HDFC Life Click 2 Wealth – Review, Features and Benefits

Future Planning is an important aspect of any investor’s life. We as an investor wants to plan for a better tomorrow. We plan for our child’s future, retirement, etc…. We always seek an opportunity which can ensure that money works for us when we need in near future. We invest for tomorrow so that we meet our desired goal.

To ensure the financial protection of our beloved ones, HDFC has come up with a policy named “HDFC Life Click 2 Wealth” which is a Unit Linked Life Insurance Plan that offers market-linked returns, charges minimally and provides valuable financial protection for you and your family.

Features of this policy –

- There are minimal changes in this policy – Only Fund Management charges towards managing your funds and mortality charge towards your life cover.

- Special Addition – 101% of the premium allocated to your fund for the first 5 years.

- Return of Mortality Charges on Maturity. In the case of the Premium Waiver option, Mortality charges pertaining to only the policyholder would be refunded.

- Three plan options to maximize the benefits

- Premium waiver benefit that protects the future of your loved one in your absence.

- Choice of 8 fund options with unlimited free switching

- Systematic Transfer Plan (STP) strategy for the advantage of Rupee Cost Averaging.

- Premium payment options of Single Pay, Limited Pay, and Regular Pay.

Benefits of this policy –

A) Maturity Benefit – The Fund value will be paid on maturity of the policy. Fund Value will be calculated by multiplying balance units in your fund(s) by the then prevailing unit price(s). As soon as your policy matures at the end of Policy Term, all risk cover will cease. The policyholder can take their Fund value at maturity in periodic installments under Settlement Option.

B) Death Benefit – This benefit will be payable in case of the unfortunate death of the policyholder. On a valid death claim for an active policy where all due premiums have been paid, the death benefit shall be highest of the following:

- Total Sum Assured less an amount of Partial withdrawals# made, if any, where Total Sum Assured is Basic Sum Assured plus any additional Sum Assured in respect of Top-ups.

- Fund Value

- 105% of Total Premiums paid

# The partial withdrawals to be deducted from the Total Sum Assured shall be:

- For death before attaining age 60: all partial withdrawals (except the top-up fund value) made during the two-year period immediately preceding the date of death.

- For death on or after attaining age 60: all partial withdrawals (except the top-up fund value) made within two years before attaining age 60 and all the partial withdrawals made after attaining age 60.

Upon payment of the death benefit, the policy shall terminate and no further benefits are payable.

- On Death of Proposer – Applicable for Premium Waiver Option ONLY (where Proposer is different from Life Assured). On a valid death claim of the Proposer for a premium paying policy, all future premiums are waived. On each future premium due date(s), an amount equal to the modal premium shall be credited to your Fund Value. The Policy shall continue until maturity with risk benefits continued on the life of the Life Assured. Upon maturity, the maturity benefit shall become payable.

C) Fund Booster –

i) Return of Mortality Charges (ROMC) – At the maturity date, the total amount of mortality charges deducted in respect of the insurance cover of Life Assured throughout the policy (including mortality charge deducted on top-up Sum Assured as applicable) will be added to the fund value.

For Golden Years Benefit Option, which has a whole of the life policy term, the total cumulative amount of mortality charges deducted will be added to the fund value at the end of policy year coinciding or immediately following the 70th birthday of Life Assured. This benefit will not be applicable in case of a surrendered, discontinued or Paid-up policy and will be added provided all due premiums have been paid.

ROMC will not be available for the policies where the Waiver of premium benefit is triggered due to the death of the Proposer.

ii) Special Addition – For Regular and Limited Pay Policies, 1% of your Annualized premium shall be added to the Fund Value at the time of allocation of premium for the first 5 policy years.

For Single Pay Policies, 1% of your Single premium shall be added at the time of allocation of single premium.

Special Edition will be available under all the 3 Plan options, viz. Invest Plus, Premium Waiver Option and Golden Years Benefit Option.

iii) Claw-back Additions – This will be as per the relevant IRDAI regulations issued from time to time. Currently, the applicable regulation is Section 37 (d) of the IRDAI (Linked Insurance Products) Regulation, 2013 which states the following –

- In order to comply with the reduction in yield requirement, the Company may arrive at specific non-zero positive Claw-back Additions, if any, to be added to the unit Fund Value, as applicable, at a various duration of time after the first five years of the contract.

