3 reasons why you enjoyed Pocket money more than your Salary !

POSTED BY ON July 18, 2013 COMMENTS (24)

Just put your hand on your heart and ask yourself what did you enjoy more! – Your Pocket Money which you used to get or your current Salary? I have asked this simple question to many people and the majority of them said “Pocket Money”. Yes, that is the answer I have got!.

That small amount that we used to receive from our parents or guardians was managed very well by us. We had very little knowledge about money or anything in life, but still, we were highly effective and careful with our pocket money, compared to what we are today with our salary or overall financial life. A lot of you might be giving pocket money to your kids or to some family members, just see how effectively they are with managing money. Here are 9 tips to make your kids respect money

Why we enjoyed our pocket money compared to Salary?

Here are some of the reasons why we enjoyed and took care of pocket money in a much better way than our salary today are as follows.

Reason 1#: You were so excited to receive it

The amount was not important but we were excited to receive the pocket money that we use to get. When you receive salary you feel – “That idiot is paid more than me, this company really does not care for me, I am really underpaid”. All these conversations inside your mind actually kill your excitement. You are unable to enjoy the money that comes into your life and obviously you can’t manage what you are not very excited about. As kids we never compared, we loved what we got, we were so content. We would put a small amount in our piggy bank and would make the most out of the money that we received. The pocket money was a GIFT!

Reason # 2: We were absolutely clear on what we will do with our pocket money

When the mind is clear it helps you take good decisions. Each month we knew what we will do with our pocket money. Before the pocket money came in our pocket, we knew where it’s going to go and how much!. We knew what to buy from our school or college canteen? How many movies we can watch? What to buy for our friends on their birthdays? It was making the most of the resources that got into our life.

Reason #3: We were accountable to someone

At the back of our minds, we knew that we are answerable to someone. We were accountable to the people who gave us pocket money. I remember buying stuff from my school canteen was so much fun. Today you are not accountable to anyone in your financial life. You start your SIPs without asking anyone and even stop or redeem them without asking anyone. I always suggest our financial coaching clients get accountable in their financial life. I ask them to see their spouse as their co-pilot. Imagine your wife won’t allow you to step into the house until you buy your term plan? Imagine your wife won’t allow you to enter the house till you don’t start your investments? Can you see the rigor it can bring into your overall financial life?

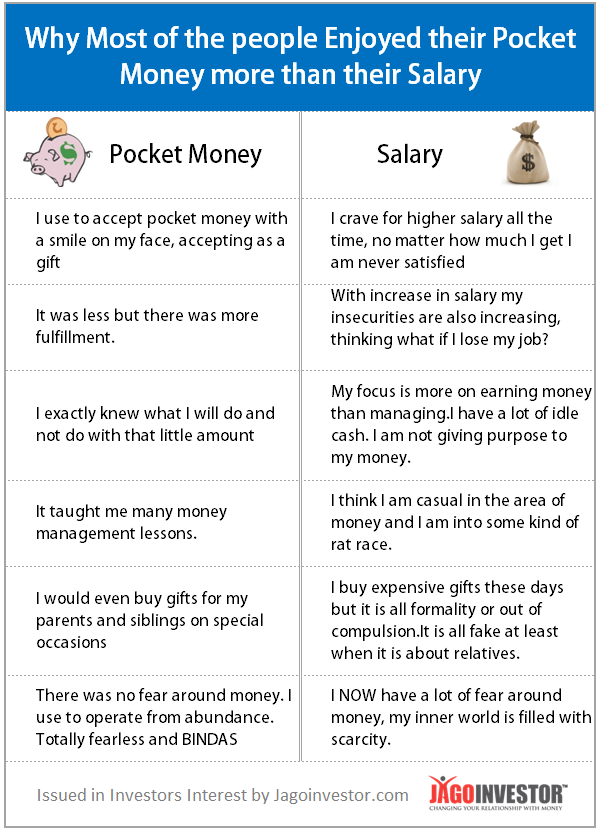

Pocket Money vs Salary – The Experiences and Feelings

When I get on a call with my clients, I keep asking them to share with me what kind of feeling they had when they got their pocket money and when they used to handle it and the same thing for the Salary they get. Here is the kind of responses I get from them. I am sure these would be true even for your case.

