Why to increase sip amount in your Mutual funds

Do you want to increase the SIP amount for your mutual funds ? Or you want to keep it constant always ? A lot of people start with a SIP amount at first and then look forward to increase SIP amount later. This is a very common of every investor and its “how to increase sip amount”

Increase SIP amount

When we say “SIP”, it generally means constant SIP, which does not increase every year. When we calculate SIP amount using any SIP Calculator – the SIP value is generally very high and does not look realistic and at times and such high investment can trigger affordability issue. However there is a clear solution for this, which is used by financial planners and that’s called “Increasing SIP”, where one starts the SIP with a lower amount and then gradually increases them year on year. This looks more realistic as one’s income also increase overtime and ability to invest increases. We see this situation a lot while working with our clients under financial coaching program.

Let me show you the example : Ajay wanted to accumulate 5,00,00,000 (5 crores) for his retirement which is 25 yrs away. When he calculates the SIP amount, it’s coming around Rs 31,000 (assuming 12% returns from equity). Now it’s not possible for Ajay to invest Rs 31,000 every month, as it’s a very high amount. Rather he is fine if he can start with a small amount today and then increase it every year as his income would also increase with time. This is called as Increasing SIP model. If Ajay is ready to increase his SIPs by 10% every year, then he has to start with just Rs. 13,500. This amount is much more convenient for Ajay to arrange, rather than Rs 31,000 per month.

Should you increase SIP amount or not ?

At the first look, a general conclusion which comes into mind is that Increasing SIP is better than Constant SIP because it is much convenient and looks logical that investment should rise as the income increases. But there are different angles through which both the options can be looked at. Let’s look at two important points one by one.

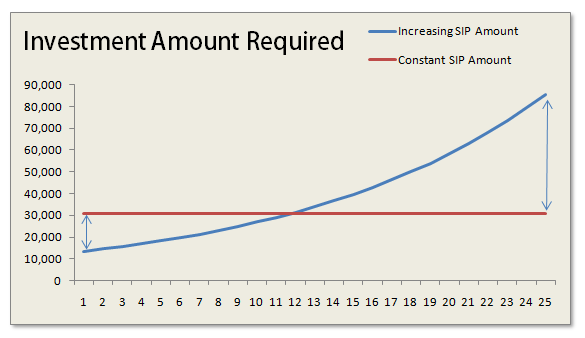

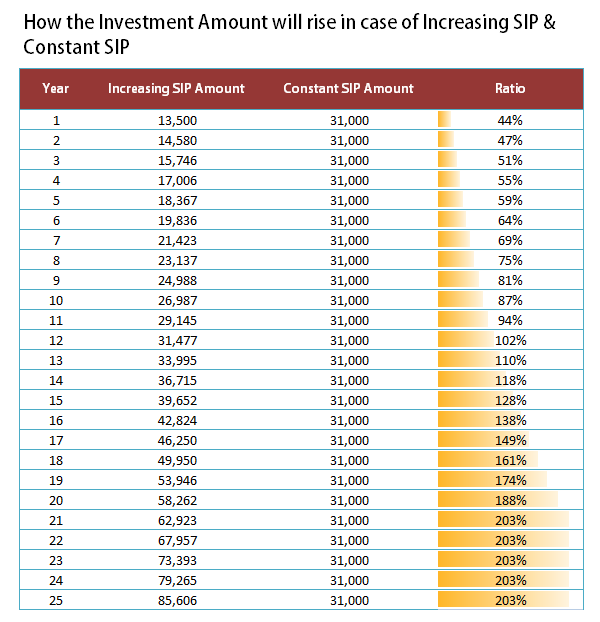

1. Investment required in case of Increasing and Constant SIP

One of the most important factor one can judge both the situation is the amount of investment needed. If we take the above example we just discussed, one would need to start SIP of 31,000 per month to accumulate 5,00,00,000 in 25 yrs assuming 12% return. Now this amount will be constant throughout the all 25 yrs. Where as one can choose to start his SIP with Rs 13,500 and then increase it by 8% per year, but in this increasing SIP model, his SIP amount would reach 50,000 in 18th year and 85,000 in 25th year, which might look very big in numbers, but years from now, it would be worth a small amount considering the purchasing power of money and the annual income one earns. So don’t get surprised by numbers.

