HDFC Life Smart Woman Plan – Review, Features and Benefits

A woman represents various qualities such as courage, compassion, wisdom, patience, endurance and many more. In this 21st century every woman wants to financially independent. No woman wants to be financially dependent on anyone.

To let every woman dream big even if they are a homemaker and be financially independent, HDFC has come up with a life insurance policy, HDFC Life Smart Woman Plan exclusively for women of India. The plan ensures that the savings will grow to leave the policyholder free to pursue their career and continue making a difference to those around them. It also provided options that cater to specific life events of women concerning their health, career, and marriage.

Features of this policy –

- Sum Assured of up to 40 times of annualized premium

- Choice of 3 Benefit Options – Classic, Premier and Elite

- Premium Waiver Benefit – Waiver and funding of 3 annual premiums on (a) Birth of child with a congenital disorder or pregnancy complications (b) Diagnosis of cancer of female organs (c) Death of spouse

- Additional periodic cash pay-outs under Premier and Elite Option

- Enhanced Allocation Rate from 11th year onwards

- This plan is available with a Short Medical Questionnaire (SQM) based underwriting

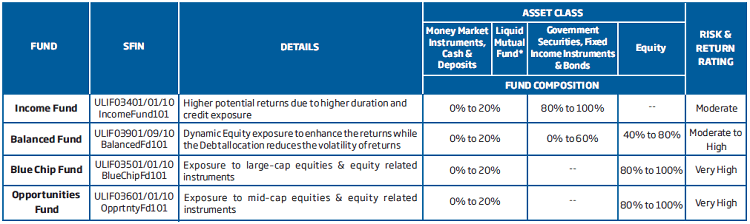

- The policyholder has an option to choose from 4 funds to suit your risk appetite

List of 4 Funds in this policy –

HDFC Life Smart Woman Plan is a unit-linked plan. Premiums paid in this plan are subject to investment risks associated with the capital markets. The unit prices of the funds may go up or down, reflecting changes in the capital markets.

So, to balance one’s level of risk and return, making the right investment choice is very important. This policy has 4 Funds that give the policyholder the potential for the following –

- Higher but more variable returns; or

- Lower but more stable returns over the term of one’s policy.

Let us have a closer look at these 4 Funds –

Benefits of the policy –

To avail the benefits from the policy, the policyholder can choose any one benefit option from below. The policyholder cannot change the benefit option subsequent during the policy term –

i) 3 Benefit Option:

A) Classic Benefit –

- Pregnancy Complications or Birth of child with the congenital disorder – Premium Waiver Benefit: Waiver and funding of 100% of your next 3 years premiums.

- Diagnosis of cancer of female organs – Premium Waiver Benefit: Waiver and funding of

Classic 100% of your next 3 years premiums. - Death of the spouse – Not covered

B) Premier Benefit –

- Pregnancy Complications or Birth of child with the congenital disorder – Premium Waiver Benefit: Waiver and funding of 100% of your next 3 years premiums + Periodic cash pay-outs of 100% of your next 3 years premiums on the respective due dates.

- Diagnosis of cancer of female organs – Premium Waiver Benefit: Waiver and funding of 100% of your next 3 years premiums + Periodic cash pay-outs of 100% of your next 3 years premiums on the respective due dates.

- Death of a spouse – Not covered

C) Elite Benefit –

- Pregnancy Complications or Birth of child with the congenital disorder – Premium Waiver Benefit: Waiver and funding of 100% of your next 3 years premiums + Periodic cash pay-outs of 100% of your next 3 years premiums on the respective due dates.

- Diagnosis of cancer of female organs – Premium Waiver Benefit: Waiver and funding of 100% of your next 3 years premiums + Periodic cash pay-outs of 100% of your next 3 years premiums on the respective due dates.

- Death of a spouse – Premium Waiver Benefit: Waiver and funding of 100% of your next 3 years premiums.

ii) Death Benefit –

If the policyholder passes away suddenly then the nominee of the policy will get greater of the following. Once the benefits are paid, the policy will terminate and no more benefits will be payable –

- Sum Assured less all withdrawals made during the two years immediately preceding the date of death or,

- The total fund value or,

- 105% of the premiums paid.

iii) Special Benefits –

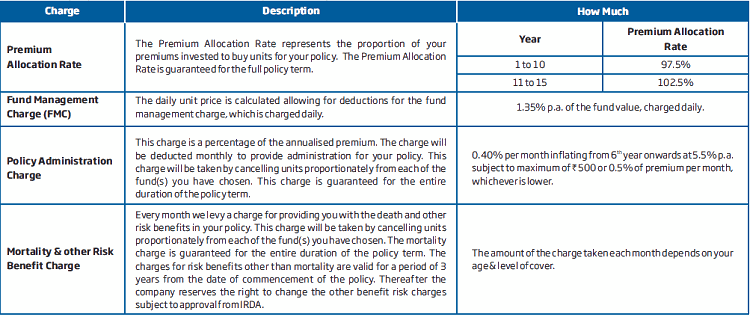

- Enhanced Allocation Rate: The policyholder can enjoy an enhanced allocation rate of 102.5% p.a. from the 11th policy year.

