Why to increase sip amount in your Mutual funds

POSTED BY ON September 8, 2011 COMMENTS (164)

Do you want to increase the SIP amount for your mutual funds ? Or you want to keep it constant always ? A lot of people start with a SIP amount at first and then look forward to increase SIP amount later. This is a very common of every investor and its “how to increase sip amount”

Increase SIP amount

When we say “SIP”, it generally means constant SIP, which does not increase every year. When we calculate SIP amount using any SIP Calculator – the SIP value is generally very high and does not look realistic and at times and such high investment can trigger affordability issue. However there is a clear solution for this, which is used by financial planners and that’s called “Increasing SIP”, where one starts the SIP with a lower amount and then gradually increases them year on year. This looks more realistic as one’s income also increase overtime and ability to invest increases. We see this situation a lot while working with our clients under financial coaching program.

Let me show you the example : Ajay wanted to accumulate 5,00,00,000 (5 crores) for his retirement which is 25 yrs away. When he calculates the SIP amount, it’s coming around Rs 31,000 (assuming 12% returns from equity). Now it’s not possible for Ajay to invest Rs 31,000 every month, as it’s a very high amount. Rather he is fine if he can start with a small amount today and then increase it every year as his income would also increase with time. This is called as Increasing SIP model. If Ajay is ready to increase his SIPs by 10% every year, then he has to start with just Rs. 13,500. This amount is much more convenient for Ajay to arrange, rather than Rs 31,000 per month.

Should you increase SIP amount or not ?

At the first look, a general conclusion which comes into mind is that Increasing SIP is better than Constant SIP because it is much convenient and looks logical that investment should rise as the income increases. But there are different angles through which both the options can be looked at. Let’s look at two important points one by one.

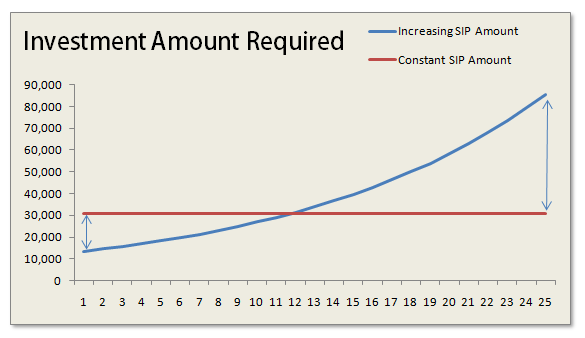

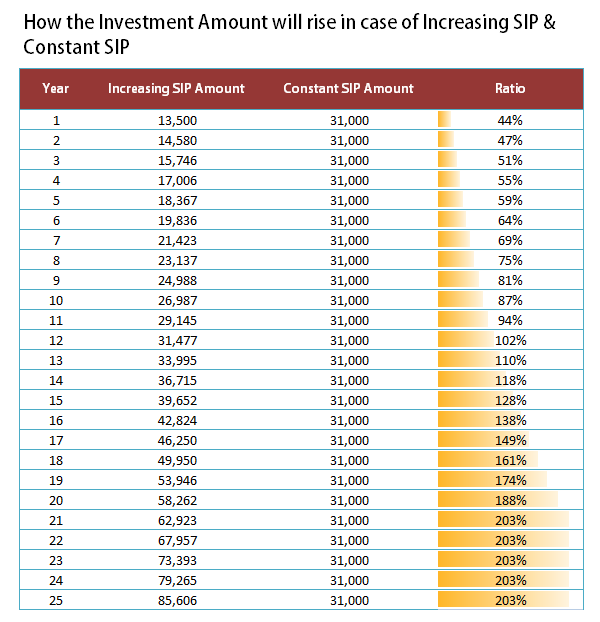

1. Investment required in case of Increasing and Constant SIP

One of the most important factor one can judge both the situation is the amount of investment needed. If we take the above example we just discussed, one would need to start SIP of 31,000 per month to accumulate 5,00,00,000 in 25 yrs assuming 12% return. Now this amount will be constant throughout the all 25 yrs. Where as one can choose to start his SIP with Rs 13,500 and then increase it by 8% per year, but in this increasing SIP model, his SIP amount would reach 50,000 in 18th year and 85,000 in 25th year, which might look very big in numbers, but years from now, it would be worth a small amount considering the purchasing power of money and the annual income one earns. So don’t get surprised by numbers.

One should opt for increasing SIP, when his situation really does not allow him to invest a big amount and he is very sure that he would be able to increase his investments in tune with his salary increase. Truly speaking I am in favour of Constant SIP if one’s situation permits because that way you are investing more in the start of your life and that would help you keep your SIP in check later on in life. Imagine after many years in life, you have to just invest the same amount where as your Income has risen 3X. Isn’t it a big relief and freedom to do whatever you want from your money at that time. Imagine your salary is Rs 50,000 per month and you do SIP of 10,000 and even after 10 yrs, when your salary has risen to say 1.5 lacs per month and you are still doing SIP of Rs 10,000 only. I would choose to pay a little more today and then get into that kind of situation.

Most of the people who are not able to go for constant SIP, because of high SIP amount is because they are very late in investments and now their goals are near and they have less time for compounding. These people have high expenses already in life. Had they started long back when they started earning they could be in a better situation now. Below is the table which shows the Increasing and Constant SIP amounts required for the example discussed above and shows you the ratio of increasing and constant sip. You can see how it started with 44%, but rose to 203% later after 25 yrs.

Conclusion

One should start his SIP’s early so that he can keep his SIP’s constant through-out the tenure. If you are late, then your SIP amount will be very high and will look unrealistic and then you will have to increase your Systematic Investment plan (SIP) amount in future if you want to reach the goals.

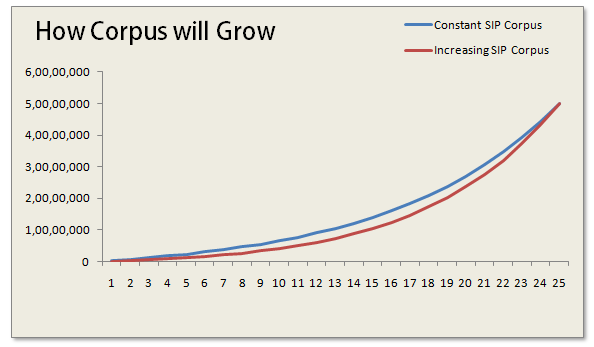

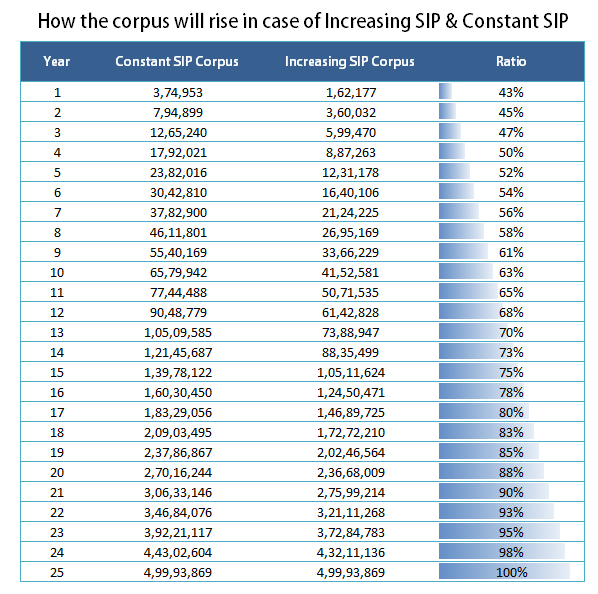

2. How the corpus will grow in case of Increasing and Constant SIP

The other major thing to look is how your over all corpus would grow in both the cases. Note that in constant SIP and increasing SIP, the final corpus is getting accumulated and they reach the same point at end, but in case of Constant SIP, the overall Corpus is always higher than the increasing SIP and it’s because you are investing higher amount in the start and that way the compounding factor is in your favour. See the chart below which shows, how the gap between the two narrows down at the end of the tenure and both the cases lead to same corpus.

