Convert your Mutual funds into demat form

Do you have all your mutual funds investments in different companies and are looking for aggregating them at a common place? If so, there’s some good news for you. Now you can convert all your existing Mutual funds into demat form, which means that you can now have it electronically stored in your demat account, just like shares! Note, that once your mutual funds are in demat form, you can sell them either through stock broker platform (your demat account) or through the normal way of selling it through your Depository participant (like you do, right now.)

Advantages of converting your Mutual funds into demat form ?

1. Centralization : Once you convert mutual funds in demat form, you will then get just a single statement for your holdings. Right now, if you have investments in say 10 AMC’s, you must be getting statements from all those AMC’s. How to choose a good mutual fund

2. Monitoring : Once you have all your mutual funds at one place, you will be able to monitor them better, & you can see the performance at one go. Compare that to when they were at different places; we tend to be lazy to look at all of them and just keep ignoring them.

3. Fast transactions : : If you have all the mutual funds in demat form, you will be able to sell those mutual funds in stock markets whenever you need money. Mutual funds are now, tradable in stock markets, so you can buy and sell them in stock exchange in real-time. If you don’t have them in demat form, selling them would not be as convenient.

Steps to convert your Mutual funds into demat form

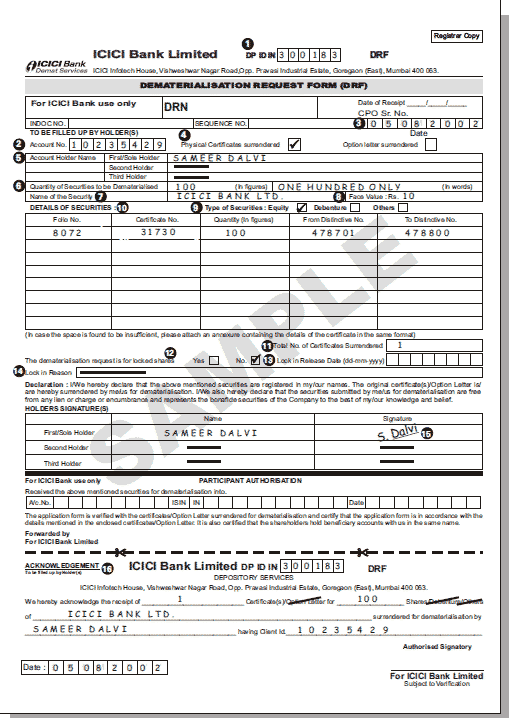

a) Obtain and sign DRF : The first step, is to ask your demat provider (like ICICIDirect, Sharekhan, Reliance Money) for a ‘Dematerialization Request Form’ (DRF) for conversion of mutual funds units held in physical form into demat form. Obtain it, duly fill it and sign it. You should be able to find the DRF form at your demat provider website. [DDET Click here to see a Sample DRF form] [/DDET]

[/DDET]

b) Sign all the statement of Accounts from your Mutual Funds : You will have to collect the statements from all the AMC’s which have the mutual funds names which you want to convert, once you have them, you have to sign it. You will get all these statements in your email box most probably. This step is important to make sure you have documentary proof that you own those mutual funds and have their names, so if you have investments in 5 different AMCs, you should collect all 5 statements.

c) Submit and Acknowledgement: Submit the duly filled and signed DRF along with and Account Statement issued by the Mutual Fund House to the Depository Participant. Acknowledgement will be given by the Depository Participant for the document acceptance, subject to verification.[DDET Click Here to see all Important points before submitting a Dematerialization Request]

1. The investor should check with their Depository participants (DPs) for the dematerialization Request Form to convert mutual funds units held in physical form into demat form.

2. The details in the DRF, i.e. Name(s), holding pattern and signature should match with the details as appearing in the account statement.

3. The form is duly filled and signed by all unit holders as per the holding nature and is complete in all aspects.

4. All the schemes as available in a folio are mentioned in the DRF and the unit balances as specified are matching with the closing balances available in the folio. No partial units or selected schemes available in the folio will be accepted for conversion.

