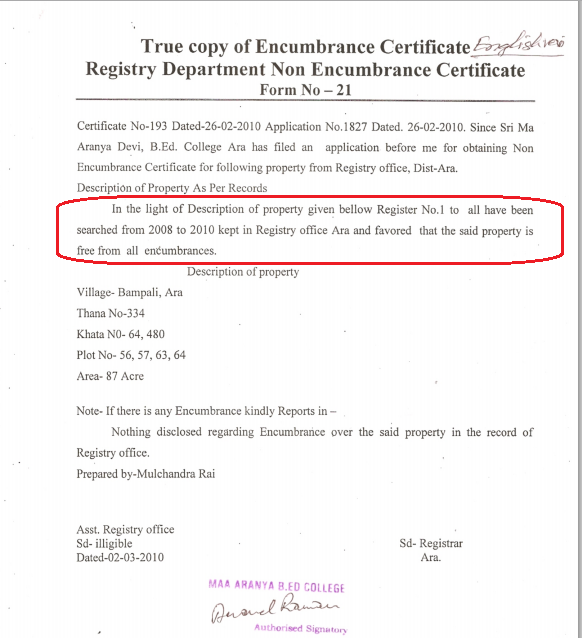

Once you clear the lien from your property, you can verify it back by applying for a new encumbrance certificate, which should mention that there is no encumbrance with the property, means no one has any legal rights in the property. You should see that its mentioned in the certificate. I was able to find a sample certificate on the internet which you can see.

Even if you are planning to not sell your house in future, still make sure you don’t skip this step, Its always a good idea to make sure 100% process is followed.

Point #4 – Make sure your CIBIL report is updated with CLOSED entry

CIBIL report is one document which records each of your loan entry and all your actions of payment. Each lender checks this CIBIL report before giving any kind of loan to you (even when they give you a credit card).

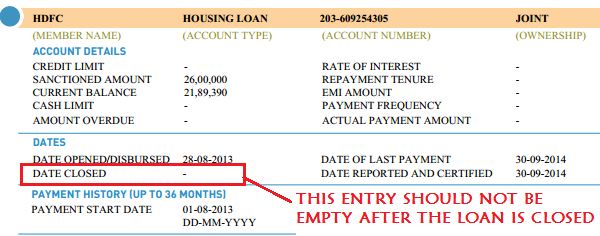

Once your home loan is closed, your bank should update CIBIL, that you have closed your home loan and an entry called “DATE CLOSED” should appear on your report with the date of closure.

But many a times, banks delay this small action or completely ignore it for months and years. Your CIBIL report might not have that updated entry. So you should double check with your bank at the time of closure of loan that they will update the CIBIL very soon.

So when should you check your CIBIL report again? A good practice is to check it after 60 days of closing the loan and verify if there is an entry of “DATE CLOSED” with a date on it.

Make your Home loan closure 100% full proof

I have tried to make sure that you take all the last mile steps after closing your homeloan. Even if you prepay your home loan early, still you need to take all these steps, otherwise your home loan closure will not be 100% full proof.

Let me know if you want to add some other point in this list and I would be happy to add it.

One more thing I wish to add that , IF MODT registered that has to be cancelled by the lender.

Can you share more about this MODT thing?

Very informative article,as my home loan is closing in next two months from now in February 2022,I want to collect all my documents from bank,but the problem is I took loan in Navi Mumbai and at present I am staying in tamil nadu, considering the COVID situation I can’t travel to Mumbai can I collect my documents in tamilnadu branch.please answer my query.

Its possible in most of the banks … Especially pvt banks .. I checked on twitter and most people said that got it themselves!

Manish

If you are not in the country then can someone else collect your documents on your behalf?

Check that with bank!

Sir, I am GpA holder of a property having loan from bank. Can I collect the original papers of that property after clearing all dues of the bank.

Whats GPA?

Appreciate the useful information shared here.

Glad to know that manu ..

