Review of ICICI iProtect Term plan

ICICI Prudential has recently launched its online Term Insurance Plan called iProtect . iProtect is extremely affordable online Term Plan whic has some very good features. Last year Aegon Religare launched its online Term Plan iTerm , but it had some limitations like no riders attached and the company didnt had much trust factor . However iProtect comes with some really great features like Accidental rider, Term upto 30 yrs , wide coverage of cities and apart from being completely online, it can also be bought by agents, corporate agents and brokers , So it you are not net savvy or dont like pure online product, you can still buy iProtect Term Insurance through offline means , however the premiums in that case can be higher compared to when you buy online,because of agents commission involved in between.

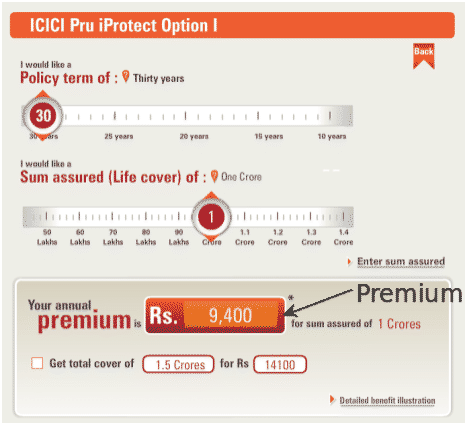

The best thing I liked about iProtect was the user interface . It was easy to operate , asks less things in the starts and you come to know about your premium just by providing basic information like Age , Term , Sum Insured etc in the start, unlike iTerm from Aegon Religare where you had to provide all the medical details and finally after some hard work it shows you your premium. Personally for me (age 27 , policy for 30 yrs) , the iProtect premium for 1 crore was just Rs 9,400 .The ICICI iProtect comes with two different Plans, one with accidental rider and one without accidental rider

Two Different Plans under iProtect

- iProtect Option I : In this option there is pure life cover without any rider, you get the sum assured only when you die, else not .

- iProtect Option II PLUS : In this option , along with pure life cover , you also have accidental rider , which is equal to the Sum Assured (subject to a maximum of Rs. 50 lacs) will be paid out in the unfortunate event of death of the Life Assured only if due to an accident

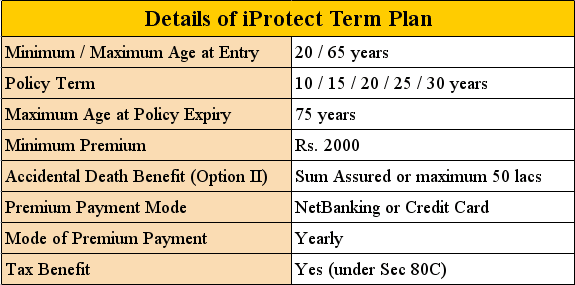

Other Features of iProtect Life Insurance Plan

More at Document Brochure

When does the Life Cover Starts in iProtect?

The best part of the policy is that your life cover begins immediately once company receives the premium in case of non-medical cases (incase there is no need of medical examination) , However, In cases where medical examination is required, cover will commence from the date of issuance of the policy. Calculate your Insurance cover

Freelook up Period

A period of 15 days is available to the policyholder to review the policy. If the policyholder does not find the policy suitable, the policy document must be returned to the Company for cancellation within 15 days from the date of receipt of the same. On cancellation of the policy during the freelook period, They will return the premium paid subject to the deduction of:

a) Insurance stamp duty paid under the policy,

b) Expenses borne by the Company on medical examination,if any

iProtect Premiums Illustrations

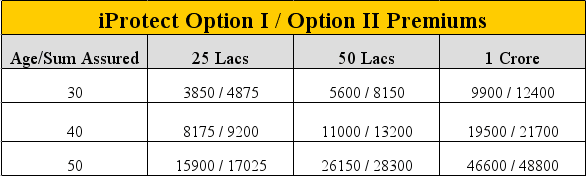

A) The table below provides annual online premium (exclusive of service tax and cesses, as applicable) for various combinations of Age and Sum Assured for a healthy male (non-tobacco user), opting for a policy term of 25 years.

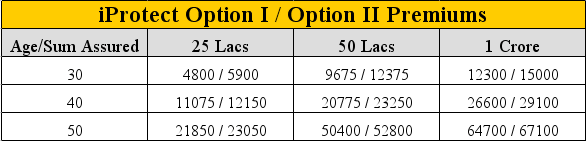

B) The table below provides annual premiums (exclusive of service tax and cesses, as applicable) for various combinations of Age and Sum Assured for a healthy male (non-tobacco user), opting for a policy term of 20 years, where policy is sourced by tied agents, corporate agents, brokers or direct sales.