- Waiver of charges on withdrawal /switch: Motherhood is an important part of a women’s life. To make the journey towards motherhood financially comfortable, the company will waive charges on 12 partial withdrawals or switches, within one year from the date of childbirth.

iv) Partial Withdrawal –

Anyone can have financial emergencies shortly. To meet the future expenses, the policyholder can withdraw the money from their funds. The company will waive partial withdrawal charges for up to 12 partial withdrawals, within one year from the date of childbirth.

The policyholder can make lump sum partial withdrawal from there funds after 5 yrs of the policy provided –

- The minimum withdrawal amount is Rs 10,000.

- After the withdrawal and applicable charges, the fund value is not less than 150% of your annualized premium.

- The maximum amount that can be withdrawn throughout the policy term is 300% of the original regular premium.

Eligibility Conditions of the policy –

Like other HDFC Policies, this policy also has some eligibility conditions. Let’s have a look at these –

Charges under this policy –

Yes, there are charges applicable under this policy. The charges under this policy are deducted to provide cost-benefits and administration provided by the company. Let us see these charges –

Some more additional charges in the policy –

a) Miscellaneous charges – This charge will attract a charge of Rs 250 per request for any policy alteration request initiated by the policyholder.

b) Partial withdrawal charge (if applicable) – If the policyholder gives a request for partial withdrawal, then the company will charge Rs 250 per request. However, if the request is executed through the Company’s web portal then the policyholder will be charged Rs 25 per request.

c) Switching charge (if applicable) – If the policyholder gives a request for a fund switch, then the company will charge Rs 250 per request. However, if the request is executed through the Company’s web portal then the policyholder will be charged Rs 25 per request.

d) Premium Redirection – On premium redirection request, the policyholder will be charged Rs 250 per request. However, if the request is executed through the Company’s web portal then the policyholder will be charged Rs 25

per request.

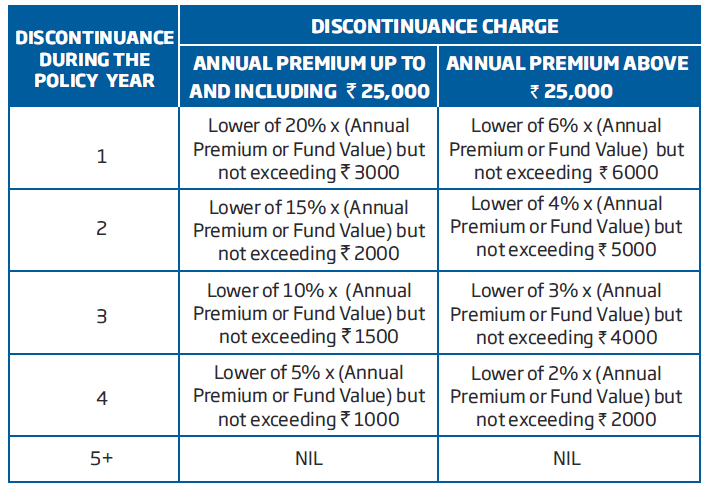

e) Discontinuance Charge – This charge depends on the year of discontinuance and one annualized premium. There is no charge after the 5th policy year. The below table shows the discontinuance charges applicable. Let us have a look at them –

Can I cancel the policy if I didn’t like its terms and conditions?

Yes, the policyholder can cancel the policy if the policyholder doesn’t like it’s terms and conditions. The policyholder can return the policy stating the reason of return within 15 days from the date of receipt of the policy. This period is called Free Look Period.

If the policy is purchased through distance marketing (a mode where policies are not sold face to face) then the free look period will be 30 days from the date of receipt of the policy.

Can a lapsed policy be revived?

Yes, a lapsed policy can be revived within two consecutive years from the date of discontinuance of the policy, subject to the companies underwriting policy. Revival is possible only if all due premiums with interest have been paid.

Can I take a loan against this policy?

No, loan against this policy is not allowed under any circumstances.

Can I surrender the policy?

Yes, one can surrender the policy. Let us see the details of the surrender value.

- Policyholder surrenders the policy before completion of the 5 years from commencement of the policy – In this case, the fund value discontinued charges will be moved to the Discontinued Policy Fund. The amount allocated to the Discontinued Policy Fund, with accrued interest, will be paid out on the completion of the lock-in period. If the policyholder dies before the payment of the surrender benefit, then the amount in the Discontinued Policy Fund will be paid out immediately.

- Policyholder surrenders the policy after completion of the 5 years from commencement of the policy – In this case the fund value will be paid out immediately. Once this benefit is paid, the policy will terminate and no further benefits will be payable.

Will I get any tax benefit, if I purchase this policy?

Yes, women who buy this policy are entitled to get tax benefits. Tax benefit for premiums paid u/s 80C of the Income Tax Act, 1961. Benefits received under a life insurance policy may be exempted u/s 10 (10D) of the Income-tax Act, 1961.

Conclusion –

As you all know by now that this is a women-oriented policy. If you all feel that this policy is the best policy for the women in your life then you can choose this policy. Do let me know if I have missed any important point in the comment section. Please feel free to ask any doubts regarding this policy.