Hi Manish,

I took SBI Maxgain home loan of 24L in Jun 2011 and I’m prepaying the home loan on regular basis. Now I’m working abroad and left with 1.2L book balance on my home loan, and am interested to close the home loan in next 2 months.

Is there a way I can close my SBI Maxgain loan account from abroad? Any power of attorney would help? Please clarify.

Thanks,

Kiran

Hi Manish,

Could you please help with this query?

Thanks,

Kiran

Hi Kiran

This article was written by someone else and we at Jagoinvestor do not have very clear understanding of SBI maxgain

Hi manish, can we use your blogs on loans on our website/platform, which attempts to empower loan consumer ..please look up whatsloan.com in next few days..

Regds

Timmana Gouda D

9900390180

timmana.gouda@whatsloan.com

Nope .

Thanks for the Exhibits. It helps in knowing what kind of document I should be looking at.

Thanks for your comment Anuradha

Dear Manish,

I have taken a home loan from SBI under MAXGAIN. Rs.30Lacs for a tenure of 20years, starting from Mar2012. EMI is 30K.

In between in paid back some amount at different occasions, upon receipt of bonus, arrears etc. At present my book balance is 10.67Lacs.

I would like to reduce my tenure to 15 or 10 years. I am 48 years and I would like to close my loan before the retirement. Hence this plan.

Are there any financial implications, in terms of additional financial burden/loss/negative points/higher interest etc. due to this? How to apply for this to SBI?

Your guidance would be highly appreciated

Thanks

Govind

i had take a loan for tractor unfortunately it is stolen, we had launched FIR for the same and intimate the bank for the same and tractor is also insured by the bank, my question is that can bank charge the interest on the balance amount after that the tractor is stolen if the intimation is already given that the tractor is stolen or the interest amount is paid by insurance company

Hi a

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hello Manish,

Good Day to you,

Would like to take your help here please,

This is Manish Chandrakant Khamkar age 28 year.. in last year 24-jun-2015, my dad passed away,.. he was employee of Union bank of India & he took home loan from his bank.. after his death bank closed his loan account and give me following paper regarding home loan.

1] Original Sale deed.

2] Original payment Receipts

3] Expired insurance Copy.

4] Xerox of Occupation certificate [ Not original].

5] Stamp duty & Registration receipts.,

6] NOC from Bank.

They have not given me below document

1] Original Conveyance deed

2] Possession Letter

3] Loan agreement

4] Any Cancelled Cheque’s

After reading your article.. i got alerts.. hence i need to confirm with you what i am supposed to do here please.

First check with your bank on this. Why they have not given all these docs ?

Hi, I have a home loan with Union bank of India. They’re charging me every year 5000 or 3000 in terms of legal fee which I can’t understand. Nothing was told to me when I went for the home loan. What can I do? Another question that I have is that the only document that I have received from the bank is loan sanction letter. Is that enough. Also the sanction letter doesn’t talk about the documents that are with the bank. What needs to be done?

You need to talk to the bank here. Ask them for the document which mentions the docs you have given them . And talk about that charge? Is it as per the agreement ?

good

Hello Manish,

I am going to purchase a resale house near coimbatore. The house is under mortgage loan for Rs 30 lac with private finance. I also need 15 Lac Housing loan from bank. what are the steps to do to buy safely? pl. note that the seller donot have the money to close his balance mortgae amount in his own.

Check if there is a way to take over the loan from bank ?

Hello

I am saddam from mumbai . My brother taken a education loan from bank of india . Borrowers my dad and my brother . We have taken loan on august2013 and in oct 2020 we have clear all loan amount . We have keep our property paper . And my dad is no more in march 2017 . But now bank is saying that bring leagal hire ship certificate . Of five child . We have given a letter of tailshdra also then also they are not issuing our property paper . I have told to that staff also we have a account from my dad and mom joined account is running from last 35 year and see over here when we take loan . And we didn’t say them to remove my dad name from joined they only done that . Over here what to do ? Please help me bcz my mom is not having a food also . She is taken a tensions .