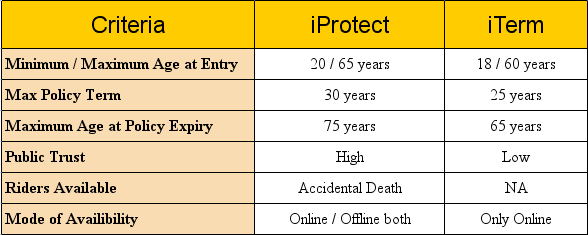

iProtect vs iTerm Comparision

I Let us look how iProtect fares in comparision to iTerm plan. I found out that iProtect beats iTerm in all the areas.

What is covered under Accidental Death ?

Accidental Death Benefit: This benefit is payable subject to the conditions mentioned below:

1. The death due to accident should not be caused by the following:

a) Attempted suicide or self-inflicted injuries while sane or insane

b) Engaging in aerial flights (including parachuting and skydiving)

c) By the Life Assured committing any breach of law

d) Due to war, whether declared or not or civil commotion;

e) By engaging in hazardous sports or pastimes

2. Death due to accident must be caused by violent, external and visible means.

3. The accident shall result in bodily injury or injuries to the Life Assured independently of any other means. Such injury or injuries shall, within 180 days of the occurrence of the accident, directly and independently of any other means cause the death of the Life Assured. In the event of the death of the Life Assured after 180 days of the occurrence of the accident, the Company shall not be liable to pay this Benefit.

Premium Comparision with other Cheap Insurance Policies

Who Should Buy ?

If you dont have Term Insurance : If you havent bought term insurance till now and were still waiting or I must say “delaying” because of your laziness , this is the time to act and finally buy term insurance online .

If you are UnderInsured : You know that you are underinsured , who still not taking the additional cover, now its your time to go and buy additional cover .

If you already have sufficient Cover : Situation changes , and so does in Personal Finance, even if you are adequately insured , It would be a good idea of explore an option of shifting fully or a part of your cover into iProtect term plan , as its a cheap plan .

Open Question, This is a new plan , we are not sure of the customer care support and how well its service is, What do you think about it ?

Comments , Do you like this iProtect Plan ? Please let me know your reasons and what you think about this plan . Are you going to take this policy ?

August 19, 2010

August 19, 2010

I m planning to take term plan of PNB METLIFE of 5000000 for me and 2500000 for my wife (housewife)…and also a 5000000 policy for me from ICICI… is my decision right…plz give me suggestion..

Hi Manish,

I am looking for a Term Life Insurance of Sum Assured of 50 lacs for 35 years.

I am confused between ICICI iProtect and Max Life Insurance. The premium of ICICI is more than MAX life. However, for me premium is not the only criteria to select a policy. What matters are the benefits and hassle free payment of the Sum assured to my family in case of any eventuality.

Can you please guide me on what policy to go with?

Both are ok. If you give your information correctly, any of them is fine.

Why not HDFC? We have had good experience with them as we have dedicated team handling our investors case. If you are interested, just fill up this form http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Btw, Max is now getting merged with HDFC anyways

Hi Manish.

I was almost going to buy the Term plan from MaxLife when I got a call from their customer service telling me about their features. Found them impressive and helpful.

But just then he mentioned that MaxLife also covers suicide. That put me off. I am of the opinion that it should cover suicides. There is a chance that it will be misused. It totally put me off.

Am now going with ICICI or LIC.

Thanks,

Manish

Every Term plan covers Suicide !

I am 25 years old non smoker Male, planning to buy a term plan of 1 Cr. for 35 years. I found ICICI’s iProtect and PNB MetLife’s Mera term plan pretty interesting. Both have good claim settlement ratios(above 90%, as per I have got online), though premium of Mera term plan is a bit less. Please suggest which plan would be bettr to buy? Whose claim settlement process is better and smoother, ICICI’s or Metlife’s? I am a bit inclined towards Metlife, will this be a good choice?

You can go with any term plan actually. Just tell them truth 🙂 . Why not HDFC ?

i have purchased term plan of icici – 50 lacs.

i paid 2 premium on 23 january, but still my policy not activated.

daily i used to call at customer care no. but not getting proper response.

i drop a more than 15 mail, but no any reply.

i really have a bad experience with icici.

i wonder what to do, shall i cancel this policy or what….

Yes, if your experience is so bad, cancel it. But if you apply for a term plan at any other place , will you get it faster then ICICI ?