One should opt for increasing SIP, when his situation really does not allow him to invest a big amount and he is very sure that he would be able to increase his investments in tune with his salary increase. Truly speaking I am in favour of Constant SIP if one’s situation permits because that way you are investing more in the start of your life and that would help you keep your SIP in check later on in life. Imagine after many years in life, you have to just invest the same amount where as your Income has risen 3X. Isn’t it a big relief and freedom to do whatever you want from your money at that time. Imagine your salary is Rs 50,000 per month and you do SIP of 10,000 and even after 10 yrs, when your salary has risen to say 1.5 lacs per month and you are still doing SIP of Rs 10,000 only. I would choose to pay a little more today and then get into that kind of situation.

Most of the people who are not able to go for constant SIP, because of high SIP amount is because they are very late in investments and now their goals are near and they have less time for compounding. These people have high expenses already in life. Had they started long back when they started earning they could be in a better situation now. Below is the table which shows the Increasing and Constant SIP amounts required for the example discussed above and shows you the ratio of increasing and constant sip. You can see how it started with 44%, but rose to 203% later after 25 yrs.

Conclusion

One should start his SIP’s early so that he can keep his SIP’s constant through-out the tenure. If you are late, then your SIP amount will be very high and will look unrealistic and then you will have to increase your Systematic Investment plan (SIP) amount in future if you want to reach the goals.

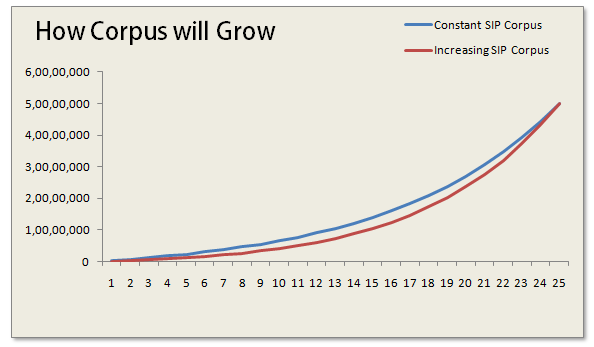

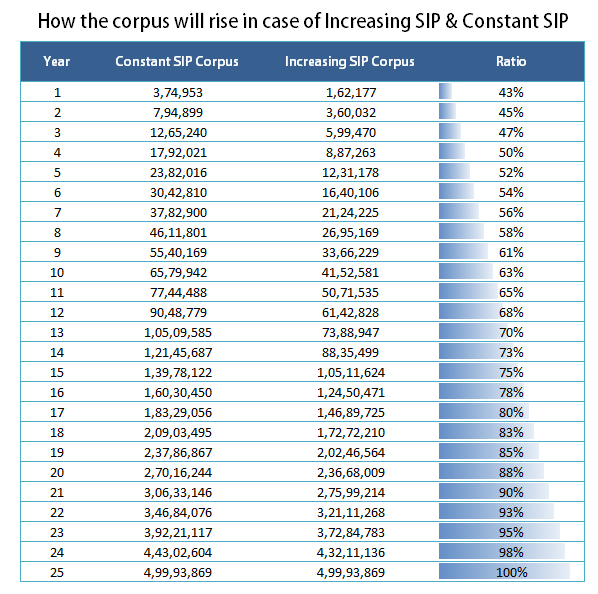

2. How the corpus will grow in case of Increasing and Constant SIP

The other major thing to look is how your over all corpus would grow in both the cases. Note that in constant SIP and increasing SIP, the final corpus is getting accumulated and they reach the same point at end, but in case of Constant SIP, the overall Corpus is always higher than the increasing SIP and it’s because you are investing higher amount in the start and that way the compounding factor is in your favour. See the chart below which shows, how the gap between the two narrows down at the end of the tenure and both the cases lead to same corpus.

If you look at the table below, you will see that the maximum difference between the two is 36,00,000 in 17-18th year and after that the difference starts coming down (not so clear in table , you need to calculate it) . As you are starting with lower amounts in increasing SIP, the overall corpus is obviously going to be less, but it’s very much above 50% all the time, so if you are saving for long-term, you should be interested in the final corpus.

Note that the example and charts above are assuming a 25 yr old tenure and equity returns of 12%. The numbers would change depending on tenure and the equity return, but the overall conclusions discussed above remains same. For a shorter tenure like 4-5 yrs, the constant SIP and increasing SIP won’t differ a lot; it would be a small number.

So the conclusion is that one should keep on increasing their mutual funds SIP amount as and when they can , preferably every year. So are you ready to increase sip amount ?

September 8, 2011

September 8, 2011

Dear Sir, I Want To Invest Rs. 6000/mth for 5 years. Please suggest some MF. Can I invest in Small cap And Mid Cap Fund.