5. Units requested for dematerialization should be should be free from credit hold, lien or any other hold. In case any units are under hold for want of credit status, conversion will be processed only after clearance of such hold.

6. Dematerialization request should not be submitted if the units are lien or locked for any Income Tax or other legal purpose.

7. Rejection letter will be sent by the Depository Participants if the documents are not in order, units are under lock, or rejected by the Registrar during the conversion process providing reason thereof.

8. Investors can check with their Depository Participant on the status of the request if no intimation has been received within twenty-one days.

9. No separate confirmation letter will be sent by the Registrar for successful transfer of physical units in demat form.

10. Post dematerialization of units the investors can only transact through the stock exchange platform. They will have to approach their broker for purchase / redemption of units.

11. Physical requests received by the Registrar of DSP BlackRock Mutual Fund for purchase/redemption of units will be rejected.

Source : http://www.dspblackrock.com/services/dematerialisation.asp

[/DDET]

d) Processing : The Depository Participant will process the application for conversion of physical units into electronic form. For this, the DP would sent the request form and Statement of Account to the Asset Management Company (AMC) / Registrar and Transfer Agent (RTA).

e) Confirmation : The AMC / RTA will after due verification, confirm the conversion request sent by your DP and credit the mutual fund units in your demat account.

Selling Mutual funds in Demat form

Note that converting the mutual funds will require you to have a demat account first, so incase you don’t have a demat account , you will not be able to convert them , because unless you have a demat account, how can it be stored . Now once you have converted the mutual funds in demat form , you can sell them through your demat account in stock market , which would attract brokerage as per defined by your Depository participant, however you can also sell your mutual funds through the normal old way where you put a request for sell through a Redemption Form .

Conclusion

This is one of those simple and small steps, towards simplifying your financial life. Once you do this, it can motivate you to take further steps in automating many things which will improve your financial life. Dematerialization of mutual funds will make sure your documentation will improve . Let me know if you plan to do this on comments section .. also lets discuss if anything is not covered in article . Has anyone done this already ?

October 28, 2010

October 28, 2010

Hi Manish,

I have an demat account and investing only in mutual funds. I feel I am paying yearly rental unnecessary hence want to close my demat account and transfer all existing mutual fund to offline ( just like paper form based).

Please suggest, if such options are available.

Thanks

Neetu

Hi Neetu

Yes,its very much possible . However the remat process is a bit lengthy and cumbersome. Why dont you sell off your units and then reinvest in non-demat style. Our team can help you with the overall process incase you want. Just let us know

Manish

dear sir ,

I think u hide things or not clear define the money absorb by the broker ….. from my view mf in the demate form will absorb some profit as brokerage charge … also demate charges by broker or sub broker .. and there is money control site oenc you enter n update your folio u can easily track your all funds in one place .. no need to give money to broker..

guys pls bewar n reserch first …

Thanks for your comment panthak

Please open a CAN account. IT is very useful.

https://www.mfuindia.com/CANBenefits

Hi Manish

Is it possible to move funds from one DMAT acct to other {say from ICICI Direct to FundsIndia} if I want to close relation with that DMAT? If yes then what is the process. Do I loose existing SIP then?

I think its possible , but the process would be too complicated !

Dear Team,

I have an demat account in icici direct since March 2012 but I am dealing with SIP mutual funds only currently I am investing 17000 INR per month through SIP. should i continue through ICICI direct or invest through Fundsindia ? please suggest.

regards,

ANy of them is fine !

Hi Manish,

Thanks for the excellent post. Just couple of queries.

I’d invested in SBI MFs some years back via CAMs. I’d forgotten about that and just now I got the account statements over mail after requesting for it. I want to transfer it to my ICICI Demat account so that I can track them better online.

1. So will the account statements as sent via email be sufficient to apply for Dematerialization ?

2. In the account statement, bank details provided is SBI. If I transfer it to my ICICI DP account, will the bank details also be updated ? That is if I were to redeem the units – will the amount go to my ICICI account linked to ICICI_Direct or the old SBI account ?

