7 Incredible reasons why you spend more money each month & How you can control it ?

POSTED BY ON January 13, 2015 COMMENTS (187)

Wow .. Today I am going to talk about your SPENDING habits and what governs it. Spending money is a critical part of anyone’s financial life and pretty much define’s how our financial life looks like.

Spending more is pretty much a reason why we go to our work, because at the end of the day, money has to change hands, be it now or later. In a way its a beautiful creation of this world. We have some great things in life today because we have spent money on it and bought it.

While I can keep talking about the best parts of spending , today I want to cover why we spend “more” and why we sometimes go beyond out set limits.

Most of the investors financial life today is highly screwed mostly because of their spending habits and the way they deal with their expenses, and many fall into the trap of “living on paycheck month after month” . So Today I want to pick few reasons which force us or makes us spend more money than we should . Lets look at each point in detail and yes – grab some coffee 🙂

Reason #1 – Because you don’t use CASH

Yes – This one simple thing can urge you to spend more.

The whole payment system has transformed totally in last 10-15 yrs in our country. There was a time when you carried cash every time you went to market to buy something. You knew how much you will be spending before hand, carried exactly that much money with some small buffer amount and bought the stuff you wanted.

Be it Milk , Vegetables, Grocery, Petrol or anything else. It was simple transaction. Exchange money and get what you want.

Then credit cards and debit cards happened. They arrived as “convenient” ways to make payment and this convenience came at a big cost.

Paying by Cash is emotionally painful

While cards gives you convenience, it also takes away that emotional feeling which you get when you pay by CASH. When you pay cash, you take out the money, count it, can think about it and it leaves your wallet and you “feel” that something parted away with you. This is not the case with credit or debit card.

This can be clearly seen in online shopping. A lot of people buy things on impulse using their cards online, the bought items arrive and you take it because you mostly have no choice. Compare this with paying cash, you think you want something, order it with cash on delivery and then let some time pass.

In this option, you have enough time to think back on your decision simply because the money has not yet left your wallet (with cards, it’s already gone) .

This is exactly what happens in real life too, people who buy things on cash on delivery often change their mind and reject to buy things because now they think they no longer need it. Read the report below

Cash on delivery is the most inconvenient payment option. It allows customers too much time to change their mind,” said K Vaitheeswaran, the founder of Indiaplaza.com.

Indiaplaza.com, which sells books and electronic goods, was the first to introduce the payment method more than a decade ago. It realised in about a year that cash on delivery was “painful”. Rejection rates are at about 45%, partly because there is no upfront cash commitment, according to Vaitheeswaran.

Source – Economic Times

Cash discourages spending

While this might not be consciously visible to you and many will deny this, but as per various studies, its shown that cash payment discourages spending, while using credit cards or gift payment encourage spending. Below you can read one of the studies on this topic.

Priya Raghubir, PhD, of the Stern School of Business at New York University, and Joydeep Srivastava, PhD, of the Robert H. Smith School of Business at the University of Maryland, College Park, asked participants to read various buying scenarios and answer questions about how much would they spend using cash versus various cash equivalents.

In the first study, 114 participants estimated how much they would pay using various payment forms for a vividly described restaurant meal. The results showed that “People are willing to spend (or pay) more when they use a credit card than when using cash,” the authors wrote. They attributed the difference in spending behavior to the way cash can reinforce the pain of paying.

Have you ever realised that when you use cards for payments, you are too casual about the actual bill amount, because you can pay any amount at that moment without worrying about it.

Also you generally don’t see the money leaving your wallet at all, the bill comes after a month and by that time, it’s too late to think about it in detail and your only job it to pay that bill. It’s just another bill and nothing else.

You can read this awesome report on cash vs cards payment and do listen to this short audio on this matter.

I am not saying that stop using cards. Do it wherever you feel its applicable and you can’t control things, but “cash payment is a pain” is highly overrated thing. You can very much use cash for various payments in today’s time exactly like you did it few years ago.

In fact you can take out cash from your account in start of the month for all the pre-planned expenses and then use cash for it.

Note that there can be some reasons like cash back and reward points offered on cards because of which you can use the cards, nothing in that. The point I just want to make sure is that using cards can change the spending behaviour in people and you should control that.

Reason #2 – Because you don’t make a list of items you need

Me and my wife shop all our grocery from DMART, a retail chain mostly in all the big cities in India. We once went there to buy “few grocery items” which were roughly 6-8 in quantity, and when I came out of the store after 45 min, I had a bill of Rs 2,800 in my hand with two big bags in my hand which had tons of things we shopped inside.

I didn’t feel much about it at that time, only to realise next morning that once again we bought many things we either don’t need or we bought it in high quantities than required. So what happened when we went to the store without a predefined list of items?

There was a chain reaction of “We need that also” and “Lets keep this too, as its going to finish soon” and then one items led to another and then we went to clothing section and then utensils sections and we could see so many things which we need WANT.

We went there without a purpose and the whole world was open for us to shop, mix this with the convenient method of payment (card) and you don’t have to feel the pinch at the same moment. It’s a deadly combination !

The other problem is that you buy things on the name of “lets try this once” and also buy things in quantities larger than you need. I once bought peanut butter, just to check why people in US love it so much, but I didn’t love it and only consumed it once, thank god my wife finished it by mixing it in curries instead of raw peanuts !

Did you use the lists many years back while shopping ?

Go back 15 yrs in life and think about those times when you mother handed over the small piece of paper which had those 10 things written down along with quantity. It was easy then, you went with the list to shop, handed over the slip to the shopkeeper and waited there for 10-15 min and that was it.

