ICICI Pru Cash Advantage – Review, Features and Benefits

We always wanted to fulfill our family’s needs be it our children’s education, our parents’ medical expenses, or that dream family vacation. We all know that to be able to meet these responsibilities, we need a comprehensive financial solution which provides regular cash flow to meet our recurring expenses while building a corpus for your long term financial goals.

ICICI Prudential introduces “ICICI Pru Cash Advantage”, a participating life insurance plan with unique savings and protection oriented plan which offers you a guaranteed amount every month for 10 years, a guaranteed lump sum at maturity, along with bonuses and life cover that provides financial security to your family in case of your death.

Features of this Policy –

- Liquidity – Payout term commences immediately after premium payment • term (PPT)

- Guarantees – Guaranteed Cash Benefit (GCB) equal to 1% of GMB every month •throughout the payout term of 10 years guaranteed Maturity Benefit (GMB) at the end of the policy term

- Protection – Life cover for the entire policy term

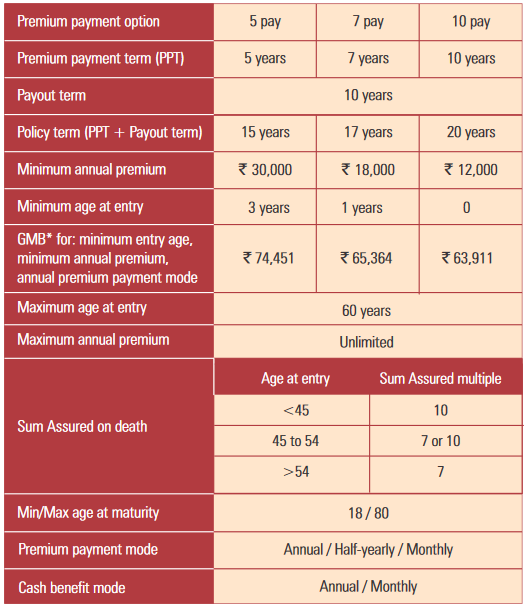

- Limited premium payment term – Choice of paying premiums for – 5, 7, or 10 years

- Tax benefits – Tax benefits on premiums paid. Maximum tax benefit up to Rs 1.5 lakh under Section 80C, 10(10D), and other provisions of the Income Tax Act, 1961.

Benefits of this Policy –

a) Death Benefit –

On the death of the life assured during the policy term, for a premium paying or fully paid policy, irrespective of the Guaranteed Cash Benefits paid, the following benefits are payable to the nominee.

Death Benefit = Highest of (A,B,C)

Where,

- A = Sum Assured on Death plus Bonuses*

- B = GMB plus Bonuses*

- C = Minimum Death Benefit*Bonuses consist of vested reversionary bonuses, interim bonuses, and terminal bonuses if any.

*Bonuses consist of vested reversionary bonuses, interim bonus, and terminal bonus if any. Minimum Death Benefit is equal to 105% of the total premiums received up to the date of death. All policy benefits cease on payment of the death benefit.

b) Cash Benefit –

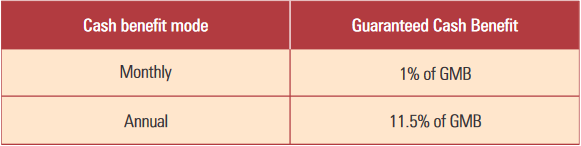

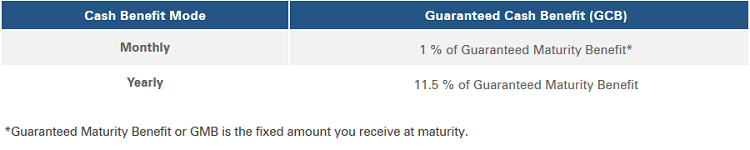

Throughout the payout term, Guaranteed Cash Benefit (GCB) is payable in advance, provided the life assured is alive and the policy is fully paid. GCB can be received in monthly or annual installments. GCB is a percentage of the Guaranteed Maturity Benefit (GMB) and depends on cash benefit mode as per the table below –

c) Maturity Benefit –

On survival of the life assured till the end of the policy term for a fully paid policy, Maturity Benefit is payable. Maturity Benefit = Maximum of (A, B)

Where,

- A = Guaranteed Maturity Benefit plus vested reversionary bonuses, if any plus terminal bonus, if any

- B =100.1% of total premiums paid (excluding any extra mortality premium, Goods & Services Tax and Cess, if any) less GCBs received.