Sadly this is not as easy as it sounds.

They cant release the property papers just like that. They have a responsibility to hand over the documents only to the LEGAL HEIRS and that has to be given.

Meet a lawyer in this case!

Hello Manish,

This is a serious query from my ends. It might be a bit long. But I will appreciate it if you get the time to get through this. I joined Infosys on 26th October,2015 as a trainee. I left on 10th November,2015 due to some serious renal disorder of my mother. I informed the company of the same and uploaded all the medical documents etc etc. I also informed them of the fact that considering the seriousness of the situation, I may have to resign. Now, I actually reigned on 26th Jan,2016 informing the company of the same and completing all the formalities. They accepted the resignation and actually informed me to withdraw the EPF. In the meantime,I was searching for jobs in my home town and actually got one. But I had not informed this new company of Infosys, I just joined as a fresher. I reckoned that 14days of experience would count nothing. Plus Infosys would take 45 days to send the relieving letter. So I would not have my letter in hand at the time of joining. Now, this new company is urging me to fill up the EPF form and all. And there I really don’t want to provide my previous employment details. I actually had not signed any form with Infosys regarding PF and all. Now my question is…would there be an UAN generated in my name already? Infosys has a PF trust. And my new company is registered to EPFO directly. What should I do? I don’t even know my PF account number in Infosys as I had not received my salary slip there for the 14 days(The salary was credited to my bank account though). I don’t want to withdraw or transfer my PF money with Infosys. Just let it be there. But I cam concerned with this new company of mine. What shuld I say on the form 11 option saying “Were you employed with any previous EPF company?” Provide previous company PF number or UAN. I don’t know my pf account number or UAN number as well. Should I lie there stating that I have not been employed etc etc? Technically, I was not employed, it was just training.

Plus I have not signed any PF related form with Infosys. Don’t even know whether they deducted any PF money from that 14 days salary !! The HR provided me with a PF withdrawal form though which I refused to withdraw. Now did they keep that deducted sum in any other account of them because they expected me to sign their PF form afterwards or not? I don’t know that.

I repeat…I have not signed any PF form with Infosys.

Thanks in advance Manish.

I dont think there is any issue here. Just fill up the form with new company. Forget the old company matter totally..

Can I close the loan by two separate cheques ? what is the RBI guideline on that

Hi Kunal Mukherjee

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Really Very Good Article…..Thaks for giving such a good information.

Thanks for your comment sushil

HI Manish,

we have taken loan against mortgage of home, which we paid all amount but still that co-operative bank asking payment are also there so they push us in court case but finally we won the case so there is no due on us as per bank remark , but they had put our property on lien what is the procedure to release our home from them, they also done complaint on some government office of local city about this loan but court has given order now in our favor, so please guide me in this process what need to do

Hi shanaya

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hi Manish, Thanks for giving good article on Loan.

I have taken a Home Loan with Axis Bank, Chennai, on a property and planning to pre-close the loan by Jan 2016. The property has lien with the lender. So I asked Axis Bank customer care how the lien will be removed once I close the loan. They say, they will give all the required document and I have to approach SRO and apply for removal of lien and when I question them, will bank not send any representative to make a transaction at SRO, they so NO. I was thinking, bank representative will come and help at SRO office [Chennai]. While availing loan, bank was following me and awaiting for my call all the time.. :), I know everyone will have the same experience.

Is this correct process from bank end and should borrower only to reach SRO to file release-of-lien with necessary document from bank and authorized bank official required?

I am not very sure if banks do help you on this or not. I cant verify it.

However I think the process should not be very complicated. Mainly you would need an NOC from bank that the loan is closed and the lien can be removed now. It will take 2-3 rounds .

Regarding banks not helping you, In crude language, now they dont need you and if its not mandatory by law, they will not care to help you.

Please note to inform your bankers to stop ECS payment to the loan account. Especially in case of prepayments.