If you look at the table below, you will see that the maximum difference between the two is 36,00,000 in 17-18th year and after that the difference starts coming down (not so clear in table , you need to calculate it) . As you are starting with lower amounts in increasing SIP, the overall corpus is obviously going to be less, but it’s very much above 50% all the time, so if you are saving for long-term, you should be interested in the final corpus.

Note that the example and charts above are assuming a 25 yr old tenure and equity returns of 12%. The numbers would change depending on tenure and the equity return, but the overall conclusions discussed above remains same. For a shorter tenure like 4-5 yrs, the constant SIP and increasing SIP won’t differ a lot; it would be a small number.

So the conclusion is that one should keep on increasing their mutual funds SIP amount as and when they can , preferably every year. So are you ready to increase sip amount ?

Dear Sir, I Want To Invest Rs. 6000/mth for 5 years. Please suggest some MF. Can I invest in Small cap And Mid Cap Fund.

Hi mahesh

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://www.jagoinvestor.com/pro

Manish

Hello,

My age is 30 and I haven’t started investing in mutual funds. I want to start now.

I am thinking of starting from 10000/- per month and will increase it annually.

Please suggest me some good SIP/Funds and any other suggestions.

Thanks.

hello

i am student and want to invest 2k per month for long time. i am thinking of increasing the amount with time. but for now which funds i should go for ???????/

You can start with ICICI Pru Balanced Advantage Fund – G

Dear Sir,

I would like to do monthly SIP of 20000 in 4 funds including one tax saving fund. Kindly suggest me the funds.

and how many year i have keep investing?

Axis long term equity and ICICI tax saver are good options for ELSS

Dear Manish, currently almost all my salary is being used for paying loan EMI’s. However, I want to invest some small amount in SIP or any other mode of investment. Please suggest some good plan/ SIP.

HDFC Prudence is a good fund to start

Sir, I would like to invest Rs.20000=00/month in SIP for only one year.(Rs.5000 x 4 diffrent companies) . Approx. what is the range of profit % per year and which SIP are better to invest now.

You can take a look at Birla top 100 and HDFC top 100 as of now .

Thank you very much for your valuable information.

Sir, Is there random top-up facility available in SIP (Ex: My SIP amount is Rs.1000=00/month. If i want to top-up Rs.5000 amount one time. But i don’t want to increase the SIP amount every month). Is it possible?

I think its not possible in regular SIP . BUt flexi-SIP options will help you

Its always possible. when market is down, You can always purchase more, this will not alter your SIP

Hi,

I am regular reader of jagoinvestor. I am 35 years old and am planning to start a monthly SIP of 10K each for these 2 funds for long term ( 10 to 15 years)

HDFC Balanced Fund

Birla Sun Life Long Term Advantage Fund

Does it make any sense to invest only in 2 funds? or I should add some more? are these two funds OK to invest in current scenario?

they look good to me overall . But just see if market scenario is fine for you to invest or not ?

hi,

myself vivek and my age is 26.Currently i am working at a soft company with take home of 35k pm.

lets say,

expenses – 10k

ppf – 50k or more, FD – 50k or more per year,to do that i save 15k per month.so that i can have some amounts in savings acc also.

As i am planning to marry after 3 yrs, i am not interested in any insurance or watsover.may be once i get

married i can start thinking of any insurance for my family.

I have remaining 10k in my hand.so thought of investing into mutual funds for long term.

So i have selected few funds,

ICICI Prudential Focused Bluechip Equity

–

Quantum Long Term Equity or uti opportunities

–

Reliance Small Cap Fund (G) or DSP-BR Micro Cap Fund – RP (G) or or hdfc mid cap opportunities or uti mid cap

–

hdfc balanced fund or hdfc prudence fund

–

Are My understandings correct ? or should i include one ELSS fund and balanced fund(as i already plannin to put some in FD) in my portfolio ?

can u help me to select proper funds and how much i can invest in these ?

You can invest in ELSS , as it will have 3 yr lock in and you can use it once you are married !

Hi,

Sorry to respond so late on this post.

Manish, you have mentioned above that it is ideal if we increase the SIP amounts by x% every year based on our salary at the time.

I agreed completely with the logic behind the post and the calculations that you have shown but how to manage this increase per year from an administrative perspective?

I can see the following options:

1. Stop the current SIP and submit a new mandate with the higher amount.

2. Continue with the existing SIP, submit a new mandate to the bank/AMC to debit the additional amount on the same day of the original SIP date/a different day in the month.

Both the options are not ideal as they increase the admin activities substantially as the investor will have to fill a lot of forms, sign a lot of first payment cheques (considering he/she invests in 4-5 funds per month). Also, imagine the number of mandates present on your account after 20 years if one selects option 2!!!

Or, is it feasible to take a 5 year view and increase the amount every 5 years purely to reduce the admin efforts and to be able to manage your investments better? But, will this lead some loss in wealth generation after say 20 years due to compounding effect?

Or are there any options available to the investor?

Will be helpful, Manish, if you can please answer my query.

Thanks,

Praj

Hi Praj

“Increasing the SIP amount with salary increase” .. the whole idea is to increase your contibution when you can do so . Like you said from administrative point of view.. So doing it every 3-4 yrs is ok .. just check the quantum .. if you start a SIP of 10k per month .. then after 4 yrs , make it 15k 🙂

Dont over optimize 🙂

Manish

dear manish

i am having 1 sip in icici dynamic g plan 2k from last 1 year i want to increase my savings by starting new 2 funds 1. hdfc top 200 3k & 2. dspbr top 100 2k and

also any 1 gold etf 2k (pl suggest)

will it be a good portfolio, pl suggest so that i can start it immidiately,

also want to know how i can invest in amc directly by online mode.

You should go for online investment in these 3 funds suggested .

please suggest how to start onlien investment any AMC.

please give me the website if any.

Sachin

You can visit the company website directly. Search on internet for the AMC you want to invest in ?

Hi Manish,

thank you for useful information.

i am 35 year old , started investing in sip in august 2011. the total amount (16000/month) in various sips is as follows

1)BSL Frontline Eqt-G -2000

2)HDFC Equity-G-2000

3)HDFC Prudence-G-1000

4)HDFC Top 200-G-2000

5)IDFC Premier Equity Plan A-G-2000

6)Reliance Banking Retail-G-1000

7)Reliance Gold Savings-G-3000

8)Reliance Pharma-G-1000

9)UTI Dividend Yield-G-1000

10)UTI Opportunities-G-1000

i wish to increase the amount to 26000/month for 10 years. is it advisable to invest this amount per month in sip? if yes kindly suggest changes required in my portfolio.

thank you again.

I think you are investing in too many mutual funds. better get rid of some .

I suggest only 5 funds .

thanks for your early reply. please suggest me which ones should i invest in and the amount in each. because i did it on suggestion of an average broker. again is it safe to invest 26000 per month for 10 years?

You can invest in HDFC Equity , DSPBR top 100 , Franlin Templeton !

thank you Manish.

Interesting conversation on long term return in equities.I too am sceptical about this long term theory on equities.If we look around the globe their are plenty of long term instances when equities have not performed well .In late eighties nikkei the japanese index was over 20k and today after more than 2 decades it is hovering under 10k.In US the the dow jones was at 10k in 2000 today after a decade it is at around 13k.So clearly even in nations which are far better governed than our country equity has underperformed over a long term.However their must be distinction made between index returns and actual stocks.We must not forget that individual stocks may have given stellar returns not only in terms of higher value but also regular dividend payments.Eventually i feel that market timing and understanding fundamental future value of an asset is necessary to make any money.Just making regular investments as touted by many as only way of wealth generation seems flawed.

Deep

There are two points regarding this.