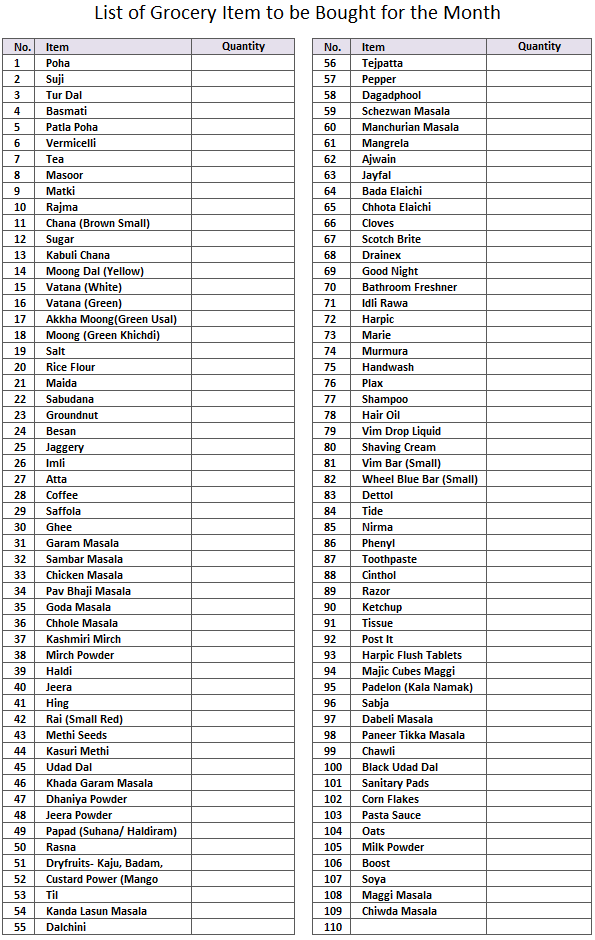

Good that my wife still does that most of times when we do the monthly grocery shopping. My wife has actually take written down all the kitchen ingredients (109 items) in excel sheet, taken many print outs and every month she checks what is needed and what is in stock. While we still buy few things which are not in the list, but it’s very small percentage.

You can see the same list of 109 items below

When you go shopping without a pre planned item list, it’s almost sure that you will buy things you really done need. If Rs 3,000 is enough to cover your actual requirement, you will spend Rs 6,000 just because you don’t go with the list. While I am not saying that you should totally shift to this kind of shopping, at least try it 2-3 times and see if you can stand it or not.

Reason #3 – Because you buy things on on short term excitement

This is mostly for the big purchases (anything above Rs 1,000) . It can be that juicer, the bigger TV, clothes, weighting scale, or even bigger car and house. Most of the people don’t spend enough time to understand if they really need something or not. This is how it typically works

- You come across something

- You are delighted by looking at it (and there is also a sale going on)

- You come across a reason which justifies you wanting it.

- Buying stuff is easy anyways (net banking debit card or credit card)

And after a week, that same thing is lying at your home unused or used once or twice. Most of the wardrobes are over stuffed by things which was bought on an impulse, because it was on Sale or because they thought they needed it (but in reality they don’t need it)

It’s extremely critical to understand today that the whole world is trying to make the buying process extremely easy for buyers today and tries to lure them with EMI’s (which makes things look affordable)

Let the excitement settle down

The solution for this is to make sure you WAIT for some time, before you buy the stuff. Let some time pass by and let that instant emotion die down.

You came across that great shoe online, where you get 40% OFF, that too with FREE home delivery and anyways your credit card is pre stored on the website – All you need to do is login and punch the CVV number and thats all – You just bought the stuff which you 100% want, but mostly don’t NEED !

I will share my own 2 dumb mistakes I did recently. First I bought a costly bicycle last year, because I so wanted to get into cycling. I joined 2 online clubs, researched a lot on cycles and within 24 hours bought one which I have to admit I hardly used. It still needs my attention.

Next I bought a little bigger size TV recently, which I wanted and needed (I watch lots of TV), but later realised that I should have bought a much bigger one, because now I can’t find much difference in the size I earlier had and the new one which I have now.

I feel I could have avoided both the mistakes, if I waited for 2-3 days and let that impulse die down. If only I had written down 3 reasons why I badly need it, I could have saved myself from the blunder I did, because I know I would not be answer myself on why I need those things strongly.

Reason #4 – Because somebody in your family/friends also have it

I seriously cant speak a lot on this, because it looks so stupid to even think how people buy things just because others have it and not because they need or want it. There are two things here ..

First is Peer Pressure , Just because friends in your group have something, you feel the pressure on you to have the same thing in your life so that you can be equal to them. If their kids go to school A , you also want your kid of go to school A , not school B . If they drive a 10 lacs car, you feel a bit uncomfortable having a Rs 4 lacs car.

The One sided Pressure most of the people feel

Most of the times, this pressure is just one-sided . It’s in your mind and not in your friends mind or even your relatives mind. True friends and people who care will never judge you with what you own and compare it with themselves. If they do, it’s better to let them go out of your life.

This peer pressure is clearly visible when it comes to giving gifts to friends/relative and spending on others when they visit you. Just because “they” put Rs 501 in the envelope, next time you can’t put less that, and god forbid if you put Rs 1,001 , now its their turn to “gift” you next time when its their turn.

If you read a book called “Linchpin” by Seth Godin, you will love the way he talks about how the world has become a place of transaction , where no real “gift” or “favor” exists in this world. Even if you truly gift something to someone without expecting anything , still the other party know it does not work that way.

Some day they will have to return the favor !

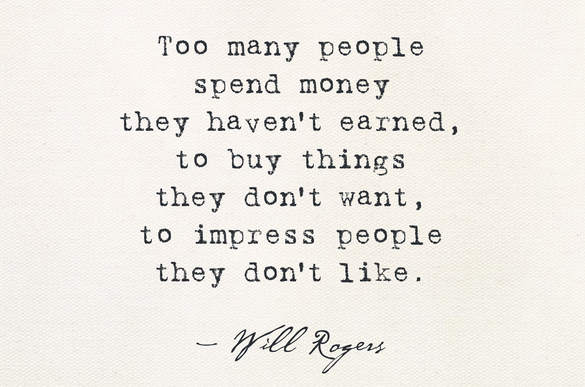

Apart from the peer pressure, at times there is purely the act of “looking good” and wanting to show off ..