Please clarify.

You should check this with ICICI direct. They will happily help you on this 🙂

Hi,

Firstly thanks for the amazing content. My question is can I store in my demat (icicidirect) direct mutual funds bought through CAN ?

Yes, you can store it ..

Hi Manish,

Great article!

I have a small query. Kindly help me.

Can i buy Direct mutual funds through Demat accout? If yes than what about benefit i get from lower expense ratio? since i am buying through an online account. I read one of your other enlightening article about Direct plan. The benefits discussed in this article will still be applicable in this case?

Thanks alot for all your efforts.

No , you wont be able to buy that from demat . I am assuming you are talking about the demat accounts we have with ICICIDirect or Sharekhan etc

Hi Manish,

Thank you for your post. I have few questions

1. I have five MFs, do we need fill five DRF forms?

2. I am coverting these MF to ICICI dmat. Do I need to physically go there? Can I send all documents via post?

Please let me know your inputs.

I am not very sure on this . You need to check it with ICICI demat office itself

Recently I purchased MF from one agent, at that time I didn’t knew we can have that in our share trading portal as well, now i wish to get from his associate company to my existing trading portal, whats the procedure for that

Why dont you just sell it and repurchase from demat !

sir,

my father and mother was expired. but i know that he has TCS e-serve shares. folio number is 034884 and there is no demat account. As a legal hair i want materialize those shares . please let me know the complete procedure. how many shares he hold. what is the worth of shares. is there any guinion consultancy for take up shares

You need to check with TCS on this

I have UTIMF Opportunities fund -dividend payout, total 1615.3 units purchesed on my wife`s name and me, 1) VecireddyVeasantha 2) Vecireddy Rajareddy and we have Sharekhan demat account with names 1) Vecireddy Rajareddy 2) VecireddyVasantha. I sent this SOA copy along with filled request form in triplicate and filled and singed TRANSPOSITION FORM for demat to the sharekhan.com but they rejected it with remarks that ” the name of the holders on the SOA should be in the same sequence as in demat account”

Give your sugesion for demat my MF

regards

Rajareddy

Hi rajareddy

The proper reply can be obtained by the company only !

Hi,

I have purchased mutual fund via online through AMC website. This purchased as direct fund(NO Broker) ELSS. I have also given option during the purchase that to credit Unit into my DEMAT account. I have filled the client id and DP Id. But after 20 days it has not been credit in my Demat account(ICICI Direct).

Regards,

Pankaj

Hi Pankaj

This is mostly related to the demat account and you should follow up with the company itself .

Hi Pankaj,

Just wondering if you got those shared transferred to your demat account. This is interesting because ICICI direct does not allow us to buy any “Direct” funds. They only allow to buy “Regular” funds. Now you have bought directly a direct fund from the AMC and are trying to get it transferred to your demat account. ICICI direct will obviously not like this as if it goes through they will not be getting their commission. I wonder if it is similarly possible to sell your units directly through the AMC and by-passing ICICI’s trading platform. This is to save transaction charged. Please reply.

Thanks,

Melwyn

You can also have the DIrect plan view in the ICICI Direct. There is a section in ICICI direct, where you can request for view only purpose those funds which you bought out side of ICICI direct. You need to fill up a form and give to ICICI Direct !

hi

i have transferred my (demat) mutual funds to a new broker , which do not provide a facility to sell MF\’s.

How can I redeem the funds.Is there any other way.

Thanks in advance

You can redeem it from mutual funds office or CAMS office ,see this post – http://jagoinvestor.dev.diginnovators.site/2011/09/mutual-funds-redeemption-process.html

Hi Manish,

My father was holding mutual funds of different AMC’s in which my mother is the nominee. All the MF’s are in physical form. Now after his death what is the procedure for transferring all his MF’s into my mother’s demat account. My mother has a demat account with ICICDIRECT.com

Diwakar

You will have to show death certificate , fill up the claim form and do KYC of your mother ..