D) Top-Up Premiums – The Policyholder has the option of paying Top-up premiums, subject to the following conditions:

- Top-up premiums are not permitted during the last 5 years of the contract.

- Total Top-up Premiums cannot exceed the sum total of the regular/limited premiums paid till that point of time or initial single premium paid, as applicable.

- Top-Up Premium will carry a Sum Assured of 125% of the amount of Top-Up Premium.

E) Partial Withdrawal – The Policyholder has the option of making partial withdrawals subject to the following conditions:

- Partial withdrawals shall not be allowed within the first five policy years.

- The Life Assured is at least 18 years of age.

- The fund value after withdrawal should not fall below 150% of the annualized premium for limited/regular premium paying policies and 25% of Single Premium for single premium policies.

The Policyholder can also submit a request for Systematic (recurring) withdrawals.

F) Settlement Option – The Policyholder can avail of the settlement option for maturity benefit. The fund value will be paid in periodical installments over a period which may extend to 5 years.

G) Systematic Transfer Plan (STP) – You can choose to avail a Systematic Transfer Plan (STP) which gives you the benefits of rupee cost averaging.

- The policyholder can invest all or some part of his investment in Bond Fund and Liquid Fund and transfer a fixed amount in regular monthly installments into any one of the following funds: Diversified Equity Fund, Blue Chip Fund, Equity Advantage Fund, Discovery Fund, Opportunities Fund or Balanced Fund.

- The transfer will be done in 12 equal installments. The transfer date can be either the 1st or 15th of every month as chosen by the Policyholder.

- At the time of transfer, the required number of units will be withdrawn from the fund chosen, at the applicable unit value, and new units will be allocated in the chosen destination fund.

- The Systematic Transfer Plan will be regularly processed for the Policyholder till the Company is notified, through a written communication, to discontinue the same. Systematic Transfer Plan will not apply if the source Fund Value is less than the chosen transfer amount.

- No additional charges apply to select Systematic Transfer Plan.

- This strategy will be available only if the premium is paid on Annual mode or for the Single Premium payment option.

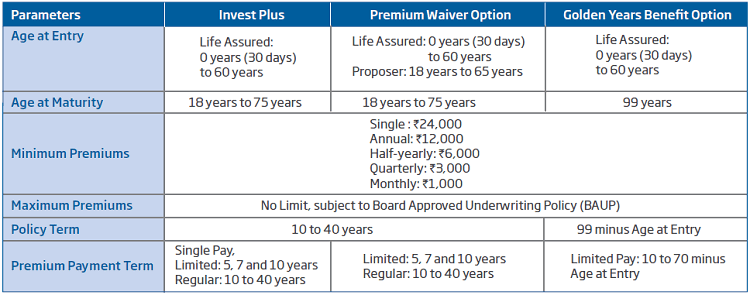

Eligibility of this policy –

Like other HDFC Policies, this policy also has some eligibility conditions. Let us have a look at these conditions –

- If the policyholder opts for the monthly premium frequency, then the company may collect three months premiums in advance on the date of commencement of the policy, as a prerequisite to allowing the monthly mode of premium payment.

3 Plan Option –

This policy offers 3 plan options in which a policyholder can choose depending on their protection and investment needs. Let us have a look at these –

- Invest Plus Option – This plan option provides life cover and takes care of the policyholder investment needs by providing accumulated Fund Value at Maturity.

- Premium Waiver Option – This plan option takes care of all financial responsibilities in the absence of policyholders. If the policyholder dies suddenly, then all future premiums will be paid by the company to make sure that the selected fund does not stop growing. On the death of the Policyholder, the Life Assured will become the policyholder. In case the Life assured is a minor, then on attaining age 18 years, the life assured automatically becomes the Policyholder and then this policyholder continues to be the premium payer under the Policy.

- Golden Years Benefit Option – This plan option is the right blend of retirement planning. It offers you the solution to build your fund value while also having life cover for the whole of life (till 99 years of age). The policyholder can opt for a systematic withdrawal facility to generate recurring post-retirement income from your accumulated fund. Options once chosen cannot be altered throughout the policy term.