Hi mahesh

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://www.jagoinvestor.com/pro

Manish

Hello,

My age is 30 and I haven’t started investing in mutual funds. I want to start now.

I am thinking of starting from 10000/- per month and will increase it annually.

Please suggest me some good SIP/Funds and any other suggestions.

Thanks.

hello

i am student and want to invest 2k per month for long time. i am thinking of increasing the amount with time. but for now which funds i should go for ???????/

You can start with ICICI Pru Balanced Advantage Fund – G

Dear Sir,

I would like to do monthly SIP of 20000 in 4 funds including one tax saving fund. Kindly suggest me the funds.

and how many year i have keep investing?

Axis long term equity and ICICI tax saver are good options for ELSS

Dear Manish, currently almost all my salary is being used for paying loan EMI’s. However, I want to invest some small amount in SIP or any other mode of investment. Please suggest some good plan/ SIP.

HDFC Prudence is a good fund to start

Sir, I would like to invest Rs.20000=00/month in SIP for only one year.(Rs.5000 x 4 diffrent companies) . Approx. what is the range of profit % per year and which SIP are better to invest now.

You can take a look at Birla top 100 and HDFC top 100 as of now .

Thank you very much for your valuable information.

Sir, Is there random top-up facility available in SIP (Ex: My SIP amount is Rs.1000=00/month. If i want to top-up Rs.5000 amount one time. But i don’t want to increase the SIP amount every month). Is it possible?

I think its not possible in regular SIP . BUt flexi-SIP options will help you

Its always possible. when market is down, You can always purchase more, this will not alter your SIP

Hi,

I am regular reader of jagoinvestor. I am 35 years old and am planning to start a monthly SIP of 10K each for these 2 funds for long term ( 10 to 15 years)

HDFC Balanced Fund

Birla Sun Life Long Term Advantage Fund

Does it make any sense to invest only in 2 funds? or I should add some more? are these two funds OK to invest in current scenario?

they look good to me overall . But just see if market scenario is fine for you to invest or not ?

hi,

myself vivek and my age is 26.Currently i am working at a soft company with take home of 35k pm.

lets say,

expenses – 10k

ppf – 50k or more, FD – 50k or more per year,to do that i save 15k per month.so that i can have some amounts in savings acc also.

As i am planning to marry after 3 yrs, i am not interested in any insurance or watsover.may be once i get

married i can start thinking of any insurance for my family.

I have remaining 10k in my hand.so thought of investing into mutual funds for long term.

So i have selected few funds,

ICICI Prudential Focused Bluechip Equity

–

Quantum Long Term Equity or uti opportunities

–

Reliance Small Cap Fund (G) or DSP-BR Micro Cap Fund – RP (G) or or hdfc mid cap opportunities or uti mid cap

–

hdfc balanced fund or hdfc prudence fund

–

Are My understandings correct ? or should i include one ELSS fund and balanced fund(as i already plannin to put some in FD) in my portfolio ?

can u help me to select proper funds and how much i can invest in these ?

You can invest in ELSS , as it will have 3 yr lock in and you can use it once you are married !

Hi,

Sorry to respond so late on this post.

Manish, you have mentioned above that it is ideal if we increase the SIP amounts by x% every year based on our salary at the time.

I agreed completely with the logic behind the post and the calculations that you have shown but how to manage this increase per year from an administrative perspective?

I can see the following options:

1. Stop the current SIP and submit a new mandate with the higher amount.

2. Continue with the existing SIP, submit a new mandate to the bank/AMC to debit the additional amount on the same day of the original SIP date/a different day in the month.

Both the options are not ideal as they increase the admin activities substantially as the investor will have to fill a lot of forms, sign a lot of first payment cheques (considering he/she invests in 4-5 funds per month). Also, imagine the number of mandates present on your account after 20 years if one selects option 2!!!

Or, is it feasible to take a 5 year view and increase the amount every 5 years purely to reduce the admin efforts and to be able to manage your investments better? But, will this lead some loss in wealth generation after say 20 years due to compounding effect?

Or are there any options available to the investor?

Will be helpful, Manish, if you can please answer my query.

Thanks,

Praj

Hi Praj

“Increasing the SIP amount with salary increase” .. the whole idea is to increase your contibution when you can do so . Like you said from administrative point of view.. So doing it every 3-4 yrs is ok .. just check the quantum .. if you start a SIP of 10k per month .. then after 4 yrs , make it 15k 🙂

Dont over optimize 🙂

Manish

dear manish

i am having 1 sip in icici dynamic g plan 2k from last 1 year i want to increase my savings by starting new 2 funds 1. hdfc top 200 3k & 2. dspbr top 100 2k and

also any 1 gold etf 2k (pl suggest)

will it be a good portfolio, pl suggest so that i can start it immidiately,

also want to know how i can invest in amc directly by online mode.