Good point

Good Post ! i have taken a loan of worth rs 15 lac against my home is there some thing that if i am not alive in future or something happen to me my family should not suffer or they should not be homeless ….please guide me if you have any plan for this

You can take a term plan covering this loan

Hi,

I payoff my loan on 28th sept. Now I waiting for the release of documents from HDFC. How many days it will take for the documents to be released and NOC to be given.

Regards,

Rajeev Saini.

It takes 1-2 weeks for them to release the documents.

Hi Rajeev

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

as rightly said y Manish, it depends on organisation, where the hard copies are kept, Maximum time< 1 month.

Mr. Manish could you please tell what to do. I have paid full credit card bill without going for settlement . But in my cibil report it shows “written off”. Please advise for the deletion in cibil report.

Hi sunil

You should first get in touch with credit card company to find out why they have marked it as written off. I am sure there is something you do not know about your debt, I mean there was some outstanding and it was never paid off

Dear Manish,

Thanks for the article. I had taken back my documents in 2014 but had no proof of loan closure. After reading your article, I immediately went to the bank and asked for the certificate and got it. I don’t know how to check the CIBIL records.

You can just go to cibil.com and check your score and report by paying the fees

Sir,

I have an UAN. But recently I have changed my job, So how can I update my old UAN to my new pf Account?

Rgds,

Tilak

Check this article http://jagoinvestor.dev.diginnovators.site/2015/02/uan-epf-guide.html

Hello Manish ,

I thought of taking home loan from India bull Housing Finance Limited for 15L and tenure term of 10 years .

Confused whether to take from this organization or not ?

Please advise .

If possible please guide me through policy and procedure to take home loan since am very new to these things.

Thanks in advance .

John

I am yet not clear on your query . Please ask exactly what you need ?

Very nice article with meaningful points to consider at the time of closing the home loan !!

Thanks..

Glad to know that Dinesh ..

Hi Manish,

This query is very urgent as my father passed away last month and I am trying to close his paper work.

My dad had a home loan from ICICI bank. He had been paying it from last 12 years. Bank kept on increasing the tenure of the loan as and when there was an increase in interest rates. Bank didn’t inform about this to my father. There was no verbal or written communication in this regard.

So, my father kept on paying a constant EMI on the loan. He never came to know that the loan that he had originally taken for 12 years, is now increased to 24 years!!! Also, the outstanding principal is obviously huge because all the money went into paying interest for all 12 years.

Is it right on the bank’s part to not inform (and take consent) the customer about increased loan tenure? I feel this is cheating on bank’s part. What do you suggest in this case?

Thanks & Regards,

Vinita

As far as I know, if the loan is on floating interest rates, this change happens automatically, Bank is not suppose to inform separately to customer

Thanks Manish!

I have a joint home loan with my wife as the co applicant. My wife is also the joint property owner with me. Coming to the Income tax benefits on Home Loan,

1.) Can we both claim individual deductions of Rs. 1.5 lacs each on account of principal payments, i.e total 3 lacs by both

2.) Can we both claim individual deductions of Rs. 2 lacs each on account of interest payments, i.e. totol 4 lacs by both.

1. Yes, you both can claim that

2. Yes, same for interest

Hi Manish,

Could you please clarify my confusion on below points.

I am working in a foreign bank IT department as Software professional in pune. I am basically from Bokaro Steel city. we have a house (Home loan 8 L) in my home town on my mother’s name. My both parent are borrower in that loan. Now we need some money.

So we have two option –

1. Clear the loan amount and sell it to some one out side.Its current price 30 L or

2. I can purchase this property by taking a home loan(25L), so house will be within us and also I can take the tax benefit of that loan, so i am planning to purchase that property after clearing all the previous loan amount on that and then take a loan on my name.

Confusion or Query

1. whether ,Sell and purchase of property within family (between mother and son) will effect my loan eligibility criteria, as we are two brother(he has no objection on this decision, its mutual).?