Hi Manish,

I am Manish Modi and I took icici iprotect for 40 years Sum assured 1crore and premium is 11864 but not yet activated…

Could please let me know on what are the points that i should discuss with insurer company before it’s get activated.

Hi Manish Modi,

Please check if all the required documents are uploaded or submitted to the insurer. Like wise, check whether the payment done was successful or not. These are the general reasons why the policy will not get activated.

Regards,

Naveen

Hello Manish,

Thanks a lot for the detailed information, I have decided to buy a term plan for 1.5 crore that too after going through yours “How to be your own financial planner”. A very good book and I feel every working individual should go though this book.

I don’t have any Life insurance plans till now and felt very happy about that. Thanks to my Mother for always guiding me not to take Life insurance(Investment + Insurance).

I want an advice from you on my below plan:

1. I am planning to buy a 1.5 crore term plan.

2. Have gone through premiums of ICICI, Relaince…

3. Option 1: Go with ICICI for 1.5 crore sum assured with a premium of 16025.

4. Option 2: Go with two term insurance, 50 lakhs with ICICI(Premium:7122) and 1crore with Reliance(Premium:8507), there by total premium will be 15629.

5. Only advantage with option 1 is by default it includes Terminal illness and Wavier of premium in case of Permanent Disability. With option 2 , Premium is bit less, and one of the insurance guy suggested its always good to split the sum assured with two different insurance companies(as it helps in minimal rejection if one company settles the claim, other one has to settle without any issues).

Can you please advice me which option would be better. Thanks a lot in Advance.

Hello Manish,

I see some problems faced mentioned here in the comment section with ICICI… As my birthday is approaching( next week)… It would really helpful, if you reply to my above comment as it will save a substantial amount wrt premium. Waiting for your reply.

Thank-you

There is no issue as such, you can go with ICICI if you wish. However HDFC is another good option . We have a special tie up with them.

You can fill up the form below if you need us to connect you to them .

http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Hi Manjunath

You can go with a single policy from ICICI Itself . You also have an option for HDFC incase it works for you. Its a good company and we have a special tieup for our readers. You can fill up this form if you want that

http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Hi Manish,

U are doing great thing by helping peoples in insurance queries. God bless u.

I am planning for ICICI i protect smart life plus which provides Death benefit and Accident benefit. I already have previous accidental policy of 10 lakh.

My query is that while filling online form what previous policies I have to declare?

I have LIC Jeevan Anand , Bajaj Accident Policy and Health Insurance from Apollo Munich.

Guide me…..

Kiran

You have to declare all the life insurance policies, not health or auto or even accidental one

Please suggest me a term plan for each parents (aged 61 and 51) for 25lac sum insured with max. term.

I suggest HDFC term plan .. You can look at http://jagoinvestor.dev.diginnovators.site/services/life-insurance and fill the form there. We will help you on that

Hi Manish,

I want to buy a term plan. I am confused between HDFC Click2Protect, ICICI iProtect. Can you please suggest me best out of two. Also I am not able to understand “Riders” benefit under Term plan. What will be the consequences in future if I dont take Riders benefit.

Thanks in Advance,

Ajay

Riders are always EXTRA . Means if you do not buy it , you will still get the main benefit that if you die, your family will get the money.

Hi ,

I really appreciate this platform of interaction and getting valuable guidance.

Actually , I am in a dilemma of “what should I consider while buying term plan”. Which term plan would be better and do settle without any hesitation/ harassment ? should I consider claim settlement ratios or some other factors?

I am also confuse thinking that “all the insurance companies have JV with other foreigner companies and what if the insurance company would not go long with their joint venture , at that point of time what would happen to the policy holders.??

Need guidance. Thanks.

Hi Sandeep sharma

You dont need to worry on that. Even if a company closes down or breaks the joint venture, its taken over by other and your term plan continues

Hi Sir,

My Name is Prakash Shrestha.I have been living in India since 2001 and i am planning to buy Life Insurance IProtect of 50Lakh.I am citizen of Nepal and my nominee will be also from Nepal.I want to know may i buy Life Insurance being nepali citizen.What are the condition for nepalese people do i have to pay extra charge being not Indian? As my insurance advisor is telling it can be done but i want to know from your side.There are two questions.

1:Can i buy life insurance being nepali?If yes than do i need to pay extra.

2:What will happen if i die out of India?Will there be any problem to receive money for my nominee.