We want you all to do this exercise. Make a table and on one side write your experiences with your pocket money and on the other side your salary.

Here is an amazing sharing from a reader Pankaj Kapadia on his experience

When I had Rs.500/ in my pocket.in 1993…I used to feel that i was richest man on the earth. I could buy pepsi Rs.2.5/-, watch movie 15/-. have bhelpuri 3/- . Give party to all friends 100/- travel by bus Rs.2/- and still had funds. Now with 50k salary and 20k emi, 8k school fees, 5k maintainance , 20k groccery bills I am left with nothing. From life of my own now I have kids and wife to look after along with parents. I am responsible for 4 more financial dependents and hence all their dreams are mine. Their education, clothes, entertainment, illness are mine.

I agree pocket money gave me more satisfaction and salary less. I also admit my son with rs.100/month is much more happier than myself. It has more to do with carrying responsibility on my shoulder. My dad did for me and I must do it for my childrens

Conclusion

It is really not important how much money comes into your life what really matters is how happy you are to receive that amount and how grateful you are with that amount and what exactly you do with the financial resources that come in your life because that’s what is in your direct control. The experience we had while we received pocket money and our first salary was the same, we can choose to have similar experience all our life if we want to. Today the good news is that you are your own boss and the bad news is that YOU are your own boss in your financial life. Report to someone what you are doing and not doing in your financial life.

We have created 100moneyactions.com program so that you can be dedicate your 20 weeks for your financial life and complete almost all your financial life actions pending till date. This will really bring in a lot of accountability and will source your financial life with action. Do share how you are going to bring in a NEW level of excitement in managing your salary money the way you use to enjoy your pocket money.

This article is written by Nandish Desai.

The main reason why I enjoyed my pocket money over salary is that I use to have no liabilities to pay like Home loan EMI and other expenses of household expenses out of my pocket money

Thanks for sharing that Harsh .. I am sure most of the people will have the same answer 🙂

Being accountable to someone is the best way to be financially disciplined. When I began working with a smaller firm, earning a smaller sum of money, I simply handed the cheque to my mother who opened joint accounts and managed the money for me. I still asked her for money for my expenses as though I was asking for pocket money – although it was earned by me!!!! :`). This continued for seven years with my mum being my financial guide & manager until I had saved just enough to book my first 1 BHK – of course with generous help from parents for a percentage of the amount. Of course in the way I did get very very thrifty as I was focussed on the goal – no unnecessary expenses.

But now after so many years I can sometimes spend on presents that I couldn’t gift to dear ones earlier…

Thanks Manish for a very nice article.

This is an amazing sharing ! . This is a proof of what can be achieved if you are disciplined !

Manish

I did not get pocket money.. but I did enjoy whatever money I used to get from parents or relatives in those days. But now with salary I agree what all you said in the article.

Yea .. when we say Pocket Money, I meant any small money we used to get on occassions also !

Bull’s eye, Manish. You are growing.

Thanks Vijay !

I never asked for pocket money to my Dad.

I stayed in hostel almost for 6 years …whatever amount my dad was giving ,i used to save it for next month..He always used to give me extra money..but i never liked to ask for money to anyone.

When I got job,for the first month my Dad gave me 17k to spend in 2007.It always created gr88 respect for my Dad as he always used to give me more than what i wanted .During my childhood i experienced financial crises.I did not have even a new dress for my Uncle’s marriage.so i was enough matured to understand how to manage money by staying away from family.

When i got job (my Salary was 19k) ,I was very happy to spend money ,the way i wanted..used to purchase the things whichever i liked for me ,for my family…

Now i am married,having a salary of 70k ,I became very very kajush just for purchasing HOME.