Please note, GMB (Guaranteed Maturity Benefit) is the Sum Assured on Maturity and will be calculated, at inception, based on your premium, premium payment option, premium payment mode, Sum Assured on Death, cash benefit mode, age, and gender.

For example, if an annual premium of Rs 50,000 is paid for a premium payment term of 10 years, the Maturity Benefit plus the sum of GCBs received during the policy term will be at least 100.1% of the total premiums paid (Rs 500,500 = Rs 50,000 x 10 x 100.1%).

Eligibility Criteria of the Policy –

Example of workings of Policy –

a) Example 1

Child’s education solution – Amit is a 30-year-old banking professional who was recently blessed with a daughter. He understands his responsibilities towards his daughter’s education as well as the need to protect his daughter’s future in case anything unfortunate befalls him.

To meet these requirements, he buys ICICI Pru Cash Advantage with a PPT of 10 years and an annual premium of Rs 100,000. His policy benefits are as follows –

-

Guaranteed Cash Benefit of Rs 5,307 per month for his daughter’s school education.

-

Guaranteed Maturity Benefit of Rs 5.31 lakh plus bonuses of Rs 10.63 lakh for his daughter’s college education

-

Life cover of Rs 10 lakh for himself for the next 20 years.

b) Example 2

An ideal gift for your loved ones – Mr. Zubin is a 65-year-old ex-serviceman. Doting on his 12-year-old grandson Rahul is what he enjoys most. He wants to gift Rahul something which will benefit him throughout his college education. Mr. Zubin gifts a policy of ICICI Pru Cash Advantage to Rahul with a PPT of 5 years and an annual premium of Rs 50,000. Rahul can expect to get the following –

-

Guaranteed Cash Benefit of Rs 1,235 per month from age 17 till he is 26.

-

Guaranteed Maturity Benefit of Rs 1.23 lakh plus bonuses of Rs 1.63 lakh on attaining age 26

Can I take a loan against this policy?

Yes, the policyholder can take loans against this policy after the policy acquires a surrender value. Loans of up to 80% of the surrender value can be availed.

The Company shall be entitled to call for repayment of the loan with all due interest by giving three months’ notice if the amount outstanding is greater than the surrender value and if the policy is in a paid-up state. In the event of failure to repay by the required date, the policy will be foreclosed. The applicable interest rate will be set monthly and will be equal to 150 basis points in addition to the prevailing yield on 10 year Government Securities.

What happens if you discontinue your premiums?

Your policy will acquire a surrender value on payment of all premiums for at least two consecutive years. Please note, if you discontinue your premiums before your policy has acquired a surrender value, no benefits will be payable under the policy.

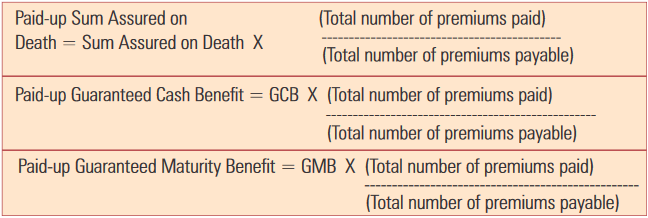

- If the policy has acquired a surrender value and no future premiums are paid, the policy may continue as a paid-up policy with reduced benefits as explained below –

- On the death of the life assured when the policy is paid-up, the nominee will receive the Paid-up Sum Assured on Death, vested reversionary bonuses, and contingent reversionary bonus if any.

- On maturity of a paid-up policy, you will receive the Paid-up Guaranteed Maturity Benefit, vested reversionary bonuses, and contingent reversionary if any. A paid-up policy will not be entitled to future bonuses.