1. Its totally true , that there can be risk of long term non-performance in equity and thats a risk with equity.

2. The instances which you mentioned are more true for a already developed nation, where there are limited growth for economy to grow compared to a developing nation , see Japan , US .. they are already a developed nation, so the juice left is not much. India will also face the same issue , but there is time for it.

Thats my stand, your view can be different depending on how you look at things. But I agree with you that one should be cautious with equity and not over depend on them

Yes, historically the odds are in favour of equities, but don’t you think its basically because of one good bull run every 10 yr period.. If you don’t get the run then there is a problem. Like people who started investing from 2008, have spent almost 5 yrs without seeing their money grow.

Moreover, it somewhat nullifies the so called effect of compounding, if the overall growth is mostly dependent on some sporadic periods of high growth.

Imon

Yes , the last 5 yrs will really bring down the effect of compounding in some way , but that is again for those who invest one time , consistency in investments is something which would help in this downside too .. These 5 yrs have been best time to get ready for the next 5-10 yrs . Have you thought of it that way ?

Manish

Sure, it has. At least I am hoping it has, as I am one of the investors who had started investing in SIPs from 2010.. :).. But again the last 20 yrs CAGR of around 8% sort of raised few doubts in my head..

The take away that I have from all these, is that, don’t neglect ppfs, and FDs (especially if you are in a lower tax bracket) at all.. Continue substantially with them along side the equity exposure..

Yes Imon

PPF and FD are no doubt important products . Now let me point out one thing .. You looked at 20 yrs period return at last 20 yrs , sensex was 2000 in 1992 and in 2012 its 16000 . The return is around 10.9% (why do you conclude it to be 8%? – want to know) .

Go 2 yrs back and now you are in 2010 , now do the same thing .. from 1990 – 2010 .. it was 1000 in 1990 and 20,000 in 2010 . So now the CAGR return is 16% .. from 10.9% to 16% .. huge gap , timing is different . So may be you are looking at worst period of 20 yrs .

Hi Manish,

Actually I corrected my mistake in my 2nd post. I wanted to point out the span from 1994 to 2012. Sensex moved from 3.6k to 16.8k.. Yes it was possibly the worst 18-20 yr period, but again, 18 yrs is a long time where one wants an assurance that the money wont get wasted. The only point that I wanted to make is that, one can’t be blind towards one asset class, even if you are looking for a period of 20 yrs. Moreover, ever since our economic reforms in 1992, there has been 2 bull runs. So the sensex rise has been driven by these 2 periods. It has not been a consistent incremental rise. What if we are out of luck in the next 2 decades !!

I agree that it can be the other way round as well where we might get better yields, but the whole point of doing an SIP over a long period is taking that chance out of the game, isn’t it??

Ok i got your point now .. and i agree that we cant do blind investment and cant rely like this on any investment no matter what it is .. One point … did you check what is SIP returns in that 18 yrs time frame , I am sure it would be very different from lumpsum ! , just an exercise !

“Did you check what is SIP returns in that 18 yrs time frame , I am sure it would be very different from lumpsum !”

I tried this out and it sort of surprised me to be honest :P. Assuming only one sip instalment each year, the CAGR come out to be 13% between 1994 to 2012.

Hmm… actually it would be much more .. how did you find out the return ? You should be using IRR in this case .. right ! .. Also if you use monthly installments , it would come much higher !

Following is the method I used.

Assume I invest Re 1 each year.

Assume 2012 sensex to be at 16800.

If the sensex value is Sy in some year Y, my investment made in year Y has risen to 16800/Sy in 2012.

So basically my final corpus is

16800*(1/S1994 + 1/S1995 + … +1/S2012) …. (1)

Now to the rate of interest part:

Assuming a constant rate of interest of x*100 % , an investment of Re 1 each year for 18 years will yield a corpus of [(1+x)^18-1]/x … (2) .

(1) and (2) matched approximately for x=0.13.

I guess this is what a layman will do ..

Yea seems to be correct .. you calculated form basic principles .. it was much easier to calculate in excel using a method called IRR .. anywyas ..

Yes, historically the odds are in favour of equities, but don’t you think its basically because of one good bull run every 10 yr period.. If you don’t get the run then there is a problem. Like people who started investing from 2008, have spent almost 5 yrs without seeing their money grow.

Moreover, it somewhat nullifies the so called effect of compounding, if the overall growth is mostly dependent on some sporadic periods of high growth.

Hi Manish,

This might be a bit off track, but “equities give the best returns in the long run” might not necessarily be true. If you look into the sensex data from 1992 to 2012, the annualised return is a meagre 7.5 % or so (4200 to 18000 in 20 yrs), which is not great any standards. Even the good old PPF beats it in the long run hands down.

Moreover, the sensex didn’t move anywhere between 1994 to around 2003 (3600 to 4000). This is a period of almost 10 yrs. Lets say you were an an SIP investor in this period. How long would you have stayed invested if your first SIP date was some day in 1994.

Would like to know your thoughts on the same.

-Regards

Imon

PS: Historical sensex data is taken from http://www.scmrd.org/Sensex%20Chart.pdf.

A small correction. The span for sensex was from 1994 to 2012 (when it rose from 4k to 17k). CAGR=8% .

-Imon

Yes agree that there are specific cases where equities have not given great return , but “equity give good return in long term” means take any long term and there are high chances (90%) that it would be good returns , how many different 10 yrs tenure have you seen ? Check 20 different long terms like 1990-2000 , 1991-2001 .. etc and then see in how many of those returns are bad !

Yes, historically the odds are in favour of equities, but don’t you think its basically because of one good bull run every 10 yr period.. If you don’t get the run then there is a problem. Like people who started investing from 2008, have spent almost 5 yrs without seeing their money grow.

Moreover, it somewhat nullifies the so called effect of compounding, if the overhaul growth is mostly dependent on some sporadic periods of high growth.

HI

Nice article manish. I am in favour of Constant SIP. As this way whenever you do ur monthly budgeting, you take into account the SIP money as well. and besides this after few years if you wish to increase your SIP you can simply cancelled the current SIP and start again with increased SIP amount. I have done this in few of my funds.and the GAP to start a new SIP is usually 1 month.

Only thing to note is that dont put all your money in one fund, you should start SIP in different funds.

Regards

Vivek

Vivek

Thanks for your suggestion .

Dear Mr. Manish,

Waiting for ur reply

Thxs….

Manish,

Will my money grow more than what i would have receive for my FD’s??

pls suggest..

Thxs

There is no guarantee .. the chances are higher that it will , but there will be ups and downs !

Manish,

Ya i m planning to put dat money in , BSL Frontline Equity 2000 pm , HDFC Mid Cap- 2000pm and few ETF’s. Is it worthy decision.

Doing for de first time, so dont want to tk any unplanned, erong decision.

pls suggest…

Thxs.

The money will be more in mutual funds provided you do it in long term , means 5-10 yrs and again its 95% chances , not 100%

Dear Manish,

Pls clarify, but do u mean by , what is ur goal. In what sense u r asking, did nt understd..

Regards

Sapna

I am asking what exactly you want to achieve .. For how long can you invest ? How much risk can you take ?

Mainsh,

I have done FD’s for 10 yrs for 5Lac on quarterly interest payout and what all payout i will receive i m planning to put all dat money for long term. Atleast for 10 yrs..

That much risk I can take.

Pls advice is it a wise decision/any other modification required.

Thxs

Sapana

Depends on where you are planning to invest ? Are you putting that money in Equity If thats the case .. then i think its a good idea !

Dear Manish,

I had done few for 10 yrs NRE FD’s on quarterly bases and than putting these quartely Interest in MF since january 2012 ,BSL Frontline Equity 2000 pm , HDFC Mid Cap- 2000pm , few ETF’s.Kindly advice is it ok or something is reqd more..

I m planning to do more FD’s on same bases, is it ok??

Regards..

What is your goal ?

Hi Manish,

Hope you are doing well. Need some suggestions.