You should go for online investment in these 3 funds suggested .

please suggest how to start onlien investment any AMC.

please give me the website if any.

Sachin

You can visit the company website directly. Search on internet for the AMC you want to invest in ?

Hi Manish,

thank you for useful information.

i am 35 year old , started investing in sip in august 2011. the total amount (16000/month) in various sips is as follows

1)BSL Frontline Eqt-G -2000

2)HDFC Equity-G-2000

3)HDFC Prudence-G-1000

4)HDFC Top 200-G-2000

5)IDFC Premier Equity Plan A-G-2000

6)Reliance Banking Retail-G-1000

7)Reliance Gold Savings-G-3000

8)Reliance Pharma-G-1000

9)UTI Dividend Yield-G-1000

10)UTI Opportunities-G-1000

i wish to increase the amount to 26000/month for 10 years. is it advisable to invest this amount per month in sip? if yes kindly suggest changes required in my portfolio.

thank you again.

I think you are investing in too many mutual funds. better get rid of some .

I suggest only 5 funds .

thanks for your early reply. please suggest me which ones should i invest in and the amount in each. because i did it on suggestion of an average broker. again is it safe to invest 26000 per month for 10 years?

You can invest in HDFC Equity , DSPBR top 100 , Franlin Templeton !

thank you Manish.

Interesting conversation on long term return in equities.I too am sceptical about this long term theory on equities.If we look around the globe their are plenty of long term instances when equities have not performed well .In late eighties nikkei the japanese index was over 20k and today after more than 2 decades it is hovering under 10k.In US the the dow jones was at 10k in 2000 today after a decade it is at around 13k.So clearly even in nations which are far better governed than our country equity has underperformed over a long term.However their must be distinction made between index returns and actual stocks.We must not forget that individual stocks may have given stellar returns not only in terms of higher value but also regular dividend payments.Eventually i feel that market timing and understanding fundamental future value of an asset is necessary to make any money.Just making regular investments as touted by many as only way of wealth generation seems flawed.

Deep

There are two points regarding this.

1. Its totally true , that there can be risk of long term non-performance in equity and thats a risk with equity.

2. The instances which you mentioned are more true for a already developed nation, where there are limited growth for economy to grow compared to a developing nation , see Japan , US .. they are already a developed nation, so the juice left is not much. India will also face the same issue , but there is time for it.

Thats my stand, your view can be different depending on how you look at things. But I agree with you that one should be cautious with equity and not over depend on them

Yes, historically the odds are in favour of equities, but don’t you think its basically because of one good bull run every 10 yr period.. If you don’t get the run then there is a problem. Like people who started investing from 2008, have spent almost 5 yrs without seeing their money grow.

Moreover, it somewhat nullifies the so called effect of compounding, if the overall growth is mostly dependent on some sporadic periods of high growth.

Yes, historically the odds are in favour of equities, but don’t you think its basically because of one good bull run every 10 yr period.. If you don’t get the run then there is a problem. Like people who started investing from 2008, have spent almost 5 yrs without seeing their money grow.

Moreover, it somewhat nullifies the so called effect of compounding, if the overall growth is mostly dependent on some sporadic periods of high growth.

Imon

Yes , the last 5 yrs will really bring down the effect of compounding in some way , but that is again for those who invest one time , consistency in investments is something which would help in this downside too .. These 5 yrs have been best time to get ready for the next 5-10 yrs . Have you thought of it that way ?

Manish

Sure, it has. At least I am hoping it has, as I am one of the investors who had started investing in SIPs from 2010.. :).. But again the last 20 yrs CAGR of around 8% sort of raised few doubts in my head..

The take away that I have from all these, is that, don’t neglect ppfs, and FDs (especially if you are in a lower tax bracket) at all.. Continue substantially with them along side the equity exposure..

Yes Imon

PPF and FD are no doubt important products . Now let me point out one thing .. You looked at 20 yrs period return at last 20 yrs , sensex was 2000 in 1992 and in 2012 its 16000 . The return is around 10.9% (why do you conclude it to be 8%? – want to know) .