People spend purely because they want to stand apart, because they want to attract some eyeballs and their ego’s are pampered just because others are talking about how great your “stuff” is , not YOU 🙂

Reason #5 – Because money is “available”

I know this would sound strange to many , but a lot of spending happens because there is money available in the pocket. However stupid that sounds, there is huge element of truth in this. Just because you have a lot of money lying with you, all the reasons to spend money seem justified to you.

Many expenses will suddenly appear “unavoidable” . Have you ever been into a situation when the supply of money was restricted for months and months? Did your life move on peacefully or not ? Did you find reasons to postpone or avoid expenses or not?

Always remember a very important point about money ..

“Money is like flowing water, if you don’t give it direction, it will find its own”

Always make sure you define a purpose for your money and allocate it for some goal in life, so that you know what is it going to be used, this is important because next time when you have some low priority expenses coming up, you know you can’t touch the money allocated for some higher priority expenses in future.

I have beautifully explained this in one of my books written by CNBC

Not just label the money, but let it leave your bank account and get invested in some financial product. By default make it tough for yourself to use it (not so tough that you cant use it at all) .

Example

To give you an example, imagine you earn Rs 80,000 per month , after your EMI and other commitments, you are left with Rs 20,000 saving per month. One thing you can do is let it be there in saving bank account and let it grow over time . After 3-4 months, you will have 60-80k in your account and more coming up in future.

At this moment, you are not that happy with your 4 yr old car and your friends are upgrading to a better car and now a small “wish” is seeding in your mind that even you deserve it (I am assuming your old car is still good enough) . In few months, you will surely make your mind to upgrade your car because you have the down-payment ready in your bank account and you also have capacity to pay the EMI for the car !

Compare this with the situation when you have already defined that the extra 20,000 will go into a recurring deposit for next 3 yrs , so that you can accumulate around 7-8 lacs in 3 yrs which will be used for your house renovation, or kids school expenses or some vacation you are looking forward from last many years.

Once you define that and let your money leave your account each month, you virtually don’t see anything lying in your bank account and your tempt to use it for your car up-gradation will die down.

This point is so powerful, that I even decided to answer one of the questions on quora.com

What is some money advice I can learn in less than 10 minutes, which will help me become rich?

Understand that I am not against upgrading your lifestyle, you have to upgrade some times when life demands it and when you really deserve it, but most of the people upgrade things not for themselves or for some strong reason, but just like that because they want to show it off or just feel a temptation.

Upgrade your life responsibly if you have to, its tough to downgrade it later 🙂

More Availability of Money and What you can Buy

You can notice that India has changed a lot in last 10-15 years in terms of availability of things we can spend on and even in disposable income lying around. There is a lot of money which can now chase a big amount of things, so naturally the temptation of buying things has gone very high.

I can say with confidence, that your most important expenses today form a very small part of your overall expenses and the big part is on things you don’t need for survival.

So whats the solution ? If you are someone who is left with money each month after your expenses, make sure you list down your goals in life, list out how much money you need to invest to achieve those goals and start your SIP’s in mutual funds or recurring deposits and let your money chase those financial goals .

Reasons #6 – Because small expenses turn out to be BIG by the month end

I love this point and this is something you can relate to easily. A lot of expenses look small in nature or a very small ticket size, but when you look at them on a monthly or yearly basis, they turn out to be a big one.

Something which costs Rs 200 might look a non trivial thing at that moment when you are spending on it, its effect on your monthly budget will not look big, but this is not how it happens in real life, you do the same thing 7-8 times and that means few thousand rupees which does not even register in your mind.

Take an example of online shopping of clothes or gadgets, while doing on transaction, it would be few hundreds or thousands, which does look big, but if you add up all the expenses by the month end or in a quarter, you will realise it was a major one which you didnt even considered while you were trying to recall where exactly your money went.

Watching Movies and Eating Out – The silent expenses

Now – I am a real movie buff (I have even started watching Marathi movies and they are so awesome) and we also eat out quote often. These two expenses are might not look quote big if you focus on it just one time. You feel you so much deserve it and that’s why you are earning so much money, But these can go over board and turn out to be a big number (at times 10-15% of your take home).

You need to keep an eye on it and I am not talking about a mental calculation, but actually writing them down for a month and seeing the real numbers. It might turn out to be a big surprise .

I did exactly that for the month of October 2014. I originally thought that my movies + eating out + snacking expenses should be somewhere around 3,000 and my grocery + veggies expenses should not be crossing 3,500.

But when I actually wrote it down for each day for the month of Oct and saw the real numbers, I was shocked to see that my movies + eating out expenses turned out to be more than double of what I originally thought, on the other hand, my grocery expenses was so less (seems like that month the grocery expenses actually were very less for some reason, as we just 2 of us).

Below you can see the exact numbers

![]()

So what you should do ? Truly speaking – I don’t think one should restrict themselves on spending on things which add up to their quality of life and if you truly enjoy it. You can surely spend money on things you truly wish and cut down on things which are waste or does not add much to your life. Ramit Sethi calls it as ‘Conscious spending’ and you should read his article on this point.

So just be a bit alert on things you are spending on and when it starts going over the roof – take charge of it and control it. Dont be over fanatic over controlling each bit of it, it does work in real life.

Reason #7 – Because of ‘Enjoy today, Pay Later’ trick

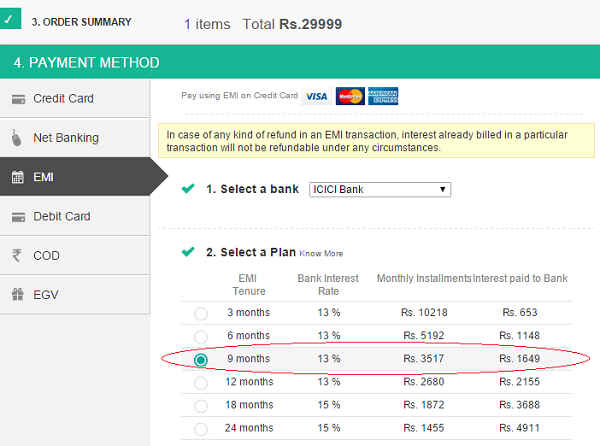

The last point I want to cover is EMI option of payments. The option of payment in installment is a powerful tool to make people believe that they can afford a stuff and because the EMI amount fits their monthly income, most of the people buy things much more than they need or can afford.