2. Banks will give me loan or not as i am working in Pune and property is in Bokaro.?

3. I will not be staying in that house but my parent, So how can i use the tax benefit of this loan.?

Thanks in advance

Bipul

1. No , banks do not have any distinction in that. If you notice , bank nevers asks anything about the SELLER !

2. Yes, banks do provide loans for other cities

3. That does not matter, you dont have to PHYSICALLY present to avail tax deductions.What is required is that you have the possession of the flat, thats all !

Manish

Hi manish,

Are you sure abt point 1. I think bank does’nt give loan for transactions within blood relation, confirmed by both HDFC & ICICI bank.

regards,

nitin

Hi Nitin

May be its changed recently, but it was given earliar atleast. I have read some comments also in past which mentioned that two brothers had taken home loan together or mother + son

Manish

Manish is right, Why should they care for the seller as long as you can pay the loan and property title is clear. Parents can charge rent from son if he is staying with him then whats the problem in this Loan.

Thanks

Is it worth investing with http://www.smartowner.com. Suggestion please!

Hi rangabashyam

I cant comment on that. There are no public reviews on that !

Manish..A very informative article indeed..Just now suggested this site for my brother who just started his career abroad with a triple salary than mine :).. Hope i have done something good for him to improve his financial literacy.

My CIBIL score is 700 but im not getting loans anymore because there are some issues unknown. Do you have any artice to understand one’s CIBIL report properly??

Hi Vishal

Good to know that 🙂 . A 700 score is not that great . In last year more than 80% loans will given to those with score of more than 750 . So 700 is on lower side. The main thing is your CIBIL REPORT remarks . This PDF from cibil does of good job of explaining things https://www.cibil.com/sites/default/files/pdf/understanding-cir-ctc.pdf

Hi

My father have taken home loan from hdfc but last month he expired so now as I m the second applicant so I will decide to pay and close the loan so what should I do and care should be taken? as there is no insurance cover on name of my father..

Check with the bank first . Were you just a second bank loan holder or also you have the house in your name ?

Hi Manish,

Well explained article.

Thanks.

Hello Manish Chauhan,

Very important and useful, well presented with examples and sample documents

Welcome .. Glad to know that Kumar ..

hey manish ,

that was superb !!!

In my case , I have also taken loan from hdfc and they have also taken a undated ( but signed) cheque from me ( for their security ) whose amount is equal to my loan amount .So my question is , after i repay my loan ,is there any chance for the bank to encash that cheque ( even after i recieve a NOC from the bank .)

Yes, they can encash it they are evil 🙂 . But I never heard about it . What you should do is , you should ideally block those cheques using their numbers or using their date range from your banking portal . Most of the banks give that facility.

Also to be on safer side, you should take the cheque’s back from the bank once you close the loan

Mansih

Indeed a great check list. I have to keep this in mind while closing my loan. Thank you.

Thanks for your comment Sachin

Thanks Manish…once again very useful article!!!

Hi Manish,

Thanks for the wonderful article.

I have recently closed an Home loan with Bank of Baroda. I did make an Equitable Mortgage with them and the EC shows that.

As i have closed the loan , clear the Equitable mortgage with BOB ?

Cheers

Good article:

http://10ways2everything.com/101-tips-to-home-loan-from-sanction-to-closure/

lots of info

I have SBI CC the limit is 103000.which I used entirely and was paying Minimum payment everymonth.Last 5 month I missed paying mimimum amount,Now the outstanding 129000.and they are asking for the settlement of 80000.

They are also telling that IF I pay 80K My name will reflect in CIBIL as Settled and I can clear it off If I pay the remaining balance 49000.

Please suggest the best option

Yes, they are correct !

Hi Manish,

I have heard that SBI is giving Top-up home loan at the same interest rate of Home loan.Is it true?.Will I get tax benefit if I use the top-up amount for interior work?

No , For interior work you will not get any tax benefit

First of all, a great and useful article. Thanks Manish!