Go 2 yrs back and now you are in 2010 , now do the same thing .. from 1990 – 2010 .. it was 1000 in 1990 and 20,000 in 2010 . So now the CAGR return is 16% .. from 10.9% to 16% .. huge gap , timing is different . So may be you are looking at worst period of 20 yrs .

Hi Manish,

Actually I corrected my mistake in my 2nd post. I wanted to point out the span from 1994 to 2012. Sensex moved from 3.6k to 16.8k.. Yes it was possibly the worst 18-20 yr period, but again, 18 yrs is a long time where one wants an assurance that the money wont get wasted. The only point that I wanted to make is that, one can’t be blind towards one asset class, even if you are looking for a period of 20 yrs. Moreover, ever since our economic reforms in 1992, there has been 2 bull runs. So the sensex rise has been driven by these 2 periods. It has not been a consistent incremental rise. What if we are out of luck in the next 2 decades !!

I agree that it can be the other way round as well where we might get better yields, but the whole point of doing an SIP over a long period is taking that chance out of the game, isn’t it??

Ok i got your point now .. and i agree that we cant do blind investment and cant rely like this on any investment no matter what it is .. One point … did you check what is SIP returns in that 18 yrs time frame , I am sure it would be very different from lumpsum ! , just an exercise !

“Did you check what is SIP returns in that 18 yrs time frame , I am sure it would be very different from lumpsum !”

I tried this out and it sort of surprised me to be honest :P. Assuming only one sip instalment each year, the CAGR come out to be 13% between 1994 to 2012.

Hmm… actually it would be much more .. how did you find out the return ? You should be using IRR in this case .. right ! .. Also if you use monthly installments , it would come much higher !

Following is the method I used.

Assume I invest Re 1 each year.

Assume 2012 sensex to be at 16800.

If the sensex value is Sy in some year Y, my investment made in year Y has risen to 16800/Sy in 2012.

So basically my final corpus is

16800*(1/S1994 + 1/S1995 + … +1/S2012) …. (1)

Now to the rate of interest part:

Assuming a constant rate of interest of x*100 % , an investment of Re 1 each year for 18 years will yield a corpus of [(1+x)^18-1]/x … (2) .

(1) and (2) matched approximately for x=0.13.

I guess this is what a layman will do ..

Yea seems to be correct .. you calculated form basic principles .. it was much easier to calculate in excel using a method called IRR .. anywyas ..

Hi Manish,

This might be a bit off track, but “equities give the best returns in the long run” might not necessarily be true. If you look into the sensex data from 1992 to 2012, the annualised return is a meagre 7.5 % or so (4200 to 18000 in 20 yrs), which is not great any standards. Even the good old PPF beats it in the long run hands down.

Moreover, the sensex didn’t move anywhere between 1994 to around 2003 (3600 to 4000). This is a period of almost 10 yrs. Lets say you were an an SIP investor in this period. How long would you have stayed invested if your first SIP date was some day in 1994.

Would like to know your thoughts on the same.

-Regards

Imon

PS: Historical sensex data is taken from http://www.scmrd.org/Sensex%20Chart.pdf.

A small correction. The span for sensex was from 1994 to 2012 (when it rose from 4k to 17k). CAGR=8% .

-Imon

Yes agree that there are specific cases where equities have not given great return , but “equity give good return in long term” means take any long term and there are high chances (90%) that it would be good returns , how many different 10 yrs tenure have you seen ? Check 20 different long terms like 1990-2000 , 1991-2001 .. etc and then see in how many of those returns are bad !

Yes, historically the odds are in favour of equities, but don’t you think its basically because of one good bull run every 10 yr period.. If you don’t get the run then there is a problem. Like people who started investing from 2008, have spent almost 5 yrs without seeing their money grow.

Moreover, it somewhat nullifies the so called effect of compounding, if the overhaul growth is mostly dependent on some sporadic periods of high growth.

HI

Nice article manish. I am in favour of Constant SIP. As this way whenever you do ur monthly budgeting, you take into account the SIP money as well. and besides this after few years if you wish to increase your SIP you can simply cancelled the current SIP and start again with increased SIP amount. I have done this in few of my funds.and the GAP to start a new SIP is usually 1 month.

Only thing to note is that dont put all your money in one fund, you should start SIP in different funds.

Regards

Vivek

Vivek

Thanks for your suggestion .

Dear Mr. Manish,

Waiting for ur reply

Thxs….

Manish,

Will my money grow more than what i would have receive for my FD’s??

pls suggest..

Thxs

There is no guarantee .. the chances are higher that it will , but there will be ups and downs !