I was pondering if dematerialization of FMPs are allowed?

and if yes, would it be possible to liquify holdings in FMP through stock exchange route , are there enough volumes?

Yes FMP are mostly in demat form , because they are just another kind of MUTUAL FUNDs only !

I have approx. MF of 15 lac of different AMCs which I wish to dematerialise to my icici demat a/c.

What charges are involved for same and once demat done, what are the charges for selling through icici demat a/c. ?

What are the disadvantage of dematerialising mutual funds of different AMCs in one demat a/c. ?

Pl guide.

For what reason you want to dematerialise it in demat account. Right now anyways you can do online transactions if you want.. If they are bought by agent, anyways you can open an online account with respective AMC’s and sell them online, or you can consolidate all the funds with fundsindia at one place. Why pay demat account charges 🙂

Hi Manish,

I too hold ICICI direct demat account which holds all my MFs. Do you know if there is a charge from ICICI every time my SIP or SWP executes?

Due to my ignorance I bought lot of MFs through ICICI direct. I understand that i get the benefit of a consolidated view, but do you suggest that I remat them? I generally only buy through SIP and rarely redeem my MFs.

If I buy/sell directly from AMC or CAMS/Karvy is there any charge (apart from entry/exit load)?

Thanks,

Melwyn

ICICI charges per SIP charges of RS 25/30 .

Thank you very much. I was so confused regarding this.

I was keenly looking for such option so that I can use it as a Margin.

Thank you once again.

Thanks

While purchasing it from online platforms like fundsindia or moneysights…

Do we get an option to get it directly in demat form?

If no, then, whether one gets physical form of MFs or what?

Jeetu

It will be in demat form already ! … Dont worry on that aspect

Is it possible to transfer mutual funds from the Karvy DP Account to Angel Trading Account to sell them.

Why not , you can do that !

If you don’t have a demat account already then there is no point to open one just for the sake of converting your mutual funds into demat mode. Demat account is not free. When you open demat account you pay opening charges, when you transact you pay transaction and brokerage charges and you also pay annual maintenance charges. This is extra burden for one who just want to hold mutual funds. Now if you already have a demat account I see the following impact.

When you make a request to convert your mutual fund units into demat mode you are actual giving dematerialization request to your trading account provider. This is similar to conerting some old physical shares into demat mode mode. So you will pay the charges for the dematerialization request.

Both CDSL and NSDL will charge some transaction charges if you add or remove anything from your demat account. That means you will pay these charges everytime you buy mutual funds. If you have SIP then you will pay these charges every time you get new units added to your account. These charges also apply when you sell your units.

brokerage, STT, service tax will apply on anything that is traded in demat account. So if you buy/sell mutual funds using your trading account then you will have to pay these charges.

Generally people holds mutual funds for long term. If you want to close your demat account in future for some reason then you cannot do it unless you sell your mutual funds or convert them into another format. I know a lot of people who closed their demat account because they no longer want to stay on risky markets. Having mutual funds in demat mode will become a constraint if you don’t want to maintain your demat account.

If you have Wipro and TCS shares can you nominate your father for Wipro shares and brother for TCS shares? No, you cannot. That is what will happen for your mutual funds also. You can nominate different people for different mutual funds. You cannot do that once you convert mutual funds into demat mode.

The above may be true for your bank account as well. The bank account on the demat account will become the account for all mutual funds.

The only advantage of holding mutual funds in demat is that you can see them all at one place. If you have same email address on your mutual funds then there are alternative ways to achieve this. Also it is never wise to place all your investments at one place. By doing so you just make it easy for people like IT department, credit agencies etc.

This article is for information purpose .. who ever sees any value , they can take actions , else not !

Dear Manish,

I want to know that, if i purchase funds through demat account (share khan).

Is there any breakage charge (means first take charge by Broker and then fund house) .pls clear it.

thanks.

Girish

I dont think so , but ICICI has it , better ask the community at http://www.jagoinvestor.com/forum