EMI option in payments is nothing less than a revolution which has driven the consumption levels to insane levels. Everything you can imagine today, especially in online shopping, where you can buy literally anything on EMI and bring it inside to your “affordability zone” by just choosing “Buy on EMI”.

If you look at an example of flipkart , I add Moto X smartphone which costs Rs 29,999 in the cart for buying. Now for someone who has a salary of Rs 30,000 per month (A lot of youth lies in this category) can’t afford this phone because its equal to one month salary.

How EMI option changes the whole equation of affordability

They can purchase it without any issue just because they can buy it on EMI option and suddenly they will just have to cough up Rs 3,500 per month. While this looks really amazing to some people, this is how the debt cycle start for most of the youngsters new into job and then they get trapped into it for many years.

Here is a report from Livemint which talks about the way companies use EMI options

EMIs (equated monthly instalments) aren’t new to Indians, but it’s a strategy that companies such as Apple Inc., Gold’s Gym and others are increasingly adopting in a bid to beat the sluggish economy, convincing customers to overcome their reluctance to spend too much money and to go ahead and splurge on an iPhone or a fitness club membership.

Clearly, India is turning into an EMI nation.

A range of items are available—cellphones, sunglasses, jeans, vacations, hair transplants, gym memberships—as companies seek to drive consumption in a weak economy. And it seems to be working, most evidently in the case of the iPhone, once a rarity, but suddenly more commonplace in urban India.

IndiGo and Jet Airways (India) Ltd, two of India’s largest airlines, are the latest to announce the availability of air tickets on three- or six-month instalments. Although the schemes have been on for a year, the firms’ recent promotion through newspaper advertisements helped persuade dithering customers, especially since fares have surged 25% in the holiday season

Hence, its important to make sure you don’t fall into the trap of EMI’s for those things which you absolutely don’t require and cant afford.

So how to spend optimal money ?

Expenses are important element of your financial, if you earn a lot , its of less use if you also spend a lot , because what ever is left at the end of the month goes into creating your financial wealth in long run. Its important review your spending pattern, various categories you spend money on and talk with your spouse, parents about it and try to optimize it.

Review each thing and see which of those expenses can be reduced or eliminated or shifted to some other category.

At the end of day we all earn money primarily to spend it on things, but at times things get out of control and does not fit into what we had originally planned.

What are your thoughts about this article ? Please write down your comments by clicking here

Its really awaking and alarming thanks for detail explanation

Glad to know that amit ..

It is eye òpner to all who are not concern on expenditures they do.

Glad to know that JPCHAUHAN ..

I Like the lines about COD.. Really we will change our mind set (necessary or not) before the product delivery if the payment option is COD.

Thanks for your comment RSR

nice points

great article read it at the correct time which it is required thanks a ton

Thanks for your comment as

Amazing article. Combines pyschology with finance. Great stuff Manish!

Glad to know that venkat ..

It’s a beautiful article and honestly all those things said above and examples above are so much similar to my spending habits. there are people who know nothing about investment and savings… I simply guide them to your site that’s it.

Glad to know that VishalDube ..

Lovely article (especially for spendthrifts 🙂 ). It was good to see real-life examples and understand how small things add up to large (and often unnecessary) expense.

Thanks for your comment Reeshita

Thanks for ur patience…I wish to take ur advice n plan my investments

Hi Jana

Looking at your query, I think your case is complicated and you should discuss and consult a financial planner, because just a random answer will not help you at all.

If you are interested, I suggest you look at our financial planning service also and fill up the form there to have initial discussions

http://www.jagoinvestor.com/services/financial-planning#fill-form

Manish

The article is very good and self explanatory and one can plan easily one’s financials by this information

Thanks for your comment Srinivasa

Just awesome! I could relate them to my habits that I had / still have. Thanks Manish for this eye-opener!

Glad to know that Ram ..

Well written. Manish Most of your articles are eye-openers,this is one among them.

Mani

Thanks for your comment Mani

Its a brilliant article. I think it is very easy to miss out on the small details, but this article very simply highlights all those points. Though each and every person has their own approach when it comes to spending, saving, investments etc. I have recently with some help and advice bought tata aia life’s Smart growth plus plan which offers flexibility in choosing policy term, has good policy returns and tax benefits u/s 80C & 10(10D).

Hi Manish,

A very good researched insightful article. I also agree with you 100%…and although I am investing in RDs, MFs thru SIPs, etc yet one thing I could do is evaluate on my expenses of eating out and movies and also books / CD’s. There could be some thing there !!!

I have been successful in avoiding credit card except for Fuel recharge.

One of the points of stuffing or buying a lot of what we dont need are the way Corporates give Food Coupons. For e.g my co. gives me an option to have food coupons (Sodexho) worth nearly Rs 30 K (2500 pm tax free) so I take this option and save tax of Rs 9K. Which otherwise would have meant net cash of Rs 21 K.

So when I went for this option suddenly I found myself loading my shopping cart with lot of tinned fruit juices , mishti dahi , ice-cream party packs ..in short all high -calorie food. But I also realised since I finished my vouchers in less than a year and now I use vouchers to buy a pretty much routined grocery list.

I am striving hard to reduce both – my expenses and my weight !!!

I cant be sure about my weight but on my expenses, I am sure if I read and implement what you have brought out in such amazing clarity, I will reduce surely some exps.

Kudos – keep up the good work Sirji.

Hi Rahul Udare

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Awesome one, really hellpfull

Excellent Article, Now a days it happens Everyone’s life.

Thank u for sharing.

Welcome .. Glad to know that varalakshmi ..

Awesome article Manish. You can be a savior to many of the people follow”who spend first think later” thoery.

Thanks for sharing

Welcome .. Glad to know that Aakash ..

Great…

I m using expense manager app for almost one year to track my real exp and it really helped me to make good control over my exp, I too saved a reasonable money and very strong budget.

Regards,

RV

Hey Rajesh Verma

Thanks for sharing your experience with all of us. It was a great learning.