I checked the SIP calculator on valueresearch and saw the returns for HDFC top 200-G from Jan 2003 to Jan 2012(10 years) as: Annualised SIP Return over period: 22.74%. I am confused here. Does that mean 22.74% compounded annually? Please clarify.

Also, I have been investing 7000 pm(SIP) since Nov 2010 in the following funds:

HDFC top 200-G 3000PM

Sundaram select midcap-G 2000PM

DSPBR equity fund 1000PM

Fidelity equity fund 1000PM

Is this a good portfolio? I need this money till 2020.

I am interested in investing 10000 PM more in SIP for a span of 20-25 years for my retirement corpus. Should i consider new funds or invest more(with a different folio) in the funds which i am already investing? If in different funds, can you please suggest some good funds.

Ravish.

Ravish

Yes its compounded yearly , and its 9 yrs , not 10 yrs.

Your portfolio looks good to me , no need to add additional funds

Manish

Two friends ABC and XYZ. Both start at salary of Rs 3,00,000/- pa. ABC is smart at investments and can make say 14% pa as against say 10% pa that XYZ can make. However, XYZ is smart at work and can get hike of 14% pa as against say 10% pa that ABC can get. They both believe in savings equally – they both save say 30% pa. Who does better?

We can do the maths and see how our human capital is one thing that we must assess much before assessing any other aspect when it comes to saving, investing, and creating wealth.

– AG

True

Agree with you !

hi Manish,

i am vivek,22 yrs old working in software concern,i have 2 plans for nw. one is for the short term(marriage at 28) and the other is like a kind of insurance so that it will useful for my kid’s education. i can save a yearly sum of 30k. i should invest in both and get beneifited. Please suggest me and guide on the above mentioned critieria.

VivekRaj

Its a good time to get into mutual funds for medium term (6 yrs) and long term both for your goals .. get into mutual funds .. for your marriage you can go with balanced funds and for other goal , go with pure diversified mutual funds

Manish

Manish

Ive been tracking a fund named ICICI Technology Fund its NAV had never gone above Rs.10 in coming 5 years but it has doubled the money in 5 to 6 years.

Bhawin

Bhavin

Good to hear that ..You must be talking about SIP . right ?

Manish

Ha Manish,

can u throw some light on VIP

PA

VIP is variable investment plan which invests a differnet sum each month unlike SIP , read more about it on net

Manish

Thanks Manish. Will analyze some data and then take final decision. I agree with your view that choosing top fund is difficult since the ranking keeps changing based on the returns. But all the ones you have mentioned are really good ones. Thanks again.

So my monthly investment will be 33% in Large cap fund, 33% in large+ mid cap fund and 33% Gold fund. Can I consider this as a balanced portfolio? I do invest substantial amount in debt i.e. ppf + epf. Please advice.

Karthik

You have to look at underlying asset classes .. see how much you are exposed to “Debt” and “Equity” at the end of your investments ..

Manish

Hi Manish,

A couple more queries-

I was looking at weekly SIP of Rs each in 6 funds (2 Large cap, 2 mid cap and 2 gold). That would be weekly outflow of 3000 Rs (i.e. Annual 3000 X 52 = 1.56 Lacs Rs.). The 2 Large and 2 mid cap funds are from the 2010 top funds you analyzed in another popular article. 2 gold funds can be reliance and UTI.

I understand that this is a bit more diversification. But personally I prefer that. My questions –

(1) Do all mutual funds (equity diversified and gold especially) allow weekly SIP?

(2) Does the minimum amout differs from fund to fund? My max limit is 500 weekly per fund.

(3) Do you see any risk with this particular approach?

(4) Any other suggestions?

Thanks!

One more thing. If weekly minimum is 1000. I am OK to go with only 1 each from above mentioned categories. (But personally I prefer 2 each).

Suggest me your 2 picks from those 3 categories. Of course I plan to evaluate perfomance of funds every year and adjust the portfolio if required.

Thanks!

PS – Off topic : Sent health insurace proposal form to medimanage yesterday (Oriental happy family gold for 6 lac).

Kartik

Why do you prefer that ? Its my first question to you … there has to be some strong logic to it ? Also why weekly SIP ? Again any logic ?

My personal feeling is that you are trying too hard ! . Weekly SIP in 6 funds OR monthly SIP in two funds , How much difference do you feel it is ? Will your strategy make more money or is less risky ?

1. Not all

2. The minumum varies , but not all have min of 500

3. I dont see more risk , but its useless to do this compared to monthyl SIP , you are trying too hard .

4. Just keep it simple ..

Manish

As I said I am OK with only 3 funds as well. But I think weekly is better than montly. It works better in volatile market (e.g. last 2 months in equity market).

What are your top 2 picks Manish in Large and mid cap segment each?

Kartik

There are studies which has shown that monthly , weekly and daily SIP , all are almost same and monthly has been good most of the times .. so make sure you take decision based on the data and not just gut feeling.

I dont have a top pick , i believe in a group of funds and one can choose 3-4 out of them , because nothing remains at top … what you choose todya will be at 5th place after 6 month . So focus more on consistency and discipline ..focus more on saving more money etc …

To name a few .. the regular one’s like HDFC top 200 , HDFC equity , DSPBR top 100 , Birla Sun life front life equity

Manish

Hi Manish

Have dmat account with icicidirect. Two questions –

1. Had invested 20000 in HDFC 200 some time back. Now I want to invest in the same fund in SIP mode for 10 years. Can I do it? How would it show in my portfolio. Two separate mutual funds?

2. If I start SIP in Reliance Gold fund now, will I be able to buy lump sum units later whenever the gold prices are down? How would this show in the portfolio? Two separate mutual funds?

Karthik

Karthik

1. You must have got a folio number when you invested in HDFC Top 200 , while buying more units (through SIP or lumpsum) , just mention that folio number and all the additional units will be credited to that same folio number .

2. Yes , there is no restrictions on wheather you can buy lumpsum or SIP later , you can buy whatever way you want anytime !

Manish

Thanks Manish.

Yes, I get to select Folio when I click on either Purchase or SIP. But only problem is that is shows multiple options there. (Folio – Unit – Joint Holder 1 – Joint Holder 2) . e.g. (Folio# – 0.000 – null – null; Folio# – 391.000 – null – null; Folio# – 1000.000 – null – null; ). Why do I see multiple options like that and which one to choose? I think the one with 0.0000 units. Please help.

Karthik

Karthik

Better talk to HDFC AMC customer care .. they will help you to understand what is it exactly

Manish

Hi Manish,

I like your website, it is very informative.

I am new to SIP, I want to be able to review my MF every 6 months and be able to close non performers, and add good performers.

a) How do we specify this 6 month period to the AMC ? Is there any timeframe information to be mentioned while applying for MF ?

b) In addition to SIP, say if I want to invest some lump-sum periodically (e.g. annual bonus), how to do this ?

c) Is buying MF via agent (paper based) expensive than buying online ? e.g. brokerage, etc.

Thanks, appreciate your good work.

Regards,

Samir

Samir

1. When you fill up the form for SIP , there will be tenure to be mentioned , at that time you need to put 6 months .

2. That you will have to invest seperatly as lumpsum investments . I would consider you open an accoutn with fundsindia.com or moneysights.com and invest in mutual funds online

Manish

BTW I have a query, I have lumpsum amount and want to put in money in a midcap fund only on days when market is down more than 1% than yesterday. I have tested it and found that its better than SIP. For this i shall have to buy MF before cutoff time for getting same day’s NAV around 1PM for most Fund houses. How to do this easily and online ?

I can do this by putting my money in my broking account and buying MF before cutoff time online. This means my lumpsum amount gets blocked and gets no interest. Even if i put it in bank, i get savings 3.5% interest rate.

Will STP help? can I shift fund from debt>equity in realtime online ?

or any other way?

Dweep

To do this, you should explore buy/sell of funds through demat account .

