LIC SIIP (Table 852) – Review, Features and Benefits

LIC’s SIIP is a unit-linked, non participating, regular premium, individual life insurance cover which offers insurance cum investment cover throughout the term of the policy. The policyholder has a choice of investing premiums in one of the 4 types of investment funds available.

Each premium paid, after deduction of premium allocation charge, will purchase a unit of fund type chosen. The unit fund is subject to various charges and the value of units may increase or decrease, depending on the net asset value (NAV).

Features of this Policy – (Table 852)

- This is a ULIP (unit-linked insurance policy) policy which means that it has no guarantee in returns.

- Tenure of the policy is 10 yrs to 25 yrs.

- This policy has a lock-in period of 5 years.

- No loan facility is available against this policy.

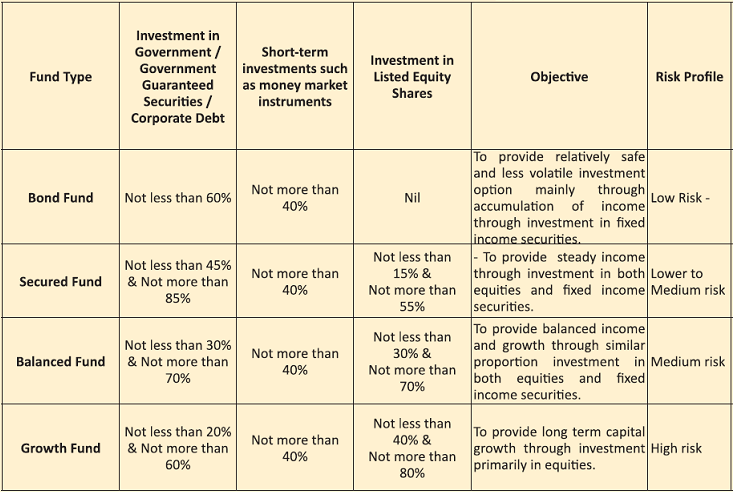

- 4 fund options where one can invest their premium into, such as Bond Fund, Secured Fund, Balanced Fund, and Growth Fund.

Benefits of this Policy –

a) Maturity Benefit –

On the Life Assured surviving the stipulated Date of Maturity, an amount equal to the Unit Fund Value shall be payable.

b) Death Benefit –

On death of the Life Assured before the stipulated Date of Maturity (including during Grace Period), provided policy is in- force, then,

i) On death before the Date of Commencement of Risk – An amount equal to the Unit Fund Value shall be payable.

ii) On death after the Date of Commencement of Risk – An amount equal to the highest of the following shall be payable –

- Basic Sum Assured reduced by Partial Withdrawals made during the two years period immediately preceding the date of death; or

- Unit Fund Value; or

- 105% of the total premiums received up to the Date of Death reduced by Partial withdrawals made during the two years period immediately preceding the date of death.

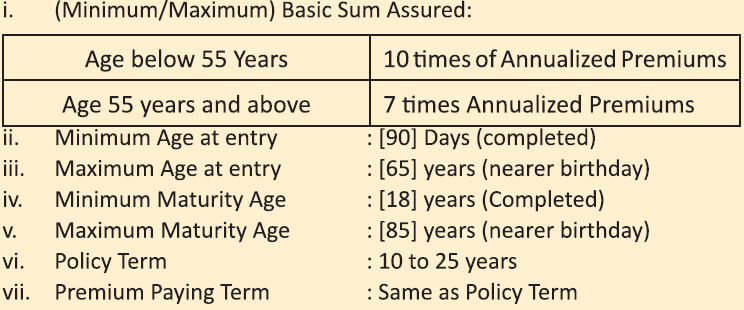

Where Basic Sum Assured is equal to ‘10 times of Annualized Premium in case age at entry of Life Assured is below 55 years and 7 times of Annualized Premium in case age at entry of Life Assured is 55 years and above and Partial Withdrawal is as specified in Condition 12 of Part D below.

Any Guaranteed Addition added subsequent to the date of death ( in case of delay in intimation of death claim) shall be recovered from the Unit Fund. The death benefit shall be payable either in lump sum amount as specified above or in installments if the Settlement Option is opted for as mentioned in Condition 11 of Part D of this Policy Document.

c) Refund of Mortality Charge –

On the Life Assured surviving the stipulated Date of Maturity provided all due premiums under the policy have been paid, an amount equal to the total amount of mortality charges deducted in respect of life insurance cover shall be payable along with the Maturity Benefit.

The total amount of mortality charges shall not include any extra amount chargeable under the policy due to underwriting decisions and tax charges levied on the mortality charges if any. The refund of Mortality Charge shall not be payable in case of a surrendered or discontinued policy.