Manish

thanks, I agree, and very smart advise, to all to follow.

Hi gajanand

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Awesome Manish… My wife always says to write down whatever i spend on .. but never did.. Most of the time my credit card is around 20K…. and wonder everytime while paying it back where did it all go.. Its a viscious cycle .. you can only end it when you stop using your credit card.. Your right .. use Cash… .Nice Article … Thanks..

Manju

Yea I know , I can relate to that 🙂

Super, as always….

Thanks !

Great article. Easy to understand and lots of insights. I need someone to guide me in terms of financial planning. I am 25 year old . I am somehow unable to cope up in corporate domain (ya ya … software engineer – rate race karma :P) and want to retire as early as possible (at an age of 32 years). I can save 20,000 Rs per month for sure and I wanted to know how do I plan if I want to meet the needs of my retirement.

Hi Amith

Thanks for sharing your views and what you need. Please contact us for financial planning via http://www.jagoinvestor.com/services/financial-planning

Manish

Good article Manish.

All of us, at one point in life (or rather a period in life) are probably guilty of having indulged in atleast one or more of the “7 deadly financial sins/pitfalls’ that you have mentioned below.

This article needs to be shared with a wider audience.

best regards

Ramesh

excellent article. Thanks manish.

Thanks Lakshman !

Dear Manish

I have read your aricles and impressed a lot. I am looking out for Health Insurance policy for me and my family( 2+ 3). My age is 40 and kid are under 11

Can you please refer some good one.

You can look at Reliage or Maxbupa . I suggest you compare some plans at https://www.coverfox.com/jagoinvestor/

Hello Manish

Your extensive article is an excellent Read. …on my way to implement it. Thankyou!

THanks

my father came across your website and he made me read this article of your.At first i was not interested but later on i now know what big mistakes we were making when it comes to money.If you really plan on saving money, before all of that you have got to read the book called Rich Dad Poor Dad.The book is brilliant and it is really helpful in making you understand a lot of thing.

Thanks for sharing that Neha .. Good to know that you got some help from this article

Hi Manish!

Kudos for the article. Keeping a tab of your expenses even the small one is a great way. I personally use Expense Manager over android(https://play.google.com/store/apps/details?id=at.markushi.expensemanager&hl=en). I think most of us should start using it. First month just think up of categories and make a note of all the expenses. Post first month start setting budget and keep a check on the target.

Works to controll the impulsive shopping.

Thanks for sharing that Vaibhav . Will try it out and also use it sometime soon in one of my article

thanks once again manish ji for the article. can you throw some light on deductions for house rent in income tax as i have to submit my TDS next month and there is a column under deduction for house rent .. also can you suggest some format for house rent receipt to be submitted along with TDS and need for owner’s PAN in the receipt.

Anuj

The rule is the you can get the minimum of

1. Actual HRA received

2. Rent Paid – 10% of your basic salary

3. 40% of your Basic Salary (50% incase of Metro)

Whatever is the minimum value , thats your HRA under tax exemption. You can check out https://rentreceipts.herokuapp.com/ for generting rent reciept .

Manish

Thanks a lot for ur help …. read in a blog that PAN of landlord is mandatory if rent paid is more than 8333/- per month.

Yes Anuj

Thats correct

Manish, Excellent article. You could also add how we choose cabs on discount if we book through app and pay through wallet.

Yea , even that is one of the points, but I am not sure how we are over spending on that? Can you put your views on this ?

execellent suggession thank you manishji be happy

Welcome !

I agree to the points mentioned in your article. I also prepare a list of items for grocery, go to the store and the man packs all the listed items. Before this I had shopped in D-Mart and used to pick up many items that were not on the list. I noticed this and immediately shifted to my previous method of listing the items and buying them from a grocery store nearby.

Thanks for sharing your views on this Deepti !

Hey,

I am looking out for (Self) Health Insurance policy can you please refer some good one.

Regards,

Ajay

Sure . WIll put a mail to you !

Its an awesome article which i have read. Though i already save on MF i am more urged to reduce my expenses and have a tab on my expenses and save more money.

It will help me plan and have a wonderful future.

Thanks for sharing that . What actions have you planned to take in your financial life to achieve that ?

This is yet another wonderful article!

I firmly believe that we must save first, and then spend. But majority of people are doing the reverse.

The pain of parting away with the cash is described in a very good manner!

We buy things of higher items which may not be viable for us. We do it because of show off. For example, if someone has to buy an LED TV, he has the option of Brand X and Brand Y. The Brand X might be 40% expensive than the other, then also he / she will buy that one, because of the emotion-dominating decision.

If we can curtain small expenses, it will be a huge saving in long run.

yea Viral . Exactly that happens in real life with most of the people . Thanks for sharing your views on this point !

Money will find it’s way if we don’t direct.. What a great sentence..Superb article..

I love Reason#5 very much as many of my friends are spending due to this..

Thanks 🙂

Very good article Manish… I would appreciate if you can share your thoughts about a good Expense Manager for the people to manage the expenses tracking and save money if you would have noticed any or using any excel, android app or website.

I hope this article is going to change some people’s life and make them more mature.

Sanket

Sanket

I have not reviewed much of them . I will write an article on this soon !

You can use perfios or myuniverse to track expenses, investments, assets, liabilities etc.. if you are a paid subscriber you can generate lot of reports which can be used to track the expenses based on category. I personally use perfios and track expenses by category every month. They will send a monthly mailer with pie charts depicting where your money has gone through for the previous month. Its very informative.

Thanks for sharing that Charan !

Nice article . I used to purchase KVP or NSC even for small amounts whenever. I get. DA arrears etc . I continued to reinvest these amounts and turned out to be sumptuous over a period of time to pay for my daughters college fees .

Thats great to know !

A good detailed article on managing one’s spending & finances. In The Point #6, author talks about writing down all the expenses based on category. I use this method and it helps me to a great extent to see where I m spending unneccessarily and cut down on it in the future.

I use a free opensource software to note down these expenses. Its called “Money Manager Ex” available for Desktop & Andriod. It gives me category wise monthly/yearly reports on my spending & also reports on my investments.