Hi, Gr8 article as always.

I just want to make a point here. This article describes increasing SIP keeping a fixed amount in mind.

I think if there is no fixed goal, and aim is for capital appreciation, increasing sip=increasing equity exposure = good long time returns.

Eg: if i start a fixed 5k sip, after 10 yrs i get 11 lakh. (Approx @ 12%), now if i start increasing that 5k by 10% every year. I am definitely getting more at end of 10 yrs.

Dweep

Yes thats correct .. what is the point yu are making here ?

That it is good to go for increasing SIP if your pocket permits and your goal will rise in proportion. Most salaried people get yearly increments hence they can.

Dweep

Yea .. thts exactly wht i wanted to say in article

Hi,

What is said is true.

SIP has to be started from the time a person starts earning. Also cutting out on wasteful expenditure also helps.

rgds

Hi Manish

I want to purchase SIP for the first time. I can invest 1000 per month. Which is the best option available. Please guide me which, what and when to purchase it.? My age is 27.

Regards

Hitesh

Hitesh

Look at : http://jagoinvestor.dev.diginnovators.site/2010/08/list-of-best-equity-diversified-mutual-funds-for-2010.html

sir,

can we think of making our own (mutual)) fund by investing directly in front line stocks.kindly note some shares like bhel, larsen and tubro, ongc, powergrid.SBI,ril, dr.reddy labs, lupin, tcs etc in SIP.these shares are prefered by fund managers.

thanks for this service.

p.s i am not happy with long term fund performance of any sip.

Srinivasu

IN that case you are not having a mutual funds . all you have is a diversified portfolio :). Why r u not happy with SIP performance ?

Manish

Manish,

Good post – clear and well written.

I have a slightly different viewpoint on this though – Planning for retirement is only a ‘minimum guideline’ at best. For example, assuming 8% inflation and 12% return might mean I have to save 5 Crore for retirement. I could then take the required monthly SIP amount and invest according. This however falls apart if any of the variables change.

What I like to do is treat these as the minimums and then have a broad budget (investing – 35% of post tax income). This is the maximum outgo that I can sustain comfortably. Needless to say with every hike, the invested amount also increases. But the key should be to invest the maximum possible today!

Ganesh

Yes ,you have made the valid point and I agree that variables are bound to change .

However, in some years , things can get beautiful and things can get ugly , so we assume that this is an average return over long term . the graph of corpus growth will not be straight , but it will be full of volatility .

Manish 🙂

no point varying the SIP too much it wiil defeat the very purpose of SIP, i feel SIP should increase at the rate of Inflation to cater for drop in value /buying power of money and how much increase ? feel central govt increase of DA is a good indicator about 5-6 % every six months.

Sameer

Increasing SIP will lead to the same thing as Constant SIP , Its not that one is better or not in terms of goal achievememnt .

Manish

Ram,

Your query brings us to one very important aspect of Financial Planning – Goal based investing. For example, If we are investing for a planned goal for child’s education / marriage, etc which is 15 yrs from now, via equity SIP. We do not want to be in a situation when during the 14th year, the market crashes big time (like 2008-09) & we loose out on the returns. To avoid loosing money in a market crash towards end of our investing tenure, we need to start SWP or STP in a Debt fund before 2-3 years of completion of the goal. This will ensure we are not loosing out due to a market crash.

Dharmesh Gangani

Dharmesh

Agree … also we can assume the target year to be less by 2 yrs (incase of long term goals)

Manish

Though not everything in life happens according to plan. There could be a delay of 2/3 years in goals/dreams like higher education (I have friends who got into IITs or IIMs only after 2/3 attempts), marriage etc. So starting SWP/STP three years ahead of planned goal deadline may not work out always. But let us calculate assuming that we live in a perfect world. Say you had invested 1k per month via SIP on sensex from 1992(Jan) to 2002(Dec) and Started doing SWP/STP of 4k from 2000(Jan) till 2002(Dec) which gives say 5% return after tax. What would have been effective IRR of this investment? Can you do the number crunching to support the concept of 12-15% return of equity MF in long run?

Btw, situation of 2008-09 lasted only for a few months after which sensex recovered quite fast. What if it had stayed low for 2/3 years or even more? Starting SWP/STP would not have worked then also.

Ram

5% return in SWP/STP , what do you mean by that .. also you can do the IRR thing in excel easily , it would take quite a time to do this .

Manish

Manish,

That was 5% after tax return from the debt fund into which STP was done in given scenario (Goal based investing as suggested by Dharmesh). Yes, the calculation would surely take some time but probably worth if it proves that the expectation of 12-15% return from equity even in long run (as long as 10yrs) may not be correct always.

Ram

Instead of going for an increasing SIP, it would make much more sense to invest by VIP mode. i.e., invest more when markets are down and less when they are up.

Dev

Both have different motive … Increasing SIP is done if one can not afford the high SIP amount today .. VIP is timing the market .. we should not compare them

Manish

Good and informative post.

Do we have something like Decreasing SIP. somewhere i read about decreasing insurance and increasing insurance. I hope there is something, if not we can think about that part too for being relax when we are not sure about future job.

Like if i am sure about my job for next 5 years and i want to invest max in this 5 yrs to secure big part of my goal . How i can plan it?

Regards

Jig

Jig

If thats the case , why do you need a number ! .. just make sure you invest MAXIMUM you can , because even if you get a SIP number more than what you can do maximum ,you will not be able to do it .

Decreasing SIP would definately be there , its all about calculation.. you can find it out !

Manish

What a change in tone. Earlier every article on SIP used to assume 15-18% returns. Now it had come down to 12%. Most of the NCDs for a period of 10 years are giving more than 12%. Looks like SIPs, Debt, FMPs, NCDs and Bonds are all going to be equal for an average investor.

Hi Krish,

Your point is valid. Assuming 15-18% returns is a flawed model for planning. One needs to take long term returns for the planning purpose. But your argument for comparing NCDs & SIP for MFs is invalid as well. NCDs want you to invest all at once…no monthly possibilities there. SIPs are ideal for people who earn monthly, save monthly & hence invest monthly necessarily. It may or may not be best for HNIs as they may want to go for highest returns on some part of their savings.

Also, just to look at real data, a SIP in HDFC Top 200 started in August 2008 for 36 months would have returned approximately 16% year-on-year – this is post tax. Not 12% pre-tax as is the case with NCD.

—

Santosh Navlani | moneysights.com

Any SIP in a good fund starting from 2008 August till date to show the three years return will give us misleading information due to great fall for a few subsequent months. Let us wait for another year i.e. till September 2012 and then calculate SIP return for 3 years since September 2009. I am sure we would be talking about only 5 five years returns at that time unless sensex shoots upto 25K+ by then.

I would love to know what would have been SIP return of Sensex from 1992 (Sensex = 4387) to 2002 (Sensex = 3500).

Please note I am not against equity. I, too, do regular SIPs in equity fund; but not very confident about 12-15% return always in long run (i.e. ANY 5yr time block ).

Ram,

Completely agree on numbers…no one can dispute these. However, what most of us forget is a fund manager’s job/ mandate is to manage the invested amount. Its not his job to “plan” the asset allocation to each individual’s investor and its the asset allocation plan which governs the returns. i’m not sure if you planned an AA first for say 10 years & stick to it, you will still see the same result.

Whether its practical to keep an eye & follow AA strictly, is a matter of debate. However, at moneysights, we believe its not impossible.

i’m saying this in addition to what you said…not against 🙂

—

Santosh Navlani | moneysights.com

Dear Manish,

Hi, I started reading your articles on http://www.jagoinvestor.com recently & now I am found of your articles. I am referring this web site to many of my friends.

I have a query that does AMC’s levy any charges to maintain SIP (like ULIP)?

Will it make difference If, instead of starting SIP (say in HDFC Top 200), I invest in same MF on every month?