What happens if you discontinue your policy?

If your policy has acquired a guaranteed surrender value as described in the previous section and you choose to discontinue your policy, you will be entitled to the surrender value which is the higher of the following –

- Guaranteed Surrender Value (GSV) plus the cash value of vested bonuses, if any

- Cash value of vested bonuses = Guaranteed Cash Value Factors For Vested Bonuses X Vested bonuses

- Guaranteed Cash Value Factors For Vested Bonuses convert the face value of vested bonuses, payable on maturity or earlier death, to their expected present value. These factors are guaranteed.

- Non-Guaranteed Surrender Value (NGSV)

Please note, if your policy has not acquired a surrender value and you choose to discontinue your policy, no benefits will be payable under the policy.

When can I revive my lapsed policy?

A policy which has discontinued payment of premiums may be revived subject to underwriting and the following conditions –

- The application for revival is made within 5 years from the due date of the first unpaid premium and before the termination date of the policy. Revival will be based on the prevailing Board approved underwriting policy.

- The policyholder furnishes, at his own expense, satisfactory evidence of the health of the life assured as required by the Company.

- The revival of the policy may be on terms different from those applicable to the policy before premiums were discontinued

- On the revival of the policy, the paid-up benefits will be restored to the benefits under the plan as if the policy had been premium paying. If reduced Guaranteed Cash Benefits have been paid since premium discontinuance, then the unpaid balance amount will be paid to the policyholder.

Note – The company reserves the right to refuse to revive the policy. Any change in revival conditions will be subject to prior approval from IRDAI and will be disclosed to policyholders.

Can I cancel the policy if I didn’t like its terms and conditions?

Yes, the policyholder has an option to cancel the policy within 15 days from the date of receipt of the policy and, 30 days in case the policy is purchased through distance marketing, if the policyholder is not satisfied with the policy terms and conditions, stating the reasons for cancellation. This period is known as the Free Look Period.

On receiving the written confirmation of canceling the policy from the policyholder, the company will refund the premium paid after deduction of Stamp duty, the proportionate risk premium for the period of cover, and the expenses borne by the company on medical tests, if any.

The policy shall terminate on payment of this amount and all rights, benefits, and interests under this policy will stand extinguished.

Is there any grace period in this policy?

Yes, this policy has a grace period of 15 days for payment of monthly premiums and 30 days for other modes.

How much Guaranteed Cash Benefit will I receive?

The regular Guaranteed Cash Benefit (GCB) starts from the year when your premium payment term ends. It is paid every year post that till the end of your policy. You can choose to receive this benefit either monthly or yearly as shown below:

How much money do I get at policy maturity?

At the end of the entire duration of the policy, you receive a lump sum pay-out called Maturity Benefit, provided all premiums until that year are paid. It will be the higher of the following –

- Guaranteed Maturity Benefit (GMB) plus Bonuses declared by the company if any

- 100.1% of total premiums paid* (*Excluding any extra mortality premium and taxes, less GCB received)

How much money will my family receive in my absence?

Your family will receive a lump sum amount which will be the maximum of the following –

- Sum Assured plus Bonuses

- Guaranteed Maturity Benefits (GMB) plus Bonuses

- Minimum Life Cover amount that is equal to 105% of the sum of all premiums paid till date

Exclusion under the Policy –

Suicide Exclusion –

If the life assured whether sane or insane, commits suicide within 12 months from the date of commencement of risk under this policy, the policyholder or nominee, as applicable will be entitled to higher of 80% of total premiums paid including extra premiums, if any, till the date of death or the surrender value, as available on the date of death.

Where the policy is revived, if the life assured, whether sane or insane, commits suicide within 12 months from the date of reinstatement of the policy, the higher of (A or B) will be payable.

Where,

- A = 80% of the total premiums paid including extra premiums, if any till the date of death and

- B = applicable surrender value.

On the above payment, the policy will terminate and all rights, benefits, and interests under the policy will stand extinguished.

Video Description of the Policy –

Conclusion –

So, by now you know each and every important detail about this policy. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.