Hi Sandeep

Can you give me the link for the software ?

http://www.moneymanagerex.org/ Look like a good software to use.

Thanks for sharing that. Will try to check it out while I review some apps !

Nice article.

You have given a grocery list.Taking that point could you put some article, especially on grocery or unavoidable expenses a human need to face for a lifetime. Like utility bills,grocery, vehicle fuel etc. How we can manage that at the lowest.

“a human..” I mean to say an Individual.

Nice Excellent article….

Welcome !

Really an eye opener. I will try to opt Rule No. 3 – Make list of items which you need.

Thanks

rule 4 … the best..good concept …. would like to inculcate this in my financial life

Do it 🙂

@ Manish, Karthikeyan – As requested:

https://play.google.com/store/apps/details?id=com.expensemanager&hl=en

Keep up the good work Manish. You are really good.

Thanks Zubin

Anyone should shares something nice with others is really good 🙂 . So are you !

Super Stuff Manish !!

A real eye opener. I can relate to it aptly. Especially online shopping, peer pressure, super market thing n so on.

Really need to sit back and review my spending habits.

Thanks for your appreciation 🙂 . I know , most of the people will be able to relate to this 🙂

Manish

OOver the last two months i have spent more than i actually budgeted for. No matter how i try to control my spending habit, i always spend more than i budget to spend and most of my spending are done with my debit card. Thanks for sharing such a provoking article .

Keep it up

Chers

Then what are the steps you are going to take after reading this article ?

Hi Manish,

Great article as always.

You can also add as to how casinos use chips instead of real money.

Using cash gives a realization of value 🙂

Cheers,

Nooresh

Thanks for sharing that Nooresh

I will read on that point and try to write on this

Manish

Excellent article indeed. I have been reading a lot from this month only & started working on my monthly budget & savings plan. I am amazed to see the exact thing mentioned above with less than expected expenses on vegetables & more on movie. I have noticed the same in my own monthly budget.

Thanks for a nice article…you truly understand the personal finance & behavior patterns of a common man….Bravo!!

Actually what happens is when we think of veggies expenses, we think like per day = Rs 50 , so for 30 days its 1500 . But in reality , there are many days when we dont buy anything , hence the monthly numbers are much lower !

thnks for such article.. actually u have save me.. I was thinking or planning to buy a car .. u have awakened me to rethink about this more rationally.

Great to hear that ..

However make sure you dont buy it if it was an impulsive decision, however if you really need it, I think you should not suppress that !

Wow! Simple yet awesome article!

Another factor I think is these easy EMI schemes or subventions, which makes affordability look “within reach”! As such I would not buy this 36K phone – but when dealer says ‘Oh! you know what! You just have to pay 3K now to take this phone!’ – I start thinking abt it!

Yea , thats one major thing which is taking all the people into debt cycle. I think the simple rule to buy something is – “If you really need it, go for it” . No other reason !

Sir I am a cent govt empee my monthly incom is 37000 I have one hdfc ‘lic;max life insurence that amout of one month is 9500 rs tell me other best investment

You can look at mutual funds now !

Nice article,

Few points from my side.

I have an bank account, where i can create an FD even for as low as as low as 7 days and they give me an interest of 7.5% online, ideally all credit cards give a payment grace period of 20 days from the time the credit statement is generated, instead of paying on the first day of your credit card you can pay on the 15th day ( 5 days in advance to be safer)

and you can get interest for 15 days.if your credit bill is roughly 20k per month you will get Rs60 as interest from FD for 15 days if you do this way. more your bill more you will get as interest from FD.Similarly you can do the same for all utility bills ( bear in mind you have to be very careful and remember the dates, and make sure you dont miss the payment).

Thanks for sharing that ! .. It was indeed a great insight . I will try to write on this topic very soon. If you can give me some more personal examples. It would help me !

Vijay, this is a good micro-management technique of credit.

However, 2 important things to keep in mind:

1. Bank FD interest is fully taxable; if you fall in 30% bracket, you need to pay advance tax (about which Manish wrote an article sometime before I think), or assessment tax after March. If we keep depositing multiple FDs over time, tracking and record keeping can be a pain. I tried this some years before, but later orphaned it due to volume.

2. For micro-management, this works, but better to plan for this as part of overall income/outlay. Liquid cash (say, earmarked for credit card payment) should still be liquid cash. And if you successfully managed this over say 3 years, it is only because you had the patience to do this! Considering the time to be available in future, you can think about macro managing your finances!

A bit lengthy but a nice eye opener article on the holy occasion of makar sankranti…

we must avoid the habit of spending through cards and EMI…. this makes our hard earned money to waste so easily on things we rarely use.

dont know why a link for ppf calculator opens itself while reading the article that obscures the view and no options to minimize or cut that screen… anyway had to read the article on my mobile and thanks for the article

Hi Anuj

Actually the link is for you to view the PPF calculation video , You can close that window . Is that not working on phone ?

Real article. Whatever is given absolutely true.

Thanks

Dear Manish,

Mindblowing Article with simple language.

I really appreciate you are mentioning realtime personal examples and expereinces, that’s something unique in your blog which makes readers to understand deeply.

Way to go Manish!

Thank you so much for your research and blog.. continue to look forward for your articles.

Shravan

Thanks Shravan 🙂 .. Yea i know personal examples really help people to understand what I am taking about ! ..

Brilliant article Manish!!!! I’ve started earning about 2 years back only and incorporate half of the things mentioned here. Now to bookmark this article and reinforce the remaining points.

Additionally, would suggest for all the readers: I have installed an application called Expense Manager on my Android phone (sure would be available on Apple as well). I ensure I add my daily expenses religiously in the app, be it even a Rs. 5 chai. This way it helps me understand where do i make most expenses every month and try to curtail it.

Zubin, can you mention the developer’s name or provide a link on the Android play store? There are many apps with that name – ‘Expense Manager’. Thanks!

Thanks for sharing that. Can you share the exact link of the app here ? Also I know how painful its to write down expenses manually , it really does not work of most of the people !