Girish

NO , it will not make any differnece .. there is no additional charges for SIP . just that SIP is a more practical and logical approach to desciplined investing . Its extremnelly hard to keep investing each month without forgetting and failing and without lazyness 🙂

Manish

Dear Manish

HDFC MF has launched new flex STP which is tototally different from convention STP has following features:

1.Under the Flex STP, unit holders will be eligible to transfer {fixed amount to be transferred per installment or the amount as determined by the following formula [(fixed amount to be transferred per installment X number of installments including the current installment) – market value of the investments through Flex STP in the Transferee Scheme on the date of transfer] whichever is higher} on the date of transfer.

2.Invest more when the markets are down – Accelerated investments on the date of transfer in the chosen equity oriented fund when markets are down

In a bullish market, continue with normal STP – Aids in keeping the power of compounding on your side in the long term.

3.Automatic tactical asset allocation – Advantage of investing more at lower levels.

4.Active management of the investment portfolio.

What do you think about this scheme? Get more details on http://www.hdfcfund.com

Suresh

This will requires a little study and some number crunching , but if its more on timing the market and hence something positive and negative is both possible, but it looks on better side .

Manish

Do the returns in SIP really calculated as compound interest? Is it calculated annually or quarterly?

While calculating SIP, we tend to use rate of return compunded annually.

Caribou

It can be done monthly , yearly ! .. its on you how you want to do it .. the best approach I think is to do it yearly and just divide hte number by 12 to get monthly number .

Manish

Hi Manish,

Well timed post…this topic is needed for people who get scared after seeing the so-called goal-based financial plans for themselves. i would like to contribute my 2 cents here –

The point you are trying to make that returns will catch up with constant SIP may not be correct. Reason being, towards the end of the tenure, one would tend to park a lot of money towards fixed-income instruments or debt funds and NOT continue with higher exposure towards equity. This will dampen the returns. So ideally, its better not to look at return comparisons but incorporate the increasing amount into goal planning. Even if the goal value is not looking to be met, one should be ok to live with decreasing ambitions by lowering the goal value or evaluate other options to reach the same goal (e.g. let the child fund his education thru loan, etc.)

—

Santosh Navlani | moneysights.com

Santosh

Good point , but there is one issue in your reasoning also .. as you said “towards the end of the tenure, one would tend to park a lot of money towards fixed-income instruments or debt funds and NOT continue with higher exposure towards equity.” .

Now this true even when a person has started his CONSTANT SIP , so even in that case he will park his money in less risky things at the end of the term and in that case what he calculated in start will not hold true . Because of that reason I didnt consider that in my calculation for increase SIP also , because its common for both the cases .

So now the answer to it is , as you said better to make sure that the calcluations takes into consideration that the money will be liquidated few years before the goal arrives , so thats will be the proper planning …

And also one should make sure he should keep on topping up his investments whenever life gives opportunity to them .

Manish

i agree with you partially. Because in the constant SIP option, because of higher allocation to equity in the beginning, the compounding will take care of the reaching goal value. In fact, one can plan that over a period of time the desired asset allocation itself would be towards more in debt & less in equity. So, a constant SIP will have “theoretically” higher chances of reaching goal value than increasing SIP. However, at moneysights, we are proponents of increasing SIP thanks to the problems you already highlighted in this post.

In one of the user queries i addressed in ActionMonth, i actually planned for a user assuming increasing SIP amount & lowering returns due to altered asset allocation plan over a period of time 🙂

i agree with you on topping up as & when 1 has money & opportunity.

—

Santosh Navlani | moneysights.com

Santosh

Ahh .. Its my bad that I didnt think about this point that you mentioned . I accept that I was wrong in my last comment , you are right that constand SIP will take care of goal with higher probablity than increasing one .. That again shows the high power of early investing in a way .. .

Thanks for pointing it out . But increasing SIP has its own place in planning and its required at times otherwise , most of hte people wont be able to plan anything .. What do you say ?

Manish

No probs. Its all for discussions for benefit of the community 🙂

Yes, as i said in above comment, we are BIG believers & proponents of the above concept. i remember, meeting a financial planner from 1 of the big companies 3 years back who scared me that time by making a plan that said “i need to invest Rs. 80k per month to reach all my goals.” and i said “are you nuts??? you have all the info about my salary & expenses. if you can’t think of the customer-interest, atleast be a good sales guy by throwing a number which will help you get the business! ;)”

—

Santosh Navlani | moneysights.com

Dear Manish,

A very timely and helpful post.. At present, I am in for the constant SIP mode, hoping to increase it by around 20% next year because I realised only after taking the SIP that I still have idle money lying around in my account.

“And also one should make sure he should keep on topping up his investments whenever life gives opportunity to them”.

This statement of yours is very true, and it takes a lot of pressure off the worried investor..

Sunnydoc..

Sunnydoc .. yea .. Better increase it to as much as possible if your situation allows 🙂

Manish

My way of understanding Increasing SIP:

1. suppose today my salary is 20k and if i think i would get same 20k even after 15-20 years, it would be better not to think.

2. If i can dream of average return of 15% or so why i can’t dream of 10 times salary i would get after 20 years.

3. it is worthless to underestimate increasing sip, you could live only if you dream.

4. you cannot predict the future, but you have to come up with some figure for the future and increasing sip is a reality.

Lokesh

I am extremelly confused on your comment , what is the point you are making ? Please explain your conclusion ? increasing SIP is just SIP which increases over time as your salary increases . Its unrealistic to say , my salary will not increase ! . Do it happen to masses ?

Manish

Yes, its unrealistic to say my salary will increase in future, but is it not about rate of return from investment into mutual funds also. that’s why we do insurance and/or diversify the investments to mitigate these uncertain things.

I just want to say to myself that i need to plan according to my future earnings/expenses, and i should plan accordingly in advance through increasing SIP or flexible SIP, and not let the

money be idle thinking what to do with when it comes?

I believe increase in salary/income/expenses do happen as the time progresses- be it the salary of a teacher/banker or consultation fees of a advocate/CA or daily wages of a worker. whatever the reason be: inflation/population/economic growth.

Discipline is the most important aspect. We should always try to do what best we can do. No point in killing yourself by starving in your early work life to meet some target for your retirement life which you may not even see. Of course, it does not mean we should use (misuse) all our money for instant gratification. Do not run behind targets, just be disciplined enough to do the best that you can do at that moment.

Some old saying: Karmanye Vadhikaraste Ma Phaleshu Kadachana…

Of course, it has been replaced by our corporate work culture where the first thing that we here is target or goal.

Ram

Good points from you .. dont run for targets at the cost of today !

Manish

Personally I don’t believe in any SIPs.. I believe in fiscal descipline and living within your means and save as much as possible in a diversified portfolio. That is the real deal for being rich. Don’t jam up your brain with unnecessary targets and numbers.. You cant guarantee life’s uncertainties.. What if the person loses a job and cant find a new job for 6 months… These SIPs and retirement targets doesn’t add any benefit other than making the person more worried.

it is better to be worried at the begining rather than at the time when those targets are knocking your door. If you do not save in a disciplined manner (which a SIP does), then when you will actually require the money only a miracle will save you. Also if you do not know the target, you will never know howe much you need to save.

and for loosing job or any kind of emergency you must have emergency fund. The amount should depend on the financial condition of the person and his risk taking ability. The amount should be enough so that the person can sleep well in night with out much worry. For someone it might be 6 months expens for someone else it may be 12 month expense. along with insurance emergency fund is an piller of personal finance.