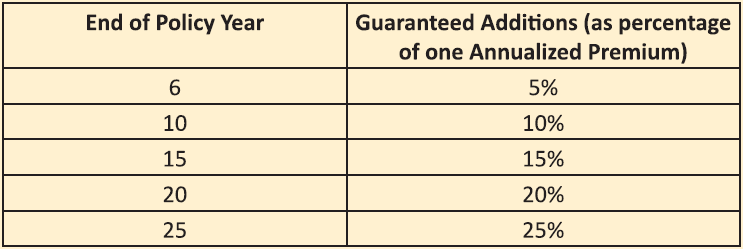

d) Guaranteed Additions –

Guaranteed Additions as a percentage of one Annualized Premium, as mentioned in the table below shall be added to the Unit fund on completion of a specific duration of policy years provided all due premiums have been paid and the policy is in force.

The allocated Guaranteed Addition shall be converted to units based on NAV of the underlying fund type as on the date of such addition and shall be credited to the Unit Fund. For policies that are not in force but revived subsequently, Guaranteed Addition shall be credited on the date of revival of the policy, provided all due premiums have been paid.

However, any Guaranteed Addition added subsequent to the date of death (in case of delay in intimation of death claim) shall be recovered from the Unit Fund.

e) Rider Benefits –

Under this policy LIC’s Linked Accidental Death Benefit Rider can be opted for even after issuance of the policy subject to the applicable terms and conditions of this rider. Whenever the rider is opted for subsequently by the eligible Life assured, the then available version of Linked Accidental Death Benefit Rider shall be applicable under the policy.

LIC’s Linked Accidental Death Benefit Rider –

Under an active policy, the LIC’s Linked Accidental Death Benefit Rider can be opted for by the eligible Life Assured, at any policy anniversary provided the outstanding Policy Term is at least 5 years but on or before the policy anniversary on which the age nearer birthday of the Life Assured is 65 years.

Eligibility Conditions and other restrictions of the policy –

4 types of Fund Unit allocation and Investment of Fund –

Unit Fund –

The allocated premiums will be utilized to buy units as per the fund type opted by the Policyholder out of the four fund types options available. Various types of fund options and broadly their investment patterns are as under –

Is there any Grace Period in the policy?

A grace period of 30 days will be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly (through NACH) premiums. If the death of Life Assured occurs within the grace period but before the payment of premium then due, the policy will still be valid and the death benefits shall be paid after deduction of all the relevant charges, if not recovered.

Will I get any value if I surrender my policy?

An in-force (active) policy can be surrendered anytime during the policy term. The surrender value, if any, shall be payable as under –

a) If the policy is Surrendered during the Lock-in-Period –

If a Policyholder applies for the surrender of the policy during the Lock-in-Period, then the Unit Fund Value after deducting the Discontinuance Charge as specified in the Policy Document shall be converted into monetary amount as specified.

This monetary amount shall be transferred to the Discontinued Policy Fund as specified. The Proceeds of Discontinued Policy Fund in respect of this policy, as specified shall be payable at the end of Lock-in-Period.

In case of death of the Life Assured after the date of surrender but before the end of the Lock-in-period, the Proceeds of Discontinued Policy Fund in respect of this policy shall be payable to the nominee/ legal heir immediately.

b) If the policy is surrendered after 5 years’ lock-in-period –

If a Policyholder applies for the surrender of the policy after 5 years’ Lock-in-period, then the Unit Fund Value as on the date of surrender shall be payable. There will be no Discontinuance Charge under the policy.

Reinstatement of a surrendered policy shall not be allowed.

Is there any possibility to revive the discontinued policy?

A discontinued policy shall be revived within a revival period of three years from the date of the first unpaid premium or up to the date of maturity, whichever is earlier.

Can I return the policy if I didn’t like its terms and conditions?

Yes, if the policyholder doesn’t like terms and conditions of the policy, the policy can be returned to the corporations within 15 days (30 days in case of online sale) from the date of receipt of the Policy Document stating the reason of objection. On receipt of the same, the Corporation shall cancel the policy and the amount to be refunded.

This 15 day period is known as the Free Look Period.

Do policyholders have any option to switch between funds?

Yes, the policyholder can switch between any fund types under this policy during the policy term. On switching, the entire amount is switched to the new Fund opted for. Within a given policy year, 4 switches will be allowed free of charge. Subsequent switches shall be subject to a Switching Charge of Rs.100 per switch.