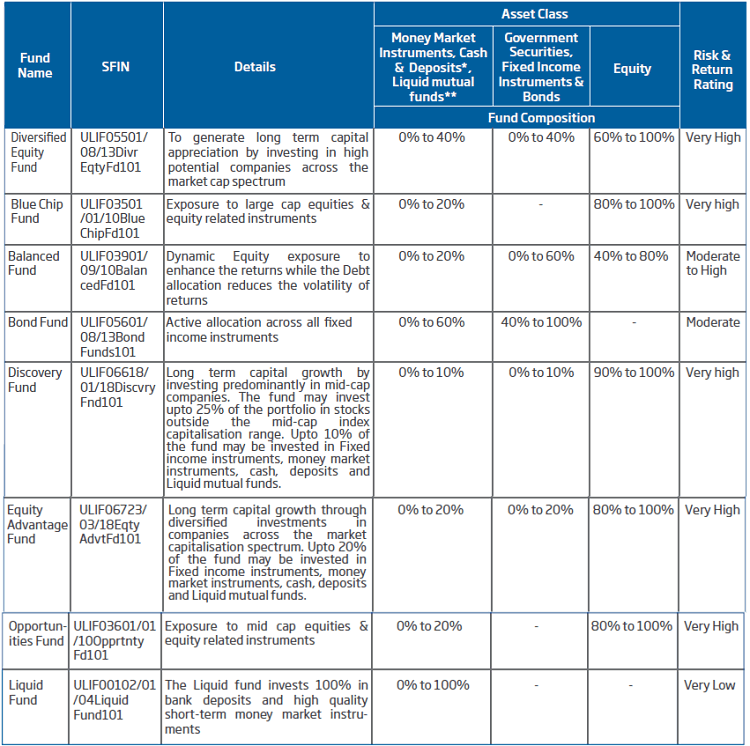

Funds Option in this policy –

HDFC Life Click 2 Wealth allows one to invest in a combination of funds by allocating their funds between 8 different fund options, giving the policyholder complete control over their money. Each fund has its asset allocation structure.

Equity-based funds invest in stock markets while debt-based funds invest primarily in safe and liquid instruments like bonds and government securities for secured growth. The policyholder can allocate the ratio between these funds and also switch between funds using fund switching options at any time.

The different fund options are given in the below table –

Exclusion in the policy –

- Suicide Exclusions – If the policyholder dies due to suicide within 12 months from the date of inception of the policy or from the date of revival of the policy, then the nominee shall be entitled to the fund value as available on the date of death. Any charges recovered subsequent to the date of death shall be paid back to the nominee along with the death benefit. In case of death of the proposer, where the proposer is different than life assured in the Premium Waiver option, due to suicide within 12 months, the policy shall continue without the benefit of waiver of future premiums.

Can I cancel the policy if I didn’t like its terms and conditions?

if a policyholder doesn’t like the terms and conditions of the policy, then the policyholder can cancel the policy, within 15 days from the date of receipt of the policy. This period is called Free-Look Period. If the policies are purchased through distance marketing (i.e. policies which are not bought face-to-face) then the free look period will be 30 days.

Can I take a loan against this policy?

No, loan against this policy is not allowed under any circumstances.

When can I get the surrender value against this policy?

A) If the policyholder surrender’s the policy before completion of the 5 years of the policy –

Upon surrender within the first five years of the policy, the Total Fund Value will be moved to a ‘Discontinued Policy Fund’ which will earn a minimum guaranteed interest rate as specified by the IRDAI. Presently, such an interest rate is 4% p.a. The amount allocated to the Discontinued Policy Fund, with accrued interest, will be paid out to the policyholder, on completion of the Lock-in Period. Once the benefit is paid the policy will terminate and no further benefit will be paid.

In the life assured dies before the payment of the surrender benefit, the amount in the Discontinued Policy Fund will

be paid out immediately. On payment of an amount, the policy will terminate and no further benefits will be payable.

B) If the policyholder surrender’s the policy after completion of the 5 years of the policy –

Upon surrender after 5 years of the policy, your fund value will be paid out. Upon payment of this benefit the policy terminates and no further benefits will be payable.

Can the lapsed policy be revived?

Yes, the lapsed policy can be revived within two consecutive years from the date of discontinuance of the policy, subject to payment of all due and unpaid premiums with interest.

Conclusion –

So, by now you know each and every important detail of this policy. Now it up to you to decide whether this policy will create a good wealth for you or not as. Do let me know if I have missed any important points in the comment section. Please feel free to ask any doubts regarding this policy.