I have few questions:

1. I have SBI Max Gian home loan and equiatable mortgage was done at the time of sanctioning. So should we ask to cancel the deed of that equitable mortgage? Can you please explain what is the procedure (with SBI)?

2. Does SBI give Encumbrance Certificate after cancellation of such mortgage deed?

3. I also have SBI Life Dhanaraksha Plus LPPT policy which is a decreasing balance insurance. I read at several questions above that we should also claim back the future premium amount if we prepay the loan. Can you please share some info on this? Mr. Ramanan shared similar view.

Hi Parag

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

By the way, regarding point #3 above, I got it clarified myself when I read the policy document. It says that if the loan is fully repaid before the end of the repayment term, then the insured person is entitled to claim the surrender value at that time. They have a formula to calculate the surrender value. So basically we get back some amount of future premium when the loan is closed. 🙂

Hi Parag

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Thanks…! its very helpfull…

Thanks for the article.

Could you explain how to get Encumbrance Certificate?

You get it at sub-registrar office in your city

sir,

i had heard about RBI cutting home loan rates..i still dont see them getting reflect in my SBI – NRI home loan account yets -they are still at 11%.

how long will it take to reflect in my home loan account-

do i need to follow up with SBI on this..i heard nationalized bank are quick with absorbing these rates ..

Yogi

RBI never cuts the home loan rate, they only change the repo rate. Its the bank who have to pass it on . Its the SBI issue, so check with SBI .

Very good article

Very informative article.

Welcome .. Glad to know that Anshudeep ..

Hi,

I had 2 credit card, personal and car loan. I closed my personal and car loan 6 month back. My CIBIL score was 832 before closing loan and now it is 817 (832-817=15 is very less)

is pre closing loan affect CIBIL score (I never used 20% of my credit card card limt), Just I’m asking

No , it will not affect !

Hi,

We had taken loan from LICHFL, and then transferred that loan to a nationalised bank after few months.

Do we need to get the NOC from LICHFL as well ? What will be the process ? Now more than a year has passed since we closed our LIC account.

Thanks,

Pushkar

I dont think NOC is required just because your have switched !

OK. Thanks. Will keep it in mind while closing current loan account.

We took a home loan from SBI Max gain for Rs. 25,00,000.00 for 20 years, on June 2013 at 10.25% interest rate.

Upto now we paid every month Rs. 25,000.00 EMI and also we paid excess amount Rs. 5,00,000.00

Now we have Rs. 15,00,000 for remaining years

We want to change my interest rate 10.15% in the SAME S B I BANK BRANCH.

Questions:

1. Now Can i Proceed for that..

2. How much they will charge for changeing the interest rate.

3. Can i change my EMI for Rs. 20,000.00

1. You can do that. Pl check with branch manager. Though RBI instructed that the rates should be similar to all loans, banks discriminate old takers from the new ones and generally charge a fee for changing from one to the other.

2. Bank manager will tell you.

3. EMI can be changed by altering the tenure.

That said, one needs to take a view after considering few things. Do you want to keep the loan for the full tenure. If answer is yea, then can try for changing the rate. But if you want to repay in another 2 or 3 years, this may not matter much.

Please check all aspects before taking a decision

Thank u for reply. we will follow ur answer.

Welcome .. Glad to know that varalakshmi ..

sir,

i currently have a loan with SBI – that am close to paying it off.

a equitable mortgage was created as part of the loan sanctioning to create a lien on my property,per requriement of the bank.

after i close the loan, who is responsible for getting this lien cancelled and getting the equitable mortgage deed document cancelled…is it at the expense of the bank or the customer? what does the guidelines say..

Its the bank

A point, distantly related to this post.

Insurance on home loan. When a bank disburses home loan, they generally insist that the borrower take an insurance for the value of the property. When the borrower is in a hurry, he will not be able to decide and select best insurance cover and banks palm off sub standard covers.