On receipt of the Policyholder’s valid application for a switch from one fund type to another, the Unit Fund Value after deducting Switching Charge, if applicable, shall be transferred to the New Fund type opted for by the Policyholder and shall be utilized to allocate Fund Units at the NAV under the new Fund type on the said date of the switch.

If a valid application is received up to a particular time (presently 3 p.m.) by the Servicing Branch Office the closing NAV of the same day shall be applicable and in respect of the applications received after such time by the Servicing Branch Office, the closing NAV of the next business day shall be applicable.

What is the mortality charge in this policy?

Mortality Charge is the cost of Life Insurance cover and this will be taken at the beginning of each policy month by canceling the Unit Fund Value appropriately. The monthly charges will be one-twelfth of the annual Mortality Charges.

Mortality Charges, during a policy year, will be based on the age nearer birthday of the Life Assured on the policy anniversary coinciding with or immediately preceding the due date of cancellation of units and hence may increase every year on each policy anniversary.

Further, this charge shall also depend on the health, occupation, and lifestyle of the Policyholder at the entry stage of the contract and at the time of revival, if applicable.

Is there any switching charges, if we switch from one fund to another?

Within a given policy year, 4 switches are allowed free of charge. Switching Charge of Rs. 100 per switch if the switches are done more than 4 times.

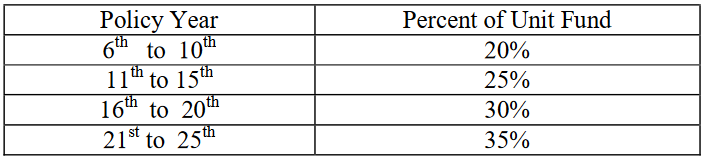

Is Partial Withdrawal allowed in the policy?

A Policyholder can partially withdraw the units at any time after the fifth policy anniversary and provided all due premiums till date of partial withdrawal have been paid, subject to the following –

i) In the case of minors, partial withdrawals shall be allowed only after Life Assured is aged 18 years or above.

ii) The Partial withdrawals may be in the form of a fixed amount or in the form of a fixed number of units.

iii) The maximum amount of Partial Withdrawal as a percentage of the fund during each policy year shall be as under –

The above Partial withdrawal shall be allowed subject to the minimum balance remaining after allowing for partial withdrawal is not less than 3 annualized premiums. The partial withdrawals which would result in termination of a contract shall not be allowed.

iv) Partial withdrawal charge as specified shall be deducted from the Unit Fund Value.

If partial withdrawal has been made then for two years period immediately from the date of withdrawal, the Basic Sum Assured or Paid-up Sum Assured, whichever is applicable, shall be reduced to the extent of the amount of partial withdrawals made.

On completion of two years period from the date of withdrawal, the original Basic Sum Assured/Paid-up Sum Assured shall be restored.

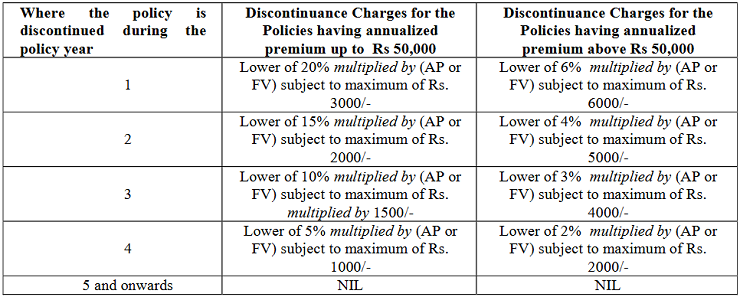

Is there any Discontinuance Charge in the policy?

This charge will be levied by canceling an appropriate number of units from the Unit Fund Value as on the date of discontinuance of Policy. The Discontinuance charge applicable is as under –

Where,

- AP – Annualized Premium

- FV – Unit Fund Value on the Date of Discontinuance of Policy

Exclusions under the Policy –

Suicide Exclusion –

If the Life Assured commits suicide within 12 months from the Date of Commencement of Policy or from the Date of Revival of the policy, the nominee or beneficiary of the policyholder shall be entitled to the Unit Fund Value as available on the date of intimation of death along with death certificate.

The Corporation will not entertain any other claim by virtue of this policy and the policy shall terminate. Any charges other than Fund Management Charges (FMC) recovered subsequent to the date of death shall be added back to the fund value as available on the date of intimation of death along with death certificate.

Any Guaranteed Addition added subsequently to the date of death (in case of delay in intimation of death claim) shall be recovered from the Unit Fund.

Note – This clause shall not be applicable in case of age at entry /age at the revival of the Life Assured is below 8 years.

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.

I take two siip in the of 63 years ans apply for PPT- 12 yrsand naximum maturity age 85 yrs, It is allowed