Yes Prakash

You can take life insurance from LIC, but it would depend on the descretion of LIC only. You dont need to pay extra for that, but final words are with LIC

The claim will not be an issue

Manish

while trying to buy iciciprudential’s i protect term plan option 1 for 30 lac for 25 years for 1st time i filled old life insurance policy details column and faced problem while filling health detail questions as a customer is provided with only max. two lines ( approx 100 words max.) to provide answer to 21 questions .. so on conforming from C.CARE they said that’s all the space for answering all questions & now old policy details column is withdrawn. So if a customer want to provide detailed answers than he has to write a email to them with all details of question & answer to respective question & his old policy details & on surprise to me this email will not be a part of policy document which you will receive for free look in period … So my question is to MANISH CHAUHAN should i opt.out of icici as i don’t trust companies which has loop holes in their documents & left customer on loose end.?

Yes, better opt out from that

Dear manish

I have read ur book regarding financial planning now I wnt to take term policy from icici of 75 lakhs I talk to there customer care they said that they wil do medical test if required wil they give me in written but they r not conforming me in this regard.kindly guide me.

Gaurav

I just replied you over email

Hi,

Even I am in the same boat. I am planning to take a 75L term insurance but ICICI is telling me that they will conduct medical only if they think it is required. Had a real bad experience with HDFC and in no mood to go ahead with them. But also at the same time I am not confident to go for the ICICI without medical test.

Please help.

Medical tests if not done , its fine . You can give the declaration while buying and that should be ok

Hi all,

I am planning to buy term insurance plan. My age is 41. Can anyone guide me on this. I checked Max Life insurance is apperantly low cost compare with ICICI & HDFC. What you say guys?

Sandeep

Generally its not that known and overall I would say go for options like Aviva, ICICI , LIC or HDFC

very horrible experience with ICICI Prudential online plan. They have not issued me a policy since one month for which i have submitted all the documents and paid the premium online. Customer care is really really very poor. After this poor service i decided to cancel the policy and guess what !!! Their customer care cannot cancel my policy.

Finally i have launched complain in IRDA.

Dear Sir(Jignesh),

We are sorry to hear your experience. We request you to help us with your contact and policy details to assist you .

Alternatively, you may also post your concern along with your policy details on https://onlinelifeinsurance.iciciprulife.com/digital/ipru/GrievanceRedStep.htm?execution=e2s1

Request you to quote the reference number 145327 whilst sharing the details. Post receipt of the requirement, our representative will get in touch with you within 48 hours.

Regards,

http://www.iciciprulife.com

Dear Sir(Jignesh),

We are sorry to hear your experience. We request you to help us with your contact and policy details to assist you .

Alternatively, you may also post your concern along with your policy details on https://onlinelifeinsurance.iciciprulife.com/digital/ipru/GrievanceRedressal.htm?execution=e1s1

Request you to quote the reference number 145327 whilst sharing the details. Post receipt of the requirement, our representative will get in touch with you within 48 hours.

Regards,

http://www.iciciprulife.com

THanks for sharing that Jignesh ..

Manish,

Till what sum assured I don’t have to go for medical tests.

50 lacs I guess !

Hi Manish,

This is very useful information.

However, Could you also share your views/analysis on term insurance from SBI like SBI Life – Smart Shield or any other ?

As I understand, SBI has a good solvency ratio and a better settlement ratio than few of the other private players.

SBI has recently launched its online term plan . While there is no issue with any company, just that I hear more about other companies.

Hi Manish,

Very informative article!!!!

I just was going thru the various choices as of now and came across TATA AIA, can you share your thoughts on same.

Thanks,

Puneet Sharma

I am not a great fan .. try Aviva or HDFC !

Sure thing, thanks! I am not good, but just thought what kind of security we have in case the insurance company goes down?

Hello Manish,

As per your advice, I am planning to convert all my existing LIC policies into paid up and take up a term insurance policy.

The query I had was , when I fill the online form for Term insurance…do I need to declare the LIC policies as I will be converting them to paid up once my term insurance is done.

Note: I am planning to take up term insurance first and then stop the LIC policies just for sake of continuity of insurance & in case my term insurance gets rejected for some reason.

Thanks in advance

Warm Regards,

Aditya

In that case you will have to declare those old policies in term plan application .

Thanks for the prompt response Manish 😉

I had a follow up query…what are the implications of declaring previous life cover policies with respect to the premium and claim process?

Does it have a negative impact?

SBI smartshield is much better than this.i have SBI smartshield. it’s very risky to buy online without medical.so it’s better to get medical test through them. you dont need to pay anything. it has good rider option to. I have 67 Lac basic sum,33 Lac Accident rider,50 Lac permenant disabity rider. tenure is 30 year.

Thansk for sharing that , I am not sure how correct it would be to say that term plans without medicals are very risky ! .