Hi Manish

Extermely thought provoking article bang on target..eye opener especially on points such as do we really need the stuff we buy sometimes ? credit and debit cards are spoilers…

Thanks for your comment Nilesh. I am sure most of the people can relate to that point which you have mentioned . We buy most of the things just because we lightly need it, not strongly !

Another great article Manish, thanks for sharing. I also tries to follow some of above points. As soon as salary get credited to my account, I starts creating FD is for my EMI, like home loan, LIC and others. I make sure that FD matures 2 days before the EMI date, it helps me in spending money and also get some interest on that. I also transfers excess amount to other bank account which I dont use for internet transactions and dont keep debit card with me. I keep only required amount in my account which is linked to credit card and which debit card I use. It helps me to reduce my expenses including credit cards bills. Only when required, I transfer money from my other account to this account so that it helps me to have some balance with me.

Thanks for sharing that tip with us Suraj ! .. It would really help a lot of people !

One should buy groceries when he is full 🙂

http://theoatmeal.com/pl/minor_differences/grocery_shopping

Yea Pankaj

I have read that some time back 🙂

Hi Manish,

Wonderfully written article. If we look at our father’s, grandfather’s generation spending habits, we will be amused as how come they would be able to manage all the expenses and in parallel they used to grow money in RD, FD, Post office A/cs without compromising on life quality. This is an inspiration from their end and your article truly echoes the same.

True 🙂 . We have to learn lots of things from past generation and adopt the good part !

Nice

Great article… specially the new formula:

Expenses = Income – Savings

🙂

Thank you.

Thanks Rahul !

Dear friend Great life changing opportunity its makes money made i am very very thoughtfully happy but basic needs to daily utilize problem solve this idea i expect thin my problem solution…… thanking you

Thanks Mr. Kailash !

Very well researched and experienced article………….I am amazed how u have collected such a truthful human behaviour traits on a simple subject in an exceptionally good manner

Congrats….

This is the only reason of popularity of your blog that you write on topics which no other personal finance blogger even thinks

Thanks Sushil 🙂 .. I have put lots of effort in this article . It was one of the best things written by me . I was really amazed at myself and how I have collected and crafted things 🙂

You need a budget. Check out this amazing software called YNAB (http://www.youneedabudget.com/). “Pay off your debt, save more money, and break the paycheck to paycheck cycle. Together.”

I have been using this software for more than a year and guess what? Its awesome. It costs USD 60, but is worth every rupee. What makes it great is the method that has 4 simple rules.

Rule One: Give Every Dollar a Job

Rule Two: Save for a Rainy Day

Rule Three: Roll With the Punches

Rule Four: Live on Last Month’s Income

Thanks for sharing about that software .Let me check if I can look at it in detail !

Interesting article.

One fact that one needs to build a corpus for future and retire easily, should fire a person to save each and every penny one can.

All others tips, tricks and points will be “feel good to read only”

Some what agree on that . Most of the people will not be able to exactly follow it, but there are a lot of people (much more than what you are expecting) who follow these points !

With increasing life expectancy, people can now expect to live 25-30 years after retirement with no income. Considering that the value of rupee will decrease significantly in future & inflation eating away into savings as always, I think present generation who have just started earning have no choice but to target atleast a crore in savings for those golden years. If nothing else works, I believe this alone can be one of the biggest motivators to start saving money.

Hi Manish,

A very nice article indeed. Keep educating 🙂

Thanks

Sahil

Thanks Sahil !

dear,

excellent article! previous article on this line was equally so. this is a matter which matters a lot. managing expenses is more fruitful than earning more. here, race of rabbit and hare applies well(savings). ‘saving/managing well is earning’, is not difficult if one knows that. your article/s do prove/s it!

i intend to give some input next time. Great effort from you dear! pl. keep it up!!

Thanks for sharing Ramesh !

This is really insightful article which talks about human behaviour and their tendencies to go overboard.

Many a times we don’t observe the finer nuances of spending pattern that is so common and almost plagues everyone of us. The article has very clearly explained each and every such little point so clearly. Good work

Thanks Saurabh ! ..

Dear Manish,

What you have written is very much correct in India now, everyone has to be careful while spending money in any foam, Cash, EMI, Credit card etc.

Thanks for your comment on this article Anil !

Very good article. In the current constant changing scenarios, spend wise is at most important. This article gives good perspective of how people tending to overspend can stop at right time.

Best Regards

Subhash

Thanks Subhash ! . I am sure even if some one takes 30-40% part of this and implement , it will help them !

excellent article as always. 🙂

Is your wife Maharashtrian?? just asking after seeing the list.

Yes – she is 🙂

Eye Opener

Thanks Amit !

Very good one. Like another comment, since this is ingrained in Gen Y (I am thankfully Gen X!) folks, better to automate – SIPs , EMIs, auto-debits for RD/PPF – all with date within first 5 days of the month. If we know we are not disciplined in our spends but do not know how to control it, then this is the best option!

Thanks for sharing your view on this topic Bharani !

It was real good one, I have stopped using cards since I started reading your books and also I have stopped taking my family to Malls for shopping. I go to DMart at 9pm alone and do shopping with the list in hands not having too much of time to look around as they close it down by 10 pm so come home with deviation in the list with no more than 5%.

It has changed my expenses and also I carry cash no card while going to Shop, it help me in overspending as I know how much bill will come and I carry only 300-500 extra in the pocket that’s it. I am not sure whether I am doing the right thing or not but it is helping me. I was running out of money for savings today I have only pre-decided money to spend and rest is not available for me to spend as I transfer it into my SBI Max Gain account, which charges a nominal fee for fund transfer. So only in emergency, I go there and withdraw some money from the Bank and while withdrawing I name the expense on why I withdrew for lately to address the expense. In case, I save few hundreds from that expense, I try to push the money back to my SBI Max Gain account.

I am loving it!! The way towards creation of Wealth. The day, I came across the JAGO Investor website, I am only reading Personal Finance articles whenever I get time. No time for any other stuff.