Life is a journey not a target… I understand your concerns.. but if i am saving 50%-60% of my salary by spending only what i need and not going for luxuries… why should i have a fixed % to save.. i can save 50% in jan, 62% in feb, 48% in march, 33% in apr.. 78% in may and so on.. as long as i am saving maximum after my expenses why should i keep worrying abt targets and constant or variable SIP? How do you even know that if you have 2 crores during retirement it will be enough.. can you predict inflation and the world you are going to live in..?? you just cant do those… try to be desciplined every day of life.. spend only what is absolutely necessary and you will have a good financial life… thats my motto

Look at comments from Ganesh and Ram below.. they are also saying the same thing.. “save as much as possible”.. i am not the only one :).. Thats the problem with lot of people they just create a target and assume certain amount of saving will take you there and then spend rest of the money like water thinking why should i care.. i have 3 crore retirement corpus anyways… but thats the problem.. that 3 crores is not guaranteed because of stock market uncertainities and inflation etc… even if it is guaranteed.. why dont u save as much as possible and achieve 5 crores of saving rather than satisfied by a target of 3 crores…

see there is no rule in this world which does not have an exception. Maybe what you do works for you. But if a general rule has to be made about general mass about what is the single most important thing to be financially successful for average people, then it has to be dicipline. This I am not saying. Most of the famous investment GURUS like graham bejamin (BOOK:intelligent investor), peter lynch, BG MALKIEL has said this. They repeatedly mentioned to invest regularly on autopilot mode. History says that these rae very true things. I also can see the importance of it. So if someone says dicipline is not the most important aspect in personal finance, then well…:)…..i just do not agree.

Secondly if you do not have a target in mind thenyou actually cannot choose your instument in which you are going to invest properly. The goal of financial planning is to achieve your goal with as less risk as possible. so only when if you know timeline and amount you need then only you can choose properly where you have to invest.

Now coming to your point: no can predict the infltion. So the way to go forward is to increase the amount of SIP (or what you can do is: save as much as possible on top of your SIP) as inflation raises (since in general your salary will also increase).

for a general person if they do not invest in autopilot mode (which is paying yourself first), they tend to spend most of it. This is because most of the people by nature is not frugal and they have a tendency for instant satisfaction (even I belong to this category in certain sense).

This SIP works for another reason. Most of us are not monks/saints so that we shall not buy any luxurious items (or buying only the necessary things) in life. We need to enjoy our life as well (and for that we need to spend some money). what this SIP essentially does is, save money, and with the remaining amount do certain luxuries. In this way people are more likely to stay focused (because they keeping themselves happy as well) on their goal. I know so many of my friends who adopted your method (but this does not mean that your method is wrong. It is correct because it works for you), continued for some time, but gave in due to the fact that they became so frugal (in trying to save whatever they can save, which is agains their basic nature) that, they made things difficult for themselves and their family(this is first hand experience, I am not making story here).

What i do is: I have a constant amount in SIP going every month. then i apply your method. Save as much as possible of whatever is leftout (and also splurge a little). Now this works for me well, so i do it. But for sure in this way i have higher probabilty of reaching my goals. this essentially achieving say 3-4 crore (with higher probability, but not assured though :)) with SIP, and with whatever extra i can save on top of that, that will give me that extra 1-5-2 crore (which will take care of uncertainties in our prediction). things can still go wrong but definitely has a lesser chance.

But having said all these, this is my personal opinion (and opinion of many of greatest names in finance space). I am not against anyones method (or criticizing anyones method). If something works for you is correct for you.

have fun

I am not against discipline.. in fact i am advocating it… may be you are right most of the people cant resist buying luxury stuff.. perhaps the background where i came from make me extra cautious and hence i save more than ordinary.. looking back all these years i ended up saving on average 60% of my salary which is too good to be true.. and yes i agree to an extent that it is probably hard for someone from above middle class or middle class family to control his senses and live with austerity.. and as you pointed out Benjamin Graham and other great investors… trust me no one is god.. even Benjamin Graham says that first rule of living your life is living within your means and not spending beyond what you earn… If you advocate that discipline in life you will actually develop an attitude which allows you to survive and adjust to even worst conditions.

I am not trying to argue here but just trying to tell everyone like some of others who commented that there is nothing called perfect plan for anything. I will give you a very good example – Its one of my best friends financial story. He started making good salary in MNC.. he targeted some X amount for a retiremend fund and kept investing in it in a SIP.. Which is good thing right.. 🙂 awesome.. Then whatever he was earning beyond that X he was just spending it like water.. He bought 4 different smart phone in last 5 years like mad person.. he bought 1 Lakh TV and then he went on to commit himself for 20 or 25 year loan of 50 lakhs for a Flat (these are rough estimates).. whenever i asked he always said you see i can pay for all these because my retirement is taken care.. hence all he need is to pay for these loans… that was always his arrogant answer.. he lost job for 3 months.. and you have to meet him then.. he was literally crying and scrambling to pay the loan amount.. thats the problem with most of the young india.. we are going in the western way too..

We assume that certain target is enough and certain SIP and insurance are enough and once we are invested in there.. We assume that our jobs are permanent (which they are not)… (IT industry rose in 15 years and can vanish to another competing cost effective country in 15 years too you never know).. We assume we can pay the SIP and since retirement is taken care.. we assume lets enjoy with whatever money we are left with.. which is wrong… Thats what iam trying to bring up.. YOU Must and should be disciplined always… You should save as much as possible and in right diversified instruments..

You are very correct. I think in order to have a good financial life along with taking action, acquireing knowledge is also very important. You friend after starting a SIP thinks that all his needs are taken care off. but the main point is he is lacking in financial knowledge. He does not even know that there is something called emergency fund. even before we start investing i think we should have two things in place 1. insurance and 2. emergency funs.

If you earn 1.2 lacs per month and you are saving say 12000 in SIP that is no way leaving within means (although it gives an appearance of being so). That is excessive and irrational spending in the name of enjoying life.

I agree very much with you on one point. Most of SW engineers in our generation has come from middle/ above middle/rich families and after that they have high paying jobs, that is why they have not ever struggled financially. this is the root cause in many cases for people spending like MAD. I am sure your friend will now know the value of money.

living life on credit has become almost a fashion statement. I do not know why people do not realize that living on credit is just a bad lifestyle.

whenever I get salary hike, I make sure that I save at least 50-60% of that increment (adding that to SIP again). This way my savings rate increases (which is a incresing SIP in a way). because of this very habit of mine i have not bought those expensive cars/sofa sets/LED TV on loan and my friends call me “KANZOOS”……….heheheheheheheheheheeh.

nice to talk to you.

Phani & Kaushik

Very good conversation going betweeen you .. I can see that both of you have given some good points ..

Phani : I think all Phani is saying is that , if one becomes self aware of his spendings and target for the maximum one can do , then he is anyways doing the minimum thing which a “financial plan” mentions .. He is totally right . No target and number can be fixed and it would be ever changing , what would be constant is your discipline and way of looking at your financial life . totally aliged 🙂

Kaushik : Kaushik is saying that one has to be paying him first , develop the attitude of saving first and then making any expenses , else after a time , one will never save anything .. most of the people in life should do this , because they dont understnad and dont believe in what Phani says ..

What do you guys think 🙂

Manish

I am novice in all these, but whatever I have learened over last two/three years is that, although there is no perfect plan in this world, but most definitely the worst plan is to have no PLAN.

Also, I find it hard to believe that if someone think of let’s say his/her kids education, for a moment even he/she does not think how much shall he/she require? course fee in IIM is 15 L today 22 years later how much do i require? these are the first thought comes to people mind whn they think of future. these are nothing but our subconcious mind creating taget for ourself.

I do not know of others, but for me this habit of paying myself first and having goals in mind works very well. A target in mind (although i give my best effort for saving whatever i can even after my SIP’s are deducted) helps me to better plan my investment. For Each goal (rather major events) in life different kind of risks has to be taken, since the nature of the goals are different. I take this combination of target+risk as a guiding factor to decide where i should invest. After this i try to add top up savings for each of this goals, hence giving my best effort. For me my targets are the minimum i must achieve under all circumstances. This is the base of my finance. After that there is my extra effort to reduce the uncertainties (in case some of the assumptions of the plan created break down).