Once upon a Time I as very with both Pocket money as well as my Salary.:)

Thanks for sharing your story and experiences Suvarna 🙂 . I am sure a lot of people would learn from your story !

Super duper article Manish! Amazingly you’ve made each article more interesting than the previous!

It would be nice if spouse is a co-pilot, but what if your wife is not interested in saving? Then it’ll be an issue. Maybe you can have an article in future on how to get spouse interested in saving

Yes, it will be an issue . The idea is not to make your wife a pro investor. But only at a level where she can question few things and understands basic level of things .

May be true or may be not….

I didn’t got any pocket money in my life 🙁

In my case, I enjoys my salary by investing not by spending. Accountability should be there for everything you do in your life (be it towards yourself).

Can’t agree with the example about co-pilot. The first thing is how many women are interested in financial things. All the women I interacted mostly in my office, doesn’t know difference b/t Term Insurance and Endowment Insurance and ULIPS. And the funny part is, if you try to explain they will give expression like you have done some crime.

So best part is self accountability which is I follows.

Good to hear that Mohit , but thats your personal case. Most of the people do not have the same experience than you . Also are you married ? I mean we have various clients where by involving the spouse itself in their financial life , the financial life has taken a new shape. I agree not all women are interested in personal finance (just like many men are not) . But thats again case to case basis.

Its great thing that you act responsibly in your financial life and thats what others have to learn from people like you 🙂

Manish

Yes, I am married.

I force my wife to understand personal finance and explain her whether she is interested in listening or not 🙂

This force learning worked and she has surrender her all useless ULIPs which she has purchased before marriage and she is filing her IT return’s without any help online even helping colleges in her office 🙂

-Mohit

Somehow the comparison feels out of place.

True. At that time, we would have been more exited about pocket money. However, it is after all my basic needs. I didn’t know the labor that goes into making it. My main intention is to spend an not to save for the future etc.

Contrast this with the salary. One knows how hard one has to work to get it.(Of course, one spends it thoughtlessly on spending sprees. One will have to(and at least in part will) plan for the future. One’s intention will be to make future better.

Thus i feel that we are comparing two very different things.

Hey Srinivas

Agree to that. We are comparing two things in two different situations . But more than anything, we are stressing on management point . We are saying managing pocket money vs managing salary or big amount. We were good at managing Rs 500 , we knew where it went, and prioratised things, but with 50k salary we dont do that. I understand that from responsbilities point of view we cant compare that . I hope you get my point .

Manish

When I had Rs.500/ in my pocket.in 1993…I used to feel that i was richest man on the earth. I could buy pepsi Rs.2.5/-, watch movie 15/-. have bhelpuri 3/- . Give party to all friends 100/- travel by bus Rs.2/- and still had funds. Now with 50k salary and 20k emi, 8k school fees, 5k maintainance , 20k groccery bills I am left with nothing. From life of my own now I have kids and wife to look after along with parents. I am responsible for 4 more financial dependents and hence all their dreams are mine. Their education, clothes, entertainment, illness are mine.

I agree pocket money gave me more satisfaction and salary less. I also admit my son with rs.100/month is much more happier than myself. It has more to do with carrying responsibility on my shoulder. My dad did for me and I must do it for my childrens

What a mind blowing sharing you have done here. It really takes courage to declare this and showcase what you feel. I am blessed to have community and readers like you 🙂 . I would say what you have said is true for everyone, salaried or business class. I think earning money is easier than enjoying it and being content .

I want others to share what they feel .

Manish

I really knew where to draw a line with my pocket money. I managed it so well because I knew that I was not entitled to get a pie more than what I was given by my parents. It taught me – cut your coat according to the cloth. Today, with my salary, I tend to splurge and then have a nail biting time. I was wiser then and a spendthrift now.

Thanks for sharing that Nandita 🙂

I respect your commitments !

Superb Article with emotional topic!!

Yea Sushil

Would have loved if you could share your thoughts on this topic. Is this true for you or not ?