Also the insurance suggested will be reducing balance type. A better way will be to take a constant value insurance at a competitive rate and provide the doc to the lender. This will not only help good bargain but also can be discontinued when the lone is foreclosed.

Hey Srinivas

Thanks for sharing your experience with all of us. It was a great learning.

Manish

being a banker , i must say this a very good article . i want to just add my two cents- many banks do insurance at time of loan and on prepayment say in 5 yrs or lesser some of your premium is refunded. dont forget that also to claim at the end.

Thanks for sharing that Gaurav

Can you share a bit more on that ? How does one get back some premium if they prepay ?

Manish

Thanks a lot

Manish

We also submit some 5-6 blank security cheques , signed cheques , i think

so that also need to get back , right ?

Hi svj_27

Yes. Good point, we should take that also back !

Hi manish,

Very useful article as 90% of the readers will use this article..

Welcome .. Glad to know that ashok ..

really a good article, thanks a lot for that, hope to have more of that kind

Welcome .. Glad to know that K N RAO ..

A Very useful article indeed.

At the time of closing the loan usually people are less careful, furthered by the euphoria of having squared up a liability…and most likely to be satisfied with the handshake and receiving a closed envelope with presumably their original documents. Now, if all pages are there, in good condition, whether there is other ‘Lien’ and/or whether NOC is issued etc, atleast I was oblivious till I read this article. Thanks a lot Manish.

Welcome .. Glad to know that Gowrisankar ..

This artical is very good for who is taking loans from , any banks.

Welcome .. Glad to know that manojkumar pandey ..

Thanks. Its a wonderful article.

Welcome .. Glad to know that Dhaval Mehta ..

thank uu so much many I come to know now , its very usefull

VP

Welcome .. Glad to know that V Priya ..

Really Helpfull

Welcome .. Glad to know that Mayur Keni ..

thank u for valuable information

WHAT ABOUT SETTLEMENT OF INSURANCE FOR FORE-CLOSURES, AS THE ENTIRE PREMIUM HAS BEEN PAID BY THE BANK OUT OF THE LOAN SANCTIONED/DISBURSED, ADDED TO THE LOAN COMPONENT, AND RECOVERED,!!!

Nageswara Rao,

You have a valid concern. The insurance you talk about refers to the one covering risks of non-payment of loans for reasons such as disability or death.

In case of foreclosure of home loans, the borrower should ask for the refund of the premium for the future period (i.e. from the foreclosure date to the maturity date of the insurance policy). Here insurance companies have their own methods of settling the amount and the amount one receives is at a heavy discount. My friend recently foreclosed his 15-year home loan account in 6 years and the insurance company quoted him somewhere around 40% of the insurance premium paid ( net of service tax).

Thanks Ramanan. I also have SBI Life Dhanaraksha Plus LPPT policy which is a decreasing balance insurance. I read at several questions above that we should also claim back the future premium amount if we prepay the loan. Can you please share some info on this?

Can you please tell me how to get the future premiums? Is there any specific banking term we should ask for?

Very important & useful information for Home loan takers

Tanks for the Information

IF A

N J Silver partner

Mysore

Welcome .. Glad to know that Chandrashekhar N ..

Thanks for the info, Manish.

Some more points ( apart from the ones you mentioned):

1. Cancellation of ECS mandate for monthly EMI payment;

2. If the property is insured for risks like fire, flood etc., with the financing bank having the first lien, get a letter from the bank addressed to the insurance company lifting the lien so that the bank has no right whatsoever in the insured property. Also follow it up with the insurance company to remove the bank’s name in the insurance document.

Hi Ramanan

Thanks for adding those points .

Thanx manish….as always ur articles are really of great help and practical

Welcome .. Glad to know that R K Kaushik ..

Hi Manish,

What a coincidence. I will be paying the last EMI next month and this article is what I was looking for.

Thanks a ton.

Regards

Atul

Hi Atul

Great to know that Atul !

Thanks Once again for such a good article

Cheerss

Important