Enjoying and Savingly,

Amit Jain

Amit

Thats was quite a revelation 🙂 . First time I came to know how much some people implement what I write and benefit so much ! .. Thanks for sharing that with all of us Amit . I am sure many will benefit with your comment. What you have demonstrated is a big point of financial life, that if you let things run on autopilot, one can save more money than they usually do ! ..

Kudos !

Manish

I think I need to implement your cash idea as well. Everytime I go to malls with the intent of buying just 1 or 2 items which I actually need, I end up exiting the mall with big packets in both hands and several thousands poorer. Its amazing how debit & credit cards make it so easy to spend money that you don’t even feel a thing.

I think we should also try to do as much grocery shopping as possible from local small shops. Shopping malls always charge MRP on whatever you buy whereas local shops give a fair amount of discount over MRP on every item. I don’t know if its true where you live but it certainly is where I live because retailers usually buy stuff way below MRP anyway.

Dear Manish,

Very informative dissertation. I congratulate you on summarising what we do think about but are afraid to admit.

However, once again I request you to please DO RE-READ WHAT YOU WRITE because there are lots of mistakes. I would not like to walk you through again like what I did previously but I am confident you will notice yourself what I mean. As a hint please look for duplicate words in “Reason #3”.

Thanks for sharing that, I read it again, but could not find a mistake 🙂 .

Sorry if I made a mistake. Thanks

Sareen

No I am glad you pointed out the mistake so that I can improve, but I could not anything wrong . may be you can share it with us !

Manish

Thanks for your good words. I will try to go back to your article and list the missing words. However I am sorry to say that even your this reply has a small mistake. There should be “find” after “not”to complete the sentence. Please correct me if I am wrong!!

Regards,

Sareen

Thats fine . I hope you got the intention and what I wanted to say . Thats all what matters 🙂

Excellent Article.

Thanks Vijay !

Fantastic article

Thanks

Dear Mr Manish,

What you have narrated in seven points in the article above is like a pieces of Bhagwad Gita in itself on spending / not spending or savings.

You have tried almost for all youths of this generation to be very much selective or alert on their habits of spending (rather not savings).

Hope, these ideas scrub their minds about the choices they have to make.

Thanks Naresh 🙂 .

This article serves as a mirror for most people, including me! Financial education is a continuous process, and if we don’t revisit old lessons, sometimes they fade away.

I remember reading your articles around 2 years ago and they helped me become a lot more financially aware.

Today, reading this article made me realize the small mistakes that can be rectified, to again reach a stage of more financial awareness.

Thank you for taking the trouble to write this.

Cheers,

Bharat

Thats great to know Bharat !

Again a very good article from Manish. I can strongly relate me with reason#3. Presently E commerce plays a important role to boost this habit. Now i resist myself to browse the E commerce websites and trying to stay away from it.

Yea . E Commerce has really taken away that extra money which some people used to save. Even I am affected by it 🙂

It is an excellent Article. Written after a thorough research on financial spendings.

Iagree with the points mentioned by 99%.. This will become an eye opener to all those who are spending as spendingspree.

TVR

Thanks Mr. Ramaswamy 🙂

Great article, again. And I completely concur with the advice of defining expenses after deducting savings from your income. Many times, your family will hate you for being stingy or too much worried about petty expenses; take it into your stride as only you would have the sight of that very important expense coming up. It may sound very difficult to begin with, but once you see a corpus building up by having small amounts put into a recurring deposit (for e.g.) you feel like doing it more often than not. Getting over the mental threshold is important. Also, with time your family will adjust with your attitude when they will see how smaller sacrifices add up to bigger rewards.

Thanks for sharing that point with us Tarun. I agree that one has to take some hard decision at times. Just that one has to keep balance in it. ONe should not be too stingy and not too casual !

Family should be the least of your worries. Even your friends & colleagues will hot hesitate to call you stingy these days if you’re not prepared to throw money into the air. This has how life has become in Urban India for many unfortunately. The cool guy in office is always the one who’s willing to splurge the big bucks for drinking, partying and eating out.

But at the end of the day its upto each one of us to look at the bigger picture i.e. our future goals and save accordingly. Sometimes new goals come into our life out of no where and its imperative to save some money for those yet unknown goals as well. We also have to keep aside a sizable fund for the tough times like health expenses which can make a big hole in our pocket.

Can’t agree more with you, Anjan. Social pressures are indeed on the rise; however, times get tough when you abstain but the family gets influenced. What my neighbor says about me has very little bearing on me; what my wife and kids complain of is something I need to work hard to keep out of the thoughts. Sometimes you break your own habits to see them happy; other days, you decide to be the bad guy in the family. And the worst part: there is no golden rule for this!

The thing is: getting away from so-called-friends and colleagues is easy; having your family believe in you is difficult. Gone are the days when the word of the man in the house would prevail. And that leads to another important point to ponder upon: how you get your kids appreciate the habit of “save small, dream big”?

Good point Tarun !

Awesome article Manish 🙂

Thanks Deepak !

Excellent article. Needs to be shared with all Generations — GenX, GenY.

The latter seem to be saving only “Time ” — spent in reading such articles!

Cards, Malls, Self-service are here to stay. So what can force such habits — is “commitments / Compulsions” — say a EMIs on house, or SIPs /RD/ PFs etc!

Recollect one of your articles said that one should remember to use the formula:

Earnings (received, not the cards) – Savings (pre-decided) = Expense

and not use this:

Earnings (+card) – Expenses (all and sundry) = Savings!

Thanks once again, Manish

Yea .. true !

Thanks for reminding the same point I made long back !

Offers lead people to spend unnecessarily. For example:

Buy 1 get 2 free.

Surrender your old laptop for a 10% discount in the price of a smartphone.

Rs. 1000/= discount if you purchase on EMI basis.

Money back life insurance schemes

Take bank loan to avail tax rebate even when you have ready money.

Exchange your old gas stove for a new one.

True . Buy 1 get 2 free is just like a SCAM most of the times !

Awesome article…a real eye opener!! Most of the points i can relate to especially online shopping where the money is not going from the wallet….loved it and will try to implement it now onwards….thnx

THanks for sharing that point Ankit !