Home loan prepayment online using NEFT payment

Replying to comments teaches me many things, so I want to share one useful learning today. One of the NRI reader called Rahul was facing a strange problem, He had taken a home loan from ICICI bank few year back and now he wanted to pre-pay his home loan. However the problem was that he was outside India and bank wanted him to visit in person to pre-pay the home loan. The other way was to go through a Power of Attorney route which is extremely lengthy process. So Rahul was really stuck, however Manu appeared and shared that he has been pre-paying his home loan by adding his LOAN account as third-party account and then doing a normal NEFT transfer.

One big reason why you should connect your loan account for prepaying your home loan or other kind of loans is because at times we get some spare cash in our life through bonus or some other reason but because prepayment needs some effort and physically going to bank takes away our excitement and all that money finds its way to some other expenses which could have been avoided. I was aware of this trick earlier but really wanted some more confirmations from other readers before writing it and now I have got 3 confirmations from different readers that a LOAN account can be added as third-party account in your online banking account and you can do a NEFT transfer to your loan account. This is a simple and powerful way of pre-paying your home loan or any other kind of loan because it’s at your finger tips and you don’t have to delay the decision of prepaying your loan just because of inconvenience caused by visiting the bank.

Let me share with you some instances where readers have confirmed about this trick –

Proof by Manu on Home Loan Prepayment through NEFT

I have done the similar way for SBI. In the last few months I have paid off a substantial chunk online without visiting the bank – in fact they themselves suggested this option. What Manish said should be possible with ICICI bank. It’s like setting up an account to which you transfer funds – lets say you send some money to your parents every month. You would have added their account in third-party transfer section. Same applies to loan account. Hope this helps.

Proof by Lakshman on prepayment by NEFT

I have a Home loan from state bank of travancore. I have online access to the loan account and part-paying is simply initiating a neft transfer from any of my saving accounts to this loan account. It has been very convenient so far.. Since its online, i can see the outstanding principal amount i have on any given day.

Proof by Pradeep on home loan prepayment by online transfer

Apart from PPF and other instruments, you can make part payment of your home loan or loan EMIs through NEFT also. Well I am doing NEFT transfer to my OBC Home loan a/c every month. Initailly it was paid through post-dated cheque.

Steps of adding your Loan Account to your online Banking account

1. Make sure you have internet banking enabled and the branch where you hold the loan account also accepts the online payments (mostly this is always true)

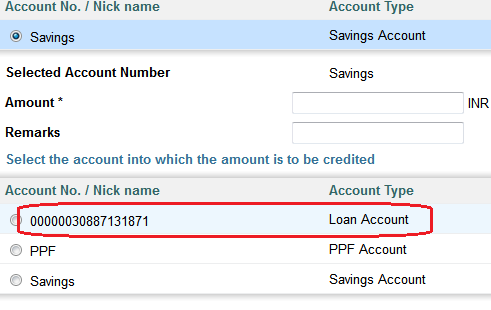

2. Just like you add a third-party account , in the same manner add your loan account as third-party account so that you can make the NEFT payment later. Once the account gets added , you should be able to see it as one of the added accounts

3. Once the account gets added, you can then make the payments to your loan account , it would be considered as your pre-payment .

Also read Online transfer to PPF account through NEFT payment

Some points on home loan prepayment

- Note that this home loan prepayment online through NEFT should be possible for all kind of loans, not just home loan.

- Why only pre-payment, you can also pay your regular EMI’s using online options instead of post dated cheques. So ask your bank to allow/enable this option.

- It might happen that this does not work in some banks. But we have seen 3 confirmations from different readers for 3 different banks , so mostly this should work on all the banks.

- If you have bank account and loan account in same bank , it should be more easy process of just linking the accounts, ask your bank on this to guide you.

So If you have a home loan, you should definately explore the idea of connecting your loan account with your bank account so that whenever you have some spare amount , you can quickly do home loan prepayment the loan by a click of the button , otherwise that “extra” cash can evaporate very soon. Are you going to do this ? Try it out and let us know in comments section if home loan prepayment worked for you through NEFT

February 6, 2012

February 6, 2012