Also i think it is very important to keep ourselves happy. I have observed that when people are happy they tend to make better financial decisions, because they are thinking logically. I shall give you an example of myself. I have habit of reading books on (wireless communication+personal finance), and i keep buying books every now and then. Sometimes these books are quite expensive. these purchases are not necessary, (i can try to get a cracked e-book (which is the norm these days 🙂 )/ borrow from someone etc), but i really get lot pleasure by buying and reading these books, (on top of it increases my knowledge). hence although i am not buying the bare minimum things for myself by buying these books, i do not have any plans to cut this expense.

The SIP helps immensely in this particular aspect. Live frugally and still be happy. This is very important.

Now all these works for me. that is why i do it. Some other mechanism will be suitable for someone else (as phani said he has a particular method).

I agree that We go beyond numbers, but that can be done through a series of monotonically increasing numbers as well (infinity is also a number which is beyond any number. I am an example of a person for whom this works). So target and number is not necessaryly only for those who does not understand that they should go beyond numbers.

at the end.

Friday night:time to spend some money now. hehehehehehehehehehehehehehehehehehehehehehe

Phani

Thats the best thing one can do .. SIP & Targets are for those who do not understand that they need to go beyond numbers , which you already have . We try to make people think on the same lines in our Financial Coaching program

Manish

yes, every word is true.

I am surprised to see no one menctioned about good quality shares like sbi, L&T, ongc, bhel, HUL, itc etc front line stocks.

thanks for this good work.

Thanks Srinivasu

My understanding of an SIP is that it is just a method of investing in MFs.I invest directly with the MF AMCs and do online transactions.

I would suggest a constant SIP with occasional top-ups when you have cash in hand.

P.S Are AMCs offering products called varaiable SIPs these days ?

sorry – not variable …increasing

Arjun

NO , I am not aware that increasing SIP are offered as integrated products by AMC’s , but they might do it … the big reason why they might not be doing it yet is because the average span of SIP duration is not more than few months or 1-2 yrs .. anyways the increase will happen after few years .. plus there might be banking restrictions on this , like one can not have increasing debit instructions 🙂

Manish

Hello arjun

In reply to your query I wish to tell you that although the fund houses dont give the offer of increasing SIP system, some online sites like fundsindia offer a concept of flexisip where you can select each month’s contribution depending no your comfort. the amount must be between a range which is spelled out at the start of SIP

dr kishan

Arjun & Kishan

When we say “increasing SIP” , we are talking about increase per year . so why not set up SIP for 1 yr and then again resetup SIP with increased amount after 1 yr .. pretty straight , but a little more work !

Manish

Manishbhai,

Plz go thru reply no.02 above.

1. Which type of Funds should be best for the Time Frame I have mentioned above?

2. At an early Age(say upto 35)—-Constant SIP—More Mid Caps/ Multi Caps

Next 15 Years—–Incresing SIP—–Large & Large+ Mid cap

After Age of 50—–Balanced Funds Or Shift Mid cap to Balanced

Is it correct approach?

Raj

1. Pure equity funds would be good enough ,, like HDFC top 200 , DSPBR top 100 , Birla front line equity

2. Dont make it too complicated , if you can do maximum in that start , you dont even need to invest later ..

Manish

Hi Manish,

Nice article.

The concept is right, but I feel its not realistic in real life for a simple reason that on a very long term target like retirement or kid college education, the latter years of investments are more geared toward capital preservation. As other readers pointed out earlier, the asset mix is very imp.

Most of the developed countries have mature Target Funds, which are variation of fund-of-funds, but with very less expense ratio. These funds maintain the asset mix and you end up taking a SIP in single fund. The asset mix changes with year as your target year approaches.

However the performance of such funds or asset mix is largely affected by how much you invested early on. Your 10K invested 20 years back will beat 1 L invested one year back (unless you are taking too much risk).

Though the linear model that you presented above is good for understanding, I think “squeezing” yourself to best in early days goes long way. Your words: start early, win the race 😉

Deepesh

I also have same thoughts , I feel the constant SIP is the intutive also .. but increasing SIP gives you some hope atleast and better than NOT doing anything atleast people can start things .

Manish

Hi Manish,

A nicely written article.

What do you think about Value Averaging…….Yes i do agree incraesing SIP will benefit most of the individual especially those who started late.But the only issue is that the income might not increase as expected and then the person takes a hit.So a constant SIP might work which you can increase as and when your income increases.

Your Views?

Jitendra

As you mentioned , “Salary might not increase” is very much true .. I have two points here

1. If a person does not have resources to start “high” constant SIP , then he has no other choice than starting increasing SIP .. what else he can do ?

2. Another point is that increasing SIP is a concept . dont take it literally that a person has to increase investments by X% always .. it might be the case that one does not increase SIP amount for 4 yrs .. then suddendly if in 4th year he gets double salary (for some reason) , he can directly increase his SIP by 100% ! , so the only idea was that one can start and later increase his investments , thats ok

Manish

Rightly Said Boss!!!!!!!

Manishbhai,

an excellent article as usual.

I think there should be mix of both SIP.

1. I think that at an early stage constant SIP is better as we can get the benefit

of compounding. At this stage we should invest max.money in SIP rather

than in Debt.

2. Then every year we should increase our SIP amount.(say 10-15 years)

3. As years passes, we should stop buying of new SIP but continue old SIP and

invest money in Debt.

Awaiting your reply.

Hi Manish,

Its a Interesting Post, here my view point (I may be wrong too!)

1) By “Increasing SIP Method”, One may loose the advantage of Compounding, and hence causing an Opportunity loss, Specially when the Investor is in his early days of investment. Better to cut down on those frequent parties and pay a Constant (little Higher) SIP now.

2)Moreover I would like to add that, Instead of “Constant SIP” one should go for “VIP (Value Averaging) Method”, the main advantage of the same is that it “Times the market with varying monthly contribution”, and works on the Principle of Buy more on lows and Buy less at Highs.

Thanks,

Harshit Patel

(My Feedback on Perfios is still Pending,Shall submit U by next week ,Sir)

Harshit

I agree with your point 1 , thats exactly what i said too ..

regarding VIP, its a different concept altogether , it has to be compared with SIP , Increasing SIP is just another way of SIP for people who can not afford constant SIP

Manish

Raj

If you start with constant SIP and then dont increase you will reach your goals anyways .. but if you increase it further , then its good for you , so if possible , why not do it.. go ahead

Manish

Manish,

+1. Does it make sense to draw a line in terms of annual percentage gains for an individual goal? I know this depends on one’s risk horizon and appetite.

Taking your example of 12% annual returns, say if one gets 15% returns can s(he) put that 3% in some debt fund(STP) or FD. Is this right approach for reaching the goal and making sure the rest of profit returns are assured?

Also I personally feel that constant SIP is valuable approach, but one should always consider increasing it per time, if it permits. I would also like to know more in detail how STP works and its comparison with normal debt cash flow and FD.

Ashish

You can never say that this approach will always lead to better results .. suppose you make 15% , then take out 3% , now suppose the market rises 100% , you will only have 24% + 3% … where as you could have 27% .. thats a loss of 3% at the moment ..

So this is actually a big area of research and various outcomes are possible ..

Regarding STP , there is detailed artcile on that : read this : http://jagoinvestor.dev.diginnovators.site/2010/03/what-is-systematic-transfer-plan-stp.html

Agreed and thanks for the information. Your thoughts on this, say an individual wants to invest 4K per month in some AMC scheme for long term via SIP route, will you suggest to make 1 SIP per month or 2 SIP on different dates or 4 SIP. What are the pros on cons of doing this?

Ashish

Its nothing but over analysis .. Dont think too much .. Just start 1 or 2 sip , thats al .. same date , not same date will not matter a lot .

Manish

Thanks Manish, i wondered the same actually it all depends on individual cash flow but wanted to get second thought from you and the same was conveyed on VROL website too.